Executive Summary:

Five Below is a rapidly growing American retailer specializing in affordable products for tweens and teens. With most items priced at $5 or less, the company offers a wide variety of merchandise across eight categories, including style, room, sports, tech, create, party, candy, and seasonal trends.

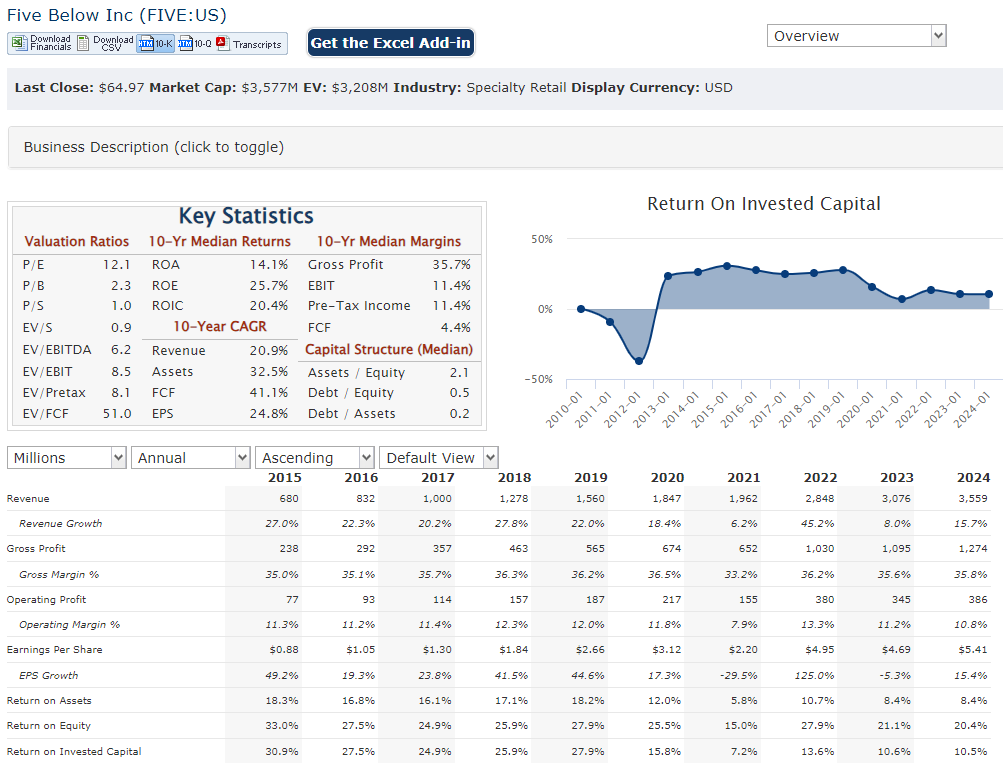

Five Below Inc. reported its earnings per share (EPS) of $3.65.

Stock Overview:

| Ticker | $FIVE | Price | $65.68 | Market Cap | $3.62B |

| 52 Week High | $216.18 | 52 Week Low | $64.87 | Shares outstanding | 55.07M |

Company background:

Five Below Inc. is an American retailer specializing in affordable products targeted at tweens and teens. Founded in 2002 by Tom Vellios and David Schlessinger, the company has experienced rapid growth since its inception. While specific details about initial funding are limited, Five Below has successfully expanded its operations through a combination of organic growth and strategic initiatives.

Headquartered in Philadelphia, Pennsylvania, Five Below operates over 1,400 stores across the United States. The retailer’s unique selling proposition lies in its pricing strategy, with most items priced at $5 or less, and a smaller assortment of products priced up to $25. Five Below offers a wide range of products across eight categories: Style, Room, Sports, Tech, Create, Party, Candy, and seasonal trends. This diverse product mix, combined with its affordable prices, has contributed to the company’s popularity among its target demographic.

Key competitors in the discount retail space include Dollar General, Dollar Tree, and Claire’s. However, Five Below differentiates itself by focusing specifically on tweens and teens, offering trend-driven products and creating a fun and engaging shopping experience. The company’s rapid expansion and consistent financial performance have solidified its position as a leading value retailer in the United States.

Recent Earnings:

Five Below, Inc. delivered a net sales surged 19.1% year-over-year to $1.34 billion, with comparable sales increasing by a solid 3.1% on a thirteen-week basis. The company’s strategic focus on Wow products and the successful Five Beyond format stores contributed net sales grew 16% to $5.6 billion, demonstrating consistent performance throughout the year.

Five Below continued to shine. Earnings per share (EPS) soared 19% to $3.65 for the fourth quarter, surpassing analyst expectations. This robust EPS growth underscores the company’s efficient operations and ability to drive margin expansion. EPS increased by 15%, reflecting the company’s strong financial health.

Operational metrics, such as new store openings, also remained strong. The company opened 63 net new stores in the fourth quarter, ending the year with a total of 1,544 stores. This expansion demonstrates Five Below’s commitment to increasing its market presence and reaching a wider customer base.

The company anticipates continued sales growth and profitability, driven by new store openings, comparable sales increases, and efficient operations.

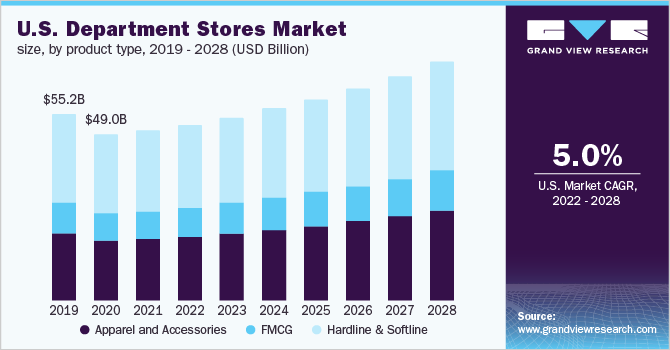

The Market, Industry, and Competitors:

Five Below operates in the highly competitive discount retail market, targeting the lucrative tween and teen demographic. The company has carved a niche by offering a curated selection of trend-driven products at attractive price points. This strategy has resonated with its target audience, leading to impressive growth in recent years.

Five Below has ambitious growth plans, aiming to triple its store count to over 3,500 locations by 2030. This aggressive expansion strategy is underpinned by the company’s strong unit economics, with new stores generating significant sales and rapid return on investment. Five Below will need to continue to innovate its product offerings, optimize store locations, and effectively manage its supply chain. The company could achieve a compound annual growth rate (CAGR) in the double digits over the next several years.

Unique differentiation:

Five Below faces competition from a variety of retailers, each with its own strengths and target market. Traditional discount retailers such as Dollar General and Dollar Tree pose a threat due to their extensive store networks and low prices. Five Below differentiates itself by focusing on a specific tween and teen demographic with a more curated product assortment. Mass retailers like Walmart and Target offer a broader range of products at competitive prices, including items that overlap with Five Below’s offerings.

Online retailers, particularly Amazon, are also a significant competitor. Amazon’s vast product selection, convenient shopping experience, and rapid delivery options challenge brick-and-mortar stores like Five Below. Five Below must continue to innovate its product offerings, enhance the in-store experience, and effectively leverage digital channels to connect with its target audience.

Five Below’s traditional discount retailers that cater to a broader customer base, They has successfully carved out a niche by offering a curated selection of trend-driven products at incredibly low prices.

The company’s emphasis on creating a fun and engaging shopping experience, coupled with its rapidly changing product assortment, sets it apart from competitors. Five Below’s ability to identify and capitalize on the latest trends in fashion, technology, and pop culture enables it to maintain a strong connection with its target audience.

Management & Employees:

Chief Executive Officer (CEO): The CEO is the highest-ranking executive responsible for the overall strategic direction, performance, and operations of Five Below. They oversee all aspects of the business, including sales, marketing, finance, and human resources.

Chief Operating Officer (COO): The COO is responsible for the day-to-day operations of the business. They oversee supply chain management, store operations, logistics, and distribution.

Chief Merchandising Officer (CMO): The CMO is responsible for product development, sourcing, and assortment planning. They work closely with the buying team to ensure that the product mix aligns with customer preferences and trends.

Financials:

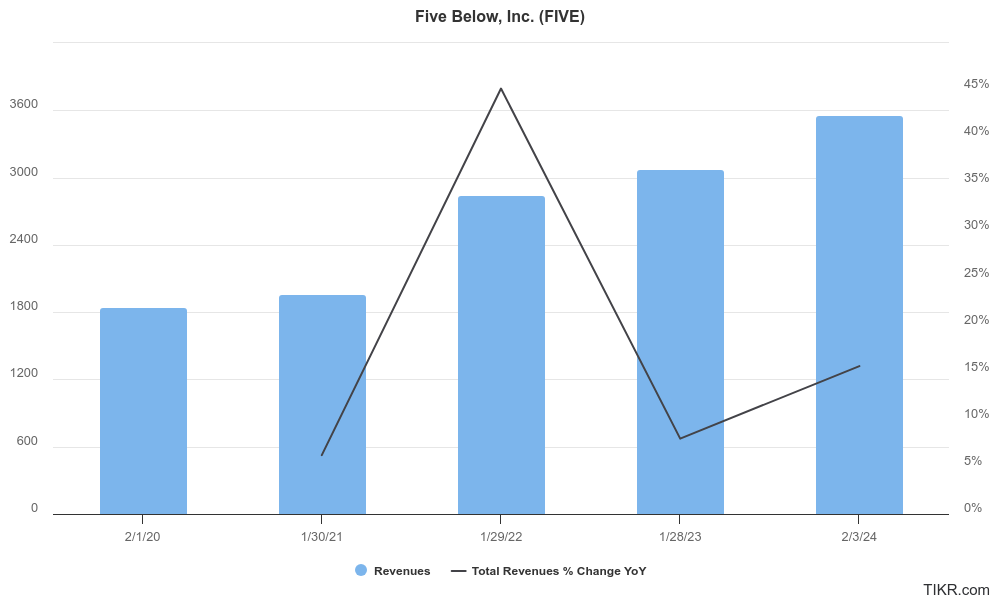

Revenue Growth:

- The company’s net sales have grown steadily, with a compound annual growth rate (CAGR) estimated to be around 12% for the period 2019-2024.

- This growth is primarily driven by the expansion of the store base, with Five Below adding an average of 100 new locations per year.

- The company has experienced success with its ‘Five Beyond’ format stores, offering a larger footprint and a wider product selection, which has contributed to increased average transaction value.

Earnings Growth:

- Five Below’s as an estimated CAGR exceeding 15%.

- This impressive profitability reflects the company’s efficient operating model, strong cost controls, and ability to generate healthy margins despite its low price points.

- Effective inventory management and strategic sourcing practices have also played a crucial role in driving earnings growth.

Balance Sheet:

- The company has consistently generated strong cash flow from operations, allowing it to invest in store growth and other strategic initiatives while maintaining financial flexibility.

Technical Analysis:

The stock has been in a stage 4 decline (bearish) on the monthly and weekly charts, breaking several key support areas. On the daily chart, the next support is in the $50 – $59 zone, which it should get to and likely reverse, but we wont be buyers in the stock yet.

Bull Case:

Target Market Demography: Five Below’s focus on the tween and teen demographic is a key strength. This market segment is large and has significant spending power, making it an attractive target for retailers.

Unique Value Proposition: The company’s combination of low prices, trend-driven products, and a fun shopping experience creates a compelling value proposition that resonates with its target customers. This differentiation helps Five Below stand out from competitors.

Operational Efficiency: Five Below has demonstrated strong operational efficiency, with a focus on cost control and inventory management. This has contributed to healthy profit margins and robust cash flow generation.

Bear Case:

Competitive Pressure: The retail landscape is highly competitive, with both traditional discount retailers and online platforms vying for customers. Increased competition could erode Five Below’s market share and profitability.

Supply Chain Disruptions: Ongoing supply chain challenges could impact product availability, increase costs, and disrupt sales.

Changing Consumer Preferences: Consumer tastes and preferences evolve rapidly, and Five Below’s ability to stay ahead of trends is crucial. Failure to adapt to changing consumer demands could negatively impact sales.