Executive Summary:

Guidewire Software Inc. is a leading provider of cloud-based software solutions specifically designed for the property and casualty (P&C) insurance industry. They offer a comprehensive platform that covers the entire insurance lifecycle, from policy management and billing to claims handling. Their solutions empower insurers to improve operational efficiency, enhance customer engagement, and drive innovation through advanced analytics and AI capabilities.

Guidewire Software Inc. reported revenue surged 15.99% year-over-year to $240.68 million. The company incurred a net loss of $5.48 million.

Stock Overview:

| Ticker | $GWRE | Price | $149.70 | Market Cap | $12.37B |

| 52 Week High | $150.72 | 52 Week Low | $78.05 | Shares outstanding | 82.66M |

Company background:

Guidewire Software Inc. is a prominent player in the property and casualty (P&C) insurance industry, specializing in cloud-based software solutions.

Guidewire offers a comprehensive suite of products designed to streamline insurance operations. Their core platform covers policy administration, billing, claims management, and underwriting, enabling insurers to improve efficiency, reduce costs, and enhance customer experience. The company has consistently invested in research and development to incorporate advanced technologies like artificial intelligence and machine learning into their solutions, helping insurers make data-driven decisions and stay ahead of industry trends.

The P&C insurance software market is highly competitive, with several established players vying for market share. Key competitors to Guidewire include Duck Creek Technologies, Applied Systems. These companies offer similar core systems and software solutions, making the competitive landscape intense. Guidewire has managed to carve out a strong market position by focusing on innovation, customer satisfaction, and deep industry expertise.

Recent Earnings:

Guidewire Software Inc. continued to demonstrate strong financial performance, driven by robust demand for its cloud-based insurance platform.

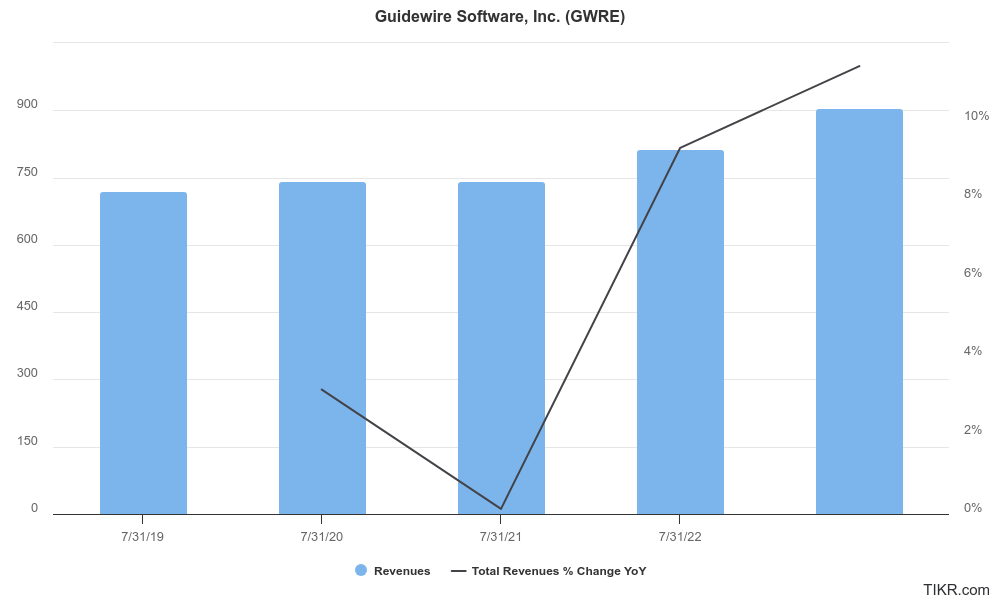

Revenue for the quarter came in at $240.68 million representing a 15.99% year-over-year growth. The company’s ability to capitalize on the ongoing shift towards cloud-based solutions in the insurance industry.

Operational metrics showcased positive trends. Subscription revenue, a key indicator of recurring income, grew year-over-year, reflecting the sticky nature of Guidewire’s software solutions. Additionally, the company’s customer retention rate remained strong, indicating high customer satisfaction. Guidewire provided upbeat guidance, projecting revenue in the range and adjusted EPS. The company’s confidence in its outlook is underpinned by the growing adoption of its cloud platform and its ability to deliver innovative solutions to the insurance market.

The Market, Industry, and Competitors:

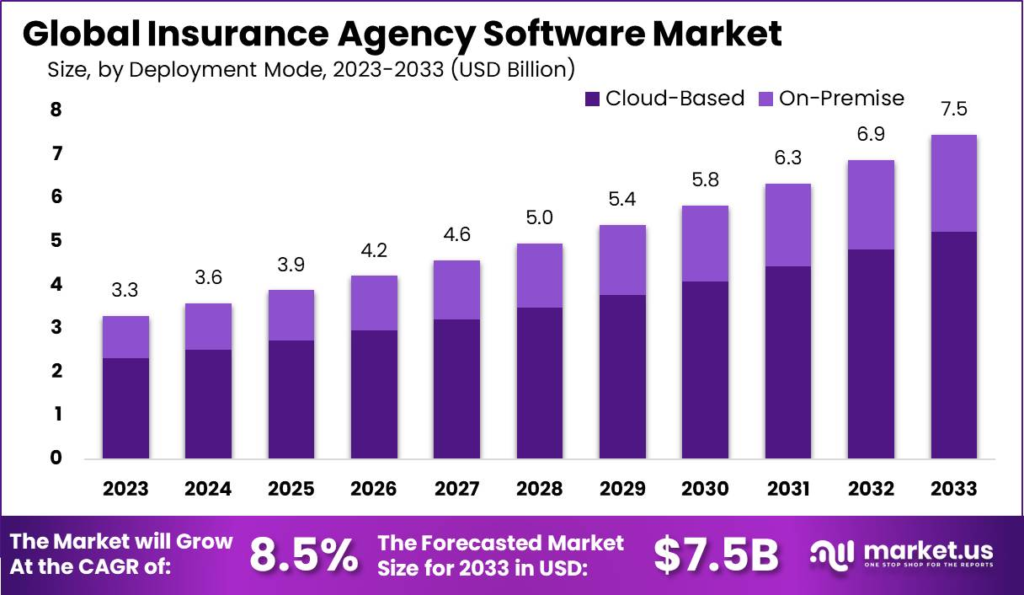

Guidewire Software operates within the property and casualty (P&C) insurance software market. This industry is characterized by a growing demand for advanced, cloud-based solutions to streamline operations and improve efficiency. Key drivers of market growth include increasing regulatory compliance mandates, the need for better risk management, and the desire to enhance customer experience.

The P&C insurance software market is poised for substantial growth. Several factors contribute to this optimistic outlook, including the increasing adoption of digital technologies, the growing complexity of insurance products, and the need for insurers to leverage data analytics for better decision-making.

Unique differentiation:

Guidewire Software Inc. operates in a highly competitive landscape. Key competitors include Duck Creek Technologies, Applied Systems, and Insurity. These companies offer similar core insurance software solutions, targeting the P&C insurance market. The competitive intensity is driven by factors such as product innovation, customer acquisition, and the ability to adapt to evolving industry trends.

Other notable players in the market include Majesco, EIS Group, and Socotra. These companies, along with the aforementioned competitors, present a dynamic and challenging environment for Guidewire. To maintain its market leadership, Guidewire must continue to invest in research and development, expand its product offerings, and strengthen its customer relationships.

- Deep industry expertise: Guidewire has a strong focus on the P&C insurance industry, allowing it to develop solutions that specifically address the unique challenges and complexities of this sector.

- Comprehensive product suite: Guidewire offers a comprehensive platform that covers the entire insurance lifecycle, from policy administration to claims management, providing insurers with a unified solution.

- Cloud-first strategy: Guidewire has been a pioneer in cloud-based insurance software, enabling insurers to benefit from scalability, flexibility, and reduced IT costs.

Management & Employees:

- Chief Executive Officer (CEO): The CEO is responsible for the overall strategic direction and performance of the company. They oversee all aspects of the business, including product development, sales, marketing, and finance.

- Chief Financial Officer (CFO): The CFO manages the financial operations of the company, including financial planning, analysis, and reporting. They also play a crucial role in investor relations.

- Chief Sales and Marketing Officer (CSMO): The CSMO oversees the company’s sales and marketing efforts, including customer acquisition, revenue generation, and brand management.

Financials:

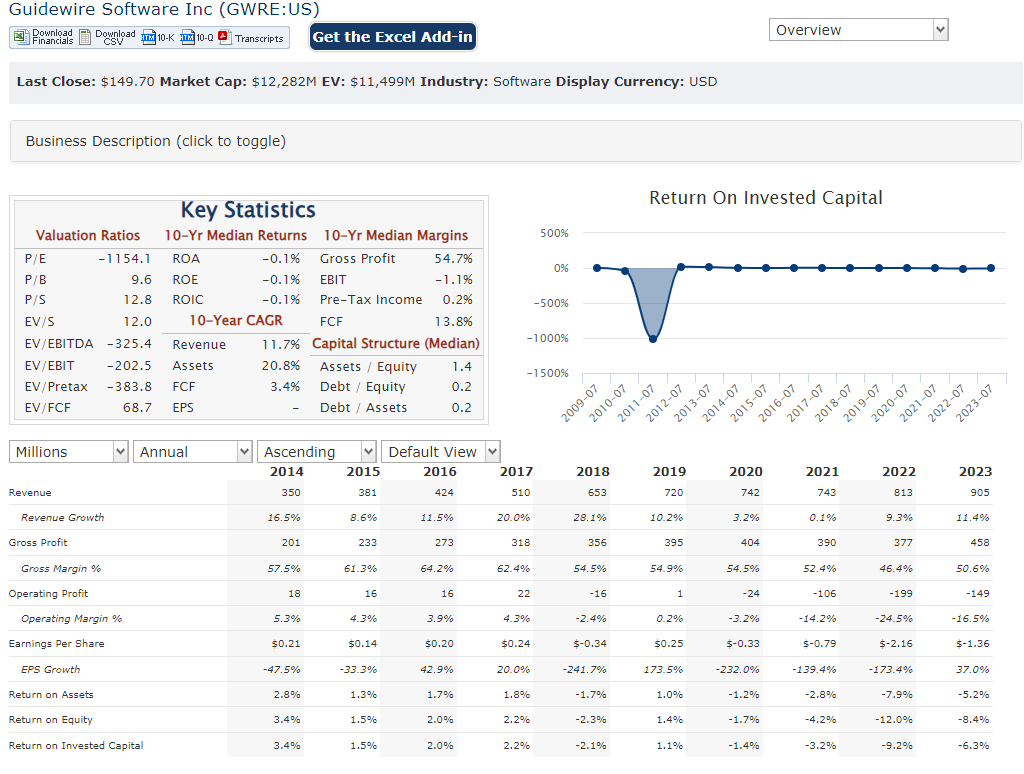

Guidewire Software Inc’s top line has expanded steadily, driven by increasing demand for cloud-based insurance solutions and a growing customer base. This consistent revenue growth has translated into a healthy Compound Annual Growth Rate (CAGR), indicating a sustained upward trajectory in the company’s financial performance.

The company has invested significantly in research and development, sales, and marketing to strengthen its market position and drive future growth. These investments have impacted profitability in some periods. There have been instances of earnings growth, demonstrating the company’s ability to generate profits when operational efficiencies are optimized. The earnings CAGR, while not as consistent as revenue growth, reflects the overall trend in profitability.

The company has maintained a reasonable level of cash and cash equivalents, providing financial flexibility. Additionally, the management of accounts receivable and inventory has been efficient, contributing to overall financial health.

Technical Analysis:

The monthly, weekly and daily charts are all in stage 2 markup and strongly bullish. While there is some resistance at the all-time-high (currently at $152 range, this stock should get to $155 and the head back lower to $120 to $145 range soon.

Bull Case:

Recurring Revenue Model: The company’s subscription-based business model generates predictable and recurring revenue, providing a stable foundation for growth.

Innovation and Product Expansion: Guidewire’s focus on research and development enables it to introduce new products and features, expanding its addressable market and driving growth.

Valuation Potential: If Guidewire can consistently deliver on its growth and profitability targets, the stock’s valuation multiple could expand, leading to significant upside potential.

Bear Case:

Economic Downturns: Economic downturns can lead to reduced insurance premiums and claims, impacting the demand for insurance software solutions. This could negatively affect Guidewire’s revenue growth.

Execution Risks: Successfully executing on product development, sales, and marketing strategies is crucial for Guidewire’s success. Failure to meet expectations could lead to disappointing financial performance.

Valuation Concerns: If Guidewire fails to meet investor expectations for revenue and earnings growth, the stock’s valuation multiple could contract, leading to a decline in share price.