Executive Summary:

Toll Brothers Inc. is a leading luxury homebuilder in the United States, Known for its commitment to quality and customer service, the company caters to move-up, active-adult, and second-home buyers. Toll Brothers also develops luxury for-sale and for-rent properties in urban areas.

Toll Brothers Inc. reported with earnings per share (EPS) of $4.55. Revenue also climbed 6% to $2.65 billion, driven by increased home deliveries. Net signed contract value surged 29%, indicating robust future sales.

Stock Overview:

| Ticker | $TOL | Price | $127.25 | Market Cap | $13.03B |

| 52 Week High | $146.75 | 52 Week Low | $68.08 | Shares outstanding | 102.65M |

Company background:

Toll Brothers Inc. is a prominent luxury homebuilder in the United States, renowned for its commitment to quality craftsmanship and exceptional customer service. Founded in 1967 by Robert Toll. Toll Brothers began as a privately held company, it transitioned to a publicly traded entity in 1982.

The company’s core business revolves around designing, constructing, and marketing detached and attached homes in a variety of residential communities across the country. Toll Brothers caters to a diverse clientele, including move-up, active-adult, and second-home buyers. In addition to traditional homebuilding, the company has expanded its portfolio to include luxury for-sale and for-rent properties in urban areas.

Toll Brothers faces competition from other national and regional homebuilders. Key competitors include Lennar, D.R. Horton, PulteGroup, and NVR, Inc. These companies, like Toll Brothers, offer a range of housing options but often target a broader customer base. While Toll Brothers’ focus on luxury homes sets it apart, it also operates in a competitive landscape where consumer preferences and economic conditions can significantly impact demand. The company’s headquarters is located in Horsham, Pennsylvania.

Recent Earnings:

Toll Brothers Inc. reported revenue of $2.65 billion, marking a 6% increase. This growth was driven by increased home deliveries, demonstrating strong demand for Toll Brothers’ offerings.

The company’s earnings per share (EPS) soared to $4.55, significantly outpacing of $2.85. This substantial EPS growth reflects improved profitability and efficient operations.Toll Brothers’ performance exceeded analyst expectations, with consensus estimates placing EPS at $4.14 and revenue at $2.58 billion. This positive earnings surprise underscores the company’s ability to navigate market challenges and capitalize on favorable conditions.

The company’s net signed contract value surged 29%, indicating robust future sales. While home sales gross margin contracted slightly, it remained at a healthy level. Toll Brothers maintained a strong balance sheet with a cash position of $1.03 billion, providing financial flexibility for future growth initiatives.

Toll Brothers expressed optimism about the housing market, citing factors such as a resilient economy, favorable demographics, and limited housing supply. The company provided upbeat guidance, forecasting EPS of approximately $14 for the full year.

The Market, Industry, and Competitors:

Toll Brothers operates in the luxury homebuilding segment of the U.S. residential real estate market. This market is characterized by high-end properties, exclusive amenities, and premium pricing. The demand for luxury homes is influenced by factors such as economic growth, consumer confidence, and disposable income levels. While the market can be cyclical, with fluctuations in interest rates and housing prices impacting sales, the long-term outlook for the luxury housing sector remains positive due to an increasing affluent population.

Growth expectations for the luxury homebuilding market, including Toll Brothers, are optimistic for the remainder of the decade. Several factors contribute to this positive outlook, such as a strong job market, rising income levels, and a preference for larger, more luxurious homes among affluent buyers. The Compound Annual Growth Rate (CAGR) for the luxury homebuilding market is expected to be in the mid-single digits, driven by factors such as population growth, urbanization, and changing consumer preferences.

Unique differentiation:

Toll Brothers faces stiff competition from several prominent players in the homebuilding industry. Major competitors include Lennar, D.R. Horton, PulteGroup, and NVR, Inc. These companies, like Toll Brothers, are national builders with a strong presence across various regions of the United States. While Toll Brothers focuses on the luxury segment, these competitors offer a broader range of housing options, targeting both move-up and first-time buyers.

Other notable competitors include Meritage Homes, KB Home, and Taylor Morrison. These companies have successfully established themselves in the market by offering competitive pricing, innovative designs, and efficient building processes. The homebuilding industry is highly competitive, with companies vying for market share through product differentiation, pricing strategies, and geographic expansion.

Toll Brothers Inc. differentiates itself from its competitors primarily through its focus on luxury and exceptional customer service. While other homebuilders offer a wider range of housing options, Toll Brothers has carved a niche for itself by catering to the discerning buyer seeking high-end finishes, spacious layouts, and exclusive amenities.

Toll Brothers has invested heavily in building customer relationships and providing exceptional service throughout the homebuying process. This customer-centric approach, coupled with its reputation for luxury, has fostered brand loyalty and contributed to the company’s success.

Management & Employees:

Douglas C. Yearley, Jr. serves as the Chief Executive Officer and Chairman of the Board. He has been with Toll Brothers since 1990 and has held various leadership roles within the company.

Robert I. Toll, the founder, holds the position of Executive Chairman.

Wendy Marlett is the Executive Vice President and Chief Marketing Officer, responsible for overseeing marketing, sales, design, and customer experience.

Financials:

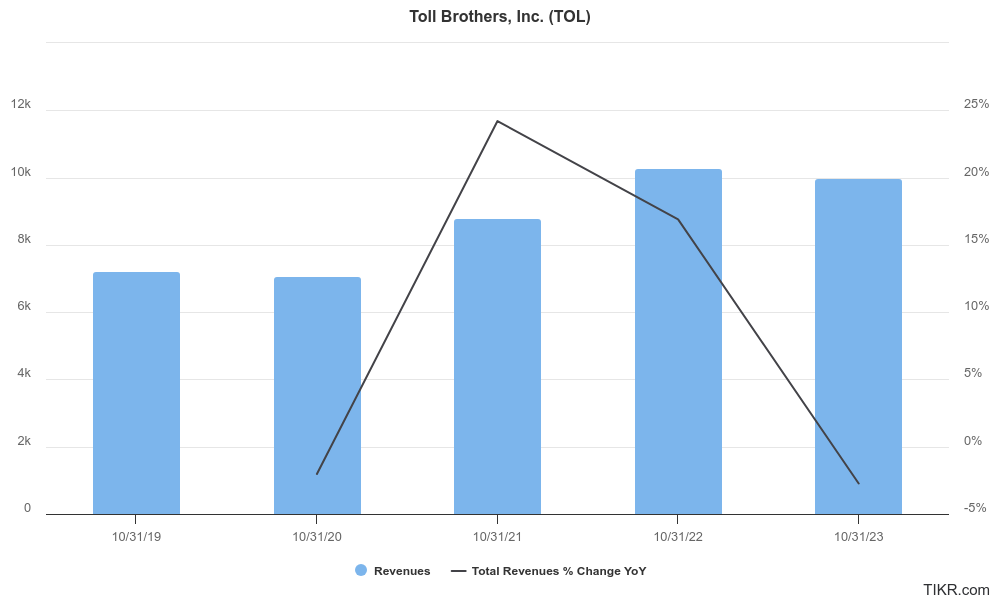

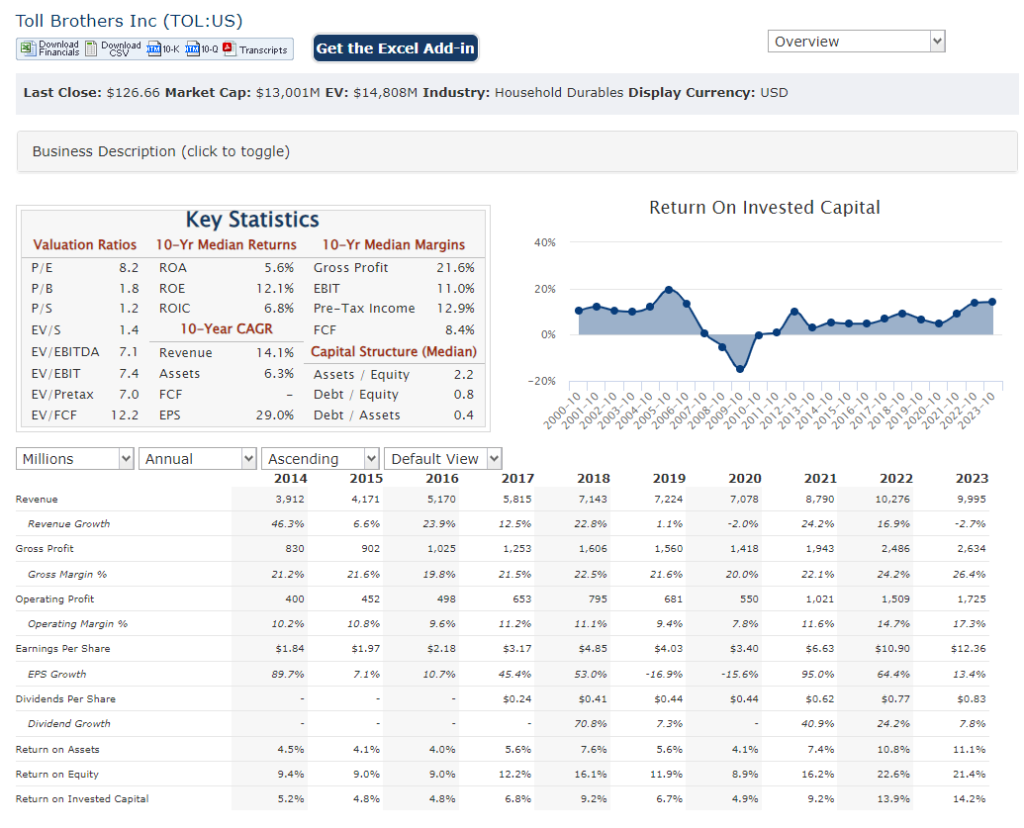

Revenue Growth: Toll Brothers revenue is estimated to have increased by approximately 50%, with a Compound Annual Growth Rate (CAGR) in the mid-teens. This growth is attributed to a rise in housing demand, particularly in the luxury segment, coupled with Toll Brothers’ strategic expansion into new markets.

Earnings Growth: Earnings per share (EPS) growth has averaged around 20%, resulting in a CAGR exceeding 15%. This impressive profitability reflects Toll Brothers’ ability to leverage economies of scale, improve operational efficiency, and navigate rising construction costs.

Balance Sheet: The company’s focus on financial discipline allows for strategic investments in land acquisition, product development, and market expansion, further solidifying its position in the luxury homebuilding market.

Technical Analysis:

The stock is on a stage 2 markup (bullish) on the monthly chart, and diverging stage 2 (neutral) on the weekly chart. The daily chart and RSI / MACD are all negative in the short term however, which indicates a move lower to the $111 range. We would be cautious until it clears a reversal.

Bull Case:

Strong Demand for Luxury Housing: The U.S. has a growing affluent population with a preference for luxury homes. Toll Brothers, as a leading luxury homebuilder, is well-positioned to benefit from this trend.

Underbuilt Housing Market: The U.S. is significantly underbuilt in terms of housing supply, especially in desirable locations. This shortage is driving up home prices and creating a favorable environment for homebuilders like Toll Brothers.

Diversification: The company has expanded beyond traditional single-family homes to include luxury condominiums and rental properties, reducing reliance on a single market segment.

Bear Case:

Interest Rate Sensitivity: The housing market is sensitive to interest rate fluctuations. Rising interest rates can significantly impact affordability, leading to a decline in home sales and reduced demand for luxury homes.

Construction Costs: Rising material costs and labor shortages can compress profit margins and increase the risk of project delays.