Executive Summary:

Elastic N.V. is a global technology company specializing in search, observability, and security solutions. The company’s flagship product, Elasticsearch, is a highly scalable and distributed search engine used by businesses of all sizes. Elastic also offers Logstash, a data pipeline tool, and Kibana, a visualization platform, to create a comprehensive data management solution.

Stock Overview:

| Ticker | $ESTC | Price | $108.92 | Market Cap | $17.97B |

| 52 Week High | $136.06 | 52 Week Low | $57.38 | Shares outstanding | 101.71M |

Company background:

Elastic N.V. was founded in 2012 in Amsterdam, the Netherlands, Elastic N.V., formerly known as Elasticsearch, is a leading provider of search, observability, and security solutions. The company was co-founded by Shay Banon, a seasoned software engineer with a passion for open-source technology. Banon’s vision was to create a powerful and scalable search engine that could handle massive datasets efficiently.

They highly scalable and distributed search engine has gained widespread adoption across various industries, including e-commerce, finance, healthcare, and government. Elasticsearch’s ability to index and search large volumes of data in real-time has made it an invaluable tool for organizations seeking to extract insights from their information.

Elastic N.V. has developed a suite of additional products, including Logstash, a data pipeline tool for ingesting and processing data, and Kibana, a visualization platform for creating interactive dashboards and reports. These products, collectively known as the Elastic Stack, provide a comprehensive solution for data management, analysis, and exploration.

Elastic N.V. operates in a competitive landscape, with key competitors such as Splunk, Datadog, and Sumo Logic. These companies offer similar products and services, targeting organizations in the search, observability, and security markets. Elastic N.V. differentiates itself through its open-source heritage, strong community support, and focus on innovation.

Recent Earnings:

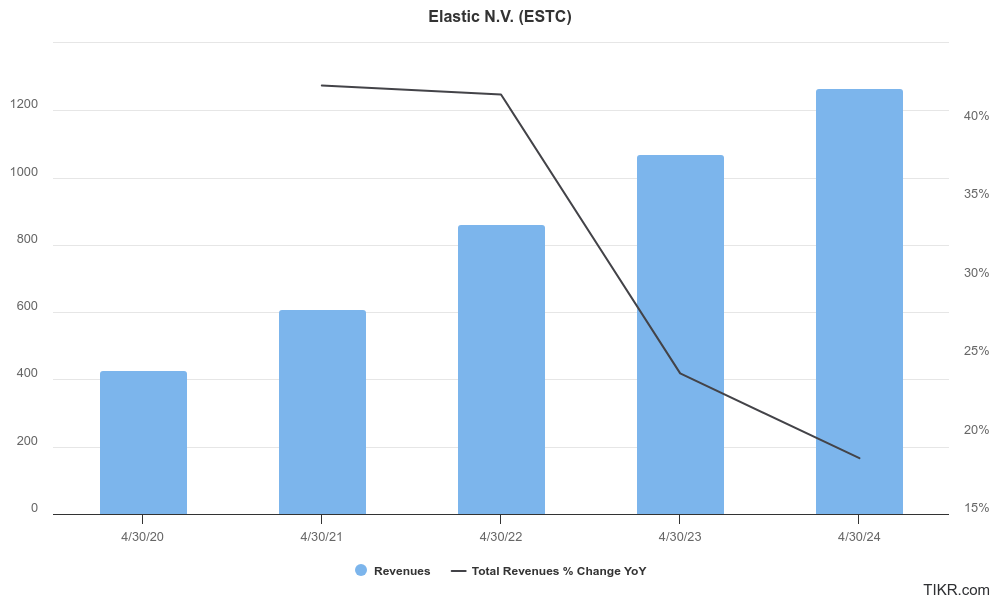

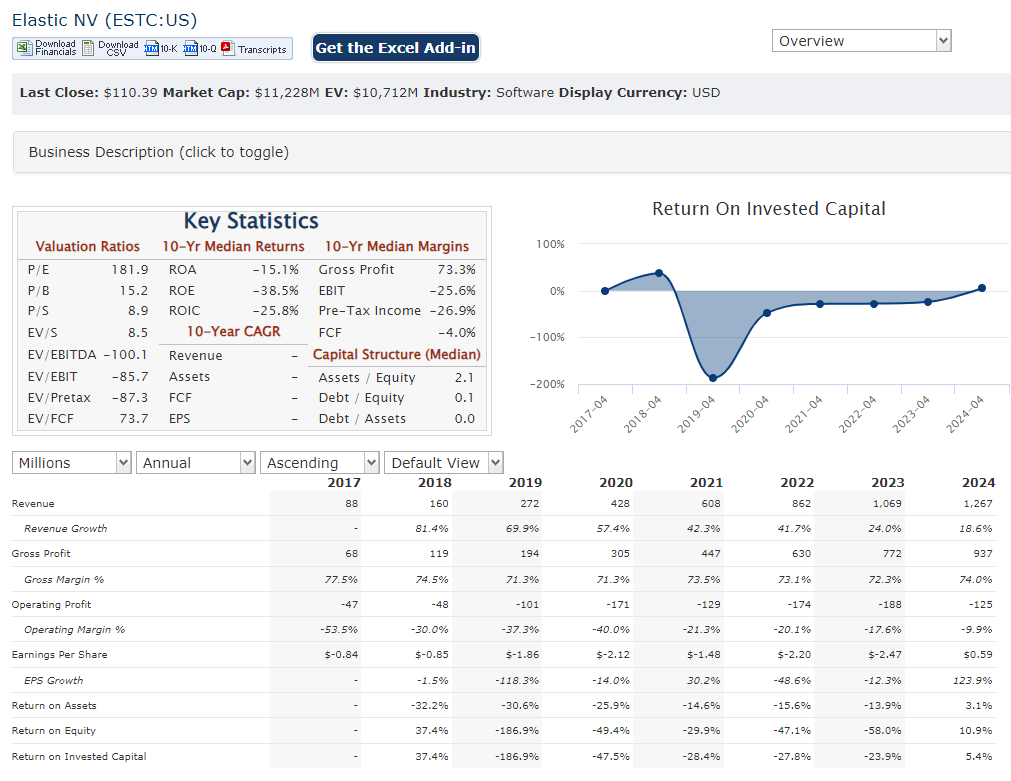

Elastic N.V. recently reported revenue for the year reached $1.267 billion, representing a 19% increase compared to the previous year. Elastic N.V. reported a non-GAAP operating income of $142 million, up from $114 million in the prior year. This improvement reflects the company’s efforts to optimize its cost structure and scale its operations. Non-GAAP diluted earnings per share increased to $1.19, surpassing analyst expectations of $1.07.

The company expects to achieve revenue growth in the range of 18-20%, with continued strong adoption of its cloud platform. Elastic anticipates maintaining its focus on profitability, aiming to improve its operating margins over time. Their latest earnings report demonstrates the company’s continued momentum in the search, observability, and security markets.

The Market, Industry, and Competitors:

Elastic N.V. operates in the rapidly growing market for search, observability, and security solutions. As organizations generate increasing amounts of data, the need for effective tools to manage, analyze, and protect that data becomes paramount. Elastic’s products, such as Elasticsearch, Logstash, and Kibana, provide a comprehensive solution for these challenges, making them essential for businesses across various industries.

Given the ongoing digital transformation and the increasing complexity of IT environments, the market for Elastic’s offerings is expected to experience substantial growth. Elastic N.V.’s strong market position, coupled with its focus on innovation and customer satisfaction, positions the company well to capitalize on this growth opportunity.

The Compound Annual Growth Rate (CAGR) for the search, observability, and security market is expected to be substantial. This indicates a consistent and significant increase in market size, providing ample opportunities for Elastic N.V. to expand its customer base and revenue.

Unique differentiation:

Splunk: Known for its powerful enterprise data platform, Splunk offers a wide range of products for data collection, analysis, and visualization.

Datadog: A cloud-based monitoring platform that provides real-time metrics, logs, and traces to help organizations understand and optimize their infrastructure and applications.

Sumo Logic: Another cloud-based log management platform that offers scalable and secure solutions for collecting, analyzing, and visualizing machine data.

New Relic: A cloud-based observability platform that provides insights into application performance, infrastructure health, and end-user experience.

Dynatrace: A cloud-based monitoring platform that offers AI-powered automation and anomaly detection capabilities.

Open-Source: As an open-source company, Elastic provides its core products, such as Elasticsearch, Logstash, and Kibana, under the Apache License. This allows users to modify, distribute, and use the software freely, fostering a vibrant community and driving innovation.

Community Support: Elastic benefits from a large and active community of developers, users, and contributors. This community provides valuable feedback, support, and contributions to the Elastic Stack, helping to enhance its capabilities and address customer needs.

Management & Employees:

Ash Kulkarni: As the CEO, Ash Kulkarni oversees Elastic’s overall strategy and execution. He has a strong track record in product leadership and has held senior roles at companies like McAfee, Akamai, and Informatica.

Shay Banon: The co-founder and CTO, Shay Banon is the visionary behind Elastic’s technology. He continues to play a crucial role in driving product innovation and technical direction.

Carolyn Herzog: As the CLO, Carolyn Herzog oversees Elastic’s legal affairs, ensuring compliance with regulatory requirements and protecting the company’s intellectual property.

Financials:

Elastic N.V. driven by the increasing demand for its search, observability, and security solutions. The company’s revenue has consistently grown at a healthy rate, with a Compound Annual Growth Rate. This growth has been fueled by the adoption of Elastic’s cloud-based offerings and expansion into new markets.

Elastic N.V. has maintained a strong financial position. The company has a healthy cash balance, which provides it with flexibility and financial stability. Elastic has managed its debt levels prudently, ensuring a sustainable capital structure.

Technical Analysis:

A head and shoulders pattern (bearish) and a stage 4 markdown (bearish) on the monthly chart and weekly chart and a short term (daily) bullish chart but weakness on RSI and MACD means, this stock is likely to revisit the $93 – $96 range soon.

Bull Case:

Growth Potential: The market for search, observability, and security is expected to continue growing at a rapid pace, driven by factors such as the increasing complexity of IT environments, the adoption of cloud computing, and the growing emphasis on data-driven decision-making. Elastic’s strong market position and focus on innovation position it well to capitalize on this growth.

Product Innovation: Elastic has a history of introducing innovative products and features, such as the Elastic Stack, which provides a comprehensive solution for data management, analysis, and exploration. This focus on innovation helps Elastic stay ahead of the competition and meet the evolving needs of its customers.

Bear Case:

Pricing Pressure: As the market matures, there may be increasing pressure on Elastic to lower its pricing to remain competitive. This could impact the company’s profitability and revenue growth.

Commoditization Risk: Over time, the search, observability, and security market could become more commoditized, with products and services becoming more standardized and interchangeable. This could reduce Elastic’s ability to differentiate itself and command premium pricing.

Economic Downturn: In the event of an economic downturn, organizations may reduce their spending on technology solutions, including Elastic’s products. This could lead to slower growth or even a decline in revenue.