Executive Summary:

Informatica Inc. is a leading enterprise cloud data management company that specializes in software and services for data integration. It offers a suite of tools for managing data across various platforms, including cloud and hybrid environments. Its focus on data quality, governance, and security helps businesses harness the power of their data for better decision-making and competitive advantage. With a strong customer base and a commitment to innovation, Informatica plays a crucial role in the modern data-driven landscape.

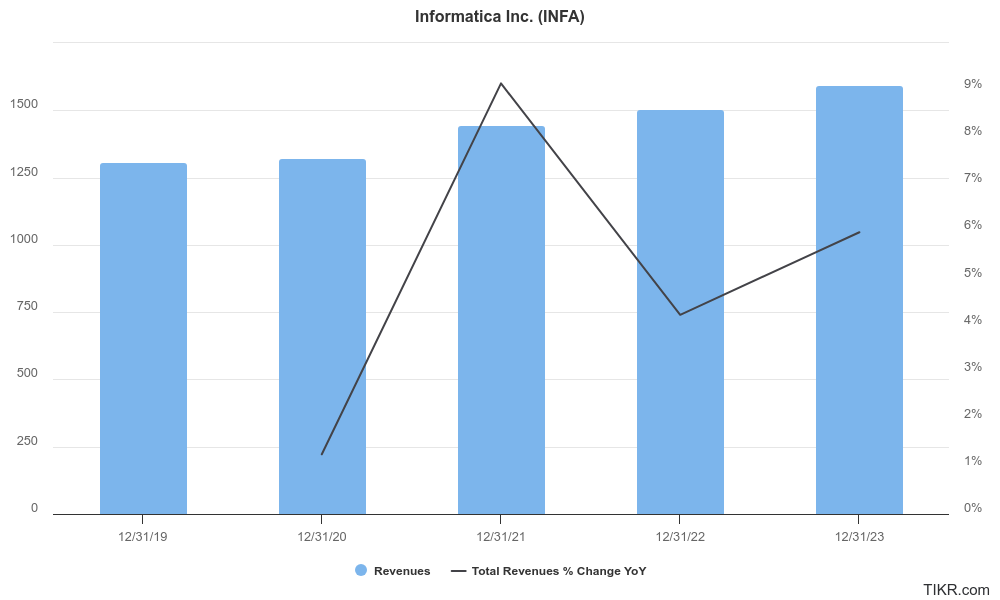

Informatica Inc revenue climbed 6.3% year-over-year to $388.6 million, also beating analyst forecasts. The company’s total annual recurring revenue (ARR) reached $1.64 billion.

Stock Overview:

| Ticker | $INFA | Price | $24.94 | Market Cap | $8.57B |

| 52 Week High | $39.80 | 52 Week Low | $18.18 | Shares outstanding | 255.58M |

Company background:

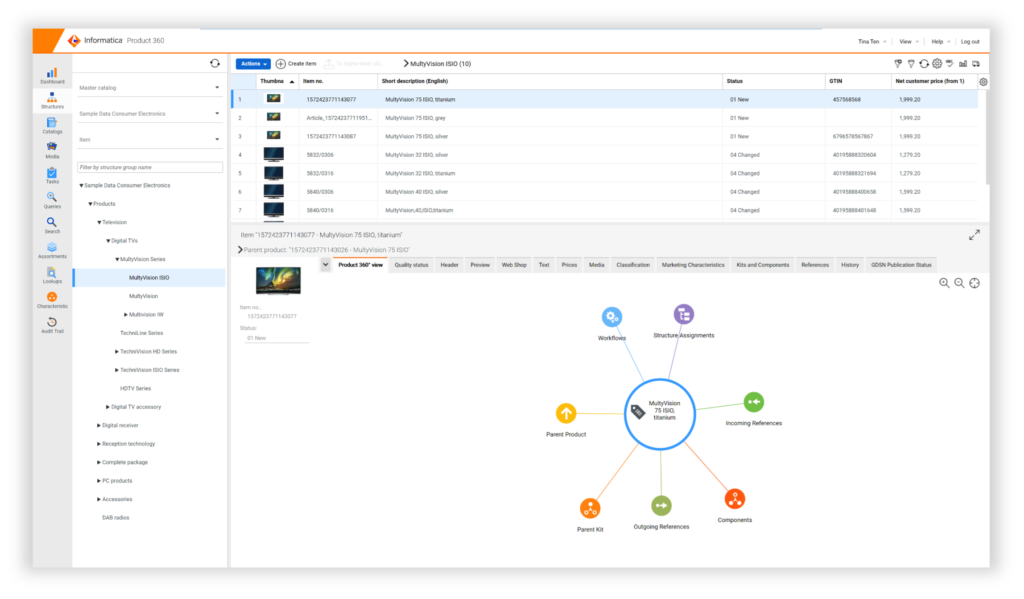

Informatica Inc. is a prominent enterprise cloud data management company established in 1993 by Gaurav Dhillon and Diaz Nesamoney. Headquartered in Redwood City, California, Informatica has grown to become a global leader in providing software and services for data integration. The company’s core focus is on helping organizations effectively manage their data across various platforms, including cloud and hybrid environments.

Informatica’s product portfolio encompasses a wide range of solutions addressing data integration challenges. By offering a comprehensive suite of tools, Informatica empowers businesses to harness the power of their data for improved decision-making, operational efficiency, and competitive advantage.

Key competitors in Informatica’s market include Talend, IBM, Oracle, and SAP. These companies offer similar data integration and management solutions, creating a highly competitive landscape. Informatica differentiates itself through its focus on cloud-based offerings, advanced data governance capabilities, and a strong emphasis on data quality.

Recent Earnings:

Informatica Inc revenue for the quarter came in at $388.6 million, representing a year-over-year growth of 6.3%. This outperformance can be attributed to the company’s continued focus on cloud-based solutions and its ability to expand its customer base. Informatica’s cloud subscription revenue surged by an impressive 35% year-over-year, highlighting its strong momentum in the high-growth cloud segment. The company’s total annual recurring revenue (ARR) reached $1.64 billion, demonstrating its increasing recurring revenue base.

Informatica reported GAAP earnings per share of $0.22, exceeding analyst estimates. This reflects the company’s effective cost management and operational efficiency. The overall financial performance indicates a healthy business.

The Market, Industry, and Competitors:

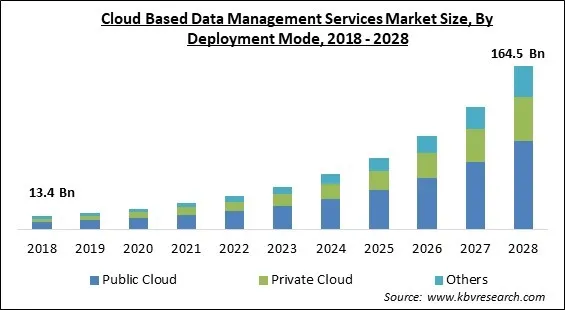

Informatica operates in the rapidly expanding enterprise data management market. This sector is characterized by the increasing complexity of data, driven by factors such as digital transformation, cloud adoption, and the proliferation of data sources. As organizations grapple with the challenges of data integration, quality, and governance, the demand for solutions like Informatica’s is on the rise.

The enterprise data management market is expected to witness substantial growth through 2030. The increasing reliance on data-driven decision-making, coupled with stringent data privacy regulations, will drive investments in data management technologies. A healthy compound annual growth rate (CAGR) in the mid-to-high single digits.

Unique differentiation:

Informatica operates in a highly competitive landscape. Key competitors include Talend, IBM, Oracle, and SAP, which offer similar data integration and management solutions. These companies have strong market positions and compete aggressively for customer share. Cloud-based providers like AWS, Microsoft Azure, and Google Cloud Platform are emerging as significant competitors with their data integration offerings.

- Comprehensive product suite: Informatica offers a wide range of data management solutions, covering data integration, quality, governance, and security, providing a comprehensive platform for customers.

- Strong focus on cloud: Informatica has been at the forefront of cloud-based data management solutions, offering robust capabilities in this growing market.

- Data governance and quality expertise: Informatica has built a strong reputation for its data governance and quality capabilities, which are crucial for organizations seeking to derive value from their data.

Management & Employees:

Amit Walia serves as the Chief Executive Officer, responsible for the overall vision and execution of the company’s strategy.

- Mike McLaughlin: Executive Vice President and Chief Financial Officer

- John Schweitzer: Executive Vice President and Chief Revenue Officer

- Graeme Thompson: Senior Vice President and Chief Information Officer

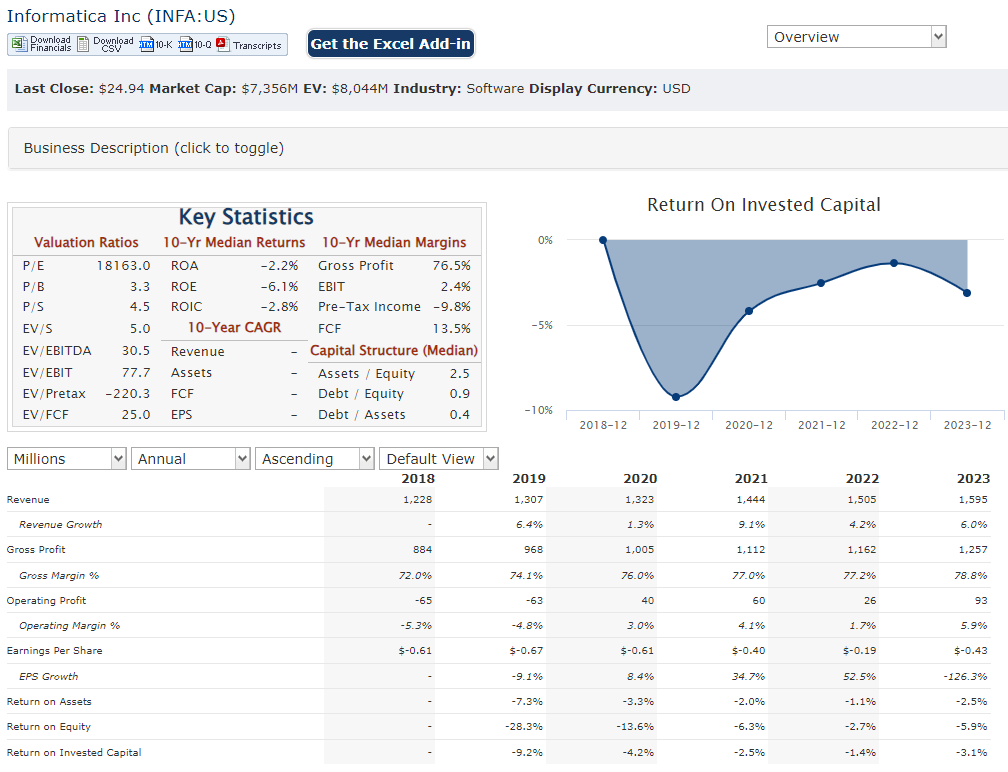

Financials:

Informatica Inc. has expanded steadily, driven by increasing demand for data management solutions. This growth has been accompanied by a healthy compound annual growth rate (CAGR) in revenue, indicating sustained expansion of the business.

On the profitability front, Informatica has also exhibited growth in earnings. The company’s ability to manage costs effectively and improve operational efficiency has contributed to earnings expansion. Consequently, the earnings per share (EPS) has shown an upward trajectory, resulting in a respectable CAGR.

Technical Analysis:

In a long term monthly and weekly stage 4 (bearish) with support in the $22 range. It is showing a bottom (stage 1 consolidation) in the $24 range on the daily chart, but an easy stock to avoid for now.

Bull Case:

- Data Management Growth: The increasing complexity and volume of data across industries is driving robust demand for data management solutions. Informatica’s comprehensive suite of products positions it well to capitalize on this growing market.

- Cloud Migration and Adoption: The ongoing shift towards cloud computing creates significant opportunities for Informatica. Its cloud-based offerings can help organizations efficiently manage their data in hybrid and multi-cloud environments.

- Strategic Acquisitions: The company’s history of strategic acquisitions has expanded its product portfolio and market reach, contributing to its growth trajectory.

Bear Case:

- Economic Downturns: In economic downturns, companies often cut back on IT spending, including data management software. This can negatively impact Informatica’s revenue and profitability.

- Execution Risk: Successfully executing on growth strategies, integrating acquisitions, and managing complex data integration projects can be challenging. Failure to execute could hinder the company’s performance.

- Valuation Concerns: Some investors may believe that Informatica’s stock is overvalued relative to its growth prospects and profitability, particularly compared to peers.