Executive Summary:

Enlight Renewable Energy Ltd was founded in 2008 that develops, finances, constructs, owns and operates renewable energy projects. Enlight is a leader in Israel’s renewable energy sector, and their projects include the Ruach Beresheet wind farm, the largest of its kind in the country.

Enlight Renewable Energy Ltd reported revenue reached $182 million.

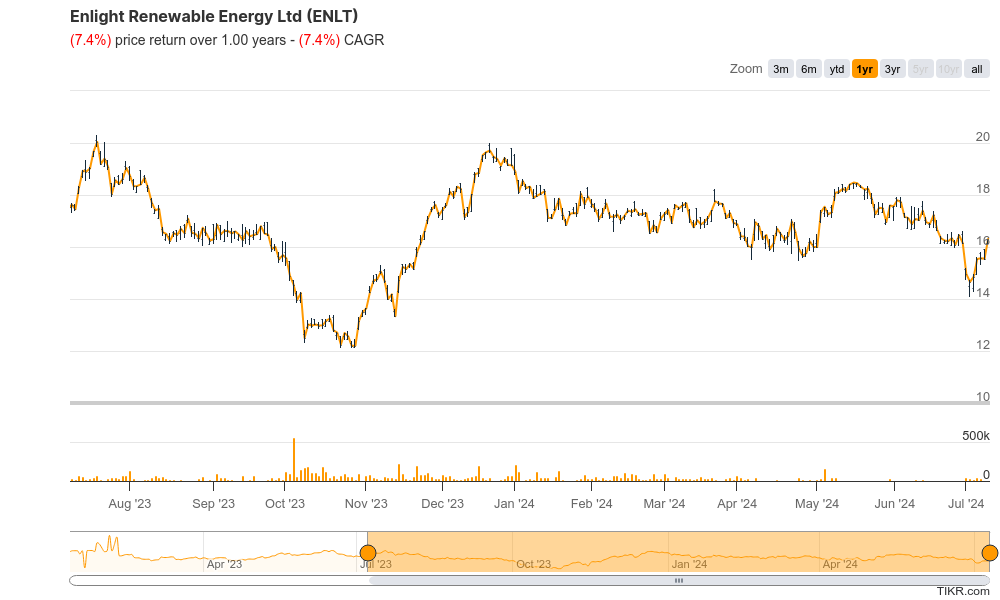

Stock Overview:

| Ticker | $ENLT | Price | $16.32 | Market Cap | $1.93B |

| 52 Week High | $20.30 | 52 Week Low | $12.11 | Shares outstanding | 118.5M |

Company background:

Enlight Renewable Energy Ltd founded by Gilad Yavetz, Zafrir Yoeli and Amit Paz, Enlight has grown from a small-scale rooftop solar company in Israel to a global renewable energy leader.

The company operates across three continents – North America, Europe, and Asia – and focuses on developing, financing, constructing, owning and operating utility-scale renewable energy projects. Their core areas of business are solar, wind and energy storage facilities. Enlight is a major player in Israel’s renewable energy sector, and one of their notable projects is the Ruach Beresheet wind farm, the largest of its kind in the country. Headquartered in Tel Aviv, Israel, Enlight competes with international renewable energy giants like Engie, EDF Renewables, and NextEra Energy.

Recent Earnings:

Enlight reported revenue of $182 million for the third quarter, reflecting a year-over-year growth of 39%. This indicates that the company’s business is expanding, which is positive news for investors.

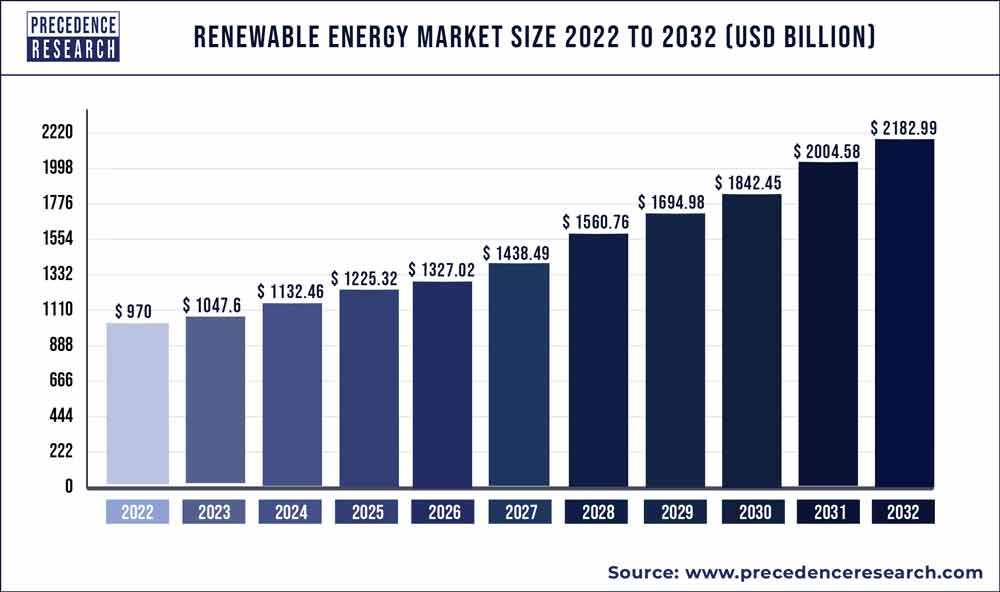

The Market, Industry, and Competitors:

Enlight Renewable Energy Ltd operates in the global renewable energy market. Government regulations around the world are increasingly promoting renewable energy sources. This is due to concerns about climate change and a desire to reduce dependence on fossil fuels. The costs of renewable technologies like solar and wind have been steadily decreasing, making them more competitive with traditional forms of energy generation. There’s a growing global focus on sustainability, leading businesses and individuals to seek out renewable energy solutions.

Unique differentiation:

Established Global Players: These are large, multinational corporations with a significant presence in the renewable energy market worldwide. Some key examples include:

- Engie: A French multinational utility company with a strong track record in renewable energy projects across various technologies.

- EDF Renewables: A subsidiary of French electric utility giant EDF, specializing in developing and operating renewable energy projects around the world.

- NextEra Energy: A US-based electric utility company and the world’s largest generator of wind and solar energy.

Regional Developers: Enlight also competes with regional developers focused on specific markets like Israel or Eastern Europe. These companies may have a deeper understanding of local regulations and established relationships with regional stakeholders.

Focus on Project Development: Unlike some competitors who might be primarily utility companies or technology providers, Enlight might focus on the entire project development cycle – financing, construction, ownership, and operation. This integrated approach could offer clients a one-stop shop and potentially streamline project execution.

Regional Expertise: Enlight has experience across three continents. They might leverage this to develop a deep understanding of regulations and stakeholder needs in specific regions, allowing them to tailor projects effectively. This could be advantageous compared to global giants who might have a more standardized approach.

Financing Solutions: It’s possible Enlight offers creative financing solutions for clients, making renewable energy projects more accessible. This could be especially attractive in developing regions where capital constraints might exist.

Management & Employees:

- Gilad Yavetz: Co-founder, CEO & Director – Responsible for the overall strategy and direction of the company.

- Amit Paz: Co-founder, SVP, Engineering, Contracting & Procurement – Leads the technical aspects of project development and execution.

- Zafrir Yoeli (departed in 2022): Co-founder, former SVP Business Development – Played a key role in securing new projects and growing the company’s footprint.

Financials:

Enlight Renewable Energy Ltd has demonstrated impressive financial growth. Revenue has been on a steady upward trajectory, with a year-over-year increase of 33% reported in 2023.

Earnings have also seen significant improvement. Net income in 2023 grew by a substantial 157% compared to the previous year. The high percentage increase points towards a positive trend in profitability.

Technical Analysis:

The stock is reversing (stage 1, neutral) after a stage 4 correction, markdown on the monthly and weekly chart. On the daily chart, the new trend is up (stage 2, markup). An entry in the $16.12 range would be a good one for a move to the $18 range.

Bull Case:

Revenue and Earnings Growth: Enlight has already demonstrated impressive revenue growth and earnings growth in recent years. Continued expansion and project execution could lead to further increases in both metrics, making the stock more attractive to investors.

Government Regulations: Policies promoting renewable energy to combat climate change and reduce reliance on fossil fuels.

Sustainability Focus: Growing global emphasis on sustainability is driving demand for renewable energy solutions.

Bear Case:

Execution Risk: Developing and constructing renewable energy projects is complex, and delays or unforeseen costs can negatively impact profitability. Execution issues could dent investor confidence in ENLT.

Policy and Regulatory Uncertainty: Government policies and regulations significantly influence the renewable energy sector. Sudden changes or a shift away from renewable energy support could hurt Enlight’s business.

Commodity Price Fluctuations: The cost of raw materials used in solar panels, wind turbines, and other renewable energy technologies can fluctuate. Price spikes could impact project budgets and profitability.