Executive Summary:

Chewy, Inc. is a leading American online retailer specializing in pet supplies. The company offers a vast selection of pet food, treats, toys, and other pet-related products from various brands. Chewy is known for its excellent customer service and focus on convenience, with features like autoship and fast, free shipping.

Chewy reported revenue of $2.88 billion, a 3.1% increase year-over-year. Earnings per share (EPS) came in at $0.15. Net income was $66.9 million, up from $22.86 million year-over-year.

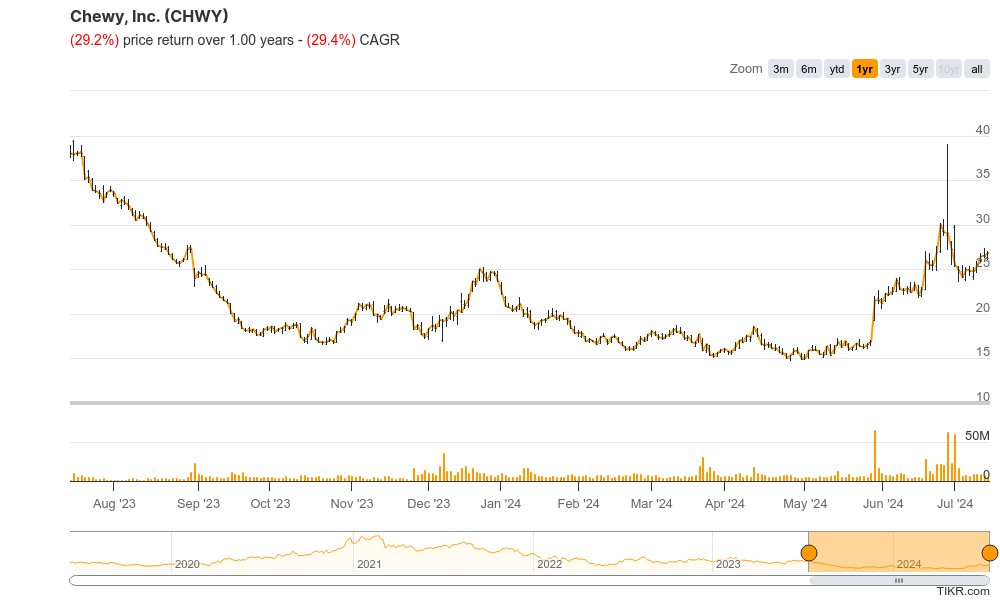

Stock Overview:

| Ticker | $CHWY | Price | $26.82 | Market Cap | $11.69B |

| 52 Week High | $39.46 | 52 Week Low | $14.69 | Shares outstanding | 137.05M |

Company background:

Chewy, Inc. founded in 2011 by Ryan Cohen and Michael Day. The company started with bootstrapping, using the founders’ own funds and some small loans, but later secured funding from venture capital firms like Volition Capital. Chewy has since grown into a pet care giant, offering a vast selection of pet food, treats, toys, and other pet-related products from over 3,500 brands. They also carry a private label line of products. Their popular Autoship subscription program ensures a steady supply of pet essentials, and fast, free shipping keeps pet parents happy.

Chewy’s main competitors include brick-and-mortar pet stores like Petco and Petsmart, as well as the e-commerce giant Amazon. Chewy has carved out a strong niche in the pet care market with its focus on superior service and a curated selection of pet products. The company is headquartered in Plantation, Florida.

Recent Earnings:

Revenue and Growth: Chewy’s revenue reached $2.88 billion, reflecting a modest year-over-year increase of 3.1%.

EPS and Growth: Earnings per share (EPS) came in at $0.15, exceeding analyst expectations of $0.03. This translates to a significant growth of 200% compared to the same period last year.

Operational Metrics: The company also continues to see healthy growth in its Autoship program, a subscription service that ensures recurring sales.

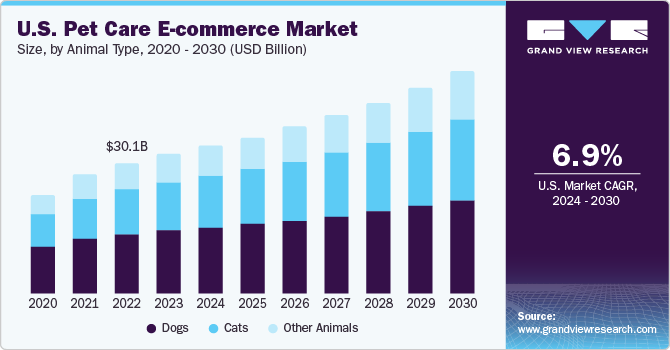

The Market, Industry, and Competitors:

Chewy Inc. operates in the booming pet care e-commerce market, which is anticipated to reach a staggering $80.0 billion by 2030. Compound annual growth rate (CAGR) of around 8.5% between 2023 and 2030. Rising pet ownership, increasing disposable income for pet owners, and a growing preference for online shopping. This trend is expected to continue for the foreseeable future, creating a favorable environment for Chewy’s business.

Chewy’s strong customer base and focus on innovation, analysts project the company to achieve a CAGR of 10.2% between 2023 and 2030. This growth is expected to outpace the overall market growth, solidifying Chewy’s position as a leader in the pet care e-commerce industry. The company’s emphasis on excellent customer service, convenience, and an expanding product portfolio are likely to be key drivers in achieving this ambitious growth projection.

Unique differentiation:

Brick-and-Mortar Retailers: Petco and Petsmart are the major brick-and-mortar pet store chains in the US. While Chewy has the advantage of online convenience and a wider selection, these stores offer physical locations where pet owners can get hands-on with products, receive grooming services, and access veterinary care. They’re also increasingly building out their own online presence to compete directly with Chewy.

E-commerce Giants: Amazon is a major competitor, offering a vast selection of pet products alongside its general merchandise. While Chewy may have a more curated selection and expertise in pet care, Amazon’s brand recognition, fast shipping options, and potential bundling with other pet-related purchases can be a significant advantage.

Specialty Online Retailers: Smaller online retailers like Petflow and Pet360 cater to specific niches within the pet market, such as organic pet food or subscription boxes. These retailers can offer a more personalized experience or cater to specific dietary needs, potentially attracting customers away from Chewy.

Convenience Features: Chewy boasts features that streamline the pet care experience for busy pet owners. Their Autoship program ensures a steady supply of essentials, and fast, free shipping adds to the convenience factor.

Curated Product Selection: While competitors like Amazon offer a vast selection across various categories, Chewy focuses on a curated selection of pet-specific products from reputable brands. This allows them to cater more directly to pet owners’ needs and offer a more specialized shopping experience.

Private Label Line: Chewy has developed its own private label line of pet products, offering customers high-quality options at competitive prices. This gives them more control over product quality and potentially increases profit margins.

Management & Employees:

Sumit Singh (CEO): As Chief Executive Officer and a member of the Board of Directors, Singh has led Chewy since 2018 and steered the company through its successful initial public offering.

Da-Wai Hu (General Counsel): Overseeing legal, compliance, risk management, and other areas, Hu leads Chewy’s Legal, Risk and Corporate Responsibility Department.

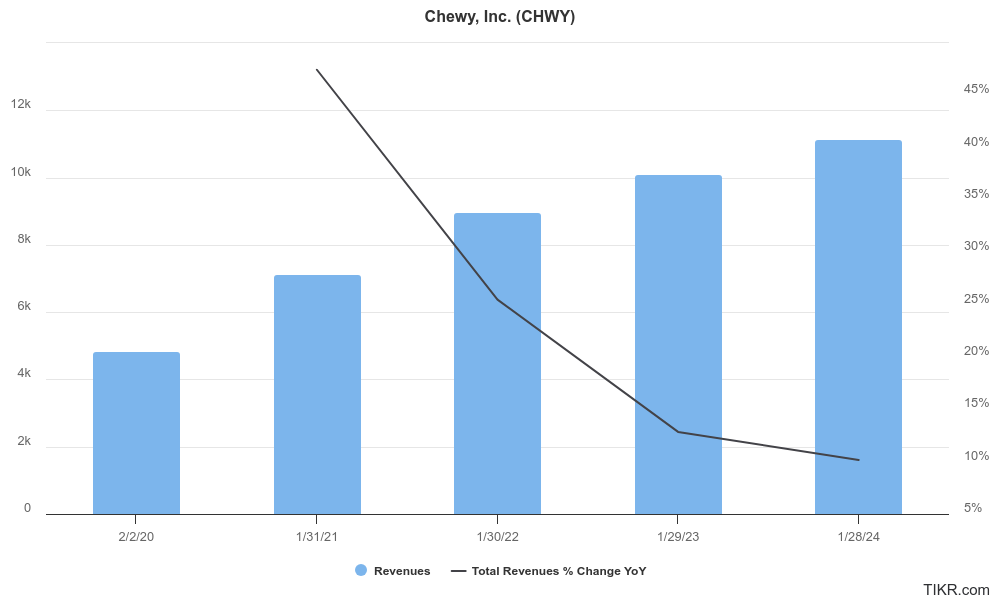

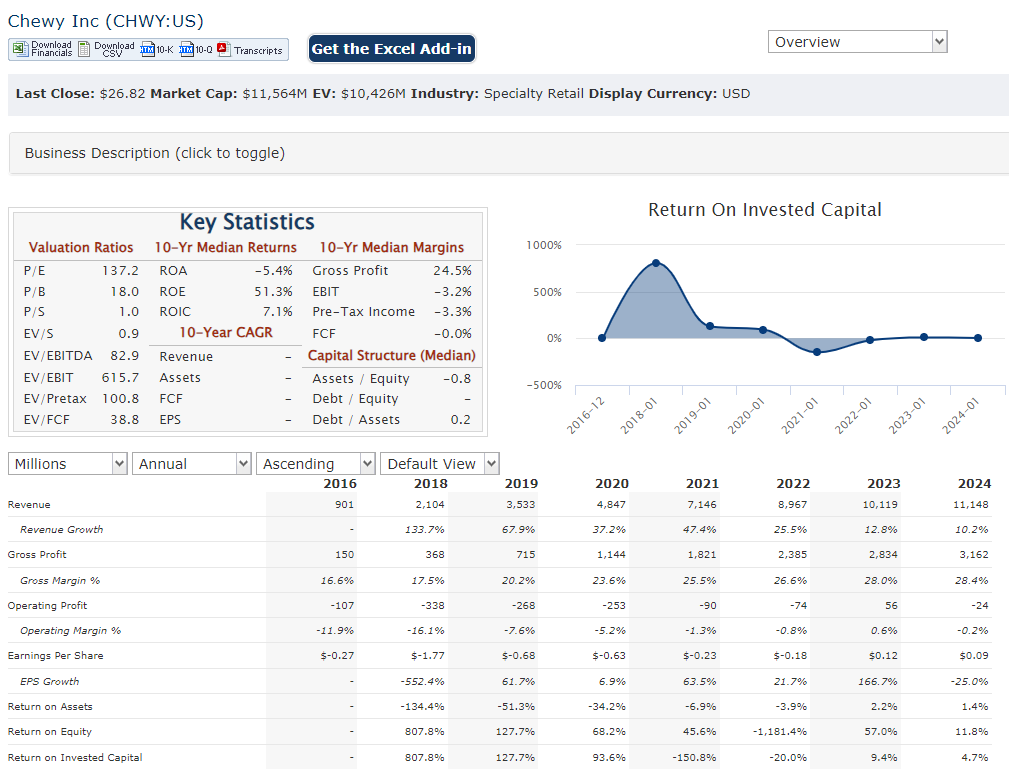

Financials:

Chewy revenue has ballooned at a Compound Annual Growth Rate (CAGR) of around 25.8%. This means on average, their revenue has increased by over 25% each year. The most recent quarter (Q1 2024) showed a more modest year-over-year increase of 3.1%.

EPS of $0.15 reflects a substantial increase compared to the same period last year. As a growing company, Chewy likely has a healthy amount of debt to finance its expansion. On the other hand, their consistent revenue growth indicates a strong ability to generate cash flow and meet their financial obligations.

Technical Analysis:

A large base (stage 1) forming on the monthly and weekly charts with a cup and handle (bullish) on the daily chart makes this a good stage 2 markup candidate. There is resistance in the $28 zone, so this should head lower short term to $25 – $26 range.

Bull Case:

Customer-Centric Approach: Chewy prioritizes exceptional customer service, offering features like 24/7 support with pet experts and convenient features like Autoship. This focus on building relationships and providing expert advice differentiates them from competitors.

Expanding Services: Beyond just products, Chewy is venturing into services like Chewy Pharmacy, tele-triage consultations with vets, and upcoming Chewy Vet Care physical practices. This strategy aims to become a one-stop shop for all pet needs, further increasing customer loyalty and potentially boosting revenue streams.

Short Squeeze Potential: The high short interest in Chewy’s stock (as of July 2024) creates the potential for a short squeeze. If the stock price starts to rise, short sellers may be forced to buy back shares to cover their positions, further driving the price up.

Bear Case:

Economic Downturn: A potential economic downturn could lead to decreased consumer spending, especially on discretionary items like pet products. This could negatively impact Chewy’s sales growth and overall financial performance.

Rising Costs: Inflationary pressures and rising costs of goods sold could squeeze Chewy’s margins. The company might struggle to pass on these cost increases entirely to consumers, potentially impacting profitability.

Limited Market Diversification: Chewy is heavily reliant on the pet care e-commerce market. If this market doesn’t grow as fast as expected, or if consumer preferences shift, Chewy’s business could be adversely affected.