Executive Summary:

F5, Inc. is a leading technology company specializing in application security, delivery, and performance. They offer solutions for multi-cloud environments, ensuring seamless and secure digital experiences. F5 helps businesses optimize their applications and protect them from cyber threats. Their flagship product, BIG-IP, has been a cornerstone in load balancing and application delivery for many years, and the company continues to innovate in the evolving digital landscape.

F5 Inc. reported EPS of $2.91. Revenue also climbed, driven by the growing demand for its application security and delivery solutions.

Stock Overview:

| Ticker | $FFIV | Price | $192.00 | Market Cap | $11.19B |

| 52 Week High | $205.92 | 52 Week Low | $145.45 | Shares outstanding | 58.28M |

Company background:

F5, Inc. is a global leader in application services, providing solutions for application security, delivery, and performance. Founded in 1996 by John McAdam, Tim Ashton, and Jeff Cox, the company has grown significantly through organic growth and strategic acquisitions.

F5’s flagship product is the BIG-IP line of load balancers, which has become synonymous with application delivery and traffic management. The company offers a comprehensive suite of products addressing application security, web application firewalling, API management, and cloud-native application services. F5’s solutions cater to a wide range of industries, from financial services and healthcare to government and retail.

The competitive landscape for F5 includes established players like Cisco, Citrix, and Palo Alto Networks, as well as emerging cloud-native providers. F5 has been focused on expanding its portfolio through organic innovation and acquisitions, while also strengthening its partnerships with major cloud providers. The company’s headquarters is located in Seattle, Washington, with offices across the globe.

Recent Earnings:

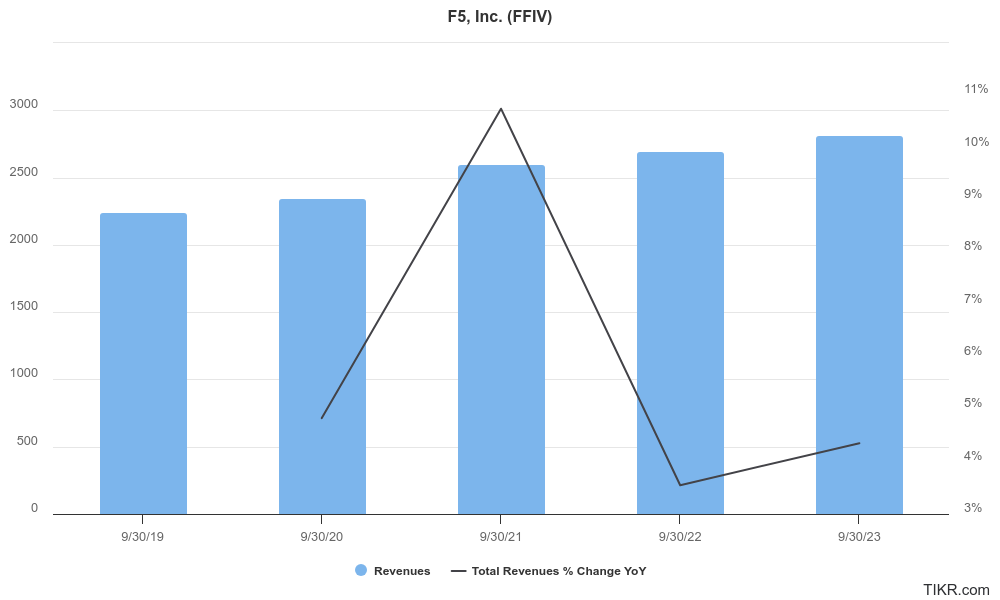

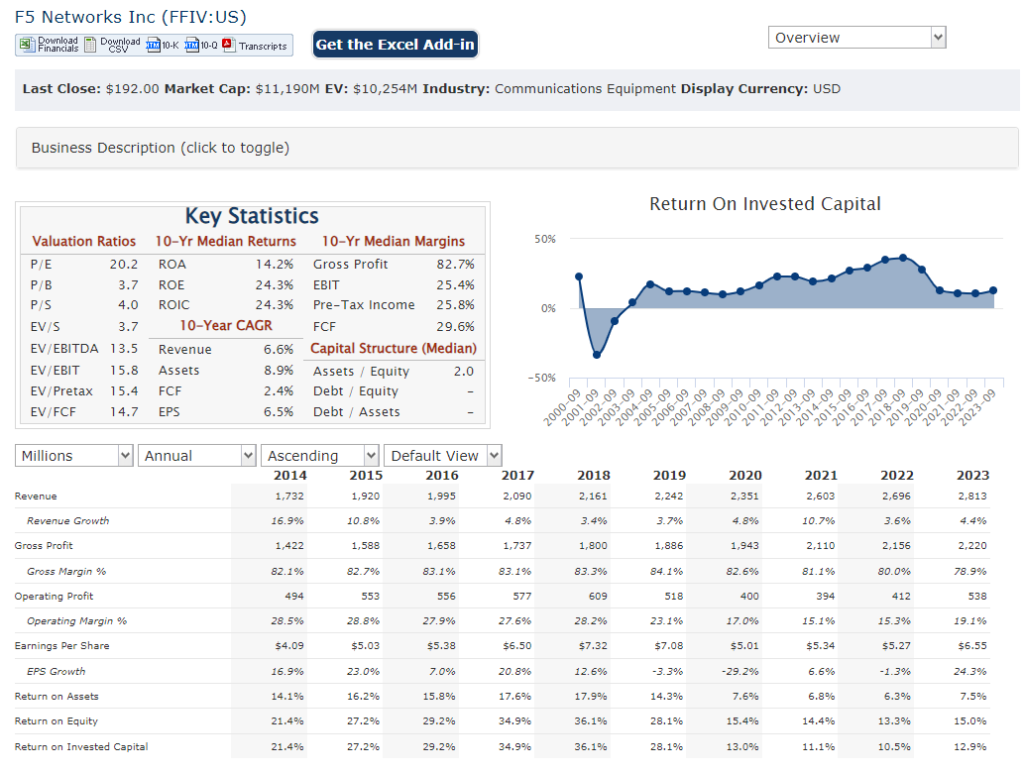

F5 Inc. delivered revenue for the fiscal year climbed 4% year-over-year to $2.8 billion. This growth was primarily driven by the expanding adoption of F5’s software solutions. The company achieved double-digit earnings per share (EPS) growth, reflecting improved operational efficiency and cost management.

Operational metrics also exhibited positive trends. Gross margin remained healthy, demonstrating F5’s ability to manage costs effectively. The company’s focus on expanding its software business and recurring revenue streams continued to yield results, contributing to overall profitability. F5’s balance sheet remained strong with ample liquidity, providing financial flexibility for future growth initiatives.

F5 expressed optimism about its business prospects. This outlook reflects F5’s confidence in its ability to maintain its market leadership and capitalize on emerging opportunities in the application services market.

The Market, Industry, and Competitors:

F5 operates in the dynamic and rapidly growing market for application services. This market encompasses a broad range of solutions, including application delivery networking (ADN), application security, and API management. The increasing complexity of IT environments, coupled with the proliferation of cloud computing and digital transformation initiatives.

Factors such as the expanding attack surface, the rise of hybrid and multi-cloud architectures, and the growing reliance on digital applications are expected to fuel market expansion. It is generally anticipated that the market will continue to exhibit a healthy compound annual growth rate (CAGR) in the coming years. This presents a significant opportunity for F5 to capitalize on its market leadership and expand its customer base.

Unique differentiation:

F5 Inc. operates in a highly competitive landscape with several established and emerging players. Traditional networking giants like Cisco and Juniper represent significant competition, offering a broad range of networking solutions that overlap with F5’s product portfolio. Additionally, security-focused companies such as Palo Alto Networks and Fortinet pose a competitive threat with their growing emphasis on application security.

The cloud landscape has introduced new competitors, including cloud service providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform, which offer their own application delivery and security services. Furthermore, specialized application delivery and security vendors such as Citrix, Akamai, and Cloudflare have established strong market positions. To maintain its leadership, F5 must continue to innovate and differentiate its offerings while effectively addressing the competitive pressures in this dynamic market.

Deep expertise in application delivery networking (ADN): F5 has a long-standing reputation as a leader in ADN, with a strong focus on delivering high performance and availability for critical applications.

Comprehensive product portfolio: F5 offers a wide range of solutions addressing application security, delivery, and performance, providing customers with a unified platform to manage their application needs.

Strong focus on multi-cloud environments: F5’s solutions are designed to operate seamlessly across different cloud platforms, helping customers optimize application performance and security in hybrid and multi-cloud architectures.

Management & Employees:

François Locoh-Donou serves as the President, Chief Executive Officer, and Director of F5. He oversees the company’s overall strategy and operations.

Chad Whalen holds the position of Executive Vice President of Worldwide Sales, responsible for driving global sales and revenue generation..

Tom Fountain holds the position of Executive Vice President, Global Services and Chief Services Officer, responsible for delivering customer success and driving service revenue growth.

Financials:

Revenue: F5’s with a Compound Annual Growth Rate (CAGR) estimated to be in the mid-single digits (around 4-6%). This growth is primarily driven by the rising demand for F5’s application security and delivery solutions as businesses increasingly prioritize digital transformation initiatives and cloud adoption.

Earnings: F5’s earnings per share (EPS) have also grown at a healthy pace. This indicates that the company is not only expanding its top line but also improving its operational efficiency and profitability. The CAGR for EPS is estimated to be slightly higher than revenue growth, potentially in the high single digits (around 6-8%).

Balance Sheet: The company has consistently generated healthy cash flow from operations, allowing it to invest in research and development, strategic acquisitions, and shareholder dividends. F5’s debt levels have remained manageable, providing financial flexibility for future growth initiatives.

Challenges and Opportunities: F5 must navigate a competitive landscape with established and emerging players. The company’s focus on innovation, its comprehensive product portfolio, and its commitment to multi-cloud adoption position it well to capitalize on the expanding application services market in the years to come.

Technical Analysis:

The cup and handle at the monthly chart is bullish with resistance in the $210+ range. On the weekly chart, it has formed a good consolidation, so while it is expected to go higher, it will experience some resistance in the $199 area. The daily chart is indicating a move higher to $200 range.

Bull Case:

Growth in Application Services Market: The increasing complexity of IT environments, driven by cloud adoption, digital transformation, and the growing number of applications, is fueling demand for application services. This presents a significant growth opportunity for F5.

Recurring Revenue Model: F5 has been transitioning towards a subscription-based model, which can lead to more predictable and recurring revenue streams, enhancing profitability and valuation.

Innovation and Adaptability: F5’s consistent investment in research and development enables it to stay ahead of technological advancements and customer needs, ensuring its product offerings remain relevant.

Bear Case:

Shift to Cloud-Native Architectures: The increasing adoption of cloud-native architectures could potentially reduce the demand for traditional hardware-based load balancers, impacting F5’s core business. While F5 has been investing in cloud-native solutions, the transition may not be seamless or without challenges.

Security Risks: F5 must continuously invest in research and development to stay ahead of emerging threats. Failure to do so could damage the company’s reputation and lead to customer churn.

Execution Risk: Successfully executing on strategic initiatives, such as cloud migration and product innovation, is crucial. Any missteps in execution could hinder growth and negatively impact investor confidence.