Executive Summary:

Saia Inc. is a leading less-than-truckload (LTL) trucking company in the United States, founded in 1924. Saia offers comprehensive transportation and logistics solutions, including LTL freight, truckload services, and third-party logistics. The company has a strong focus on customer service and technological innovation, aiming to provide efficient and reliable shipping solutions for businesses of all sizes.

Saia Inc. delivered earnings per share (EPS) of $3.83.

Stock Overview:

| Ticker | $SAIA | Price | $392.49 | Market Cap | $10.33B |

| 52 Week High | $628.34 | 52 Week Low | $341.26 | Shares outstanding | 26.59M |

Company background:

Saia Inc. is a prominent Less-Than-Truckload (LTL) shipping company with a rich history dating back to 1924. Founded by Louis Saia Sr. in Houma, Louisiana, the company initially started as a small operation transporting goods within the state. They have expanded its operations through strategic acquisitions and organic growth, solidifying its position as a major player in the LTL industry. Saia operates a vast network of terminals across the United States, offering a range of transportation and logistics services.

The company’s primary focus lies in LTL freight, which involves transporting smaller shipments that don’t fill an entire truck. Saia has diversified its offerings to include truckload services and third-party logistics solutions through acquisitions such as The Robart Companies and LinkEx Inc.

Saia competes with other major LTL carriers in the United States, including Old Dominion Freight Line, Yellow Corporation, and UPS Freight. Saia emphasizes customer service, technological innovation, and operational efficiency. The company is headquartered in Johns Creek, Georgia.

Recent Earnings:

Saia Inc. recently reported its revenue of $823.2 million, reflecting a robust year-over-year growth of 19%, although this fell short of analysts’ expectations of $827.8 million. EPS reported $3.83, which was below the anticipated $4.00, marking an increase from $3.42 in the same quarter last year.

Operational metrics highlighted Saia’s performance in the less-than-truckload (LTL) sector, with LTL shipments rising to 2.33 million, up 18% from the previous year and surpassing estimates. The company also noted an 18.1% increase in LTL shipments per day and a 9.7% rise in LTL tons per day. The operating ratio stood at 83.3%, slightly higher than last year’s 82.7% and above the expected 82.6%.

Saia Inc. anticipates an average revenue growth of 8% annually over the next three years, which is slightly above the 7.7% growth forecasted for the U.S. transportation sector.

The Market, Industry, and Competitors:

Saia Inc. operates within the highly competitive Less-Than-Truckload (LTL) shipping market. This sector involves transporting smaller shipments that don’t fill an entire truck, catering to a diverse customer base ranging from small businesses to large corporations. The LTL industry is characterized by its complex network of terminals, extensive routes, and sophisticated technology infrastructure required for efficient operations.

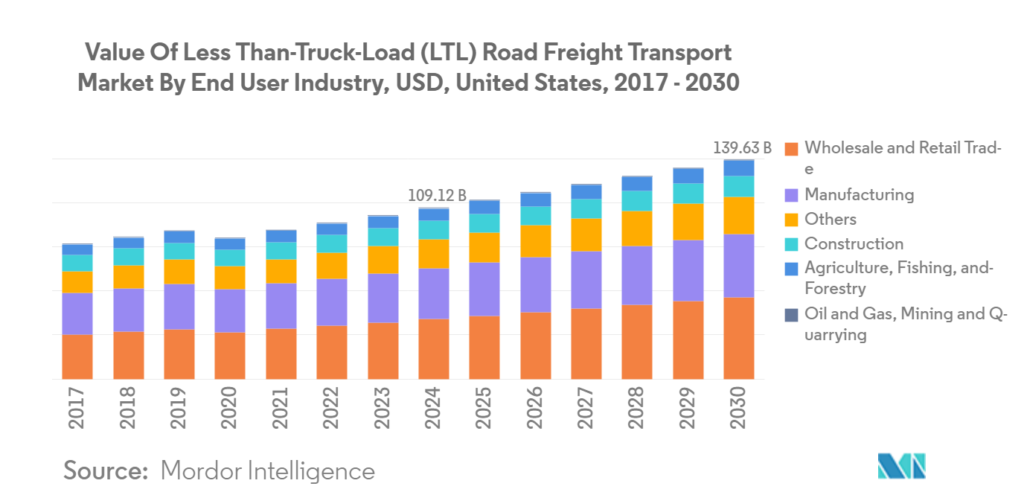

The increasing e-commerce penetration and the overall expansion of the economy are expected to drive demand for shipping services. Industry reports forecast a robust growth trajectory for the LTL market, with projections indicating a Compound Annual Growth Rate (CAGR) of around 4-5% between 2024 and 2030.

Unique differentiation:

Saia Inc. operates in a highly competitive LTL shipping landscape, facing off against several formidable rivals. Key competitors include industry stalwarts such as Old Dominion Freight Line, Yellow Corporation, and UPS Freight. These companies possess extensive networks, strong brand recognition, and substantial financial resources, making them formidable challengers.

LTL carriers and emerging players also pose competition to Saia. These companies often have a deep understanding of local markets and can offer specialized services. To thrive in this competitive environment, Saia must continuously invest in its network, technology, and customer service to maintain a competitive edge.

Operational Excellence: A commitment to operational efficiency is a cornerstone of Saia’s strategy. By optimizing its network and processes, the company strives to deliver faster transit times and improved service quality.

Network Density: While not as extensive as some larger competitors, Saia’s network is strategically positioned to serve key markets effectively. This focus on density allows the company to provide efficient service within its operating regions.

Management & Employees:

Frederick Holzgrefe is the President and Chief Executive Officer of Saia Inc. He oversees the overall strategy and direction of the company. Prior to assuming this role, Holzgrefe held the position of Chief Financial Officer and has been instrumental in the company’s financial performance.

Raymond Ramu serves as the Executive Vice President and Chief Customer Officer. He is responsible for enhancing customer satisfaction, driving revenue growth, and fostering customer loyalty. Ramu plays a crucial role in shaping Saia’s customer-centric approach.

Financials:

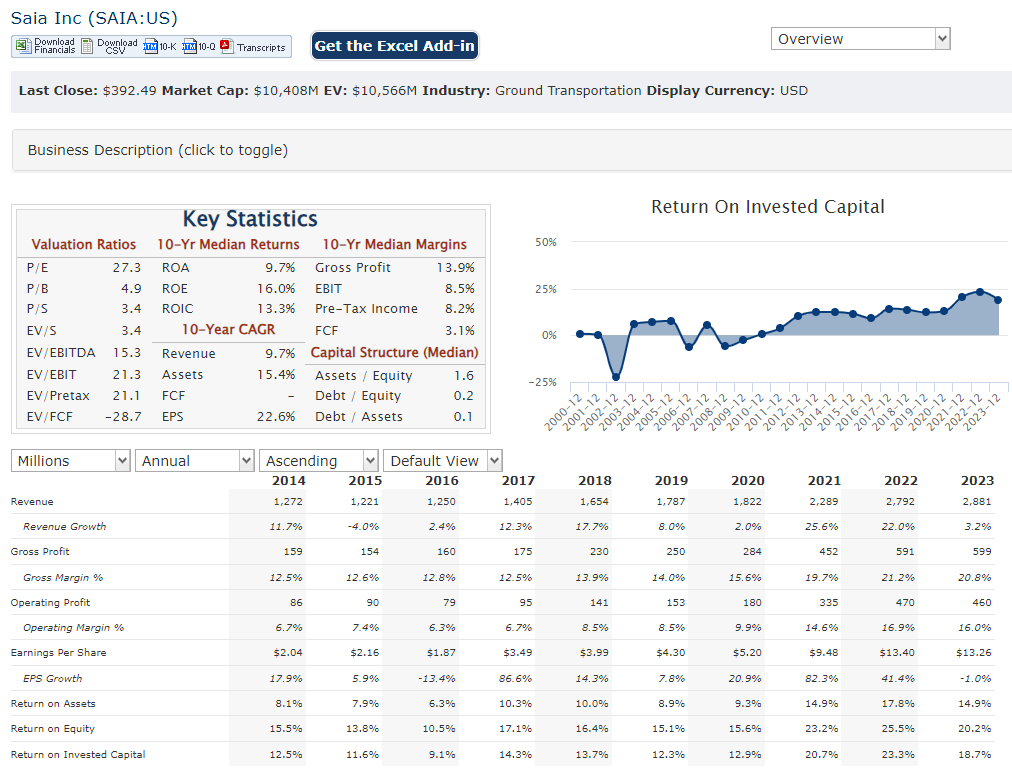

Saia Inc. revenue has increased at a compound annual growth rate (CAGR) of approximately 13.2%, reflecting a consistent upward trend in demand for its transportation services. This growth trajectory is notably higher than the average revenue growth rate of 13.2% in the transportation industry, indicating Saia’s strong market positioning and operational efficiency.

Earnings growth for Saia has been even more impressive, with a CAGR of around 28.6% over the same period. This exceptional growth rate is significantly above the transportation industry’s average earnings growth of 16.3%, underscoring Saia’s effective cost management and strategic initiatives. The company’s earnings per share (EPS) growth rate of 28.0%.

The earnings growth rate for the most recent year was 4.3%, which is a deceleration compared to the five-year average, which faced a decline of 39.5%. Saia maintains a healthy financial position, with a return on equity (ROE) of 18.2% and net margins of 12.4%.

Technical Analysis:

The stock is in a stage 4 markdown (bearish) on the monthly, weekly and daily charts. However, on the daily chart, the retest of the $358 zone indicates a low might be in for a reversal. The stock is likely going to go back to the $360 zone again however, based on RSI and MACD.

Bull Case:

Strong Industry Tailwinds: The LTL shipping industry is experiencing robust growth driven by factors such as e-commerce expansion, increased consumer spending, and a reshoring trend.

Operational Excellence: Saia has consistently demonstrated strong operational performance, characterized by high on-time delivery rates and efficient network optimization. This operational excellence translates into cost savings, improved customer satisfaction, and increased profitability.

Pricing Power: The LTL industry has shown pricing resilience, allowing carriers like Saia to pass on increased costs to customers. This pricing power can contribute to improved profit margins.

Bear Case:

Driver Shortages: The ongoing shortage of truck drivers can lead to operational challenges, higher labor costs, and service disruptions.

Fuel Price Volatility: Fluctuations in fuel prices directly impact operating costs and profitability.

Regulatory Changes: Changes in environmental regulations or labor laws could increase operating expenses and compliance costs.