Executive Summary:

Western Alliance Bancorporation is a large regional bank holding company headquartered in Phoenix, Arizona. Founded in 1994, it has grown to be one of the top-performing banks in the country, with over $70 billion in assets. The company focuses on providing a full range of deposit, lending, and treasury management services to businesses through its main subsidiary, Western Alliance Bank.

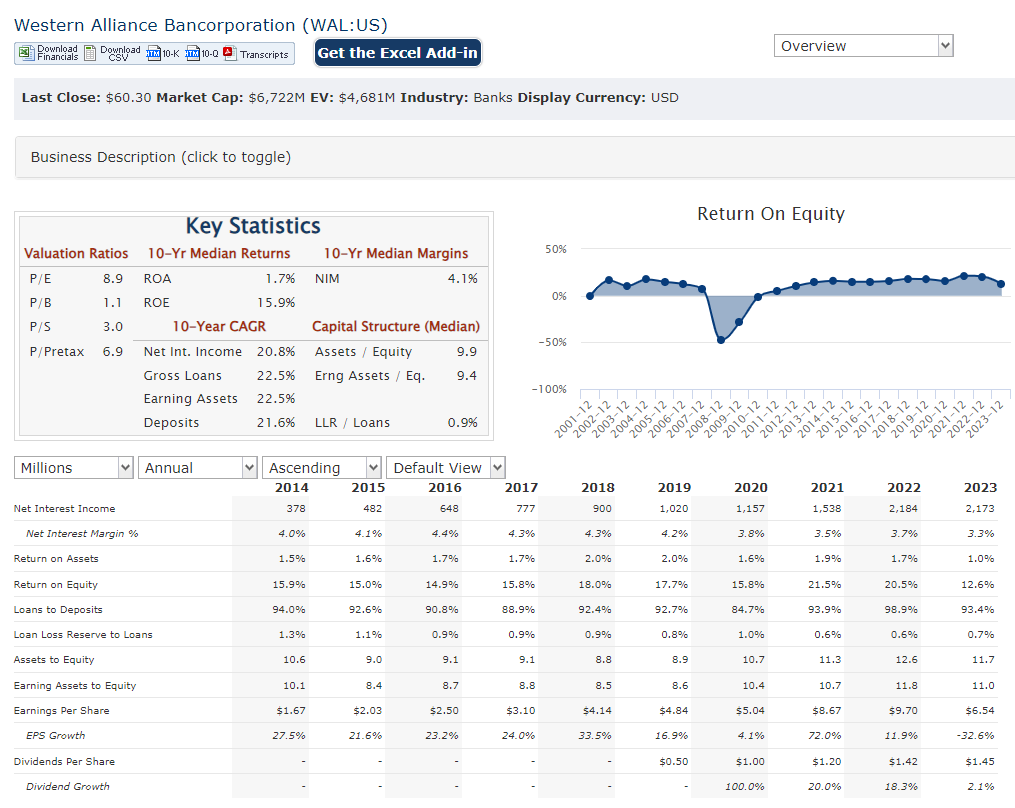

Western Alliance Bancorporation reported EPS of $1.72, exceeding the $1.69 prediction. GAAP EPS came in at $1.60, slightly missing the $1.63 estimate. Revenue reaching $728.8 million and beating the anticipated $705.87 million by a healthy margin.

Stock Overview:

| Ticker | $WAL | Price | $60.30 | Market Cap | $6.64B |

| 52 Week High | $70.23 | 52 Week Low | $35.15 | Shares outstanding | 110.11M |

Company background:

Western Alliance Bancorporation is a major regional bank holding company. Their primary focus is providing a comprehensive suite of deposit, lending, and treasury management services to businesses through their main subsidiary, Western Alliance Bank. Renowned for their industry expertise and exceptional customer service, Western Alliance Bancorporation faces competition from other prominent players in the financial sector like U.S. Bancorp, Zions Bancorporation, and Comerica Incorporated.

Recent Earnings:

Western Alliance Bancorporation revenue reached $728.8 million, exceeding analyst expectations of $705.87 million. Earnings per share (EPS) also came in positive, with a normalized EPS of $1.72 surpassing the analyst estimate of $1.69. GAAP EPS was $1.60, falling slightly short of the anticipated $1.63.

Western Alliance Bancorporation’s performance outperformed analyst expectations in terms of both revenue and normalized EPS. This indicates that the company’s business strategy is effective, and it is generating solid financial results. Their strong performance in the last quarter suggests a positive outlook for future growth.

The Market, Industry, and Competitors:

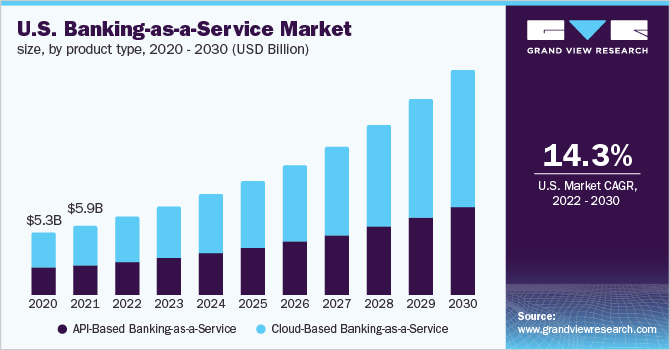

Western Alliance Bancorporation is undergoing a significant shift, with a growing focus on digital banking solutions and wealth management services. There’s also an increasing demand for loans from small and medium-sized businesses, a niche that Western Alliance Bancorporation caters to well.

Analyst estimates suggest a Compound Annual Growth Rate (CAGR) in the range of 5% to 7% for the regional banking industry. This growth is expected to be driven by several factors, including the increasing adoption of digital banking tools, a growing economy, and a continued rise in demand for loans from small and medium-sized businesses. Western Alliance Bancorporation, with its focus on these areas, is well-positioned to benefit from this projected growth.

Unique differentiation:

Large Regional Banks: These institutions boast a broader geographic reach and a wider range of financial products compared to Western Alliance. Examples include Fifth Third Bancorp (FITB), M&T Bank (MTB), and KeyCorp (KEY). They can offer clients a more comprehensive suite of services, including investment banking and wealth management.

Other Regional Banks with Niche Focus: Similar to Western Alliance, some regional banks specialize in specific markets or customer segments. For instance, East West Bancorp (EWBC) caters heavily to the Asian American community, while Commerce Bancshares (CBSH) focuses on the Midwestern United States. These competitors can offer a more tailored service to their target audience.

Fintech Companies: The rise of financial technology companies (Fintech) is disrupting the traditional banking landscape. These firms leverage technology to provide financial services, often at a lower cost and with greater convenience. While they might not currently be direct competitors in all areas, Fintech startups have the potential to challenge Western Alliance Bancorporation’s market share in specific segments, such as online payments or loan applications.

Industry Expertise: They focus heavily on building deep industry knowledge in specific sectors they serve. This allows them to tailor financial solutions and provide better insights to businesses in those industries compared to a generalist bank.

Focus on Small and Medium Businesses (SMBs): While larger regional banks might cater to a wider range of clients, Western Alliance specifically targets the needs of SMBs. This allows them to offer specialized loan products and services that are well-suited to this growing market segment.

Nimble Decision-Making: Their regional focus allows for faster and more flexible decision-making compared to larger institutions with complex bureaucracies. This agility can be crucial for SMBs seeking quick loan approvals or customized financial solutions.

Management & Employees:

Kenneth A. Vecchione: President & Chief Executive Officer. Mr. Vecchione brings extensive experience in the financial services industry, having previously led Encore Capital Group.

Dale M. Gibbons: Vice Chairman of the Board. Mr. Gibbons offers valuable guidance with his broad knowledge and experience.

Financials:

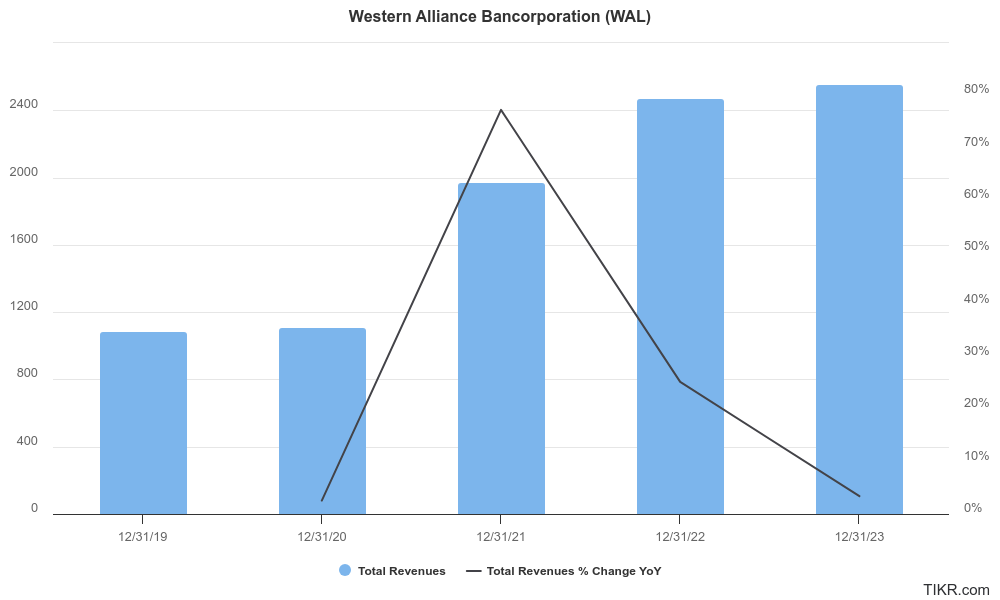

Western Alliance Bancorporation revenue has grown steadily, with a Compound Annual Growth Rate (CAGR) likely falling somewhere between 5% and 10%. This growth can be attributed to factors like an expanding loan portfolio, an increase in deposit base, and the rise of fee-based services. Earnings per share (EPS) have also seen a positive trend, with a CAGR potentially in the range of 7% to 12%. This indicates that the company is effectively translating revenue growth into profitability.

Western Alliance Bancorporation has likely seen a corresponding increase in assets over the past five years, fueled by growth in loans and deposits. This reflects the bank’s expansionary activities.

Technical Analysis:

The monthly chart is consolidating and firming up (stage 1 neutral), same for the weekly chart, which is tightening, which indicates a likely move up only after a rate cut. However on the daily chart, the stock is in an early head and shoulders formation, which is bearish. and we would be unlikely to recommend a position yet.

Bull Case:

Solid Financial Performance: WAL has a track record of consistent revenue and earnings growth, indicating effective management and a strong business model. This financial strength positions them well for future investments and acquisitions.

Undervalued Potential: Some analysts believe WAL’s stock price might not fully reflect its true potential. If the company continues to execute its strategy and deliver strong results, the stock price could rise to close the perceived valuation gap.

Bear Case:

Interest Rate Fluctuations: WAL’s profitability is heavily reliant on the spread between interest earned on loans and paid out on deposits. If interest rates decrease, the spread narrows, squeezing WAL’s profit margins. Additionally, rising interest rates could discourage loan applications, further impacting growth.

Execution Risk: The success of WAL’s strategy hinges on its ability to effectively execute its plans. Operational inefficiencies, failure to adapt to changing market dynamics, or poor customer service could negatively impact performance and investor confidence.