Executive Summary:

NIO Inc. is a leading Chinese electric vehicle manufacturer focused on premium smart cars. The company designs, develops, and produces electric vehicles, emphasizing innovation in battery swapping technology, autonomous driving, and digital technologies. NIO aims to create a user-centric community and offers additional services like battery subscription and a charging network to enhance the ownership experience.

NIO Inc. reported an EPS of -$0.36, surpassing analyst expectations of -$0.31. Revenue for the quarter reached $9.91 billion.

Stock Overview:

| Ticker | $NIO | Price | $3.77 | Market Cap | $7.55B |

| 52 Week High | $14.17 | 52 Week Low | $3.61 | Shares outstanding | 1.91B |

Company background:

NIO Inc., a prominent player in the global electric vehicle (EV) market, was founded in November 2014 by a group of automotive industry veterans led by William Li. The company’s headquarters are situated in Shanghai, China. NIO has rapidly gained traction with its innovative approach to EV ownership, focusing on premium vehicles and a comprehensive ecosystem of services.

The company has attracted support from both domestic and international investors, including Tencent, Baidu, and Sequoia Capital. NIO’s product lineup comprises a range of stylish and technologically advanced electric SUVs and sedans. The company has gained recognition for its battery swapping technology, which offers a convenient alternative to traditional charging methods. NIO provides value-added services such as battery subscription plans, charging infrastructure, and a connected car ecosystem, aiming to create a seamless and premium ownership experience for its customers.

The EV market is highly competitive, with established automakers and emerging startups vying for market share. NIO’s primary competitors include domestic rivals such as Xpeng and Li Auto, as well as global giants like Tesla, BYD, and Volkswagen. Differentiating itself through innovative technology, superior user experience, and a strong brand identity will be crucial for NIO’s continued success in this dynamic landscape.

Recent Earnings:

Revenue and Growth: NIO’s revenue growth as an indicator of overall business performance and market demand for its electric vehicles. A consistent increase in revenue, particularly from vehicle sales, signifies strong market acceptance and expansion. The company’s ability to diversify revenue streams, such as battery subscription services and charging network operations, can contribute to overall growth.

EPS and Growth: Earnings per share (EPS) is a crucial metric that reflects NIO’s profitability. The EV industry is characterized by heavy investments in research and development, manufacturing, and charging infrastructure, which can impact short-term profitability.

Comparison to Analyst Expectations: Beating analyst estimates can positively impact the stock price, as it signals stronger-than-anticipated performance.

Operational Metrics and Forward Guidance: Operational performance indicators such as vehicle deliveries, gross margin, and research and development expenses. These metrics provide insights into NIO’s production capacity, pricing strategy, and innovation efforts.

The Market, Industry, and Competitors:

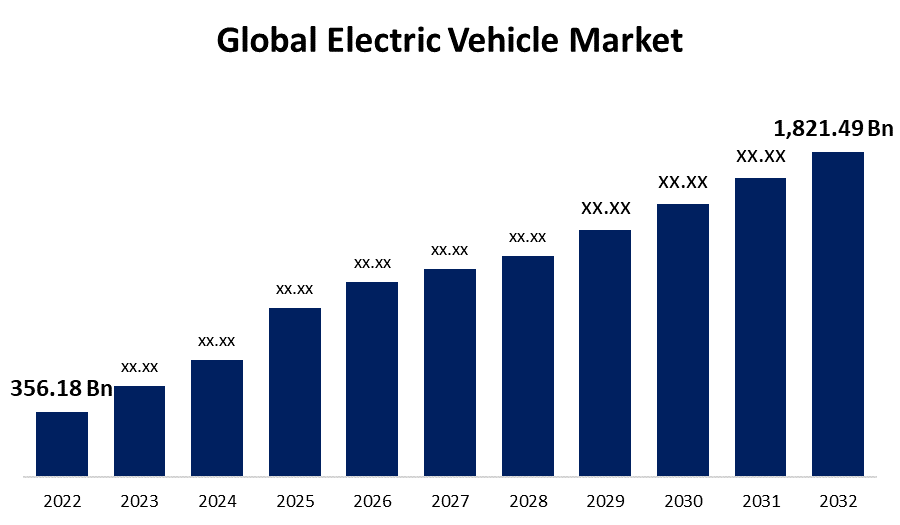

NIO operates in the rapidly expanding electric vehicle (EV) market. Their market is characterized by intense competition from both established automakers and emerging EV startups. Key factors driving growth in this sector include increasing environmental concerns, government incentives, advancements in battery technology, and growing consumer acceptance of electric vehicles.

NIO, with its focus on innovation, premium branding, and a strong foothold in the Chinese market, is well-positioned to capitalize on this growth. NIO can vary industry analysts often estimate that the overall EV market, including NIO’s segment, will achieve a Compound Annual Growth Rate (CAGR) in the double digits during this period.

Unique differentiation:

NIO faces stiff competition in the burgeoning electric vehicle market. Companies like Xpeng and Li Auto are key rivals, offering comparable or even overlapping product segments. These competitors are well-versed in Chinese consumer preferences and have been rapidly gaining market share.

Tesla remains the dominant force, setting the benchmark for EV technology and performance. Companies like Lucid Motors and Rivian, with their focus on luxury and electric pickups respectively, are also vying for market share. These competitors bring substantial financial resources, technological expertise, and brand recognition to the table, making the competitive landscape highly dynamic and challenging for NIO.

NIO has carved out a distinct position in the competitive EV market through a combination of innovative technology and a customer-centric approach.

The company’s most prominent differentiator is its battery swapping technology. Unlike competitors who primarily rely on charging stations, NIO offers a rapid battery swap solution, significantly reducing charging times and addressing range anxiety concerns.

NIO, has created a strong brand identity and a dedicated community of owners. Its focus on premium features, stylish designs, and a comprehensive ecosystem of services, including battery subscription plans and charging infrastructure, sets it apart from competitors. This holistic approach to EV ownership has contributed to NIO’s reputation as a lifestyle brand rather than just a car manufacturer.

Management & Employees:

Bin Li: As the founder and CEO, Bin Li oversees the company’s overall strategy and operations. He brings extensive experience in the automotive industry and internet technology.

Lihong Qin: A co-founder of NIO, Lihong Qin plays a crucial role in the company’s development.S

Ganesh V. Iyer: Leading NIO U.S., Iyer brings his expertise in autonomous technology and information technology to the company.

Financials:

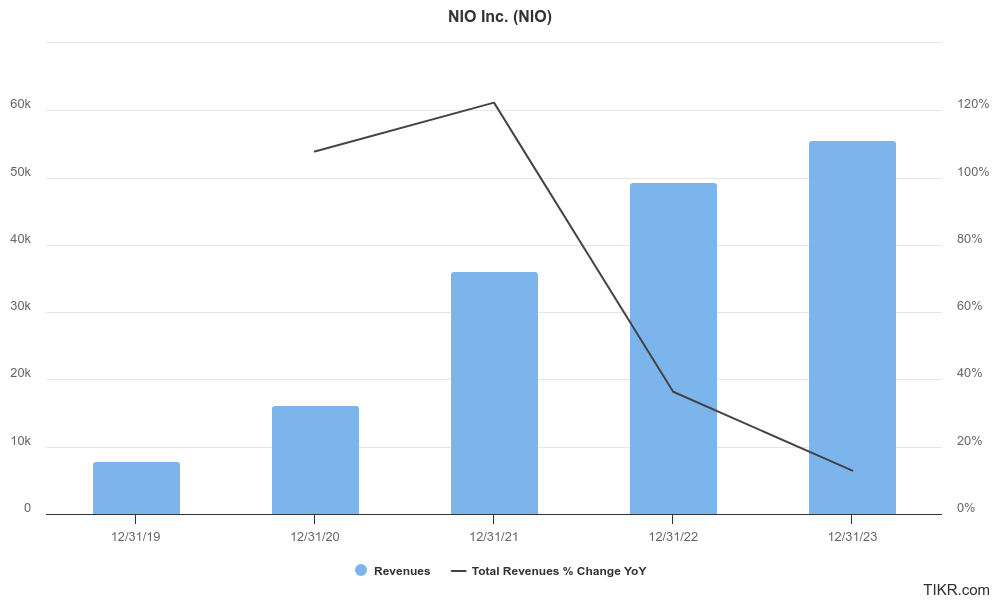

NIO revenue has exhibited a robust upward trajectory, reflecting expanding sales and market penetration. To gauge the consistency of this growth, calculating the Compound Annual Growth Rate (CAGR).

While revenue growth is encouraging, profitability remains a key challenge for many EV manufacturers, including NIO. Earnings per share (EPS) and overall profitability have likely fluctuated due to heavy investments in research and development, infrastructure, and marketing. Assessing the CAGR for EPS would offer insights into the company’s progress in achieving sustainable profitability.

NIO’s balance sheet would reveal the company’s financial health and liquidity position. Key areas to analyze include cash reserves, debt levels, and the overall capital structure. A strong balance sheet is crucial for supporting NIO’s growth initiatives, such as expanding production capacity, developing new models.

Technical Analysis:

The stock is in a stage 4 markdown (bearish) on the monthly, weekly and daily charts. This is a sure indicator to watch for a reversal but we recommend waiting for a reversal in place with a retest of the lows. This would likely be in the $2 range.

Bull Case:

Pioneering Battery Swap Technology: NIO’s innovative battery swap technology offers a unique value proposition by addressing range anxiety, a common concern among EV users. This could potentially give NIO a competitive edge over other EV manufacturers.

Growing EV Market: The overall electric vehicle market is experiencing rapid growth, driven by environmental concerns, government incentives, and technological advancements. NIO, as a key player in this market, stands to benefit from this tailwind.

Technological Innovation: The company’s focus on research and development can lead to groundbreaking advancements in electric vehicle technology, maintaining its competitive edge.

Economic Headwinds: Economic downturns can negatively impact consumer spending on luxury goods, which could affect demand for NIO’s premium electric vehicles.

Geopolitical Risks: As a Chinese company, NIO faces geopolitical risks, including trade tensions and potential regulatory challenges.

Valuation Concerns: Some investors argue that NIO’s stock price may be overvalued relative to its current financial performance and profitability.