Executive Summary:

The J.M. Smucker Company is a renowned American food and beverage manufacturer, the company has a rich history of producing high-quality products, including fruit spreads, peanut butter, coffee, and pet food. The J.M. Smucker Company remains a leading force in the food industry with a diverse portfolio of beloved brands.

The J.M. Smucker Company (SJM) reported earnings per share (EPS) of $2.66, marking a year-over-year increase of 0.76% from the prior year’s EPS of $2.64. The company’s revenue for the quarter reached $2.21 billion.

Stock Overview:

| Ticker | $SJM | Price | $118.34 | Market Cap | $12.59B |

| 52 Week High | $134.62 | 52 Week Low | $105.69 | Shares outstanding | 106.41M |

Company background:

The J.M. Smucker Company is a leading American food and beverage manufacturer, founded in 1897 by Jerome Monroe Smucker in Orrville, Ohio. The company started as a small family-owned business, producing apple butter and later expanding to include other fruit spreads. Smucker’s has grown significantly through strategic acquisitions and product diversification.

Smucker’s is a multinational corporation with a market capitalization of billions of dollars. The company’s product portfolio includes a wide range of well-known brands, such as Jif peanut butter, Folgers coffee, and Uncrustables.

It faces competition from other major food and beverage companies, including Kraft Heinz, Kellogg’s, and Conagra Brands. These competitors offer similar products and often compete on price and brand recognition. Smucker’s has maintained a strong market position through its focus on quality, innovation, and consumer preferences.

Recent Earnings:

The J.M. Smucker Company (SJM) announced net sales of $1.94 billion, representing a 12% decline compared to $2.21 billion in the same quarter of the previous year. This decrease was primarily attributed to the divestiture of certain pet food brands, which accounted for $385 million in sales in the prior year.

Earnings per share (EPS) for the quarter stood at $1.90, a 6% increase from $1.79 in the same period last year. Adjusted EPS, which accounts for certain nonrecurring items, rose by 8% to $2.66, up from $2.64 in the prior year. The company’s ability to deliver organic sales growth and improved profitability reflects its successful execution of strategic priorities, including the integration of newly acquired brands like Hostess and Voortman.

Smucker reported an adjusted operating income of $385.4 million, a slight increase from $379.6 million year-over-year, demonstrating effective cost management despite revenue challenges. The gross profit margin improved to 37.4%, up from 31.8% in the previous year.

The company anticipates continued momentum in its core categories and expects to achieve adjusted EPS in the range of $9.70 to $10.00, reflecting confidence in its strategic initiatives and market positioning. Smucker’s focus on integrating acquisitions and capitalizing on synergies is expected to drive long-term sustainable growth and enhance shareholder value

The Market, Industry, and Competitors:

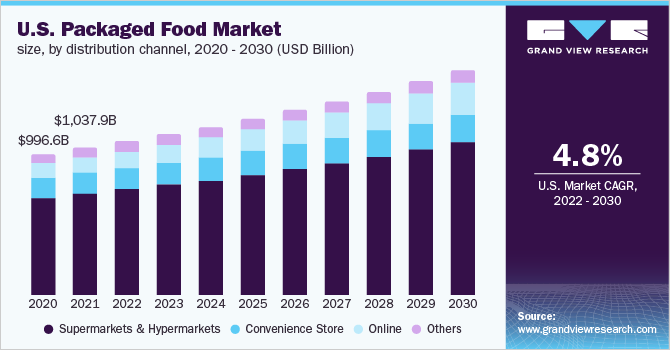

The J.M. Smucker Company operates in the highly competitive consumer packaged goods market, primarily focusing on food and beverage products. Smucker leverages its strong brand recognition and distribution capabilities to cater to a broad consumer base. The market is characterized by evolving consumer preferences, with an increasing demand for convenience and health-oriented products, driving companies like Smucker to innovate and adapt their offerings.

The growth expectations for The J.M. Smucker Company are optimistic, with projections indicating a compound annual growth rate (CAGR) of approximately 5% through 2030. This growth is anticipated to be fueled by strategic acquisitions, expansion into emerging markets, and a focus on product innovation to meet changing consumer demands. The company’s commitment to sustainability and community impact also positions it favorably in a market where consumers increasingly prioritize ethical and environmentally friendly brands.

Unique differentiation:

Kraft Heinz: A global food and beverage conglomerate known for brands such as Kraft, Heinz, Philadelphia, and Oscar Mayer. Kraft Heinz competes with Smucker’s in categories like peanut butter, jelly, and coffee.

Kellogg’s: A leading producer of breakfast cereals, snacks, and frozen foods. Kellogg’s competes with Smucker’s in the coffee category and also offers some complementary products.

Conagra Brands: A diversified food company with a portfolio of brands including Healthy Choice, Orville Redenbacher, and Marie Callender. Conagra competes with Smucker’s in categories such as frozen meals and snacks.

Post Holdings: A food company focused on cereals, snacks, and refrigerated foods. Post competes with Smucker’s in the cereal and coffee categories.

Strong Brand Equity: Smucker’s has built a portfolio of iconic brands, such as Jif, Folgers, and Uncrustables, that are widely recognized and trusted by consumers. This brand equity helps to drive customer loyalty and market share.

Focus on Sustainability: Smucker’s has made significant strides in sustainability, including reducing its environmental footprint and supporting ethical sourcing practices. This commitment resonates with environmentally conscious consumers and helps to differentiate the company from competitors.

Strong Distribution Network: Smucker’s has a well-established distribution network that allows it to reach a wide range of customers. This helps to ensure that the company’s products are readily available to consumers.

Management & Employees:

Mark Smucker: Chair of the Board, President, and Chief Executive Officer.

Jeannette Knudsen: Chief Legal Officer and Secretary

Jill Penrose: Chief People and Company Services Officer

Financials:

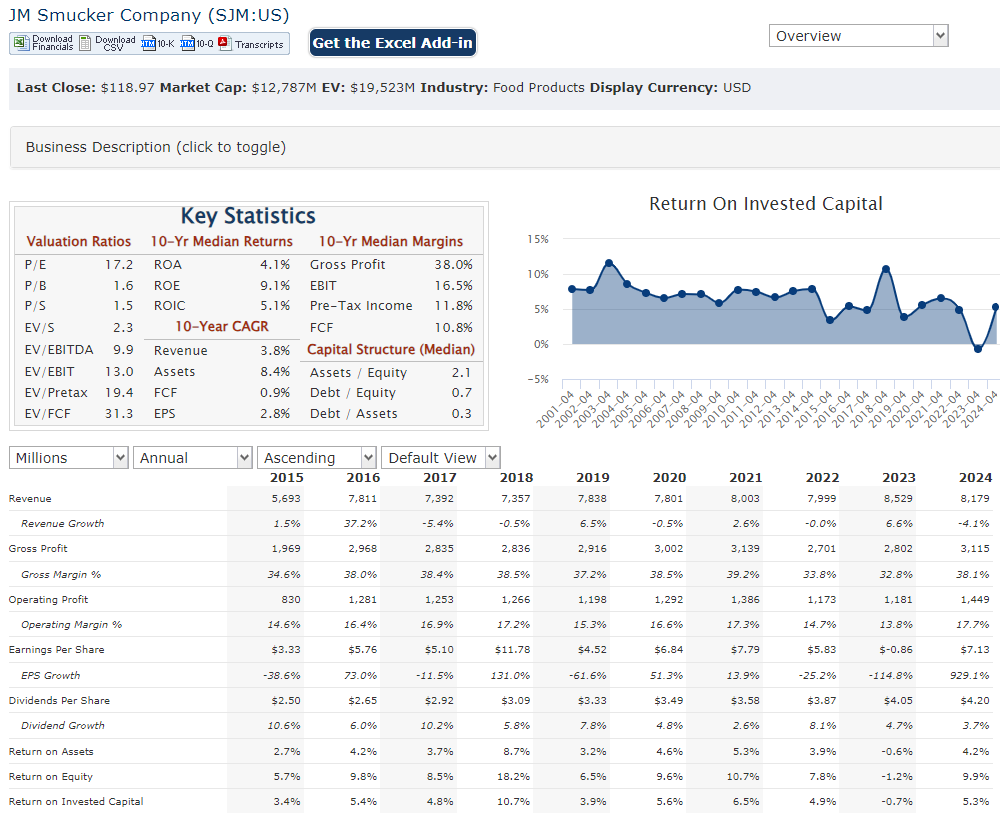

The J.M. Smucker Company has reported net sales of approximately $8.7 billion, reflecting a compound annual growth rate (CAGR) of around 3.20% from the previous five years. This growth trajectory has been supported by the company’s efforts to expand its product offerings and enhance brand presence, particularly in the coffee and pet food segments. The overall revenue growth has been resilient, driven by strong consumer loyalty and effective marketing strategies.

Earnings growth has also been notable, with adjusted earnings per share (EPS) reaching $9.94 for fiscal year 2024, an increase of 11% compared to the previous year. The five-year CAGR for adjusted EPS stands at approximately 6.5%, highlighting the company’s ability to enhance profitability alongside revenue growth.

The company’s focus on integrating acquisitions, such as Hostess Brands, has further contributed to its earnings potential. The J.M. Smucker Company maintains a solid financial position, with total assets valued at approximately $20.3 billion as of July 2024. The company has managed its liabilities effectively, with total liabilities at around $12.6 billion, resulting in a healthy debt-to-equity ratio.

Cash flow from operations has remained strong, with cash provided by operations totaling $1.11 billion in fiscal year 2024, enabling the company to sustain dividend payments and reinvest in its business.

Technical Analysis:

The stock is on a stage 4 decline (bearish) markdown on the monthly chart. It has another trend channel lower, stage 4 bearish on the weekly chart as well. On the daily chart, it has a bear flag forming and should retest the $109 – $112 range soon. We would not be buyers here.

Consistent Financial Performance: The company has a history of delivering steady financial results, with consistent revenue growth and profitability. This track record of performance instills confidence in investors.

Defensive Industry: The food and beverage industry is generally considered defensive, meaning it is less susceptible to economic downturns. This provides a degree of stability to Smucker’s stock.

Dividend Payout: Smucker’s has a long-standing commitment to returning value to shareholders through dividends. The company’s dividend yield is typically attractive to income-oriented investors.

Bear Case:

Changing Consumer Preferences: Consumer tastes and preferences can shift rapidly, and Smucker’s may struggle to keep up with these changes. If the company fails to adapt its product offerings, it could lose market share.

Regulatory Risks: The food industry is subject to various regulations, including those related to food safety, labeling, and marketing. Changes in regulations could increase costs and create uncertainty for Smucker’s business.

Valuation Concerns: If Smucker’s stock becomes overvalued relative to its earnings and growth prospects, it may be vulnerable to a price correction.