Executive Summary:

Roku Inc. is a leading American technology company that revolutionized the streaming industry. They pioneered streaming devices that allow users to access a vast library of movies, TV shows, and other content directly on their televisions. The company has since expanded its offerings to include smart TVs, soundbars, and an ad-supported streaming service.

Stock Overview:

| Ticker | $ROKU | Price | $69.15 | Market Cap | $10.00B |

| 52 Week High | $108.84 | 52 Week Low | $48.33 | Shares outstanding | 127.36M |

Company background:

Roku Inc., a pioneer in the streaming technology industry, was founded in 2002 by Anthony Wood, Daniel Hastings, and Benjamin Seitel. The company’s headquarters are currently located in San Jose, California. Roku’s journey began with a focus on developing set-top boxes that enabled users to stream content from various online sources directly to their televisions. This innovative approach disrupted the traditional cable TV landscape and paved the way for the streaming revolution.

Roku’s early success led to significant funding rounds, with notable investors including Netflix, News Corporation, and Sky. Roku has launched a range of smart TVs and soundbars, further solidifying its position in the consumer electronics market.

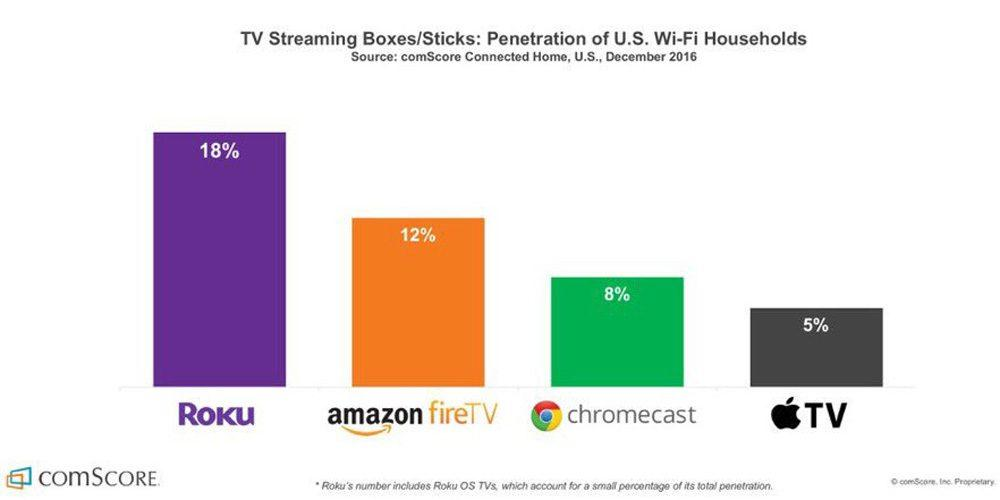

Roku’s key competitors in the streaming industry include Amazon’s Fire TV, Google Chromecast, and Apple TV. These companies offer similar products and services, vying for market share in the rapidly growing streaming space. Roku has managed to maintain a strong market presence through its user-friendly interface, extensive content library, and strategic partnerships with major content providers.

Roku’s journey from a small startup to a leading streaming technology company is a testament to its innovative spirit and ability to adapt to the evolving market landscape. The company’s commitment to providing consumers with seamless streaming experiences has earned it a loyal customer base and solidified its position as a key player in the digital entertainment industry.

Recent Earnings:

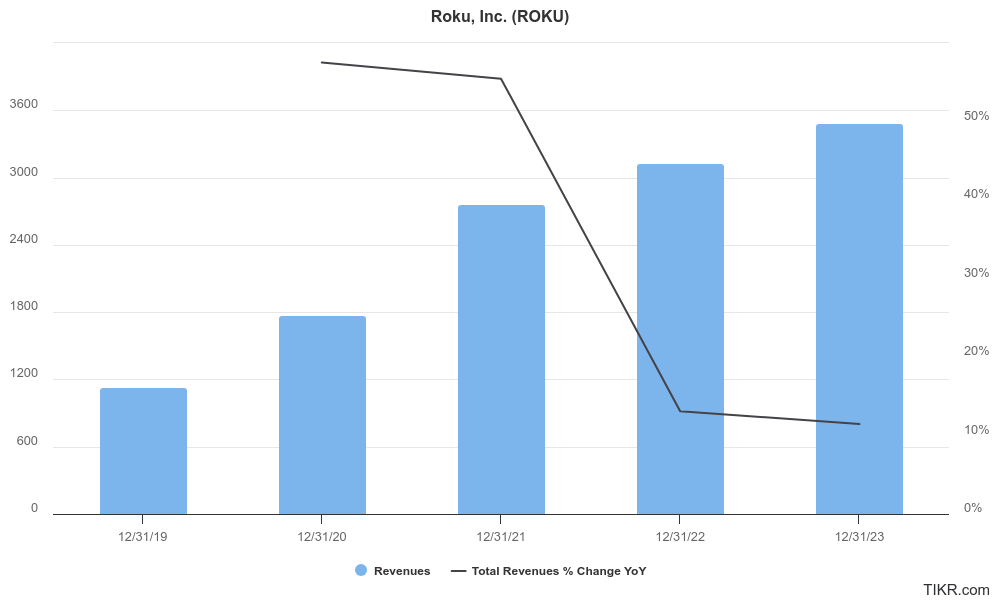

Roku Inc. reported revenue grew by 11% year-over-year to reach $865 million, which had projected revenue of $880 million. This shortfall was primarily attributed to a decline in platform revenue, which offset growth in player revenue.

Earnings per share (EPS) front, Roku experienced a loss of $0.42 per share, compared to a loss of $0.76 per share in the same quarter of the previous year. It was still worse than analysts’ consensus estimate of a loss of $0.35 per share. Active accounts increased by 1.4 million to reach 73.7 million, but average revenue per user (ARPU) declined slightly from $44.10 to $43.71.

The company projected revenue in the range of $800 million to $875 million, with EPS expected to be between a loss of $0.35 and a loss of $0.15. This guidance suggests that Roku is anticipating continued challenges in the advertising market and may need to implement further cost-cutting measures.

The Market, Industry, and Competitors:

Roku operates in the highly competitive streaming market, which is characterized by rapid technological advancements, intense competition, and evolving consumer preferences. The company competes with major players like Amazon, Google, and Apple, as well as a growing number of niche streaming services. Despite this competitive landscape, Roku has managed to carve out a significant market share through its innovative products, user-friendly interface, and extensive content partnerships.

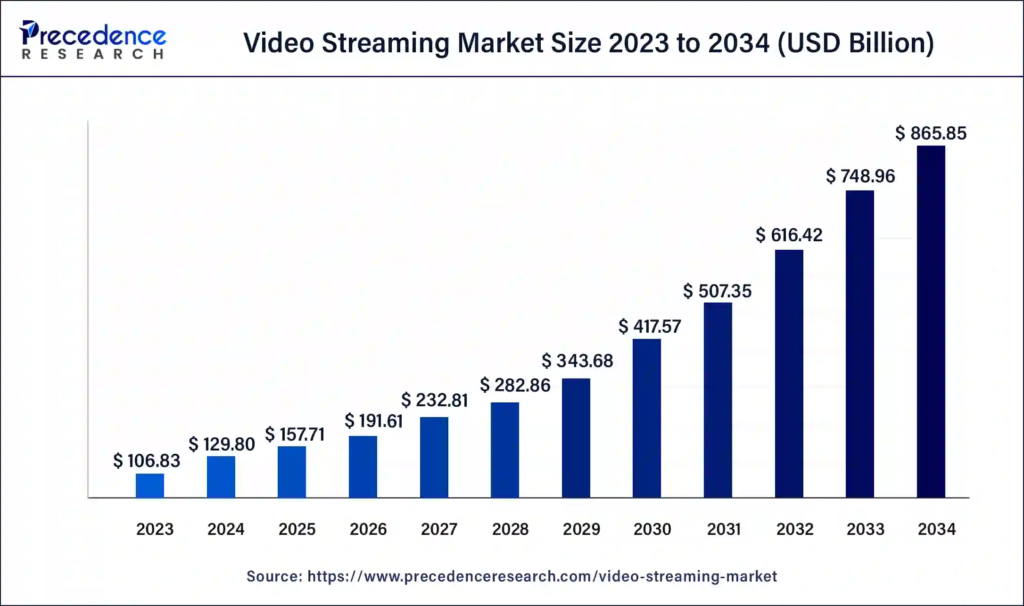

The streaming market is expected to continue growing at a substantial pace in the coming years, driven by factors such as increasing internet penetration, rising disposable incomes, and a shift towards cord-cutting. The global streaming market is projected to reach $247 billion by 2030, with a compound annual growth rate (CAGR) of 15.7% during the period from 2023 to 2030.

Unique differentiation:

Amazon Fire TV: Amazon’s Fire TV platform is a major competitor to Roku, offering a wide range of streaming devices and smart TVs. Amazon’s extensive ecosystem, including its Prime Video service and Alexa voice assistant, gives it a significant advantage.

Google Chromecast: Google’s Chromecast is another popular streaming device that allows users to cast content from their smartphones or computers to their TVs. Chromecast’s integration with Google’s other services, such as YouTube and Google Assistant, makes it a strong contender.

Apple TV: Apple TV is a premium streaming device that offers a seamless experience for Apple users. Its integration with Apple’s ecosystem, including the App Store and Apple Arcade, makes it a desirable option for many consumers.

Roku’s competitive advantages: Despite the intense competition, Roku has managed to maintain a strong market position through its user-friendly interface, extensive content library, and strategic partnerships with major content providers. The company’s focus on providing a seamless streaming experience has earned it a loyal customer base.

Platform neutrality: Roku is platform-agnostic, meaning it supports a wide range of streaming services and content providers. This gives users access to a vast library of content without being tied to a specific ecosystem.

Simple interface: Roku’s interface is designed to be intuitive and easy to navigate, making it accessible to users of all ages and technical abilities.

Voice control: Roku devices are compatible with voice assistants like Alexa and Google Assistant, allowing users to control their streaming experience with voice commands.

Management & Employees:

- Anthony Wood: CEO and President

- Mustafa Ozgen: President, Devices, Product, and Marketing

- Stephen H. Kay: Senior Vice President and General Counsel

- Jason Korosec: Vice President and Head, Roku Pay

Financials:

Revenue has consistently outperformed analyst expectations, demonstrating strong market demand for its products and services. This growth has been fueled by both organic factors, such as the increasing number of active accounts and average revenue per user, as well as strategic acquisitions and partnerships.

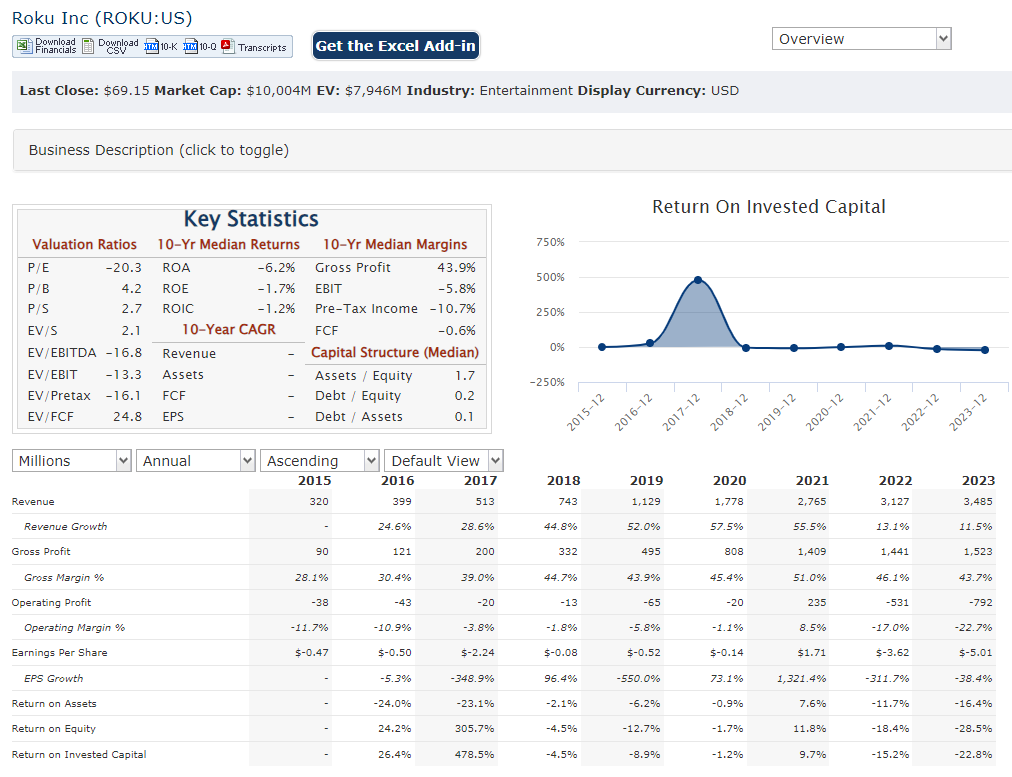

The company has reported significant losses in recent years, primarily due to investments in growth initiatives, marketing expenses, and the competitive nature of the streaming market. While Roku has taken steps to improve its cost structure and enhance operational efficiency, profitability remains a key challenge for the company.

Roku has generally maintained a healthy financial position. Its balance sheet is also influenced by factors such as the timing of revenue recognition, the level of inventory, and the valuation of intangible assets.

Technical Analysis:

The stock is on a long term stage 1 consolidation (neutral) both on the monthly and weekly chart, but in a stage 2 markup (bullish) on the daily chart. The current momentum can carry it to $70s range, but it is poised to drop and retest the $62 range again soon.

Bull Case:

Growing streaming market: The streaming market is expected to continue growing at a rapid pace, driven by factors such as increasing internet penetration, rising disposable incomes, and a shift towards cord-cutting. Roku’s strong market position positions it well to capitalize on this growth.

Product diversification: Roku has diversified its product offerings beyond streaming devices to include smart TVs and soundbars. This diversification can help reduce reliance on a single product line and drive revenue growth.

Bear Case:

Economic uncertainty: Economic uncertainty can impact consumer spending and advertising budgets, which could negatively affect Roku’s revenue and profitability.

Regulatory risks: The streaming industry is subject to regulatory scrutiny, and changes in regulations could impact Roku’s business model or operations.

Valuation concerns: Roku’s stock has experienced significant volatility, and some investors may believe that the company’s valuation is currently overvalued relative to its financial performance and growth prospects.