Executive Summary:

RPM International Inc. is a multinational company specializing in specialty coatings, sealants, and building materials. With a diverse portfolio of brands, RPM offers products for both professional and consumer use. The company operates in various industries, including construction, manufacturing, and automotive.

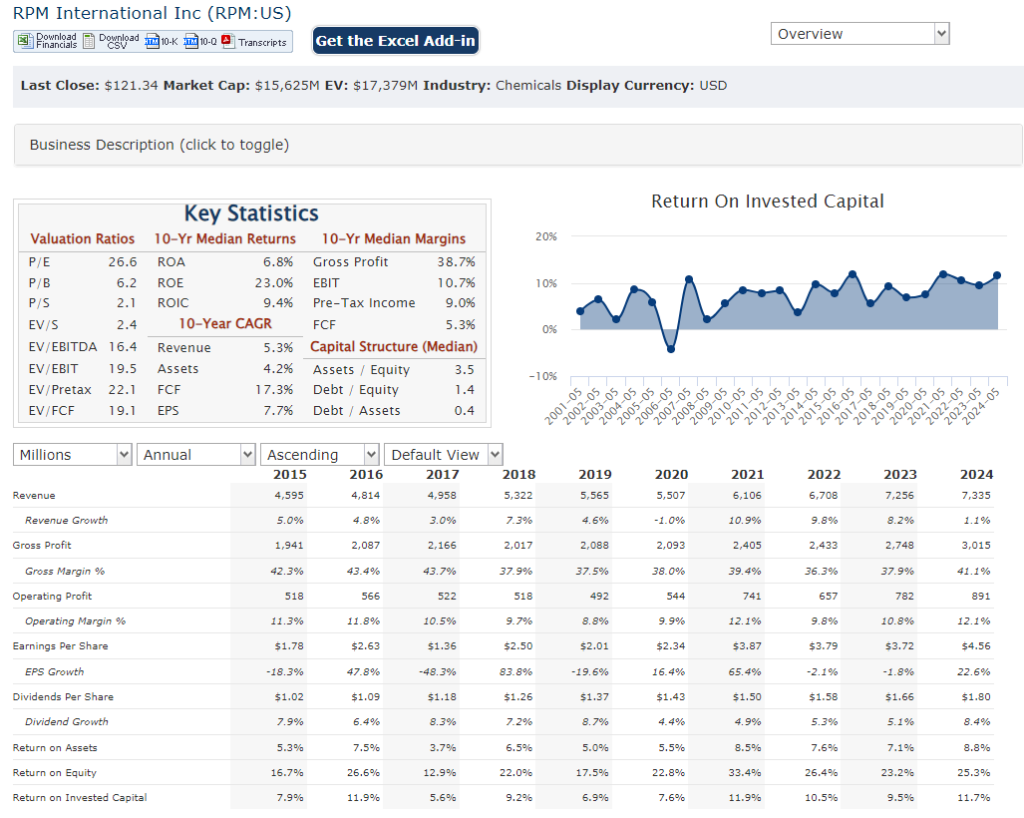

RPM International Inc. delivered a record net income of $588.4 million and record diluted earnings per share (EPS) of $4.56. Revenue for the period exceeded forecasts, growing by 1.6% year-over-year to $2.02 billion.

Stock Overview:

| Ticker | $RPM | Price | $121.34 | Market Cap | $15.63B |

| 52 Week High | $122.92 | 52 Week Low | $88.84 | Shares outstanding | 128.77M |

Company background:

RPM International Inc., a leading multinational manufacturer and marketer of specialty coatings, sealants, and building materials, traces its roots back to 1947 when it was founded as Republic Powdered Metals Inc. RPM has expanded its product portfolio and geographic reach through acquisitions of well-known brands like Rust-Oleum, DAP, Zinsser, and Tremco.

While RPM does not rely on external funding sources, its consistent profitability and strong financial performance have fueled its organic growth and expansion. The company’s diverse product offerings cater to a wide range of industries, including construction, manufacturing, automotive, and consumer markets. Some of RPM’s key competitors include Sherwin-Williams, PPG Industries, and AkzoNobel.

RPM International Inc. is headquartered in Medina, Ohio, and maintains a global presence with operations in over 170 countries. The company’s commitment to innovation, quality, and customer satisfaction has solidified its position as a trusted leader in the specialty coatings and building materials industry.

Recent Earnings:

RPM International Inc. delivered record net income of $588.4 million, up from $478.7 million in the prior year. Diluted earnings per share (EPS) also reached a new high of $4.56, surpassing the consensus estimate of $4.30. Revenue for the quarter increased by 1.6% to $2.02 billion.

The company’s gross margin expanded by 130 basis points to 34.1%, reflecting higher selling prices and improved product mix. Adjusted EBITDA for the quarter rose by 11.9% to a record $941.6 million. Operating activities’ cash flow surged to $1.12 billion, up from $545.2 million in the previous year.

The company remains optimistic about its future prospects, driven by its strong market position, diversified product portfolio, and ongoing innovation.

The Market, Industry, and Competitors:

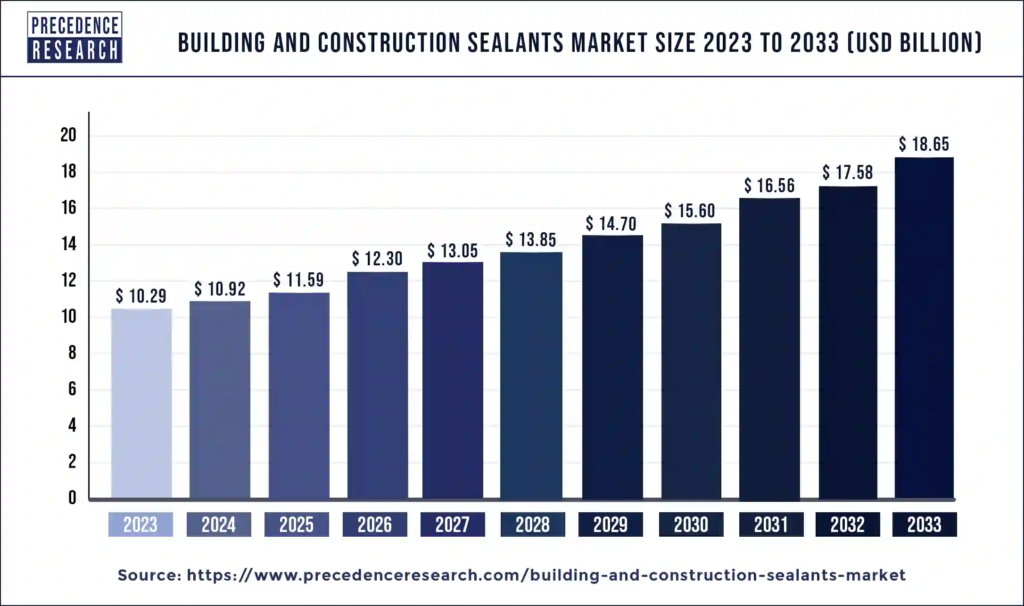

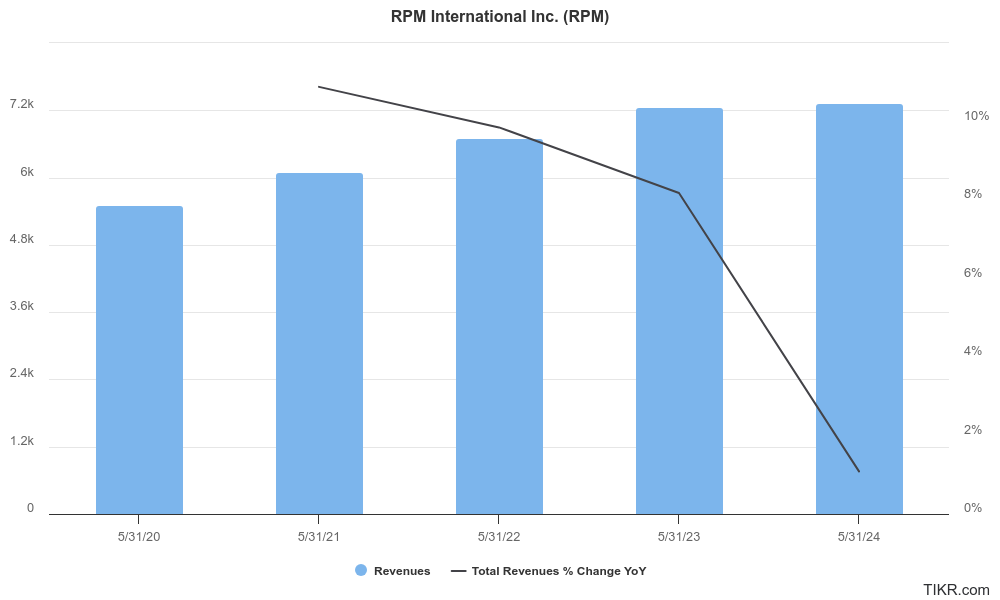

RPM International Inc. operates in the specialty coatings, sealants, and building materials market, which is characterized by a diverse product portfolio and a strong focus on innovation. RPM reported net sales of $7.26 billion, reflecting an 8.2% increase from the previous year, driven by strong demand for engineered solutions in infrastructure and maintenance projects, despite challenges in new construction markets due to destocking and inflationary pressures.

RPM International Inc. has set ambitious growth targets for its MAP 2025 initiative, aiming for $8.5 billion in revenue. This initiative focuses on operational excellence, strategic acquisitions, and geographic expansion to enhance market penetration and efficiency. The company has achieved a compound annual growth rate (CAGR) of 6.4% over the past five years, and it anticipates continued growth in the coming years, supported by its diversified business model and resilience in the construction sector. This positions RPM to capitalize on emerging opportunities while navigating the complexities of the global market environment.

Unique differentiation:

RPM International Inc. faces competition from a number of companies, including Sherwin-Williams, PPG Industries, and AkzoNobel. These companies are all large, global manufacturers and marketers of specialty coatings, sealants, and building materials. They have strong brand recognition, extensive product portfolios, and a wide distribution network.

Sherwin-Williams offers a wide range of products for both professional and consumer use, including paints, coatings, sealants, and adhesives. PPG Industries is another major competitor. The company is headquartered in Pittsburgh, Pennsylvania, and has operations in over 100 countries. PPG Industries offers a wide range of products for the construction, industrial, transportation, and consumer markets. AkzoNobel is a Dutch multinational company that is one of the world’s largest producers of paints, coatings, and specialty chemicals.

Diversified Product Portfolio: RPM offers a broader range of specialty coatings, sealants, and building materials, catering to a wider variety of industries and applications. This diversification helps to mitigate risks and provides a more stable revenue stream.

Strong Brand Recognition: RPM owns a portfolio of well-known and trusted brands, such as Rust-Oleum, DAP, Zinsser, and Tremco. These brands have strong brand equity and loyal customer bases, giving RPM a competitive advantage in the marketplace.

Management & Employees:

Frank C. Sullivan: Chairman and Chief Executive Officer

Edward W. Moore: Senior Vice President, General Counsel, and Chief Compliance Officer

Janeen B. Kastner: Vice President – Corporate Benefits and Risk Management

Financials:

RPM International Inc. has reported net sales of $7.26 billion, an increase of 8.2% from the previous year. This growth trajectory reflects a compound annual growth rate (CAGR) of approximately 6.4% over the past five years. Earnings performance has also been robust, with RPM achieving an average annual earnings growth rate of 12.5% over the same five-year period. The company reported a net income of $478.7 million, slightly down from $491.5 million in fiscal 2022, resulting in diluted earnings per share (EPS) of $3.72. This represents a decrease of 1.8% compared to the prior year.

The adjusted diluted EPS increased by 17.5% to $4.30, indicating strong underlying performance. The earnings growth has been supported by the company’s ability to leverage pricing power in response to inflationary pressures and the successful implementation of cost-saving initiatives. Total liabilities stood at approximately $6.59 billion, with total stockholders’ equity at around $2.51 billion, reflecting a solid equity base. The company’s debt-to-equity ratio is approximately 0.96, indicating a balanced approach to leveraging. RPM has demonstrated strong cash flow generation, with record cash provided by operating activities of $767.8 million, which has allowed the company to reduce debt by nearly $140 million.

Technical Analysis:

The stock is on a stage 2 markup (bullish) on the monthly chart and is building higher off a strong base on the weekly chart (bullish, stage 2). The daily chart has a double top, but the momentum should carry it to over $125 in the short term.

Bull Case:

Consistent Financial Performance: The company has a history of delivering consistent financial performance, with strong revenue growth, earnings growth, and cash flow generation. This track record inspires confidence in its future prospects.

Favorable Industry Trends: The specialty coatings and building materials market is expected to continue growing, driven by factors such as urbanization, infrastructure development, and rising consumer demand. RPM is well-positioned to benefit from these trends.

Valuation: RPM’s stock may be undervalued relative to its peers, offering investors a potentially attractive entry point.

Bear Case:

Raw Material Costs: RPM’s profitability can be influenced by fluctuations in raw material prices. Rising costs could impact margins if the company is unable to pass them on to customers.

Supply Chain Disruptions: Global supply chain disruptions, such as those experienced during the COVID-19 pandemic, could affect RPM’s ability to source raw materials and deliver products to customers.

Integration Risks: RPM has a history of acquiring businesses. Successful integration of these acquisitions can be challenging and may impact the company’s performance.