Executive Summary:

Carvana is an online platform revolutionizing the used car buying experience. It allows customers to research, select, finance, and even purchase a vehicle entirely online. Known for its innovative car vending machines, Carvana offers a convenient and transparent approach to car ownership, providing detailed vehicle information, warranties, and various delivery options.

Stock Overview:

| Ticker | $CVNA | Price | $128.89 | Market Cap | $26.11B |

| 52 Week High | $147.25 | 52 Week Low | $25.09 | Shares outstanding | 116.95M |

Company background:

Carvana was founded in 2012 by Ernest Garcia III, Ryan Keeton, and Ben Huston, the company is headquartered in Tempe, Arizona. Carvana’s core product is its online platform that allows customers to research, select, finance, and purchase a vehicle entirely online.

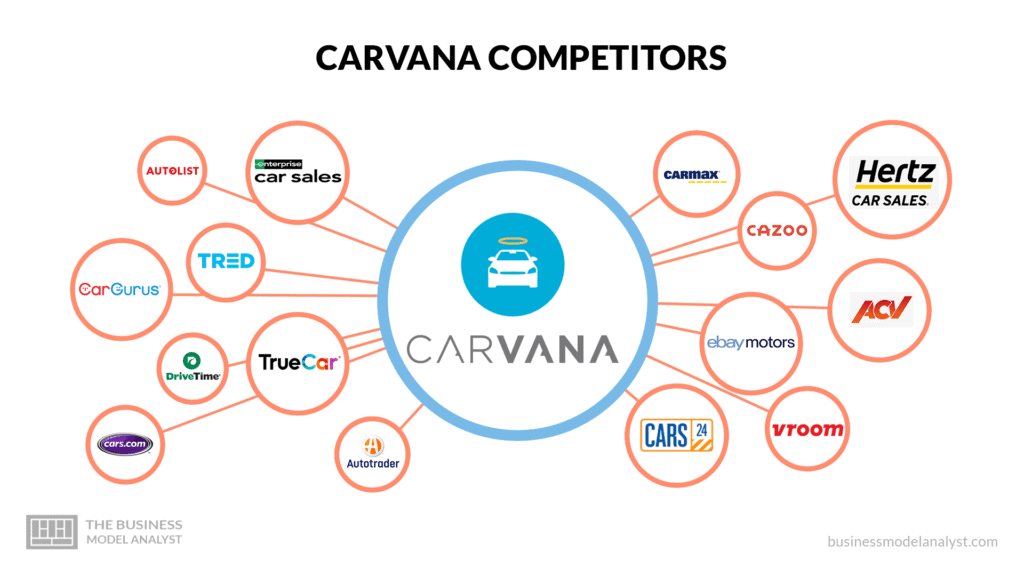

Carvana’s primary competitors include traditional car dealerships, other online car retailers like Vroom and Shift, and rental car companies that have entered the used car market. It has differentiated itself through its customer-centric approach, technology-driven platform, and unique car vending machine concept.

Recent Earnings:

Carvana Co milestone journey towards profitability. While challenges persist in the used car market, the quarter showcased encouraging signs of recovery for the online car retailer. They reported a quarterly earnings per share (EPS) of $0.23, a substantial improvement from the previous year.

The company’s retail unit economics improved, reflecting better pricing and cost management. Inventory levels remained in check, indicating improved efficiency in vehicle sourcing and turnover. Carvana also highlighted its continued focus on cost reduction and operational optimization, which is crucial for achieving sustained profitability.

The company reiterated its commitment to profitability and free cash flow generation. While economic uncertainties and market volatility remain, the positive momentum exhibited in Q1 provides a foundation for future growth.

The Market, Industry, and Competitors:

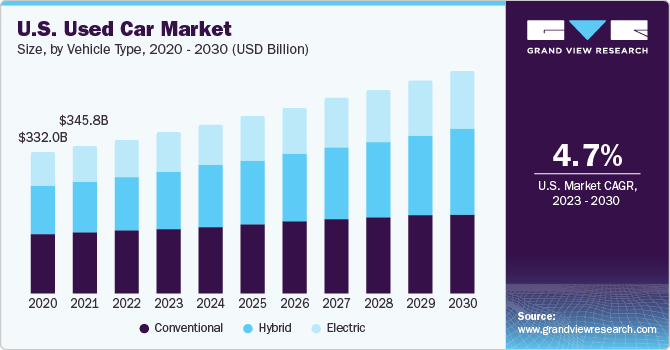

Carvana operates in the rapidly evolving used car market. Traditionally dominated by brick-and-mortar dealerships. Factors driving this change include the increasing preference for online shopping, the desire for convenience, and the transparency offered by digital marketplaces. Carvana has positioned itself as a leading player in this space by offering a seamless online car buying experience, including vehicle selection, financing, and delivery.

The used car market is expected to continue growing in the coming years. This optimistic outlook, including the increasing average age of vehicles on the road, the rising cost of new cars, and the growing popularity of car subscription services. As Carvana continues to innovate and expand its market share, it has the potential to outperform the industry average and achieve substantial growth in the next decade.

Unique differentiation:

Carvana operates in a competitive landscape traditional car dealerships, with their established physical presence and extensive inventory, remain formidable competitors. Companies like CarMax, with its vast network of stores, and local dealerships offer a familiar buying experience for many consumers.

Carvana faces competition from other online car retailers such as Vroom, Shift, and Cazoo. These companies have adopted similar business models, focusing on online platforms and offering a convenient car buying process. Automotive marketplaces like Autotrader and Cars.com, while not direct competitors in terms of vehicle ownership, compete for consumer attention in the car shopping journey.

Unlike traditional dealerships, Carvana eliminates the hassle of negotiating prices, test driving multiple vehicles, and dealing with paperwork. Customers can browse a vast inventory online, complete the purchase process digitally, and have the car delivered directly to their doorstep or picked up from a Carvana vending machine. This level of convenience and transparency is unparalleled in the industry.

Carvana’s car vending machines have become an iconic symbol of the company, creating a memorable and engaging customer experience. While competitors may offer online platforms or home delivery, none have replicated the novelty and excitement associated with Carvana’s vending machines.

By combining technology, convenience, and a unique customer experience, Carvana has carved out a distinct position in the competitive used car market.

Management & Employees:

Ernie Garcia III serves as the President and Chief Executive Officer of Carvana Co. He co-founded the company and has been instrumental in its strategic direction.

Daniel Gill serves as the Chief Product Officer at Carvana Co. He leads the product development and innovation initiatives within the company.

Ryan Keeton is the Chief Brand Officer at Carvana Co. He oversees the company’s branding, marketing, and public relations efforts.

Financials:

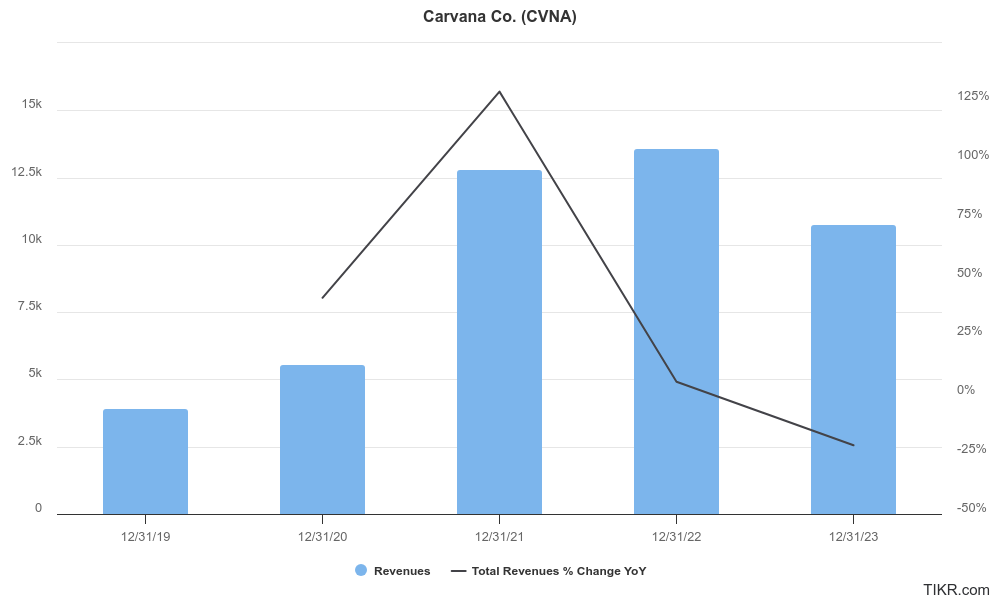

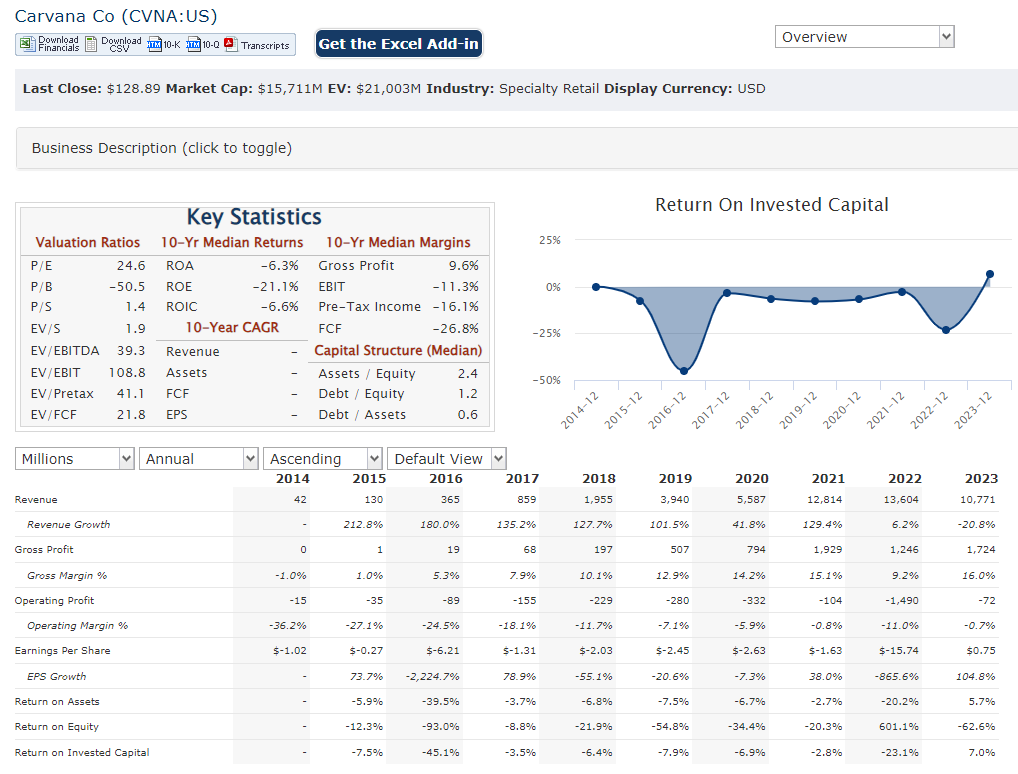

Revenue Growth: Carvana estimates suggest a CAGR exceeding 50%. This rapid growth can be attributed to the rising adoption of online car buying, Carvana’s expanding inventory and geographic reach, and its innovative approach to customer experience.

Earnings Growth: Earnings before interest, taxes, depreciation, and amortization (EBITDA) have improved steadily, indicating better cost management and operational efficiency. Carvana is not yet consistently profitable on a net income basis.

Balance Sheet: Carvana’s rapidly growing asset base, including its inventory of vehicles, helps offset the debt burden. The company is focused on improving its working capital management and optimizing its inventory levels to achieve a more balanced financial position.

Looking Ahead: Carvana’s future financial performance will depend on its ability to navigate the evolving used car market and achieve profitability. The company’s success hinges on factors such as maintaining a strong inventory selection, managing costs effectively, and expanding its market share through continued innovation and customer focus.

Technical Analysis:

Still building a base on the monthly chart, and a strong move from the lows of $5 to over $125. The weekly chart is positive with a cup and handle formation and the daily chart shows near term weakness to the $00 – $118 range.

Bull Case:

- Operational Efficiency: The company has made significant strides in improving its operations, including inventory management, pricing, and cost control. These efforts can lead to improved profitability and cash flow generation.

- Financial Restructuring: The company has taken steps to reduce debt and improve its financial position, which could enhance investor confidence.

- Market Share Growth: As Carvana expands its geographic reach and increases brand awareness, it has the potential to capture a larger share of the used car market.

Bear Case:

- Profitability Challenges: Despite significant revenue growth, Carvana has struggled to achieve consistent profitability. The company’s operating model, including high inventory costs and operational expenses, has hindered its ability to generate positive net income.

- Economic Downturns: The automotive industry is cyclical, and economic downturns can significantly impact car sales. A recession could lead to reduced consumer spending on vehicles, negatively affecting Carvana’s revenue and profitability.