Executive Summary:

Wingstop Inc. is an American restaurant chain specializing in buffalo wings. Founded in 1994 in Garland, Texas, they’ve grown into an international franchise with a unique aviation-themed decor. Their menu offers sauced and dry-rubbed wings in a variety of flavors, alongside fries and other sides.

Wingstop Inc. reported revenue jumped 34.1% year-over-year to $145.8 million. Earnings per share (EPS) reaching $0.98 per diluted share.

Stock Overview:

| Ticker | $WING | Price | $383.82 | Market Cap | $11.27B |

| 52 Week High | $431.03 | 52 Week Low | $150.08 | Shares outstanding | 29.37M |

Company background:

Wingstop Inc was Foundedby Garland, Texas by Antonio Swad, Wingstop has become a global restaurant franchise with over 2,200 locations as of December 2023. While they started with classic bone-in and boneless chicken wings, their menu has expanded to include flavored tenders, fries, and even a chicken sandwich. Their wings come in a variety of bold flavors, from classic Buffalo to Atomic-hot, all designed to tantalize your taste buds.

Wingstop’s primary focus is on franchised locations, generating revenue from royalties and advertising fees paid by franchisees. They also own a small number of company-operated stores. The company went has seen impressive growth, becoming one of the fastest-growing restaurant chains.

In the competitive world of chicken wings, Wingstop faces stiff competition from national chains like Buffalo Wild Wings, Domino’s, and KFC. They also compete with regional chains and local wing spots. Wingstop differentiates itself through its unique flavor offerings and aviation-themed decor, creating a memorable dining experience.

Recent Earnings:

Wingstop Inc revenue climbed a significant 34.1% year-over-year to $145.8 million, demonstrating continued strong consumer demand for their flavorful wings. This impressive growth surpassed analyst projections, highlighting the brand’s momentum.

Earnings per share (EPS) mirrored the revenue growth, surging 83.5% to $0.98 per diluted share. This robust increase also outperformed analyst expectations, showcasing Wingstop’s ability to translate revenue growth into healthy profits.

Domestic same-store sales, a key indicator of existing store performance, rose an impressive 21.6%. This suggests a loyal customer base and continued success with their menu offerings. Digital sales continue to be a major driver, constituting over 68% of system-wide sales. This demonstrates Wingstop’s adeptness at adapting to the growing trend of online ordering and delivery.

The Market, Industry, and Competitors:

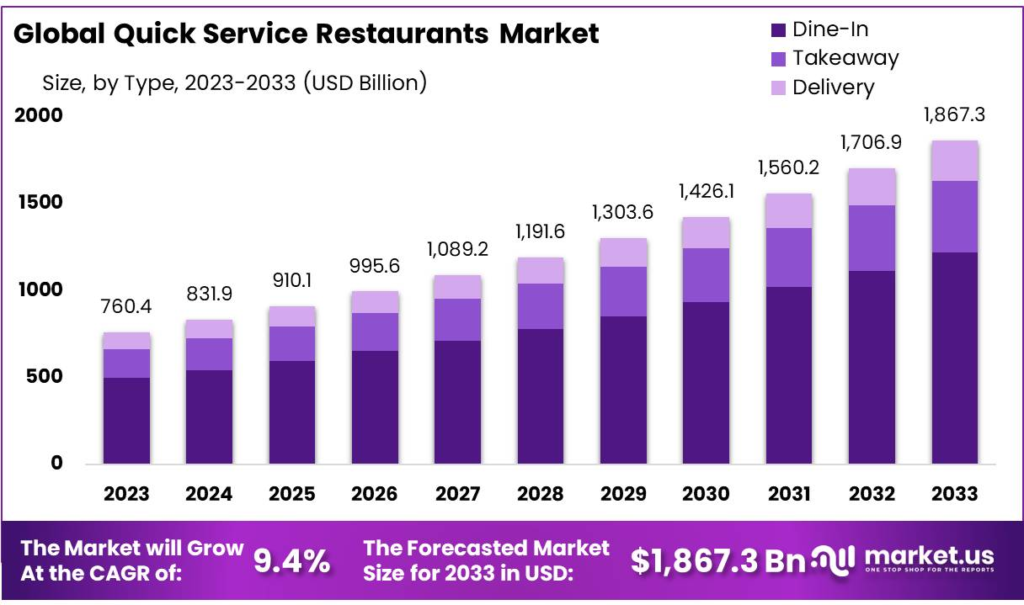

Wingstop operates in the highly competitive quick-service restaurant (QSR) industry, specifically within the chicken wing segment. This market is projected for steady growth, fueled by consumer demand for convenient and flavorful options. The rise of delivery platforms further benefits Wingstop’s delivery-focused model. Competition is fierce, with established chains like Buffalo Wild Wings and regional players vying for market share.

Wingstop’s growth expectations are generally positive. Analysts use Compound Annual Growth Rate (CAGR) to predict long-term performance. Wingstop’s historical CAGR has been impressive, with some sources estimating it around 26%.

Unique differentiation:

Wingstop faces a two-pronged attack in the competitive world of chicken wings. Nationally recognized chains like Buffalo Wild Wings and KFC are major contenders. Buffalo Wild Wings offers a similar wing-centric menu with a sports bar atmosphere, while KFC boasts a wider variety of fried chicken options and a long-established brand presence. Both chains can leverage their vast resources and brand recognition to compete with Wingstop.

Beyond these national giants, Wingstop faces competition from regional chains and local wing spots. These smaller players often have a deep understanding of their local customer base and can tailor their menus and offerings to appeal to specific tastes. Their focus on bold flavor varieties offers a clear differentiation from competitors like KFC. The aviation theme creates a memorable dining experience that some customers might prefer. Wingstop’s success hinges on its ability to maintain its core strengths – flavorful wings, efficient operations, and a focus on digital sales – while adapting to the ever-evolving fast-food landscape.

Flavor Focus: Unlike competitors like KFC with a broader fried chicken menu, Wingstop stakes its claim on flavorful wings. They offer a wide range of options, from classic Buffalo to fiery Atomic, catering to adventurous taste buds. This focus on unique and exciting flavors keeps customers coming back to explore the menu.

Themed Experience: Wingstop sets itself apart from the typical fast-food experience with its aviation theme. This unique décor creates a memorable atmosphere that some customers might prefer over the standard burger joint ambiance. It adds a layer of fun and distinction to the Wingstop brand.

Management & Employees:

- Chief Executive Officer (CEO): Michael Skipworth

- Directors: Krishnan Anand, David L. Goebel, Michael J. Hislop, Kate S. Lavelle, Kilandigulu (Kay) M. Madati, Wesley McDonald,Ania Smith

Financials:

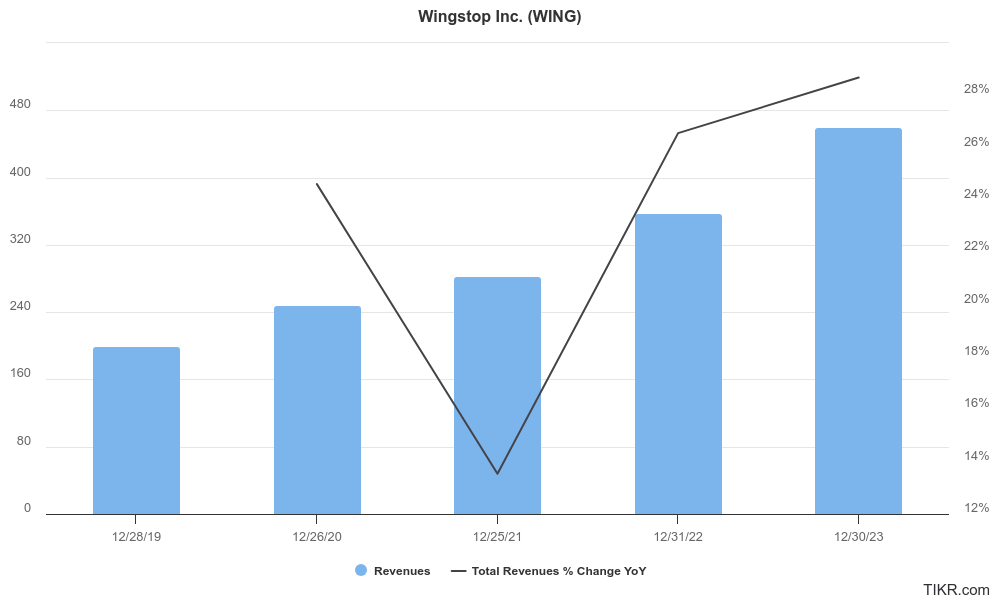

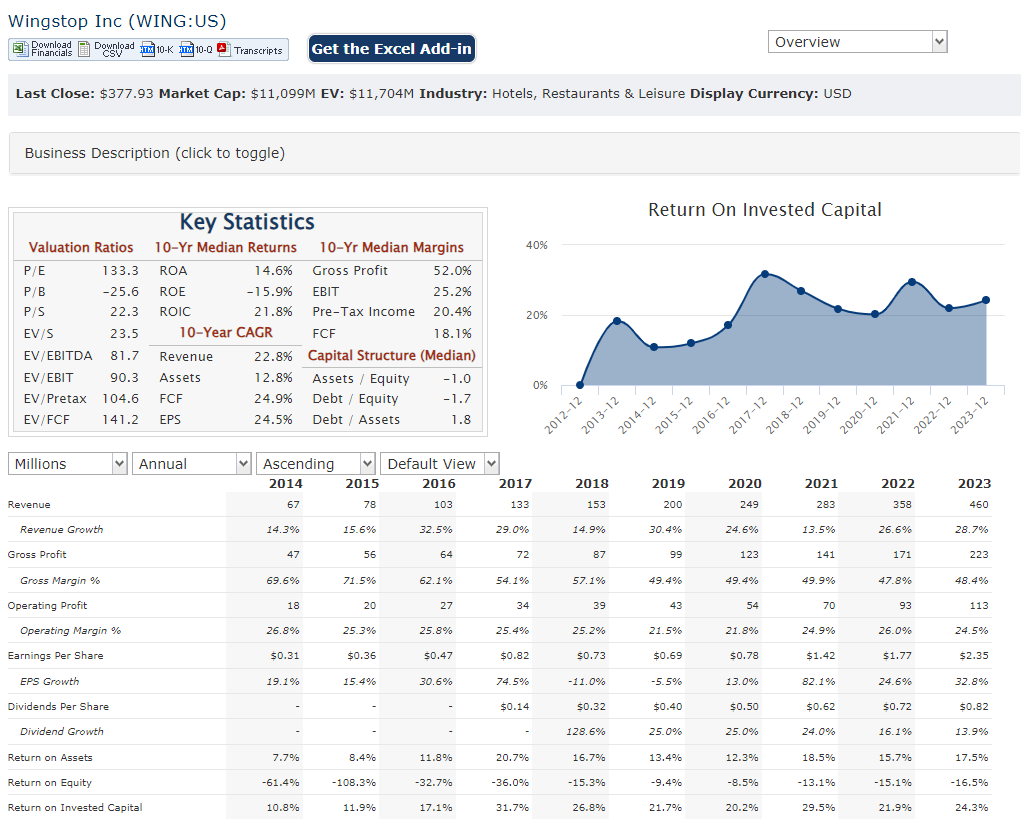

Revenue has seen a steady climb, with some analysts estimating a Compound Annual Growth Rate (CAGR) around 26%. Their fiscal first quarter of 2024 alone saw a 34.1% jump compared to the same period in the previous year.

Earnings growth has mirrored the revenue trend. Wingstop has been adept at translating increased sales into healthy profits. The company has consistently reported strong earnings growth, with some estimates suggesting a CAGR in the high teens or even low twenties. This indicates their ability to not just generate revenue, but also manage costs effectively.

Bull Case:

Room for Franchise Growth: Wingstop’s primary focus is franchised locations, which allows for faster expansion compared to opening company-owned stores. This model can lead to significant revenue growth with minimal investment in infrastructure. Analysts are bullish on the potential for further domestic and international franchise expansion.

Unique Selling Points: Wingstop differentiates itself through bold flavor varieties and a unique aviation theme. This strategy attracts customers seeking an exciting twist on traditional chicken wings and creates a memorable dining experience.

Loyalty and Brand Recognition: Wingstop’s same-store sales growth indicates a loyal customer base. Their consistent focus on flavor and experience fosters brand recognition and customer loyalty, which are crucial for long-term success.

Bear Case:

Commodity Reliance: Chicken wings are a commodity ingredient, and their price can fluctuate. If wing prices rise significantly, it could squeeze Wingstop’s profit margins or force them to raise prices, potentially impacting customer demand.

Franchise Dependence: Wingstop relies heavily on franchised locations. While this allows for rapid expansion, it also means less control over operational consistency and brand experience across all locations. Inconsistency could lead to customer dissatisfaction.

Economic Downturn: Fast food is often seen as a discretionary expense. During economic downturns, consumers might cut back on eating out, impacting Wingstop’s sales.

A stage 3 consolidation and stage 4 (markdown, bearish) on the monthly and weekly chart gives us pause to invest given the stocks’ high valuation. The daily chart is showing a stage 1 consolidation after a reversal with multiple touches to the $380 range. There is strong support in this range, but the RSI and MACD pointing lower indicates the stock still has room to move lower to the $340 range.