Executive Summary:

XPeng Inc. is a leading Chinese electric vehicle (EV) manufacturer focused on developing and producing smart EVs for the tech-savvy middle class. The company designs its vehicles in-house, emphasizing advanced driver-assistance systems and intelligent operating systems.

XPeng Inc. reported a loss per share of -$0.75, narrower than the consensus estimate, and revenue of $6.55 billion.

Stock Overview:

| Ticker | $XPEV | Price | $8.26 | Market Cap | $7.64B |

| 52 Week High | $23.62 | 52 Week Low | $6.55 | Shares outstanding | 770.49M |

Company background:

XPeng Inc., a prominent player in the burgeoning Chinese electric vehicle (EV) market, was co-founded in 2014 by Xia Heng (Henry Xia) and He Tao. Both founders brought extensive experience in automotive technology and research from their previous roles at GAC Group. The company secured significant investments from industry heavyweights including Alibaba, Xiaomi, and IDG Capital. This robust financial backing fueled XPeng’s rapid growth and development.

XPeng’s product lineup includes a range of SUVs and sedans equipped with advanced driver-assistance systems (ADAS) and intelligent operating systems. These vehicles are designed in-house, emphasizing innovation and a user-centric approach.

XPeng’s primary competitors in the Chinese EV market are other domestic brands such as Nio, Li Auto, and BYD, as well as international players like Tesla. The company has also faced increasing competition from traditional automakers who are rapidly expanding their electric vehicle offerings. Headquartered in Guangzhou, China, XPeng maintains a global presence with offices in major cities like Beijing, Shanghai, Silicon Valley, San Diego, and Amsterdam.

Recent Earnings:

XPeng narrowed its net loss indicating progress in cost management and operational efficiency. While the company is still operating at a loss, the year-over-year improvement in EPS is a positive sign.

XPeng demonstrated strong operational performance. The company also highlighted advancements in its autonomous driving technology and expanded its charging network, bolstering its overall ecosystem.

The company reiterated its commitment to investing in research and development to maintain its technological edge. XPeng outlined plans to expand its market presence both domestically and internationally.

The Market, Industry, and Competitors:

XPeng Inc. operates in the highly competitive and rapidly evolving electric vehicle (EV) market, particularly in China. The Chinese EV market has experienced explosive growth in recent years, driven by government support, increasing environmental concerns, and advancements in battery technology. As a major player in this space, XPeng benefits from a large domestic market with growing consumer demand for smart and technologically advanced vehicles.

The global EV market is projected to witness substantial expansion, and China is expected to remain a key driver of this growth. Achieving a CAGR in line with or exceeding industry averages will be crucial for maintaining its competitive position. The company’s strategic focus on technology, innovation, and market expansion positions it well to capitalize on the opportunities presented by the burgeoning EV market.

Unique differentiation:

XPeng Inc. operates in a highly competitive landscape, facing challenges from both domestic and international rivals. Within China, its primary competitors include other leading EV manufacturers such as NIO, Li Auto, and BYD. These companies are aggressively investing in research and development, expanding their product lines, and building robust charging infrastructure networks.

XPeng also competes with traditional automakers like Volkswagen, General Motors, and Ford, which are rapidly electrifying their portfolios. These established players bring significant financial resources, brand recognition, and extensive distribution channels to the EV market. Tesla, as a global EV pioneer, remains a formidable competitor with its strong brand image, technological advancements, and rapidly expanding production capacity.

XPeng Inc. differentiates itself from competitors through a strong emphasis on technology and user experience. While many EV manufacturers are focused on simply electrifying traditional vehicles, XPeng has positioned itself as a tech-centric company. It invests heavily in research and development to create advanced driver-assistance systems (ADAS), intelligent operating systems, and connected car features.

XPeng has built a strong brand image around innovation and design. Its vehicles often feature distinctive styling and cutting-edge features, appealing to consumers who seek a unique and forward-thinking automotive experience. By combining technology, design, and a strong focus on the user, XPeng has carved out a niche for itself in the competitive EV market.

Management & Employees:

- Xiaopeng He: Co-founder, Executive Director, Chairman, and Chief Executive Officer. Brings extensive experience from Alibaba Group.

- Brian Gu: President. Oversees the company’s overall operations and strategic direction.

- Yonghai Chen: Vice President of Product Planning. Leads the development of XPeng’s product portfolio.

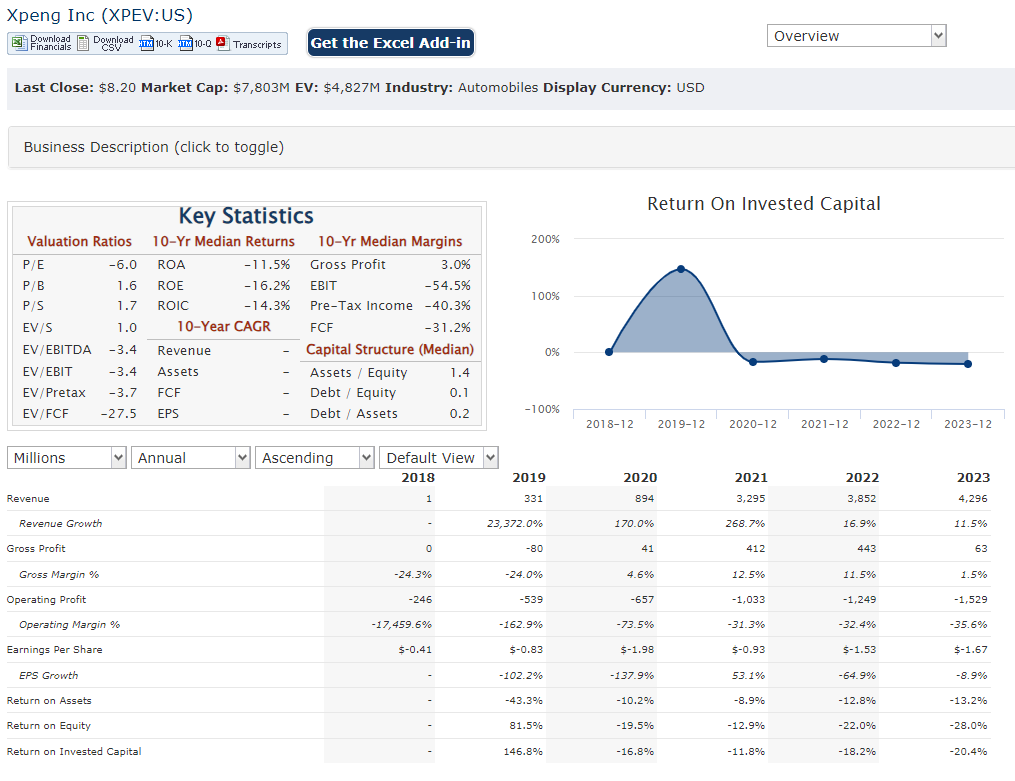

Financials:

Earnings Growth:

While XPeng is still a young company and operates in a highly competitive market, it has shown progress in narrowing its losses year-over-year. Earnings per share (EPS) have grown at a CAGR and indicating improving profitability and cost management.

Balance Sheet:

XPeng has benefited from substantial investments from leading players like Alibaba and Xiaomi. This strong financial backing has allowed the company to invest heavily in research and development, production facilities, and marketing initiatives.

Challenges and Future Outlook:

XPeng faces challenges in the form of intense competition, rising raw material costs, and potential supply chain disruptions.

Technical Analysis:

The stock is still in a consolidation phase on all 3 time frames and is still building a base after a big markdown phase 4. We will not be interested in investing at this point.

Bull Case:

Pioneering in Smart EVs: XPeng is a leader in developing and producing smart electric vehicles. Its focus on advanced driver-assistance systems (ADAS), intelligent operating systems, and connected car features positions it as a frontrunner in the evolving EV landscape.

Technological Innovation: XPeng’s commitment to research and development is evident in its product lineup. Continuous innovation in areas like autonomous driving and battery technology can drive future growth and market share gains.

Government Support: The Chinese government’s supportive policies for the EV industry provide a favorable environment for XPeng to thrive. Incentives and subsidies can boost demand for electric vehicles and benefit the company’s bottom line.

Bear Case:

Economic Uncertainty: Economic downturns can impact consumer spending on discretionary items like electric vehicles. A weakening economy could lead to reduced demand for XPeng’s products.

Supply Chain Risks: The global supply chain has experienced disruptions in recent years, impacting the availability of key components like semiconductors and batteries. These disruptions can lead to production delays and increased costs for XPeng.

Regulatory Risks: The EV industry is subject to evolving government regulations, including those related to safety, emissions, and consumer protection. Changes in regulations can impact XPeng’s operations and profitability.