Executive Summary:

Wayfair is a major American online retailer specializing in furniture and home goods. Founded in 2002, the company boasts over 14 million products from a global network of suppliers. With headquarters in Boston and Berlin, Wayfair operates fulfillment centers across North America and Europe, offering efficient home delivery to a vast customer base.

Wayfair’s reported a net loss of $248 million, which translates to a diluted loss per share of $2.06. This represents an improvement year-over-year, as they lost $3.22. Revenue of $2.73 billion remained relatively flat compared to the prior year.

Stock Overview:

| Ticker | $W | Price | $52.25 | Market Cap | $6.37B |

| 52 Week High | $90.71 | 52 Week Low | $38.37 | Shares outstanding | 96.24M |

Company background:

Wayfair founded by Niraj Shah and Steve Conine, the company started small but has grown significantly. Wayfair reach extends beyond furniture, encompassing housewares and home improvement goods as well. They operate several retail websites under the Wayfair umbrella, including Joss & Main, AllModern, Birch Lane, and Perigold, allowing them to cater to various design aesthetics and budgets.

Wayfair faces competition from retail giants like Amazon, Target, and Walmart, all of whom have also invested heavily in their online home goods offerings. Wayfair’s focus solely on home goods allows them to curate a deep selection and provide a more specialized shopping experience for customers furnishing their homes.

Recent Earnings:

Revenue: Wayfair reported total net revenue of $2.73 billion. This represents a slight decrease of 1.0% compared to the same quarter in the previous year.

EPS: Earnings per share (EPS) came in at -$2.06, reflecting a net loss, but it’s an improvement compared to a loss per share of -$3.22 in Q1 2023.

The Market, Industry, and Competitors:

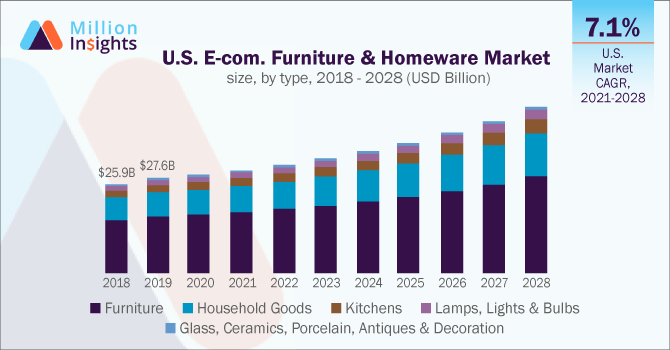

Wayfair operates Compound Annual Growth Rate (CAGR) of 5-7% for the online furniture market in the next five years. This growth is attributed to several factors, including increasing consumer preference for online shopping, a trend that has been amplified by the COVID-19 pandemic. Additionally, rising disposable incomes and a growing focus on home improvement are expected to contribute to market expansion.

Wayfair is well-positioned to benefit from this projected growth trajectory. The company’s vast product selection, efficient delivery network, and established brand presence position them to capture a significant share of the online furniture market in the coming years. By staying ahead of trends and capitalizing on the growing demand for online furniture shopping, Wayfair is expected to see continued growth through 2030 and beyond.

Unique differentiation:

Retail Giants: Major players like Amazon, Walmart, and Target have all significantly expanded their online furniture offerings in recent years. These companies leverage their vast brand recognition, established logistics networks, and competitive pricing to challenge Wayfair’s market share.

Pure-Play Online Furniture Retailers: Companies like Overstock and Houzz compete directly with Wayfair on selection and price. These online-only retailers often focus on specific niches within the furniture market, appealing to budget-conscious shoppers or those seeking a particular design aesthetic.

Brick-and-Mortar Retailers with Online Presence: Traditional furniture stores like Ikea and Bed Bath & Beyond have also bolstered their online presence, offering customers the option to browse and purchase furniture online alongside their in-store experiences. While their physical stores can be a drawback for some online shoppers, these established brands hold recognition and loyalty among some customer segments.

Curated Selection & Deep Inventory: Unlike general e-commerce giants like Amazon, Wayfair focuses solely on home goods. This allows for a curated selection of over 30 million products, offering a depth and variety that competitors may struggle to match.

Specialized Shopping Experience: By focusing on home goods, Wayfair can tailor the shopping experience to furniture and home decor needs. This might include features like design inspiration tools, room planning aids, and robust filtering options by style, size, and budget.

Multiple Retail Sites under One Umbrella: Wayfair owns several online retail destinations like Joss & Main and Birch Lane. This caters to diverse customer preferences by offering a range of aesthetics and price points, all under the trusted Wayfair brand umbrella.

Management & Employees:

Niraj Shah (Co-Founder, CEO & Co-Chairman): Shah has been at the helm since Wayfair’s founding in 2002. He brings extensive experience in building online businesses.

Kate Gulliver (CFO & CAO): Gulliver oversees Wayfair’s financial operations and administrative functions. Her expertise lies in corporate finance and strategy.

Enrique Colbert (General Counsel): Colbert provides legal guidance and oversees compliance matters for Wayfair.

Financials:

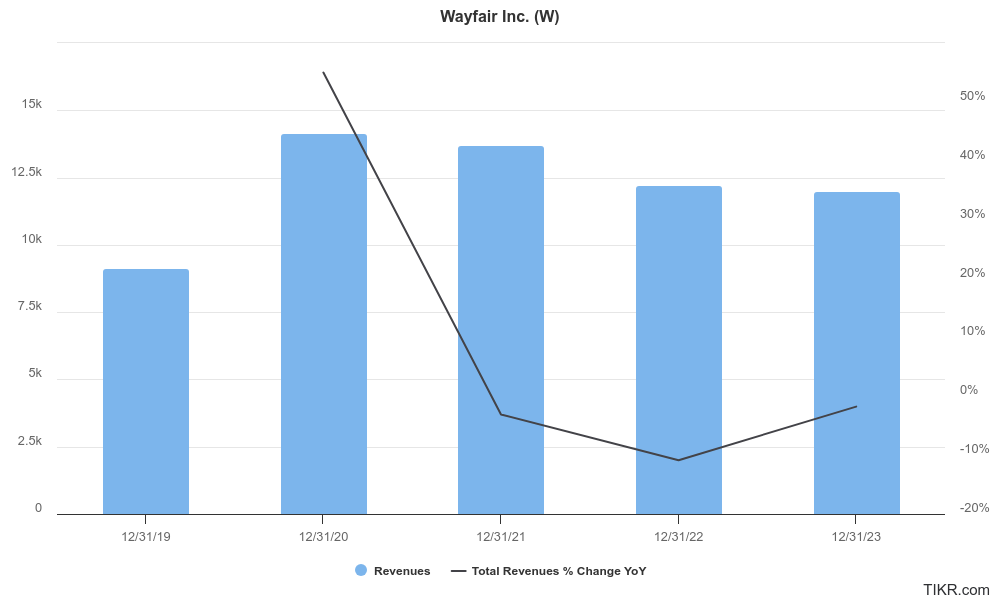

Revenue: Wayfair with a Compound Annual Growth Rate (CAGR) exceeding 30% between 2017 and 2020.The trend has shifted in recent years. Total net revenue for 2023 reached $12.0 billion, a slight decrease from its peak in 2020.

Technical Analysis:

The stock is forming a basing (stage 1 neutral) pattern on the monthly chart, and a small handle is visible (bullish) on the weekly chart. There is enough support in the $50 range, and a reversal confirmation on the daily chart would be a good entry for the medium term (6-9 months) for this stock. However, there seems to be more downside with support in the $48 zone.

Bull Case:

Shifting Consumer Trends: The trend of online furniture shopping is expected to continue growing in the coming years. Wayfair is well-positioned to capitalize on this trend, with their established online presence and efficient delivery network.

Focus on Profitability: While not yet consistently profitable, Wayfair has shown a commitment to achieving profitability. Recent reports highlight progress in cost-cutting measures and improved pricing strategies. These efforts, if successful, could lead to a significant increase in shareholder value.

Bear Case:

High Inventory Levels: Wayfair maintains a vast inventory to ensure product availability. However, if buying trends shift or demand weakens, this large inventory could become a burden, leading to write-downs and impacting profitability.

Customer Acquisition Costs: Attracting new customers online can be expensive, especially with strong competition. Rising customer acquisition costs could eat into Wayfair’s margins and hinder their ability to generate profits.

Recent Insider Selling: The recent sale of company stock by a co-founder, while not necessarily a negative indicator, can be seen by some bears as a sign of waning confidence in the company’s future prospects.