Executive Summary:

Etsy is an American e-commerce company focused on connecting buyers and sellers of handmade and vintage goods. The company operates a two-sided online marketplace where artisans and entrepreneurs can sell their creations alongside vintage treasures. Etsy also owns Reverb, a marketplace for musical instruments, Depop, a platform for fashion resale, and Elo7, a similar marketplace based in Brazil.

Etsy’s reported Earnings per share (EPS) came in at $0.48. Revenue for the quarter was $645.95 million, reflecting a solid growth rate.

Stock Overview:

| Ticker | $ETSY | Price | $65.47 | Market Cap | $7.66B |

| 52 Week High | $102.81 | 52 Week Low | $55.08 | Shares outstanding | 116.93M |

Company background:

Etsy, launched in 2005, is an American e-commerce company that thrives on the unique and personal connection between buyers and sellers. The brainchild of Rob Kalin, Chris Maguire, and Haim Schoppik. It has since grown into a much larger marketplace, encompassing a wide range of products including art, jewelry, clothing, home decor, toys, and craft supplies.

Etsy prioritizes human connection in an age dominated by automation. Sellers can create personalized storefronts to showcase their handcrafted creations or vintage finds. This focus on individual sellers and their stories fosters a unique shopping experience for millions of buyers worldwide.

Today, Etsy operates a global marketplace with over 4 million active sellers. It faces competition from e-commerce giants like Amazon Handmade and eBay.

Recent Earnings:

Etsy’s revenue reached $645.95 million, indicating continued growth for Etsy. This positive trend aligns with the company’s focus on expanding its seller base and offerings. Earnings per share (EPS) came in at $0.48, falling short of analyst expectations of $0.49 by a small margin.

Etsy’s specific operational metrics such as active user numbers or order volume.

The Market, Industry, and Competitors:

Etsy operates in the dynamic and ever-evolving world of e-commerce. This market is projected for continued significant growth, fueled by factors like rising internet penetration and increasing consumer preference for online shopping. Within this broad space, Etsy occupies a unique niche focused on handmade, vintage, and personalized goods. This segment is expected to see even faster growth than the overall e-commerce market, driven by consumer demand for authenticity, sustainability, and unique finds.

The company’s revenue could potentially more than double by 2030, with a Compound Annual Growth Rate (CAGR) ranging from 10% to 15%. This growth hinges on Etsy’s ability to maintain its core audience while attracting new buyers and sellers. The company’s recent acquisitions and focus on expanding its product categories position it well to capitalize on the growing demand for unique and personalized online shopping experiences.

Unique differentiation:

Large E-commerce Players: On a broader scale, Etsy competes with established e-commerce leaders like Amazon and eBay. While these platforms offer a wider variety of products, including handmade items through Amazon Handmade and vintage finds on eBay, they lack the focus on personalization and seller connection that Etsy prioritizes. Etsy sellers can cultivate unique storefronts and connect directly with buyers, fostering a more intimate shopping experience. However, Amazon and eBay leverage their vast user bases and brand recognition to attract a significant portion of online shoppers.

Niche Marketplaces: Within the handmade and vintage goods space, Etsy faces competition from several niche online marketplaces. These platforms often cater to specific product categories or regional audiences. For instance, Ruby Lane focuses on vintage fashion, while Society6 caters to art prints and home decor. While these platforms offer a curated selection and potentially a more loyal customer base, Etsy’s larger seller base and wider product range provide a more comprehensive shopping experience for a broader audience. Etsy’s strategic acquisitions, like Depop for fashion resale, further solidify its position in specific product segments. By continuing to expand its offerings and cater to diverse buyer interests, Etsy can maintain its competitive edge within the handmade and vintage goods market.

Focus: Etsy carves out a distinct niche by specializing in handmade, vintage, and personalized goods. This sets it apart from larger e-commerce platforms like Amazon and eBay, which offer a vast array of products, including mass-produced items.

Experience: Etsy prioritizes a human connection in the online shopping experience.

- Sellers: Etsy empowers artisans and entrepreneurs by giving them the tools to create personalized storefronts and connect directly with buyers. This allows them to tell their stories and build brand loyalty.

- Buyers: This focus translates to a unique shopping experience for buyers. They can connect with the makers of the products, fostering a sense of authenticity and personalization often missing in traditional online shopping.

Management & Employees:

Josh Silverman (Chief Executive Officer): With over two decades of experience leading consumer technology companies, Silverman is responsible for Etsy’s overall strategy and growth.

Rachel Glaser (Chief Financial Officer): She oversees Etsy’s financial performance, ensuring responsible fiscal management and strategic investment.

Colin Stretch (Chief Legal Officer and Corporate Secretary): Stretch manages Etsy’s legal affairs and corporate governance.

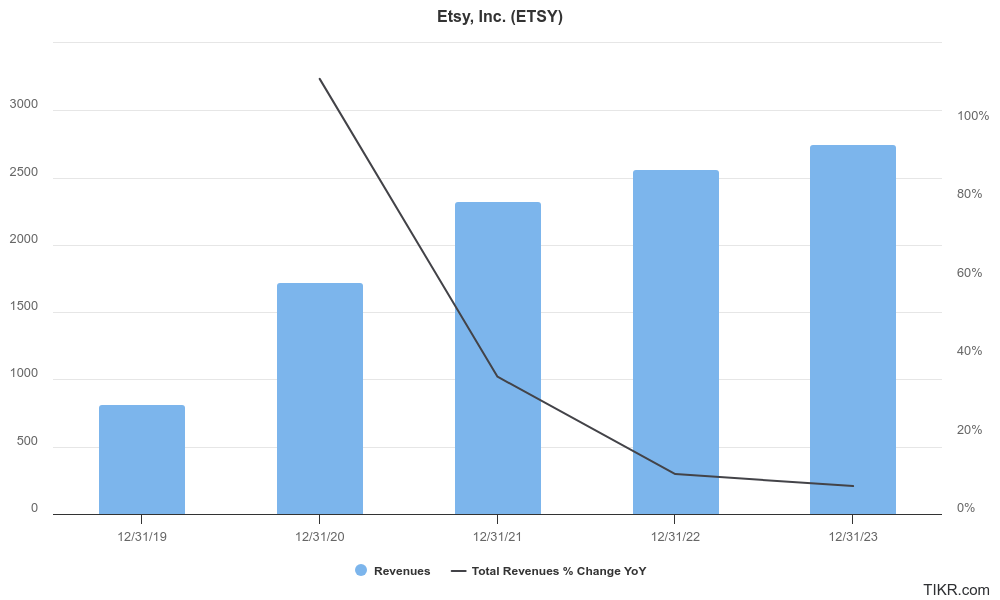

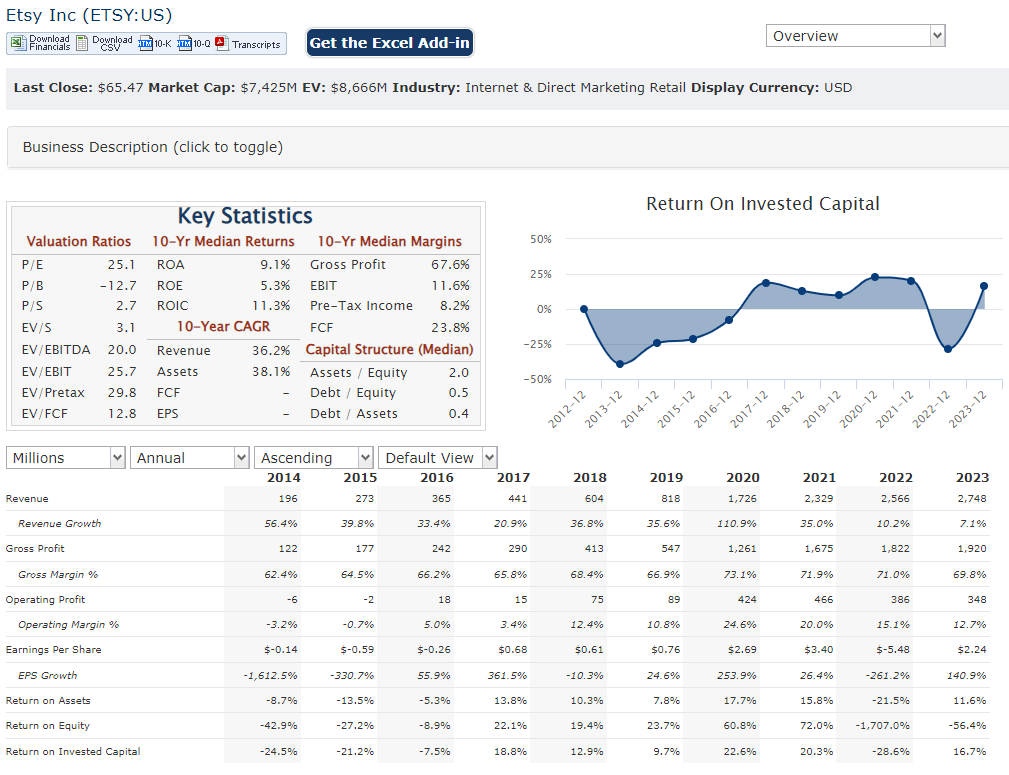

Financials:

Analysts estimate a Compound Annual Growth Rate (CAGR) in the range of 10% to 15%. This upward trajectory aligns with the increasing popularity of e-commerce and consumer demand for unique, handcrafted items.

Earnings growth, however, seems to be a less clear-cut picture.

It’s safe to say Etsy likely has a growing pool of assets, including cash reserves and inventory held by its sellers. The company might also have some debt to finance its operations and growth initiatives.

Technical Analysis:

The stock is still in a stage 4 decline (bearish) on the monthly and weekly chart, but has reversed on the daily chart with support at $54. There is a lot of resistance in the $67 – $70 range. At that point, we expect the stock to head lower.

Bull Case:

Unique Market Niche: Etsy occupies a strong niche in the e-commerce market, specializing in handmade, vintage, and personalized goods. This distinct focus differentiates them from giants like Amazon and eBay, offering a more curated and authentic shopping experience.

Strategic Acquisitions: Etsy’s acquisitions of Reverb (musical instruments), Depop (fashion resale), and Elo7 (Brazilian marketplace) have expanded its product offerings and user base. This strategic move strengthens its position in specific product categories and broadens its global reach.

Focus on Human Connection: Etsy prioritizes the human connection between buyers and sellers. Sellers can cultivate personalized storefronts and connect with customers, fostering brand loyalty and a unique shopping experience. This focus on community and storytelling sets Etsy apart from competitors.

Bear Case:

Post-Pandemic Slowdown: Etsy’s significant growth during the pandemic lockdowns might not be sustainable in the long run. As brick-and-mortar stores reopen and consumer habits normalize, Etsy could face a slowdown in user and revenue growth.

Valuation: Even after recent stock price declines, some investors might believe Etsy’s valuation doesn’t reflect its future growth prospects. The company’s P/S ratio (price-to-sales ratio) might be higher compared to some competitors, making the stock seem less attractive.

Macroeconomic Factors: A broader economic slowdown or recession could dampen consumer spending, impacting Etsy’s sales of non-essential goods.