Executive Summary:

Zillow Group Inc. is a leading online real estate marketplace company that provides a range of services to home buyers, sellers, renters, and mortgage seekers. Through its platform, users can search for properties, estimate home values, find real estate agents, and access financing options. Zillow also offers a suite of tools for professionals in the real estate industry, including marketing software and property management solutions.

Stock Overview:

| Ticker | $Z | Price | $57.53 | Market Cap | $13.22B |

| 52 Week High | $61.13 | 52 Week Low | $33.80 | Shares outstanding | 170.95M |

Company background:

Zillow Group Inc is an American online real estate marketplace company founded in 2006 by co-executive chairmen Rich Barton and Lloyd Frink, former Microsoft executives and founders of Microsoft spin-off Expedia. Zillow’s headquarters is located in Seattle, Washington, Other notable co-founders include Spencer Rascoff, a co-founder of Hotwire.com, David Beitel, Zillow’s current chief technology officer, and Kristin Acker, Zillow’s current technology leadership advisor.

Zillow’s primary business model revolves around providing a comprehensive platform for home buyers, sellers, renters, and mortgage seekers. Its platform offers a plethora of services, including property listings, estimated home values (Zestimates), real estate agent referrals, mortgage financing options, and rental listings. Zillow has also expanded its offerings to include tools for real estate professionals, such as marketing software and property management solutions.

Zillow has garnered significant funding throughout its history, with major investors including DST Global, Institutional Venture Partners, and Benchmark Capital. This financial backing has enabled the company to invest in technology, expand its services, and acquire other real estate companies, such as Trulia and StreetEasy.

Zillow’s key competitors in the online real estate market include Redfin, Realtor.com, and Apartments.com. These companies offer similar services and compete for market share by providing their own unique features and value propositions.

Recent Earnings:

Zillow Group Inc. reported revenue for the quarter reached $572 million, representing a 13% year-over-year increase. This growth was driven by strong performance in both residential and Premier Agent revenue segments. Residential revenue reached $409 million, surpassing the company’s outlook and outperforming the overall residential real estate industry growth of 3%.

Earnings per share (EPS) for the quarter came in at -$0.06, compared to -$0.19 in the prior-year period. The company’s adjusted EBITDA for the quarter was $134 million, exceeding the midpoint of its outlook range by $41 million.

Zillow’s traffic to its mobile apps and sites remained relatively flat year over year, averaging 231 million monthly unique users in the second quarter. Zillow’s platform increased by 4% year over year to 2.5 billion.

Zillow’s management team expressed optimism about the company’s prospects for the remainder of the year. They highlighted the ongoing strength in the housing market and the company’s continued investments in technology and innovation.

The Market, Industry, and Competitors:

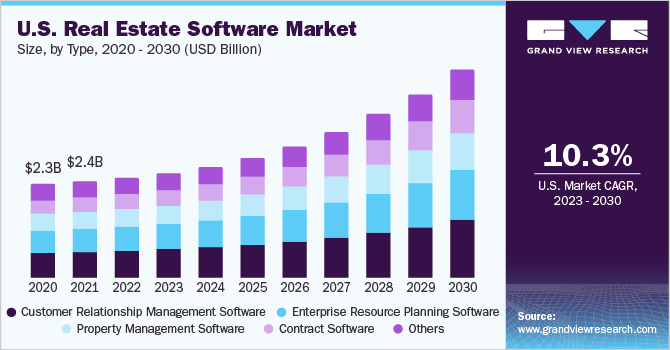

Zillow Group Inc. operates is a dynamic and ever-evolving industry. It is influenced by various factors, including economic conditions, interest rates, demographic trends, and technological advancements. Increasing urbanization, rising home prices, and a growing demand for rental properties.

The company’s strong brand recognition, extensive platform, and innovative offerings make it a valuable resource for home buyers, sellers, renters, and mortgage seekers. As the market continues to evolve, Zillow is expected to benefit from increased adoption of its services and expanded offerings.

Zillow is projected to experience continued growth, driven by factors such as increasing urbanization, rising home prices, and a growing demand for rental properties. The company is expected to expand its market share and further solidify its position as a leading online real estate marketplace.

Unique differentiation:

Redfin: Redfin is a technology-powered real estate brokerage that offers a range of services, including buying, selling, renting, and refinancing homes. Redfin is known for its data-driven approach and its use of technology to streamline the home-buying and selling process.

Realtor.com: Realtor.com is the official website of the National Association of Realtors (NAR) and provides a comprehensive platform for home buyers, sellers, and renters. The site offers a vast database of property listings, as well as information on real estate agents and mortgage lenders.

Apartments.com: Apartments.com is a leading online rental marketplace that focuses on apartment listings. The site offers a user-friendly interface and a wide range of rental options, including apartments, condos, and townhouses.

Other notable competitors include Trulia, a subsidiary of Zillow Group Inc., and Homes.com. These companies offer similar services to Zillow and compete for market share by providing their own unique features and value propositions.

Comprehensive Platform: Zillow offers a comprehensive platform that caters to various needs within the real estate ecosystem, including home buyers, sellers, renters, mortgage seekers, and real estate professionals. This comprehensive approach provides users with a one-stop-shop for all their real estate needs.

Zestimates: Zillow’s proprietary Zestimates, which provide estimated home values, have become a widely recognized and used tool in the industry. This feature offers valuable information to home buyers, sellers, and real estate professionals, helping them make informed decisions.

Acquisitions and Partnerships: Zillow has strategically acquired other real estate companies, such as Trulia and StreetEasy, expanding its reach and capabilities. Additionally, the company has formed partnerships with various industry players to offer additional services and enhance its value proposition.

Management & Employees:

Rich Barton: Co-Executive Chairman

Spencer Rascoff: Co-Founder and Former CEO

David Beitel: Chief Technology Officer

Brooke Stribling: Chief Marketing Officer

Financials:

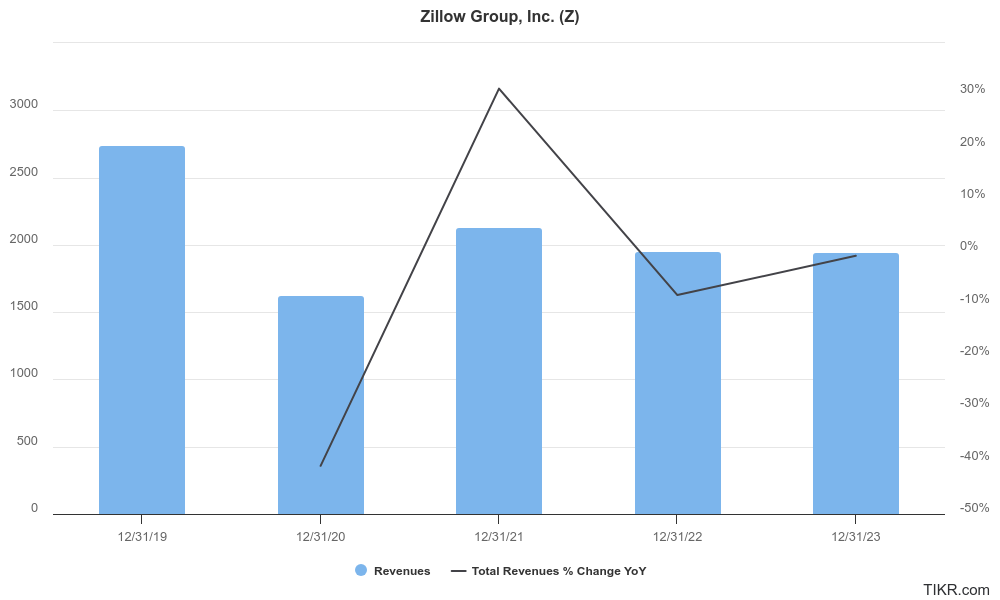

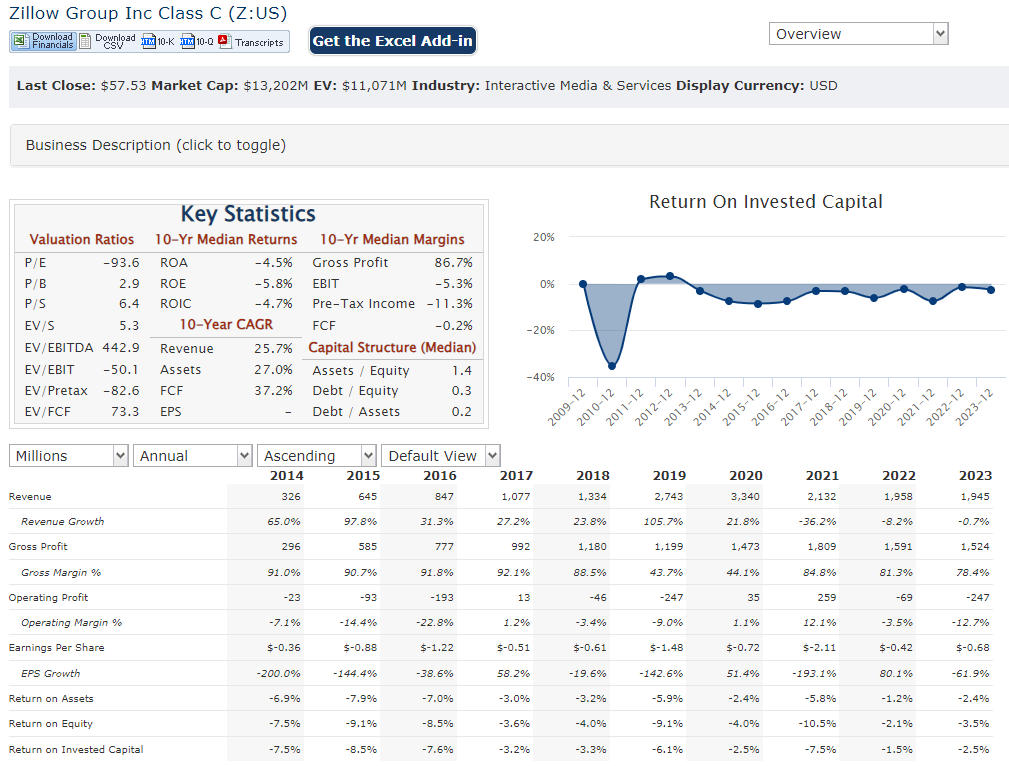

Zillow Group Inc. has demonstrated steady growth in recent years, driven by its strong market position and strategic investments. Revenue has consistently increased, with a compound annual growth rate. This growth can be attributed to factors such as increased user adoption, expansion of services, and strategic acquisitions.

While profitability has fluctuated due to market conditions and strategic initiatives, Zillow has made significant strides in improving its bottom line. The company’s focus on cost management, operational efficiency, and revenue diversification has contributed to its improved financial performance.

Zillow’s with a healthy cash position and manageable debt levels. The company has been able to fund its growth initiatives through a combination of internal cash flow and external financing.

Technical Analysis:

The stock is forming a long base on the monthly chart, and on the weekly chart another cup formation (neutral). The daily chart is also slightly bullish with momentum to the $59 range, at which point it faces a lot of resistance, which should see it retest the $54 zone.

Bull Case:

Growing Real Estate Market: The real estate market is expected to continue growing, driven by factors such as increasing urbanization, rising home prices, and a growing demand for rental properties. This growth provides significant opportunities for Zillow to expand its market share.

Expanding Services: Zillow has been expanding its offerings beyond traditional real estate services, such as mortgage financing and home improvement services. This diversification can drive revenue growth and reduce reliance on the core real estate market.

Bear Case:

Regulatory Risks: The real estate industry is subject to various regulations, and changes in these regulations could have a negative impact on Zillow’s business.

Dependence on Zestimates: Zillow’s Zestimates, while valuable, are not always accurate. Reliance on these estimates could expose the company to legal risks and damage its reputation.

Cost Structure: Zillow’s cost structure includes significant investments in technology and marketing. If the company is unable to manage these costs effectively, it could impact profitability.