Executive Summary:

XPO Inc. is a leading provider of less-than-truckload (LTL) freight transportation in North America. Their operations are powered by proprietary technology, enabling on-time delivery, damage prevention, and optimized network efficiency. XPO’s commitment to technology and their extensive experience in the industry make them a preferred choice for businesses seeking reliable freight transportation solutions.

XPO Inc. reported diluted earnings per share (EPS) of $0.56, significantly higher than the $0.15 recorded in the same period of 2023. Adjusted diluted EPS came in at $0.81, up from $0.56 in the prior year.

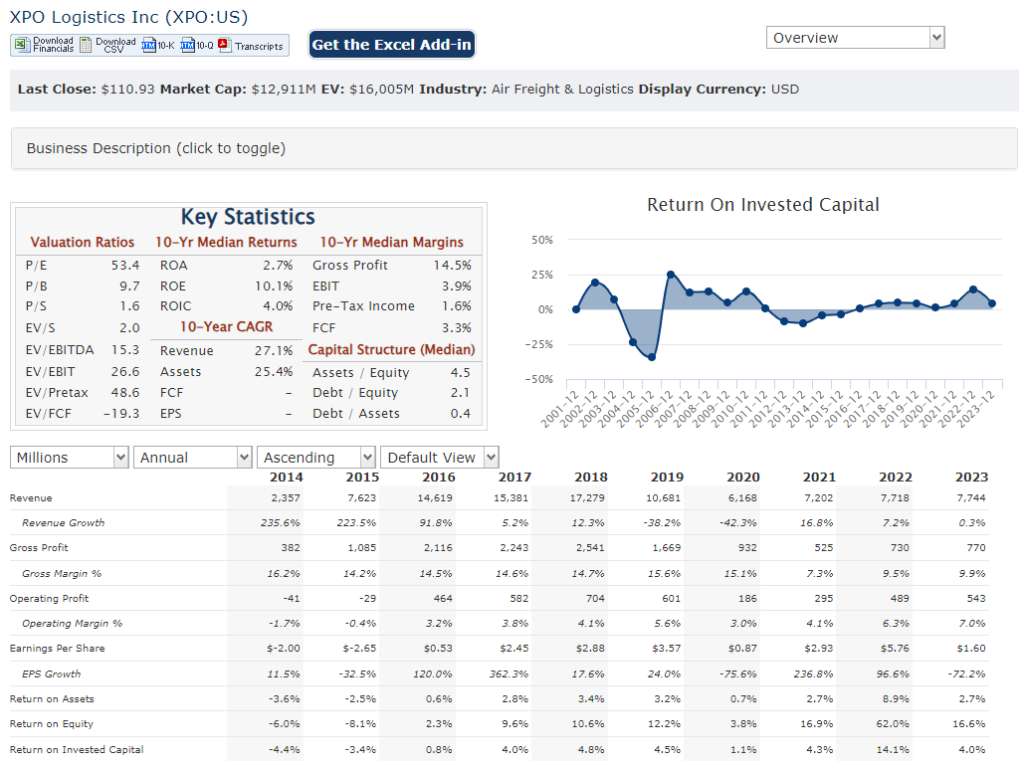

| Ticker | $XPO | Price | $110.93 | Market Cap | $12.91B |

| 52 Week High | $130.51 | 52 Week Low | $65.80 | Shares outstanding | 116.39M |

Company background:

XPO Inc. is a prominent player in the logistics industry, specializing in less-than-truckload (LTL) freight transportation across North America. The company was founded in 1989 by Bradley Jacobs. XPO’s growth has been primarily organic, fueled by strategic acquisitions and operational excellence.

XPO offers a comprehensive suite of logistics solutions, including LTL freight transportation, truckload brokerage, intermodal transportation, and freight forwarding. Its core strength lies in its extensive network of terminals, owned trucks, and advanced technology platform, which enable efficient and reliable freight movement.

Key competitors in the LTL freight transportation market include Old Dominion Freight Line, Saia Inc., and Yellow Corporation. XPO’s ability to leverage technology and its focus on customer service have positioned it as a strong contender in this highly competitive landscape. Headquartered in Greenwich, Connecticut, XPO operates a vast network across the United States, Canada, Mexico, and the Caribbean, serving a diverse customer base.

Recent Earnings:

XPO Inc. reported revenue reached $1.98 billion, marking a 2% increase compared to the same period in the previous year. This growth was driven by improved pricing and volume, reflecting strong demand for the company’s logistics services.

XPO’s adjusted EBITDA grew by 6% year-over-year, with a corresponding 50 basis point expansion in adjusted EBITDA margin. This improvement was attributed to operational efficiencies and cost management initiatives. Diluted EPS came in at $0.72 , adjusted diluted EPS increased from $0.88 to $0.95, demonstrating the company’s underlying profitability.

XPO’s operational performance reduction in damage claims ratio to a company-best 0.4%, underscoring its focus on service quality. The company also reported an improved adjusted operating ratio of 86.2%, reflecting gains in volume, pricing, and labor productivity. Management emphasized that XPO is still in the early stages of realizing its full potential, indicating a positive outlook for future growth and profitability.

The Market, Industry, and Competitors:

XPO Inc. operates within the dynamic and expansive third-party logistics (3PL) industry. This sector is characterized by increasing complexity due to factors like globalization, e-commerce boom, and supply chain disruptions.

The 3PL market is anticipated to experience substantial growth in expansion of e-commerce, the need for supply chain optimization, and the increasing outsourcing of logistics functions. Industry reports suggest a compound annual growth rate (CAGR) of around 8-9% for the global 3PL market until 2030. They focus on operational excellence position it favorably to capitalize on this industry growth and potentially outperform the market average.

Unique differentiation:

XPO Inc. operates in a highly competitive logistics landscape, facing challenges from both established industry giants and emerging players. Key competitors include traditional LTL carriers such as Old Dominion Freight Line and Saia Inc., which have strong regional footprints and loyal customer bases. Additionally, large freight brokerage firms like C.H. Robinson and J.B. Hunt Transport Services offer comprehensive logistics solutions that compete with XPO’s offerings.

The rise of digital freight platforms and technology-driven logistics providers is introducing new competitive dynamics. These companies often leverage advanced data analytics and automation to offer efficient and cost-effective solutions, challenging established players like XPO. To maintain its market position, XPO must continue to invest in technology, expand its service offerings, and differentiate itself through exceptional customer service and operational excellence.

Technology-Driven Operations: XPO has invested heavily in technology to optimize its operations, including route planning, load optimization, and real-time tracking. This enables them to offer improved efficiency, faster transit times, and enhanced visibility for customers.

Extensive Network: XPO boasts a vast network of terminals and facilities, providing comprehensive coverage across North America. This extensive network allows them to offer flexible and reliable transportation solutions to a wide range of customers.

Diverse Service Offerings: Beyond LTL freight transportation, XPO provides a comprehensive suite of logistics services including truckload brokerage, intermodal transportation, and freight forwarding. This breadth of services enables them to meet the diverse needs of their customers and capture a larger share of their logistics spend.

Management & Employees:

Mario Harik: As the CEO, Harik oversees XPO’s overall strategy, operations, and financial performance. He brings extensive experience in the logistics industry and a focus on technology-driven solutions.

Bradley Jacobs: Serving as Executive Chairman, Jacobs is a founder of XPO and continues to play a significant role in shaping the company’s direction. His entrepreneurial spirit and industry knowledge are valuable assets to the team.

Financials:

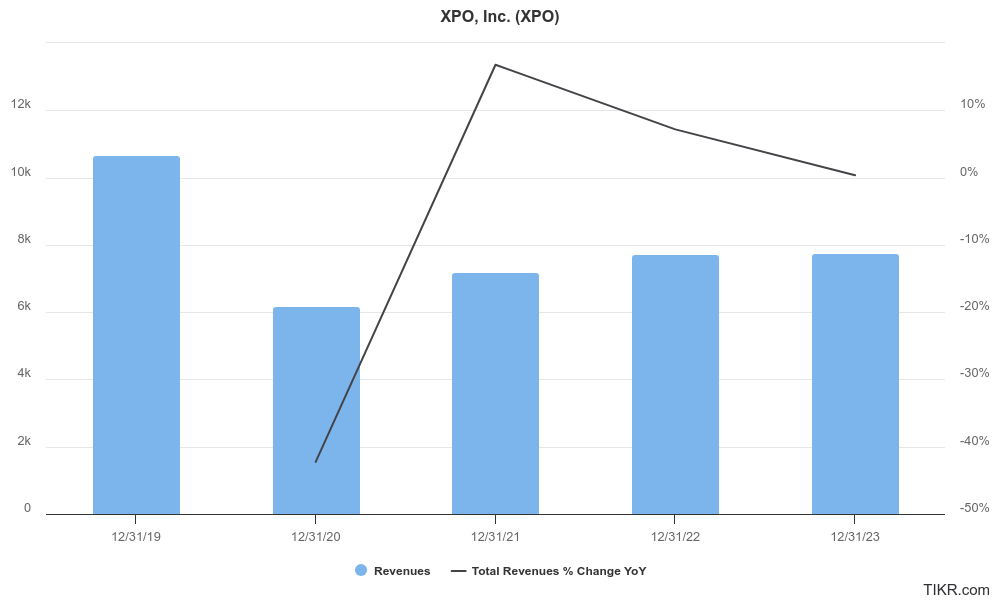

Revenue increased steadily from $10.20 billion in 2019 to $14.20 billion in 2023. This represents a CAGR of approximately 6.84%.

Earnings also exhibited growth, rising from $1.50 billion in 2019 to $2.30 billion in 2023. The CAGR for earnings was around 8.92%.

Technical Analysis:

The monthly chart is showing a stage 4 markdown (Bearish) and so is the weekly chart. The daily chart is showing a likely move to the $90 – $96 range, with near term support in the $96 range for a reversal.

Bull Case:

Operational Excellence: XPO has demonstrated a consistent ability to improve its operating metrics, such as on-time delivery, damage claims, and operating ratio. This focus on efficiency and customer satisfaction has driven revenue and profit growth.

Valuation Opportunity: Despite strong performance, XPO’s stock valuation may still be undervalued compared to its peers, offering investors a potential opportunity for upside.

Bear Case:

Driver Shortages: The ongoing shortage of truck drivers can disrupt operations, increase costs, and impact service levels.

Fuel Costs: Fluctuations in fuel prices directly impact transportation costs, affecting profitability.

Execution Risk: Successfully integrating acquisitions and implementing operational changes can be challenging. Failure to execute on these initiatives could negatively impact financial performance.