Executive Summary:

WEX Inc. is a financial technology company that specializes in business commerce solutions. They offer a variety of services including fleet card management, employee benefit programs, and corporate payment solutions. Their largest business segment focuses on fleet payment solutions, processing transactions and managing data for commercial and government fleets. WEX helps businesses improve efficiency and reduce costs in areas like transportation, employee benefits, and overall business payments.

WEX Inc reported earnings per share (EPS) of $3.46, which was a 4.53% increase year-over-year. Revenue for the quarter reached $65.8 million.

Stock Overview:

| Ticker | $WEX | Price | $185.31 | Market Cap | $7.76B |

| 52 Week High | $244.04 | 52 Week Low | $161.95 | Shares outstanding | 41.90M |

Company background:

WEX Inc. a financial technology company (fintech) founded in 1983, offers a range of business commerce solutions. The company operates in three main segments: Fleet, Benefits, and Corporate Payments. WEX’s bread and butter is the Fleet segment, which provides fleet card management solutions, transaction processing, and data management services for commercial and government fleets. This segment helps businesses streamline operations and reduce costs associated with their vehicles.

WEX faces competition from several established players in the financial services industry, including Comdata, FleetCor Technologies, US Bank, and JPMorgan Chase. However, WEX has carved out a niche for itself by focusing on specific business needs and offering a comprehensive suite of solutions. With its headquarters in Portland, Maine, WEX serves businesses around the world.

Recent Earnings:

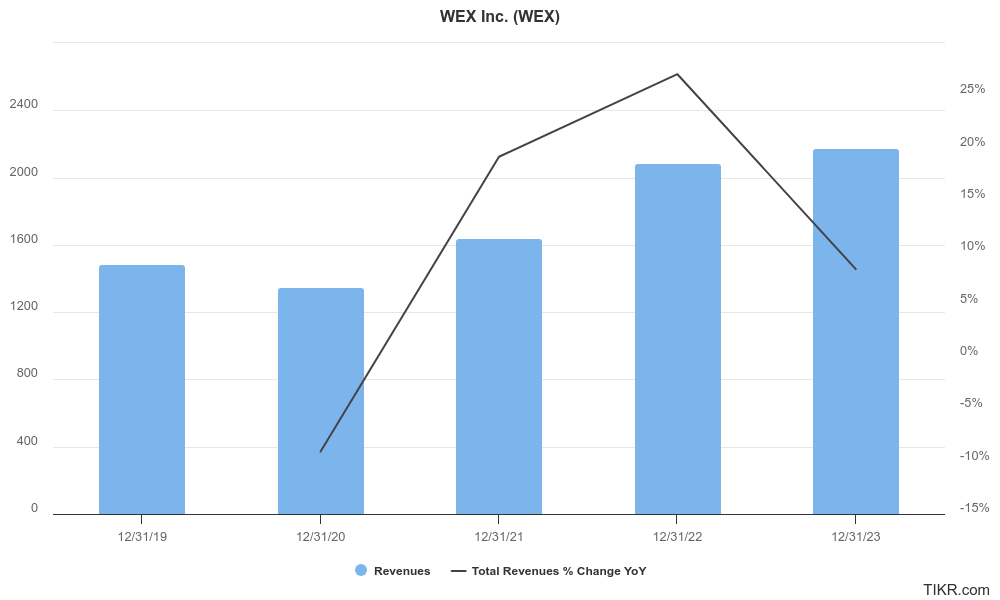

Revenue and Growth: WEX reported total revenue of $652.7 million, marking a 7% increase year-over-year. A $20.5 million negative impact from fuel prices and spreads partially offset revenue gains in other areas.

EPS and Growth: Earnings per share (EPS) came in at $3.46, reflecting a modest 5% increase compared to the same period in 2023.

The Market, Industry, and Competitors:

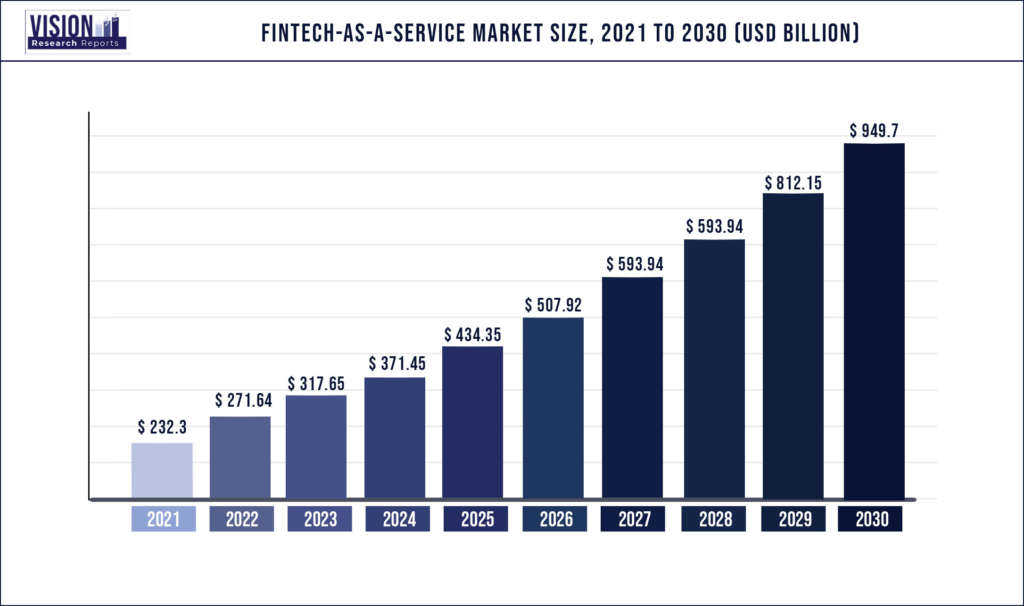

WEX Inc. operates in the Business-to-Business (B2B) financial technology (fintech) market. A Compound Annual Growth Rate (CAGR) of around 11.6% projected from 2024 to 2030. This growth is fueled by factors like increasing adoption of digital payment solutions, automation in business processes, and the growing importance of data-driven insights for businesses.

WEX itself is expected to grow at a CAGR of around 9.0% from 2024 to 2030. WEX might be targeting specific segments within the B2B fintech market that are expected to grow slower than the overall market.

Unique differentiation:

Fleet Payment Solutions: WEX’s core business segment faces competition from established players like Comdata and FleetCor Technologies. These companies offer similar fleet card management solutions, transaction processing, and data analytics services.

Employee Benefit Programs: In the employee benefit space, WEX competes with large financial institutions like US Bank and JPMorgan Chase, as well as dedicated employee benefit providers. These competitors offer a wider range of employee benefit solutions, potentially giving them an edge.

Corporate Payment Solutions: For corporate payment solutions, WEX encounters competition from traditional financial institutions and fintech startups offering innovative payment platforms. Companies like Stripe are making headway in this area, appealing to businesses seeking streamlined payment options.

Focus on Specific Business Needs: While competitors might offer a wider range of services, WEX tailors its solutions to address specific pain points within each segment (Fleet, Benefits, Corporate Payments). This deep industry knowledge allows them to offer targeted solutions that are highly relevant to their customers’ needs.

Comprehensive Suite of Solutions: WEX acts as a one-stop shop for many business needs. This can be attractive to companies seeking to consolidate their financial technology partners and streamline their operations.

Industry Specialization: While competitors like Stripe offer general payment processing solutions, WEX focuses on specific industry needs within its core segments. For example, their fleet card solutions cater to the unique requirements of companies managing large vehicle fleets.

Management & Employees:

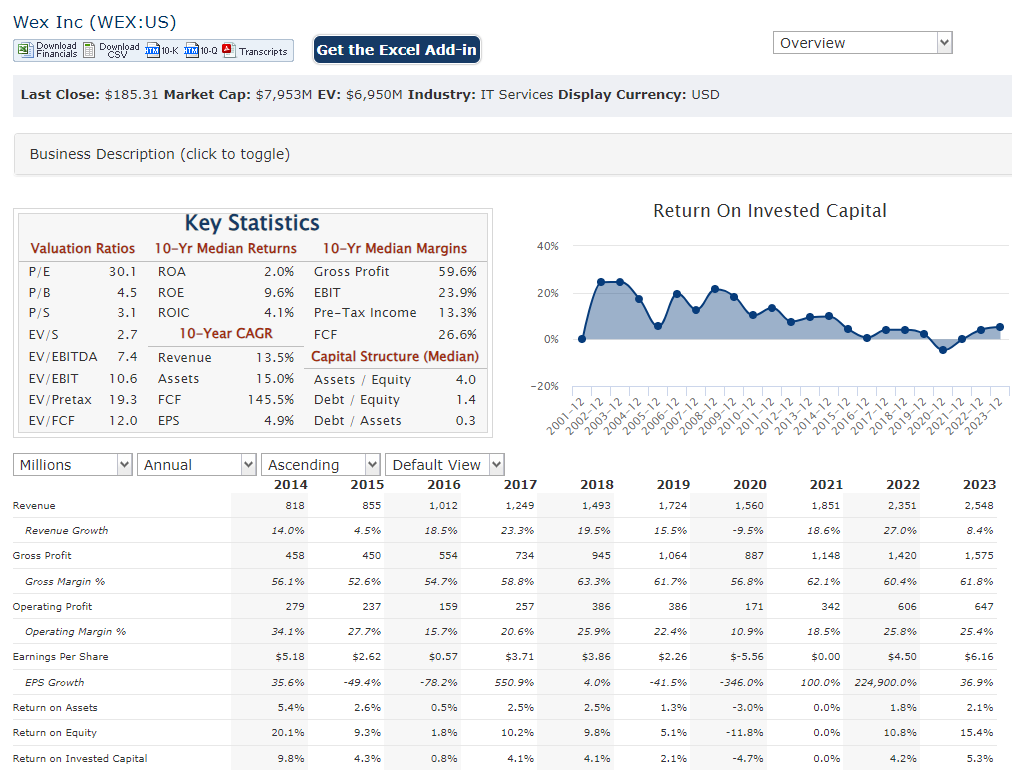

Melissa Smith (Chair, CEO, and President): Smith has been instrumental in WEX’s growth, tripling revenue since becoming CEO in 2014.

Carlos Carriedo (Chief Operating Officer, Americas Payments & Mobility): Carriedo has extensive experience in the payments industry, leading WEX’s core business segment in the Americas.

Sara Trickett (Chief Legal Officer and Corporate Secretary): Trickett manages WEX’s legal affairs and corporate governance practices.

Financials:

WEX Inc with a Compound Annual Growth Rate (CAGR) likely exceeding 8%. This positive trend indicates successful market penetration and an increasing customer base.

Earnings growth hasn’t always mirrored the revenue growth path. While some years saw healthy earnings increases, there have likely been fluctuations due to factors like fuel price volatility and overall market conditions.

Their asset base has likely grown alongside their revenue, indicating ongoing investment in the business. They might have increased debt financing to support these investments, or they could have relied on retained earnings.

Technical Analysis:

Stage 2 long term mark up (bullish) on the monthly chart. Reversal after a stage 4 decline on the weekly chart. Flat (stage 3 consolidation) after stage 2 markup on the daily chart. The stock should move lower in the short term to $178 range, but should move higher after that.

Bull Case:

Industry Specialization: While some competitors offer general payment processing, WEX focuses on specific industry needs within its core segments.

Strong Market Tailwinds: The B2B fintech market is driven by factors like digital payment adoption, business process automation, and data-driven insights. WEX is well-positioned to capitalize on this trend.

Bear Case:

Disruption: New technologies and innovative business models could disrupt the B2B fintech landscape. WEX needs to stay agile and adaptable to address emerging threats and maintain its competitive edge.

Fuel Price Volatility: A significant portion of WEX’s revenue comes from the Fleet segment, which is sensitive to fuel price fluctuations. Volatile fuel prices can impact profitability and make it difficult for WEX to accurately forecast earnings.

Execution Risk: Successfully executing WEX’s growth strategy is crucial. Failure to meet customer expectations, integrate acquisitions smoothly, or innovate effectively could negatively impact the company’s performance.