Executive Summary:

Exact Sciences Corporation is a molecular diagnostics company focused on early cancer detection and prevention. Renowned for its non-invasive colorectal cancer screening test, Cologuard, the company has expanded its portfolio to include other screening and precision oncology tests. With a mission to eradicate cancer by detecting it earlier and guiding personalized treatment.

Stock Overview:

| Ticker | $EXAS | Price | $58.97 | Market Cap | $10.89B |

| 52 Week High | $85.71 | 52 Week Low | $40.62 | Shares outstanding | 184.77M |

Company background:

Exact Sciences Corporation is a molecular diagnostics company specializing in early cancer detection and prevention. Founded in 1995 by Stanley Lapidus and Anthony Shuber in Marlborough, Massachusetts, the company initially focused on developing a non-invasive test for colorectal cancer. Through persistent research and development, the company achieved a major breakthrough with the launch of Cologuard, the first stool DNA test for colorectal cancer, in 2014. This non-invasive test has significantly impacted colorectal cancer screening and prevention.

Exact Sciences has expanded its product portfolio to include other screening and precision oncology tests, aiming to address a broader spectrum of cancer types. The company’s mission is to eradicate cancer by detecting it earlier and guiding personalized treatment. Exact Sciences has grown significantly since its inception, securing substantial funding through various channels, including public offerings and investments.

Headquartered in Madison, Wisconsin, Exact Sciences competes with other major players in the molecular diagnostics industry, including companies focused on cancer screening and diagnostics. As the company continues to innovate and expand its offerings, it aims to solidify its position as a leader in early cancer detection and improve patient outcomes.

Recent Earnings:

Exact Sciences Corporation core screening business, driven primarily by Cologuard, continued to perform well. The company incurred a loss per share. Exact Sciences highlighted positive operational metrics, including an increase in the number of Cologuard tests shipped and a growing installed base of healthcare providers. These indicators suggest strong underlying business momentum. The company also emphasized advancements in its precision oncology and early detection pipelines, indicating potential future growth drivers.

The company remains focused on expanding the adoption of Cologuard, launching new products, and driving growth in its precision oncology business. While the near-term outlook involves managing costs and investments, the long-term vision centers on solidifying Exact Sciences’ position as a leader in early cancer detection and improving patient outcomes.

The Market, Industry, and Competitors:

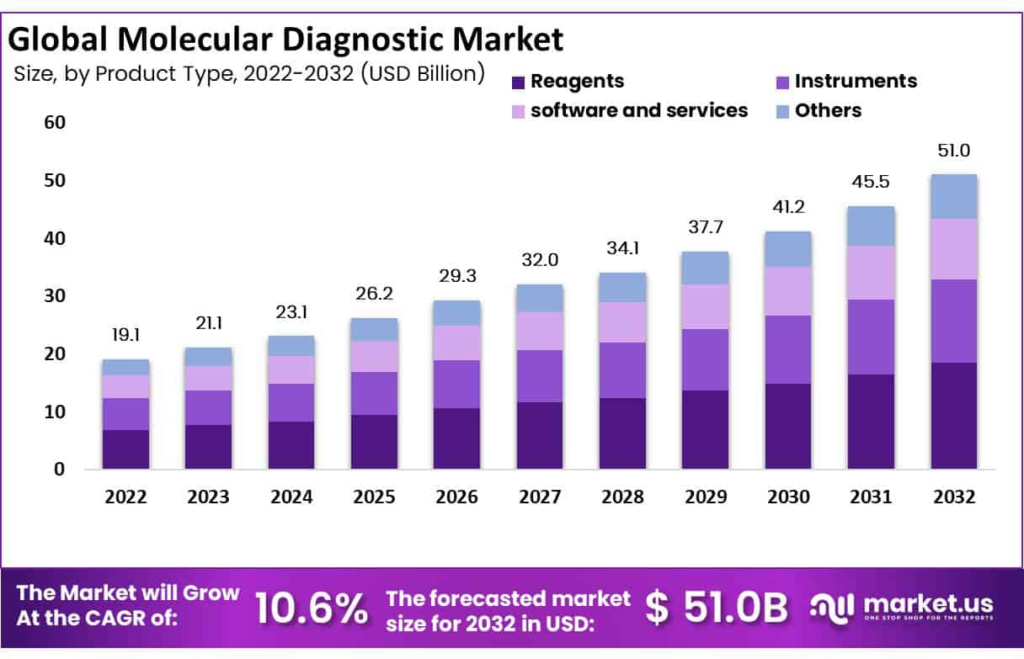

Exact Sciences operates in the rapidly growing molecular diagnostics market, specifically focusing on early cancer detection and prevention. This market has witnessed significant expansion driven by technological advancements, increasing cancer prevalence, and a growing emphasis on early diagnosis. The company’s flagship product, Cologuard, has played a pivotal role in shaping the colorectal cancer screening landscape.

The growth is fueled by factors such as an aging population, rising cancer incidence, and increasing adoption of preventive healthcare measures. Exact Sciences, with its strong product portfolio and research and development capabilities, is well-positioned to capitalize on this market expansion.

Unique differentiation:

Exact Sciences Corporation faces a competitive landscape within the molecular diagnostics industry. Key competitors include companies like Guardant Health, which specializes in liquid biopsy and early cancer detection, and Foundation Medicine, focused on genomic-based diagnostics for cancer. Other notable players are Natera, known for its cell-free DNA testing, and ArcherDX, specializing in molecular cancer diagnostics.

The competitive dynamics within the industry are intense, driven by factors such as technological advancements, regulatory approvals, and market access. Exact Sciences must continually innovate and expand its product portfolio to maintain a competitive edge. The company’s ability to differentiate its offerings, build strong partnerships with healthcare providers, and effectively communicate the value of its tests to patients will be crucial for long-term success.

Exact Sciences Corporation differentiates itself primarily through its early focus on colorectal cancer screening and the subsequent successful commercialization of Cologuard. This non-invasive stool DNA test has established the company as a pioneer in the field, building a strong brand reputation and a significant market share.

Exact Sciences has demonstrated a commitment to research and development, continuously expanding its product portfolio to address other cancer types. The company’s emphasis on patient education and outreach has been instrumental in driving awareness and adoption of colorectal cancer screening, further solidifying its market position.

Management & Employees:

Kevin Conroy: As Chairman and CEO, Conroy has been instrumental in transforming Exact Sciences into a leading cancer diagnostics company. His leadership has been crucial in the development and commercialization of Cologuard.

Sarah Condella: As Executive Vice President of Human Resources, Condella is responsible for talent acquisition, development, and employee engagement.

Brian Baranick: In his role as General Manager of Precision Oncology, Baranick leads the company’s efforts in developing and commercializing precision oncology tests.

Financials:

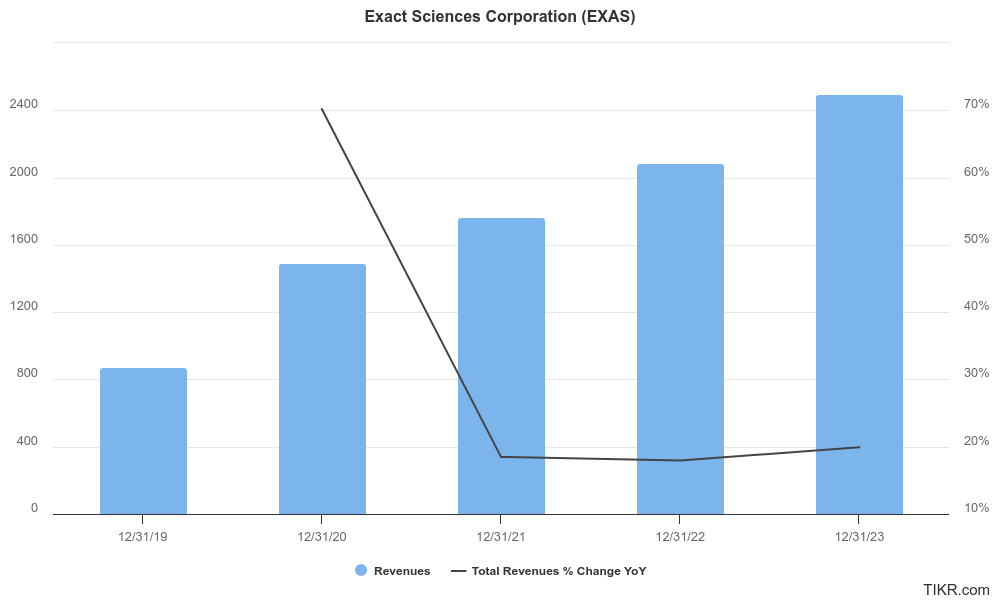

Exact Sciences Corporation (EXAS) has experienced significant revenue growth, driven by the expansion of its cancer screening and diagnostic test portfolio. From 2019 to 2023, the company’s revenue grew at a compound annual growth rate (CAGR) of 25.5%, reaching $2.499 billion in 2023.

The company reported a net loss of $204.1 million in 2023, compared to a net loss of $623.5 million in 2022. The earnings growth CAGR for the past five years is not available due to the lack of consistent profitability.

Exact Sciences’ balance sheet showed total assets of $6.38 billion, total liabilities of $3.24 billion, and stockholders’ equity of $3.13 billion. The company’s liquidity position included $652 million in cash, cash equivalents, and marketable securities.Looking ahead, Exact Sciences expects to generate revenue of $2.810-$2.850 billion in 2024.

Technical Analysis:

The stock is on a stage 4 decline on the monthly chart, but is starting a recovery reversal post the low of $39 on the weekly chart. The daily chart is in stage 2 (bullish) markup, but has lots of resistance in the $63 and again in $69 area. The RSI and MACD are stretched, so it is likely the stock moves higher to $63 but should retest $59 range soon.

Bull Case:

Cologuard Dominance: Exact Sciences holds a dominant position in the colorectal cancer screening market with Cologuard. As the leading non-invasive option, Cologuard has the potential to capture a substantial share of the market as screening rates increase.

Pipeline Potential: The company has a robust pipeline of products in development, including tests for other types of cancer. Successful commercialization of these products could significantly expand the company’s revenue streams and market reach.

Payer Coverage Expansion: Increasing payer coverage for Cologuard and future products can drive significant revenue growth. As more insurance plans cover these tests, patient access will improve, leading to higher adoption rates.

Bear Case:

Competitive Pressure: The molecular diagnostics market is highly competitive, with numerous companies developing innovative cancer detection technologies. Increased competition could erode Exact Sciences’ market share and profitability.

Reimbursement Challenges: While payer coverage for Cologuard has expanded, securing favorable reimbursement rates remains crucial for the company’s financial performance. Changes in reimbursement policies or declining reimbursement rates could negatively impact revenue.

Operational Expenses: The company’s high research and development expenses, along with sales and marketing costs, can impact profitability. If these costs continue to rise without commensurate revenue growth, it could pressure margins.