Executive Summary:

Rivian Automotive Inc. is an American electric vehicle manufacturer. The company focuses on producing high-performance electric vehicles, including pickup trucks and SUVs, designed for both on-road and off-road adventures. Rivian’s goal is to accelerate the adoption of electric cars by offering compelling products that combine sustainability with performance and functionality.

Rivian Automotive Inc. reported an earnings per share (EPS) of -$1.39. Its revenue for the quarter was $1.16 billion.

Stock Overview:

| Ticker | $RIVN | Price | $11.71 | Market Cap | $11.81B |

| 52 Week High | $24.87 | 52 Week Low | $8.26 | Shares outstanding | 1.00B |

Company background:

Rivian Automotive Inc., an American electric vehicle manufacturer, was founded in 2009 by Robert Scaringe, RJ Scaringe, and Mark Vincenzino. The company’s mission is to create electric vehicles that are capable of off-road use and adventure. Rivian has secured significant funding from investors, including Amazon, Ford, and T. Rowe Price, which has fueled its growth and product development.

Rivian offers a range of electric vehicles, including the R1T pickup truck, the R1S SUV, and the EDV delivery van. These vehicles are designed to be both powerful and environmentally friendly, with features such as all-wheel drive, long-range batteries, and advanced driver-assistance systems. Rivian’s focus on outdoor adventure and capability sets it apart from other electric vehicle manufacturers.

Rivian faces competition from established automakers like Tesla, Ford, and General Motors, as well as other emerging electric vehicle companies. Rivian’s unique product offerings and strong financial backing give it a competitive advantage. The company’s headquarters are located in Irvine, California, and it has manufacturing facilities in Normal, Illinois. As the demand for electric vehicles continues to grow, Rivian is well-positioned to become a major player in the automotive industry.

Recent Earnings:

Rivian Automotive Inc. reported its revenue surged by 3.3% year-over-year to reach $1.16 billion, surpassing analysts’ expectations. While Rivian incurred a net loss of $1.457 million.

Rivian’s earnings per share (EPS) of -$1.39 outperformed analysts’ estimates by a narrow margin. This positive deviation from expectations indicated that Rivian was effectively managing its costs and making strides toward profitability. The company’s operational metrics also demonstrated positive trends, with a production rate of 10,000 vehicles per year and a growing order backlog.

The company reiterated its full-year production target of 50,000 vehicles and expressed confidence in its ability to achieve this goal. Rivian also acknowledged the ongoing challenges in the global supply chain and the competitive landscape, which could impact its future performance.

The Market, Industry, and Competitors:

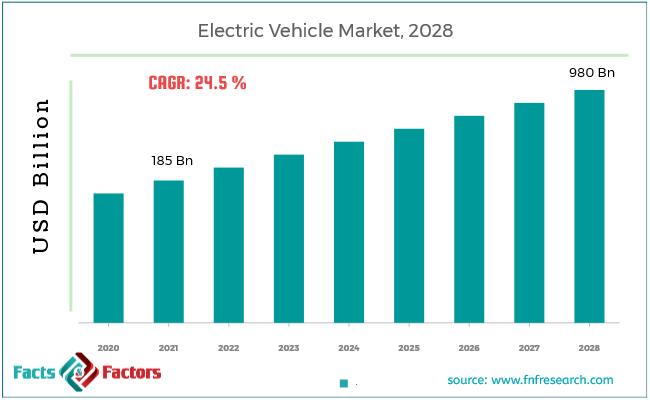

Rivian Automotive Inc. operates in the rapidly growing electric vehicle (EV) market, specifically targeting the high-performance and outdoor adventure segments. The global EV market is experiencing significant expansion, driven by factors such as government incentives, increasing environmental concerns, and advancements in battery technology. Rivian’s focus on innovative design, off-road capabilities, and strong brand positioning positions it well to capitalize on this market growth.

Industry experts project substantial growth for the EV market, with forecasts suggesting a compound annual growth rate (CAGR) of around 20-25% between 2024 and 2028. Rivian is expected to benefit from this market expansion, with analysts predicting significant increases in its revenue and production volume over the next few years. The company’s success will also depend on its ability to overcome challenges such as supply chain constraints, intense competition, and the rapid pace of technological advancements in the EV industry.

Unique differentiation:

Rivian Automotive Inc. faces competition from both established automakers and emerging electric vehicle (EV) companies. Established automakers like Tesla, Ford, and General Motors are investing heavily in developing their own electric vehicle lines, leveraging their extensive manufacturing capabilities and brand recognition. These companies pose a significant threat to Rivian, as they have deep pockets and can potentially undercut Rivian’s pricing or offer more comprehensive product ranges.

Rivian also competes with other emerging EV companies such as Lucid Motors, Nikola Corporation, and Lordstown Motors. These companies are focused on disrupting the automotive industry with their own innovative electric vehicle offerings. While Rivian has a strong early mover advantage, these competitors are rapidly gaining traction and could challenge Rivian’s market share.

Rivian Automotive Inc. differentiates itself from its competitors primarily through its focus on outdoor adventure and off-road capabilities. While other electric vehicle manufacturers often emphasize luxury or daily commuting, Rivian positions its products as capable and versatile vehicles for exploring the outdoors. This unique selling point attracts customers who seek vehicles that can handle diverse terrains and challenging conditions. Rivian’s emphasis on sustainability and innovation sets it apart, as the company strives to create electric vehicles that not only perform well but also contribute to a cleaner.

Management & Employees:

RJ Scaringe: Founder, Chief Executive Officer, and Chairman.

Javier Varela: Chief Operating Officer.

Frank Klein: Chief Product Development Officer.

Jimmy Knauf: Executive Vice President of Facilities.

Financials:

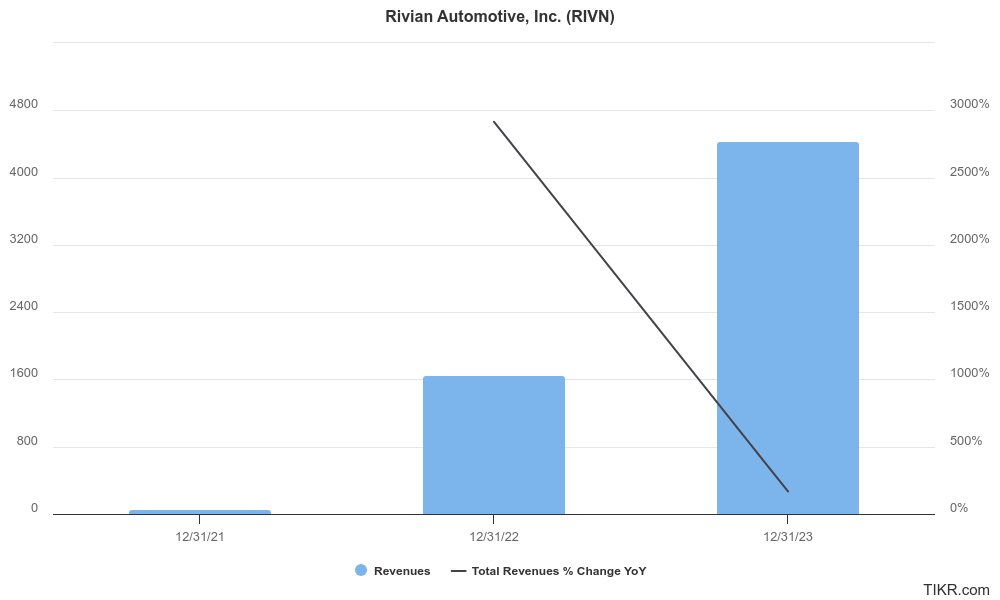

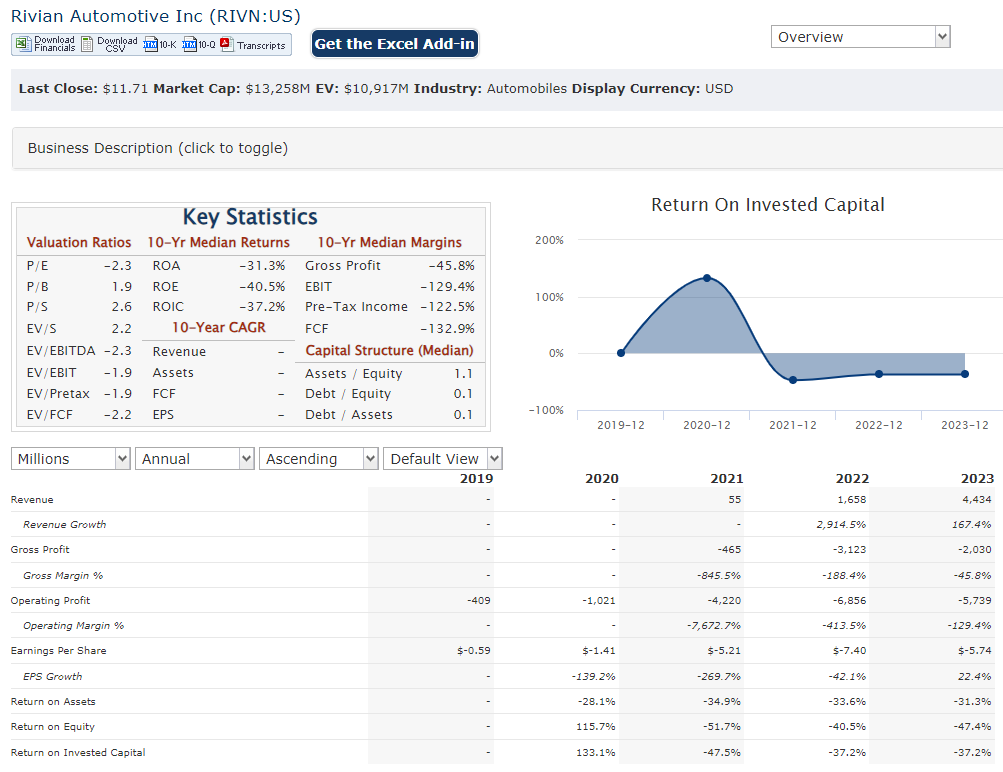

Rivian Automotive Inc. reported annual revenue of approximately $4.43 billion for the latest fiscal year. This represents a compound annual growth rate (CAGR) of around 32.1%, driven primarily by increased vehicle production and sales, particularly of its R1T pickup and R1S SUV models. Rivian has struggled to achieve profitability, posting a net loss of $5.43 billion over the same period.

The company reported an EPS of -$5.77 over the last four quarters, indicating a challenging path toward profitability. Analysts forecast that Rivian’s EPS will improve gradually, with expectations of reaching -$2.95 per share in the coming year, reflecting a projected growth rate of 22.1% per annum. This anticipated improvement is contingent on the company’s ability to scale production efficiently and manage costs effectively as it ramps up operations.

Rivian has faced increasing scrutiny regarding its debt levels and cash flow management. Their net debt has decreased from approximately $16.7 billion in 2021 to about $4.6 billion in 2023, showcasing efforts to improve its financial stability. They continue to operate with negative cash flow, which raises concerns about its long-term sustainability without additional funding or revenue growth. The cautiously optimistic as analysts predict continued revenue growth alongside improvements in earnings as the company navigates the competitive electric vehicle landscape and works towards achieving profitability.

Technical Analysis:

The stock is on a long term consolidation (phase 1) neutral phase right now on both the monthly and weekly charts. It is still trying to find a bottom which seems to be in the $10.3 range and then again in the $8 range. Until there is a good sign of reversal, we wont be interested in the stock.

Bull Case:

First-Mover Advantage: Rivian has established itself as an early mover in the EV market, particularly in the high-performance and off-road segments. This positions the company to capitalize on the growing demand for electric vehicles and potentially capture a significant market share.

Innovative Product Offerings: Rivian’s products, such as the R1T pickup truck and R1S SUV, offer unique features and capabilities, including off-road performance, advanced technology, and a focus on sustainability. These innovative offerings can attract a diverse customer base and differentiate Rivian from competitors.

Potential for Diversification: Rivian has expressed interest in expanding its product line beyond pickup trucks and SUVs, potentially entering other segments of the EV market. This diversification could provide additional growth opportunities and reduce the company’s reliance on a single product category.

Bear Case:

Supply Chain Challenges: The EV industry is heavily reliant on a complex supply chain, which can be vulnerable to disruptions. Factors such as component shortages, rising raw material costs, and geopolitical tensions could impact Rivian’s production, costs, and profitability.

Technological Risks: The EV market is characterized by rapid technological advancements, including improvements in battery technology, charging infrastructure, and autonomous driving capabilities. Rivian’s ability to keep pace with these advancements and remain competitive will be crucial to its long-term success.

Scaling Challenges: Rivian is still a relatively young company and may face challenges in scaling up its production, expanding its distribution network, and building customer awareness. These scaling challenges could impact the company’s growth and profitability.