Executive Summary:

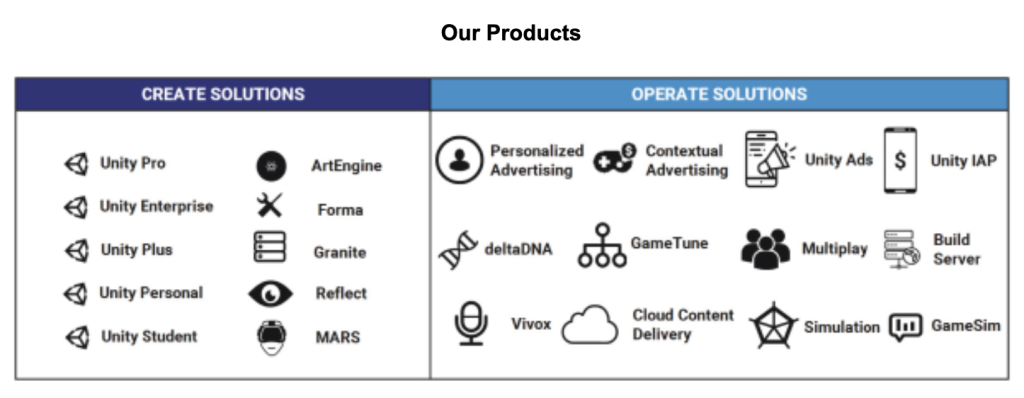

Unity Software Inc. is a leading global platform for creating and operating interactive, real-time 3D (RT3D) content. Its flagship product, the Unity game engine, is used by millions of developers worldwide to create games, apps, and experiences across various industries. Unity offers a comprehensive set of tools and services, including development, runtime, and monetization solutions, to help creators bring their visions to life.

Stock Overview:

| Ticker | $U | Price | $17.21 | Market Cap | $6.83B |

| 52 Week High | $43.54 | 52 Week Low | $13.90 | Shares outstanding | 396.86M |

Company background:

Unity Software Inc., a leading global platform for creating and operating interactive, real-time 3D (RT3D) content, was founded in Denmark in 2004 as Over the Edge Entertainment and later changed its name to Unity Technologies in 2007. The company’s headquarters are currently located in San Francisco, California.

Unity’s flagship product, the Unity game engine, has gained immense popularity among developers worldwide, empowering them to create a wide range of applications, including games, architectural visualizations, automotive designs, and virtual reality experiences. The company’s comprehensive platform offers a suite of tools and services, encompassing development, runtime, and monetization solutions, catering to the diverse needs of creators across various industries.

Key competitors in the RT3D content creation space include Unreal Engine, developed by Epic Games, and Godot Engine, an open-source game engine. Unity differentiates itself by offering a user-friendly interface, extensive documentation, and a vast asset store, making it accessible to developers of all skill levels. Unity’s commitment to empowering creators and fostering innovation has solidified its position as a dominant player in the RT3D industry.

Recent Earnings:

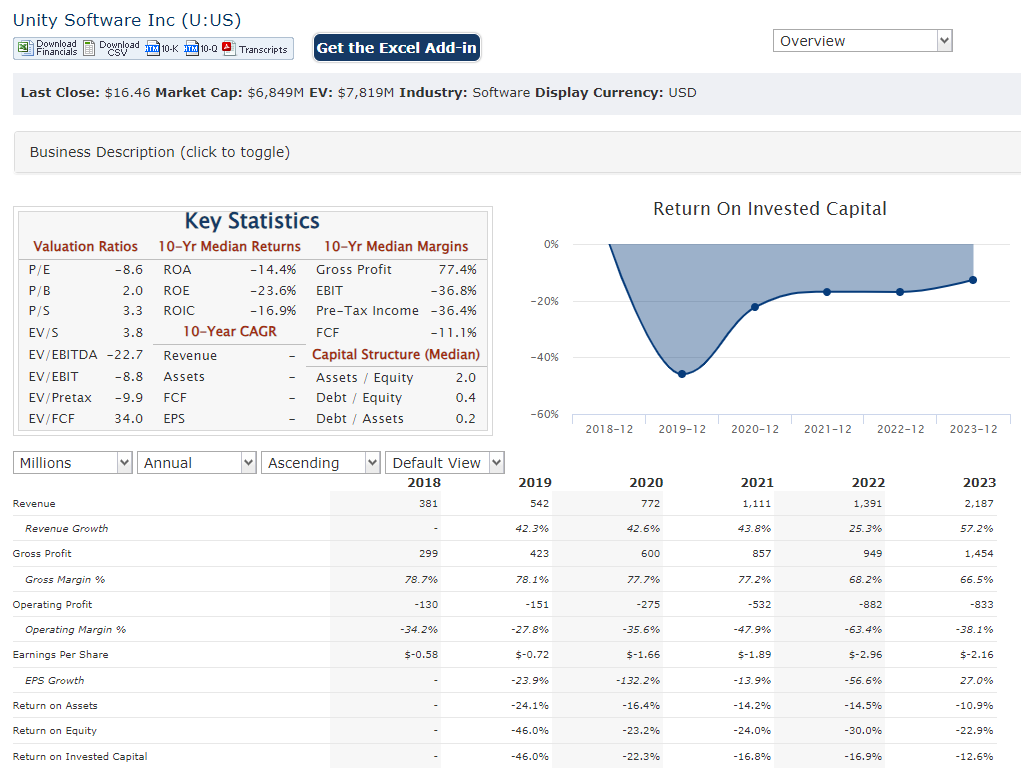

Unity Software Inc. reported revenue of $460.38 million. The company’s net profit for the quarter was reported at -$291.07 million, which is a 34.65% increase in losses compared to the same quarter last year, indicating ongoing challenges in profitability despite the increase in revenue.The earnings per share (EPS) for Unity was reported at -$0.75, which was below analysts’ expectations of -$0.63, resulting in a surprise percentage of -19.05%.

Unity’s return on assets (ROA) was reported at -0.07, and the return on equity (ROE) stood at -0.24, both indicating negative performance relative to the company’s asset and equity utilization. The net profit margin was reported at -63.22%. Unity is facing as it attempts to stabilize its operations and return to growth.

The Market, Industry, and Competitors:

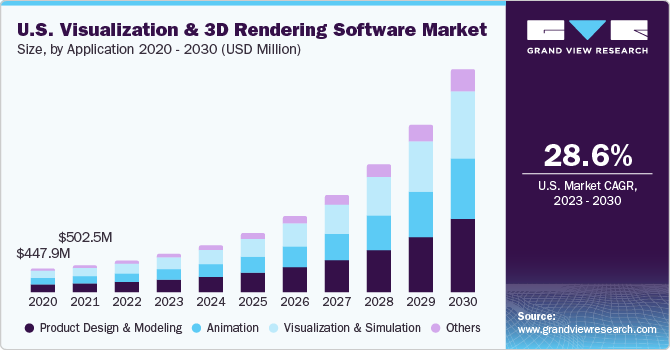

The market for Unity Software Inc. is primarily the real-time 3D (RT3D) content creation industry, which encompasses a wide range of applications, including video games, augmented and virtual reality experiences, architectural visualizations, and automotive designs. The RT3D market is experiencing rapid growth, driven by technological advancements, increasing demand for immersive experiences, and the growing adoption of RT3D content across various industries.

Unity’s revenue and user base by 2030, driven by factors such as the growing popularity of mobile gaming, the development of metaverse platforms, and the increasing adoption of RT3D in industries like healthcare and education. The company’s strong market position, coupled with its continuous innovation and expansion efforts, positions it well to capitalize on these growth opportunities.

Unity’s compound annual growth rate (CAGR) is expected to remain robust throughout the forecast period. This indicates that the company’s revenue and other key metrics are anticipated to grow at a steady and substantial pace, outpacing the overall market growth.

Unique differentiation:

Unity Software Inc. faces competition from several key players in the real-time 3D (RT3D) content creation market. The most prominent competitor is Unreal Engine, developed by Epic Games. Unreal Engine is widely used for high-end games and offers powerful features for physically based rendering and cinematic-quality visuals.

Other notable competitors include Godot Engine, an open-source game engine that is gaining popularity due to its flexibility and community-driven development. Lumberyard, previously developed by Amazon, is another option for developers seeking a free game engine with cloud integration capabilities. Additionally, smaller, specialized game engines like CryEngine and GameMaker Studio cater to specific niches within the RT3D market.

The competitive landscape for Unity is dynamic, with new players and technologies emerging regularly. Unity’s ability to maintain its market leadership will depend on its ability to innovate, address the evolving needs of developers, and provide a comprehensive and user-friendly platform for creating RT3D content.

Comprehensive Ecosystem: Unity provides a comprehensive ecosystem of tools, services, and assets, including the Unity game engine, the Unity Asset Store, and Unity Connect. This ecosystem offers creators a one-stop-shop for all their development needs, streamlining the workflow and saving time.

Strong Community and Support: Unity has a large and active community of developers who share knowledge, resources, and collaborate on projects. This fosters a supportive environment where creators can learn from each other and find solutions to challenges. Additionally, Unity provides excellent customer support, ensuring that developers have access to assistance when needed.

Cross-Platform Compatibility: Unity’s engine is designed to create content that can be deployed across multiple platforms, including mobile devices, consoles, PCs, and virtual reality headsets. This enables developers to reach a wider audience and maximize the potential of their creations.

Focus on Democratization: Unity is committed to democratizing RT3D content creation, making it accessible to creators of all backgrounds. This includes initiatives such as Unity Learn, which provides free online tutorials and courses, and Unity for Humanity, which supports projects that use RT3D technology to address social and environmental challenges.

Management & Employees:

- Matthew Bromberg– CEO, President, and Director.

- James Whitehurst: Executive Chair of the Board and Senior Advisor

- Anirma Gupta: Senior Vice President

Financials:

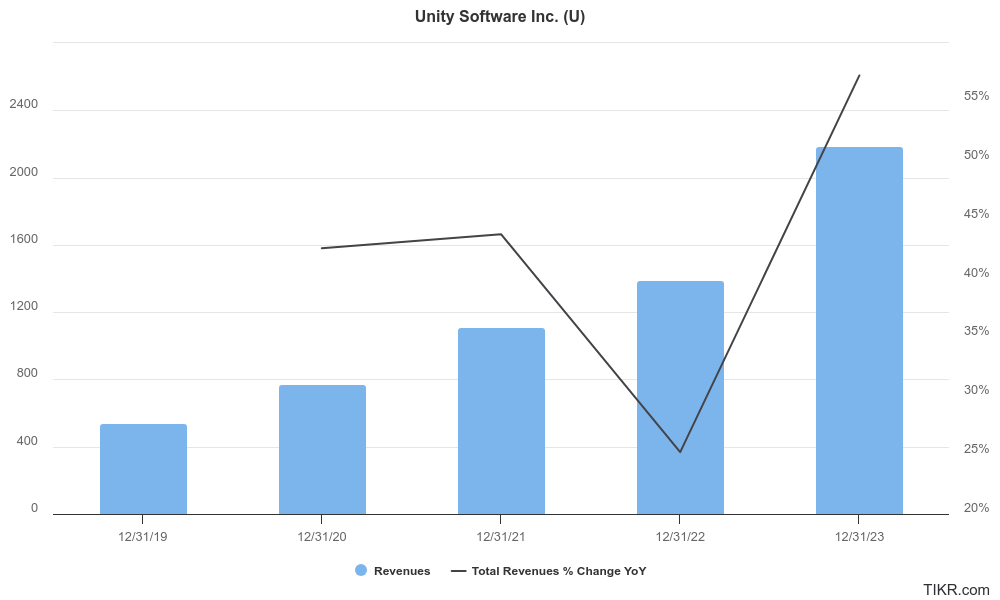

Unity Software Inc. has demonstrated a strong trajectory of growth, driven by the increasing demand for real-time 3D (RT3D) content creation tools. This growth can be attributed to factors such as the expansion of the gaming industry, the rise of virtual and augmented reality, and the increasing adoption of RT3D in various industries.

Unity has also faced challenges in achieving consistent profitability. The company’s focus on investing in research and development, expanding its product offerings, and acquiring new businesses has contributed to these fluctuations.

The company has managed its finances prudently, investing in growth initiatives while maintaining a healthy financial position.

Technical Analysis:

The stock is in a bearish stage 4 markdown phase in the monthly and weekly charts. The daily chart has a lot of resistance in the $18 range, and this stock is better left alone without an entry for the short to medium term.

Bull Case:

Growing Demand for RT3D Content: The demand for real-time 3D (RT3D) content is increasing across various industries, including gaming, automotive, architecture, and education. Unity’s platform is well-positioned to capitalize on this growing market.

Diverse Revenue Streams: Unity’s business model includes multiple revenue streams, such as software sales, asset store transactions, and platform fees. This diversification helps to mitigate risks and provides a more stable revenue base.

Strategic Acquisitions: Unity has actively pursued strategic acquisitions to expand its product offerings and capabilities. These acquisitions can enhance its competitive position and drive growth.

Bear Case:

Economic Downturn: A global economic downturn could reduce spending on gaming and other RT3D applications, impacting Unity’s revenue and growth.

Dependency on Large Customers: Unity’s revenue is concentrated among a few large customers, such as major game publishers. A loss of these customers or a decline in their spending could have a significant impact on Unity’s financial performance.

Integration Challenges: Unity has acquired several companies in recent years. Successful integration of these acquisitions is crucial for realizing their full potential. Failure to integrate these businesses effectively could create challenges and hinder growth.