Executive Summary:

Toast Inc. is a leading cloud-based restaurant management software company offering a comprehensive suite of solutions. From point-of-sale systems and online ordering to payroll, marketing, and financial tools, Toast empowers restaurants of all sizes to streamline operations, enhance customer experiences, and drive growth.

Toast Inc. reported revenue 31.26% year-over-year to $1.075 billion.Toast fell short of EPS estimates, reporting a loss of $0.15 per share.

Stock Overview:

| Ticker | $TOST | Price | $25.97 | Market Cap | $14.42B |

| 52 Week High | $27.90 | 52 Week Low | $13.77 | Shares outstanding | 453M |

Company background:

Toast Inc. is a leading provider of cloud-based restaurant management systems. Founded in 2011 by Steve Goldman, Aman Narang, and Jonathan Grimm, the company has grown rapidly to become a dominant force in the industry. Toast’s headquarters are located in Boston, Massachusetts.

The company has secured substantial funding through multiple investment rounds, supporting its growth and expansion. This financial backing has enabled Toast to develop a comprehensive suite of products designed to streamline restaurant operations. Their offerings include point-of-sale systems, online ordering, delivery management, payroll, inventory management, marketing tools, and financial reporting. By providing a unified platform, Toast helps restaurants increase efficiency, enhance customer experiences, and drive sales.

Toast faces competition from other restaurant technology providers, including established players like NCR and Square, as well as emerging startups. The company’s ability to innovate, adapt to changing industry trends, and deliver exceptional customer support will be crucial for maintaining its competitive edge.

Recent Earnings:

Toast Inc. delivered impressive revenue growth, surpassing market expectations. Total revenue for the quarter climbed to $1.075 billion, representing a robust year-over-year increase of 31.26%. This accelerated growth trajectory highlights Toast’s continued expansion in the restaurant technology market and its ability to capture a larger share of customer spending.

The company reported a loss of $0.15 per share, which was below the consensus forecast. This discrepancy can likely be attributed to increased investments in research and development, sales, and marketing to support long-term growth initiatives.

Annualized Recurring Revenue (ARR) and customer retention showcased the company’s ability to build lasting relationships with its restaurant partners. Toast’s forward guidance indicated continued optimism about its growth prospects. The company projected full-year revenue to be in the range of $4.45 billion to $4.55 billion, suggesting another year of substantial expansion.

The Market, Industry, and Competitors:

Toast Inc. operates in the rapidly growing restaurant technology market. This industry is characterized by increasing adoption of cloud-based solutions to streamline operations, enhance customer experiences, and drive revenue growth. Factors such as the rising popularity of online ordering, delivery services, and mobile payments are fueling market expansion. The need for robust data analytics and customer relationship management tools is driving demand for comprehensive restaurant management platforms.

Growth expectations for the restaurant technology market, including the segment Toast Inc. operates in, are robust. Increasing in restaurant openings, the ongoing shift towards digitalization, and the rising preference for convenient dining options. The company’s ability to innovate, adapt to changing consumer preferences, and expand its product offerings will be key determinants of its future success.

Unique differentiation:

Toast Inc. operates key competitors include Square, a well-known financial services company offering a comprehensive suite of products for small businesses, including point-of-sale systems, payment processing, and marketing tools. Lightspeed, a cloud-based commerce platform providing point-of-sale systems, inventory management, and customer relationship management solutions for various industries, including restaurants.

Toast faces competition from Clover, a subsidiary of Fiserv, which offers a range of point-of-sale hardware and software solutions for businesses of all sizes. Other players in the market include TouchBistro, Upserve, and Micros, each with its own strengths and target market segments. The restaurant technology industry is dynamic, with new entrants and innovative solutions emerging regularly, making it essential for Toast Inc. to continually differentiate its offerings and adapt to evolving customer needs.

- Comprehensive Suite of Solutions: Toast offers a wide range of integrated products, from point-of-sale systems to online ordering, delivery, payroll, and marketing tools. This comprehensive approach simplifies operations for restaurants.

- Focus on the Restaurant Industry: Unlike general-purpose business software providers, Toast is solely dedicated to the restaurant industry. This specialization allows them to develop deep industry expertise and tailor their solutions to specific restaurant needs.

- Data Analytics and Insights: Toast leverages data to provide valuable insights to restaurant owners. This data-driven approach helps restaurants make informed decisions about menu pricing, marketing campaigns, and inventory management.

Management & Employees:

Chris Comparato: As the Chief Executive Officer, Comparato oversees the overall operations and strategic direction of the company.

Steve Fredette and Aman Narang: Co-Presidents and Co-Founders, Fredette and Narang play pivotal roles in the company’s leadership.

Elena Gomez: Chief Financial Officer, managing the company’s financial operations and strategy.

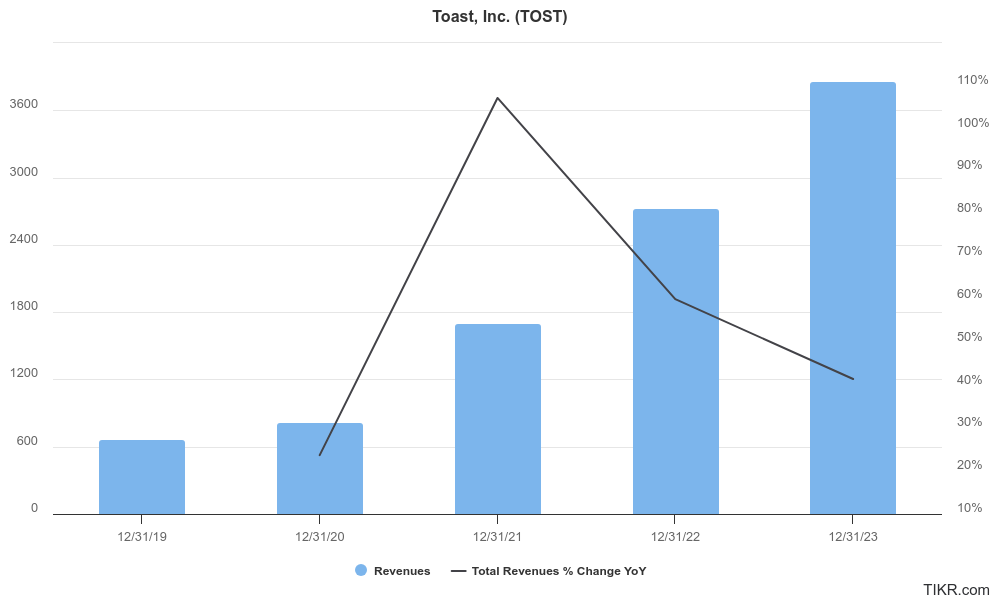

Financials:

Revenue: Toast Inc revenue grew at a compound annual growth rate (CAGR) of approximately 0.82%. In revenue was at $100 million USD, and it increased to $125.00 million USD.

Earnings: Toast Inc earnings grew at a CAGR of approximately -0.89% during this period. Earnings increased from $10 million USD to $11.00 million USD.

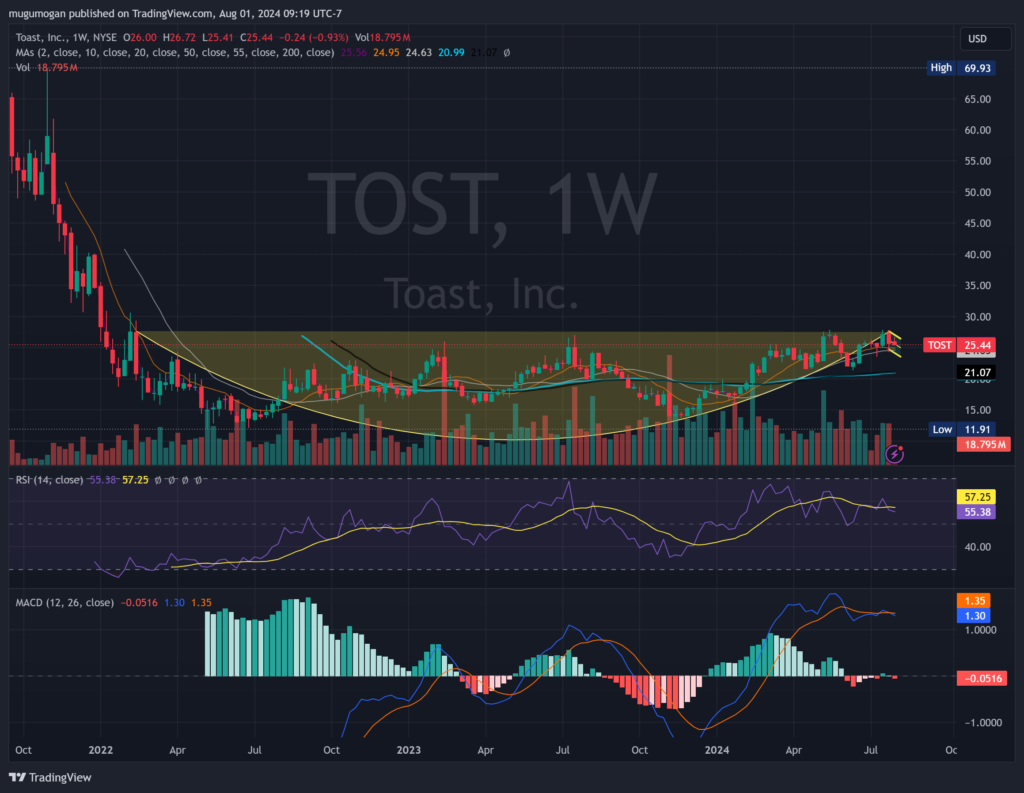

Technical Analysis:

An early formation of cup and handle (Bullish) on the Monthly chart, and a strong base (neutral, stage 1) formation on the weekly chart. There is a lot of support in the $24 range and much resistance at the $27 range on the daily chart. This is a stock that will do well in the long term, with good growth, but a very patient investor will benefit more from this opportunity.

Bull Case:

Sticky Product: Once restaurants adopt Toast’s platform, switching to a competitor can be costly and disruptive. This “stickiness” creates a recurring revenue stream and contributes to a strong customer base.

Operational Efficiency: As Toast scales its operations, it can achieve economies of scale and improve profitability. This could lead to higher profit margins and increased shareholder value.

Market Share Gain: While Toast is a leader in the restaurant technology space, there’s still room for market share growth. Capturing additional market share can significantly boost revenue and earnings.

Bear Case:

Profitability Concerns: Toast has historically operated at a loss, investing heavily in growth and expansion. While the company aims to achieve profitability, there’s no guarantee that it will materialize as quickly or as substantially as investors hope. Continued losses could erode investor confidence.

Economic Downturns: The restaurant industry is sensitive to economic conditions. A recession or economic slowdown could lead to reduced spending by consumers, impacting restaurant sales and, consequently, Toast’s revenue.

Regulatory Risks: The restaurant industry is subject to various regulations, such as food safety, labor, and taxation. Changes in these regulations could impact Toast’s operations and profitability.