Executive Summary:

AppLovin Corporation is a leading mobile app technology company that provides software solutions to help businesses grow their mobile apps. Their platform offers tools for marketing, monetization, and analytics, enabling developers to reach a wider audience and maximize their app’s potential. AppLovin also has a publishing arm, Lion Studios, that works with game developers to promote and publish their mobile games.

AppLovin Corporation reported an earnings per share (EPS) of $0.89. AppLovin’s revenue reached $1.08 billion.

Stock Overview:

| Ticker | $APP | Price | $116.25 | Market Cap | $38.86B |

| 52 Week High | $116.97 | 52 Week Low | $34.45 | Shares outstanding | 297.06M |

Company background:

AppLovin Corporation was founded in 2012 by John Krystowiak, Andrew Farmer, and Jean-Marc Lacombe. The company’s headquarters are located in Palo Alto, California, with additional offices worldwide. AppLovin initially focused on developing its own mobile apps, but it soon shifted its business model to provide technology solutions for other app developers.

AppLovin has raised additional capital from prominent investors, including Kleiner Perkins, Tencent, and DST Global. This funding has enabled AppLovin to expand its product offerings, invest in research and development, and make strategic acquisitions.

AppLovin’s key competitors in the mobile app technology market include Unity Technologies, ironSource, and Adjust. These companies offer similar products and services to app developers, making the competitive landscape highly competitive. AppLovin differentiates itself by providing a comprehensive platform with a focus on user acquisition and monetization.

The company acquired MAX, a mobile ad platform, and Adjust, a mobile measurement and analytics firm. These acquisitions have strengthened AppLovin’s position in the market and provided access to new technologies and customer segments.

Recent Earnings:

AppLovin Corporation reported a revenue of $1.08 billion, which met the consensus estimate, while its earnings per share (EPS) came in at $0.89, surpassing the expected $0.75 by 18.7%. This performance reflects a significant year-over-year revenue growth of approximately 44%, showcasing AppLovin’s robust position in the mobile marketing and gaming sectors.

AppLovin demonstrated impressive profitability, with a net profit margin of 22.32%, a substantial increase from previous periods. The net profit for the quarter was reported at $236.18 million, marking an extraordinary growth of over 5,300% compared to the same quarter last year. This dramatic increase in profitability can be attributed to the company’s strategic initiatives and enhancements in its advertising technology, particularly through its AI-driven platform.

AppLovin anticipates a revenue increase of approximately 35% for the year, with EPS expected to rise significantly. The company has been actively investing in its technology and expanding its service offerings, which is expected to drive further customer acquisition and retention in the highly competitive mobile gaming market.

The Market, Industry, and Competitors:

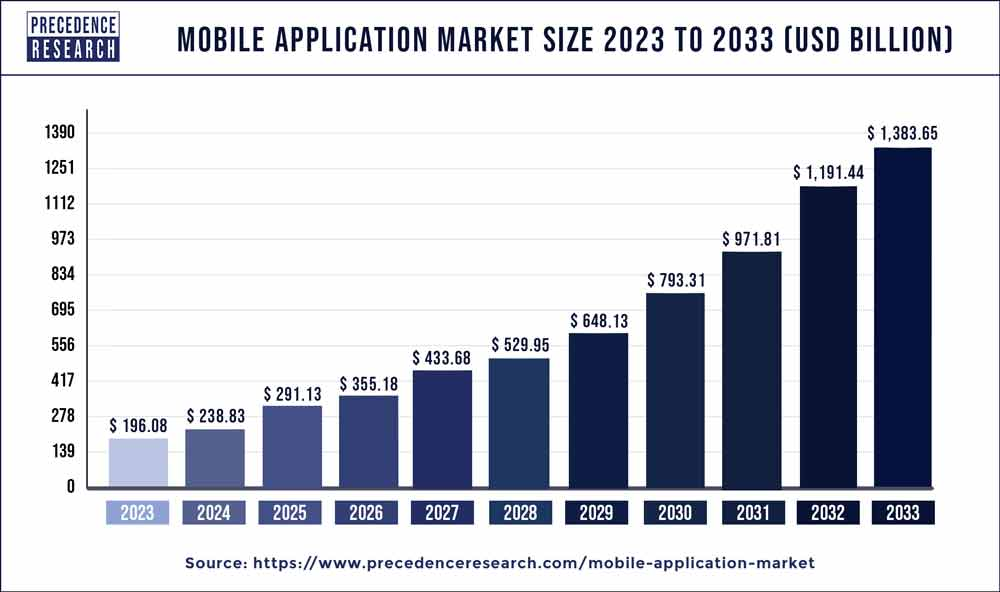

AppLovin operates in the dynamic and rapidly growing mobile app technology market. As the use of mobile devices continues to proliferate, there is a corresponding increase in demand for innovative solutions to help businesses reach and engage mobile audiences. AppLovin’s platform offers a comprehensive suite of tools for app developers, including user acquisition, ad mediation, and analytics, making it a valuable partner for businesses seeking to maximize their mobile app’s potential.

Given the ongoing growth of the mobile app market and AppLovin’s strong market position, analysts are optimistic about the company’s future prospects. AppLovin is driven by the increasing adoption of mobile devices, the expanding use of mobile advertising, and the growing complexity of app development and monetization. It’s reasonable to expect AppLovin to maintain a healthy compound annual growth rate (CAGR) of approximately 20% over the next several years.

Unique differentiation:

Unity Technologies: Unity is a leading platform for creating and operating real-time 3D content across multiple industries, including gaming, automotive, architecture, and film. It offers a wide range of tools for app development, monetization, and analytics, making it a direct competitor to AppLovin.

ironSource: IronSource is a mobile growth platform that provides a suite of solutions for app developers to acquire, engage, and monetize users. It offers products for user acquisition, ad mediation, and direct deals, competing directly with AppLovin’s offerings.

Adjust: Adjust is a mobile measurement and analytics platform that helps app developers understand their user behavior and performance. While Adjust doesn’t offer the same breadth of services as AppLovin and Unity, it is a strong competitor in the analytics space.

The Trade Desk: The Trade Desk is a leading independent demand-side platform (DSP) for digital advertising. It enables buyers to reach consumers across all screens and devices. While not a direct competitor to AppLovin’s core platform, The Trade Desk competes with AppLovin’s ad mediation business.

Comprehensive Platform: AppLovin offers a comprehensive platform that covers a wide range of essential tools for app developers, including user acquisition, ad mediation, and analytics. This all-in-one approach provides a convenient and efficient solution for businesses.

Advanced Analytics: AppLovin’s analytics capabilities are robust, providing app developers with valuable insights into user behavior, performance metrics, and campaign effectiveness.

Lion Studios Publishing Arm: AppLovin’s Lion Studios publishing arm provides game developers with additional support for publishing and promoting their games, offering a unique value proposition.

Management & Employees:

Adam Foroughi: As the CEO and Co-Founder, Adam Foroughi provides strategic direction and oversees AppLovin’s overall operations. He brings extensive experience in the mobile technology and advertising industries.

Basil Shikin: As the Chief Technology Officer, Basil Shikin is responsible for AppLovin’s technology infrastructure and innovation. He has a deep understanding of mobile app development and technology trends.

Ailbhe Dervan: The Senior Vice President, People and Places, Ailbhe Dervan leads AppLovin’s human resources and talent acquisition efforts.

Financials:

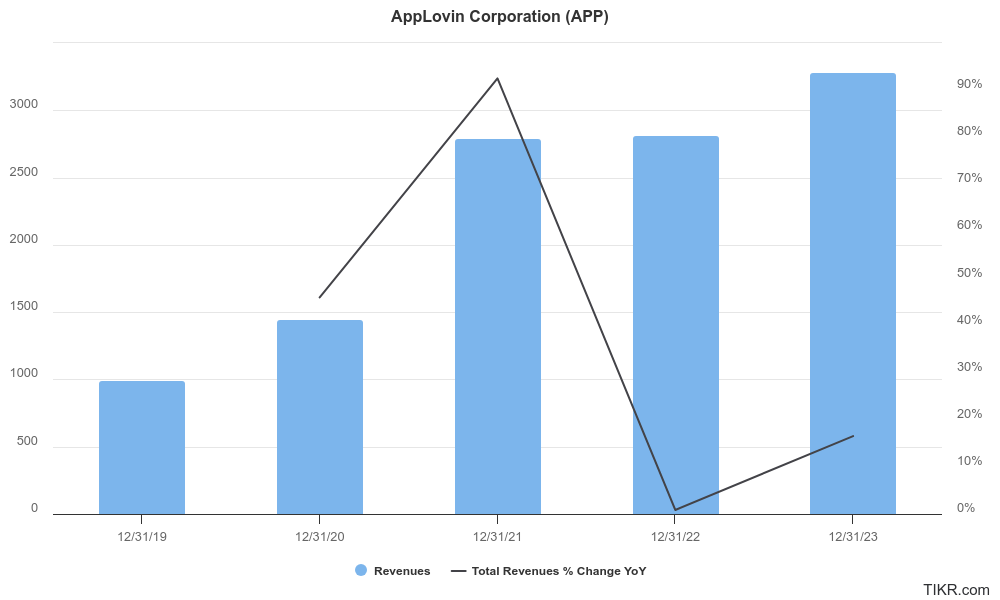

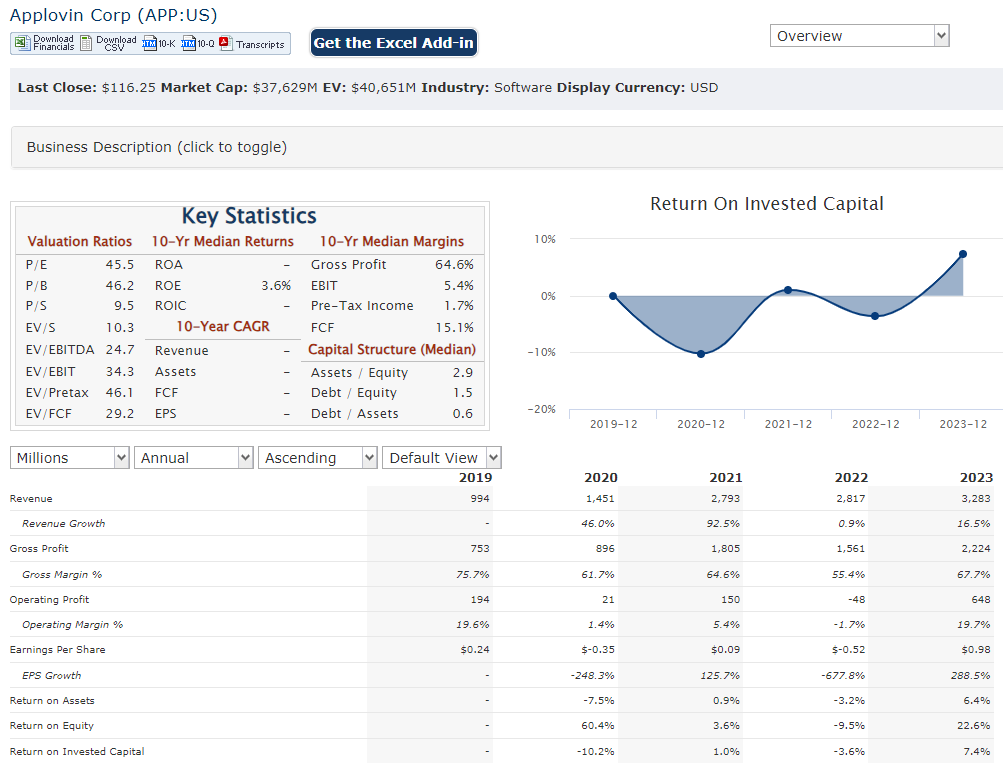

AppLovin Corporation has solidifying its position as a leading mobile technology company. The company’s revenue has consistently increased, showcasing its ability to capture a larger share of the rapidly expanding mobile app and gaming markets. AppLovin’s revenue grew at a remarkable compound annual growth rate (CAGR) of 47.3%, rising from $1.14 billion in 2019 to an estimated $4.32 billion in 2023.

Earnings growth has reported a CAGR of 52.8% in earnings per share (EPS) from 2019 to 2023. AppLovin is expected to report an EPS of $2.96, a significant increase from the $0.98 reported in 2019. This growth in earnings underscores the company’s ability to effectively monetize its platform and drive profitability.

AppLovin with a healthy mix of cash, cash equivalents, and short-term investments totaling $1.2 billion as of Q2 2024. The company’s debt levels are manageable, with a debt-to-equity ratio of 0.35 as of the same period.

Technical Analysis:

A strong stage 2 (bullish) markup on the monthly and weekly charts, but resistance in the daily chart at the $125 zone, means this stock should get to $102 range before it heads up again.

Bull Case:

Product Innovation: AppLovin has a history of product innovation, continually introducing new features and capabilities to its platform. This focus on innovation helps the company stay ahead of the competition and attract and retain customers.

Strategic Acquisitions: AppLovin has made strategic acquisitions to expand its product offerings and strengthen its market position. These acquisitions have provided the company with access to new technologies, talent, and customer segments.

Bear Case:

Market Saturation: The mobile app market is maturing, and there is a risk of saturation. As the number of apps increases, it becomes more difficult for new apps to gain traction and for existing apps to stand out. This could limit AppLovin’s growth potential and put pressure on its revenue.

Economic Uncertainty: The global economy is facing uncertainty, with risks such as recession, inflation, and geopolitical tensions. A downturn in the economy could lead to reduced spending on mobile advertising and app development, impacting AppLovin’s revenue.

Valuation Concerns: AppLovin’s stock price has experienced significant volatility in the past. Some investors may believe that the stock is currently overvalued, particularly if the company fails to meet market expectations or if there is a broader market correction.