Executive Summary:

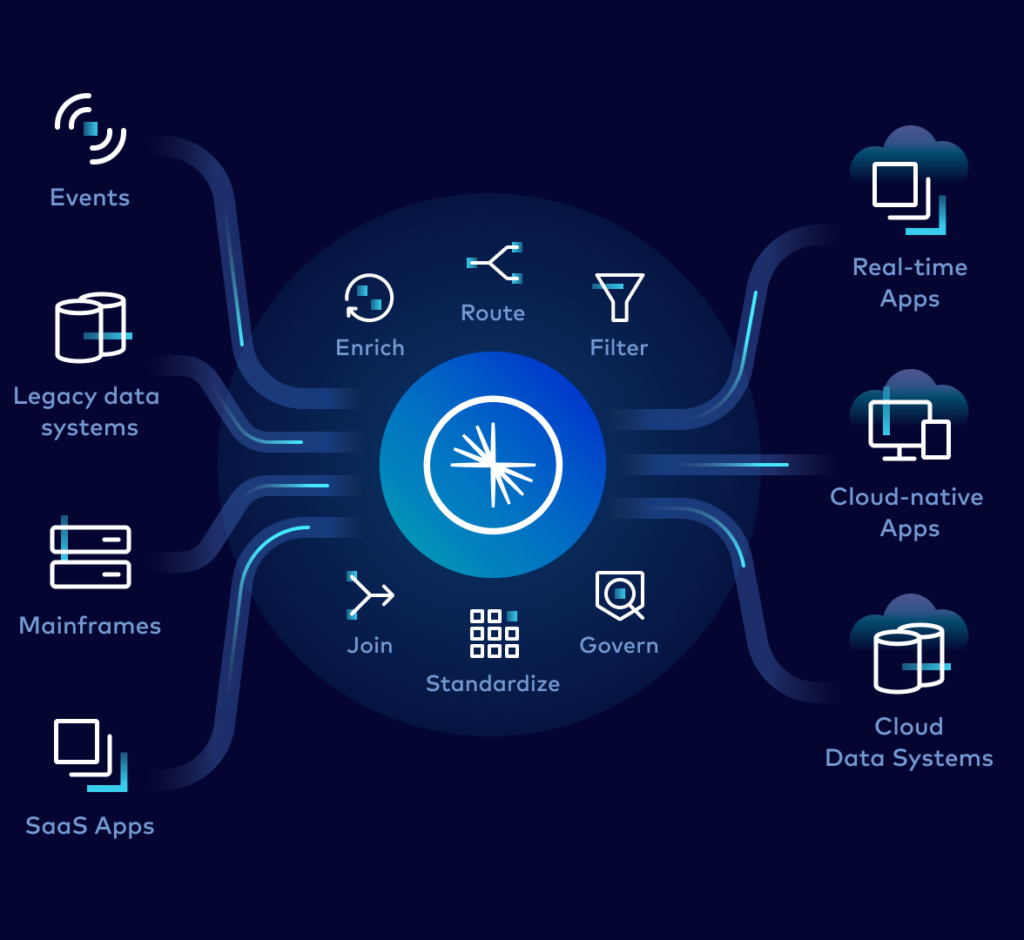

Confluent is a company that specializes in data streaming, a technique for handling real-time data flows. Their cloud-based platform, built upon the open-source Apache Kafka, is designed to be the central nervous system of an organization’s data infrastructure. This allows businesses to react to events and make data-driven decisions instantly. Confluent boasts features like scalability, reliability, and low latency to handle even the most demanding data workloads.

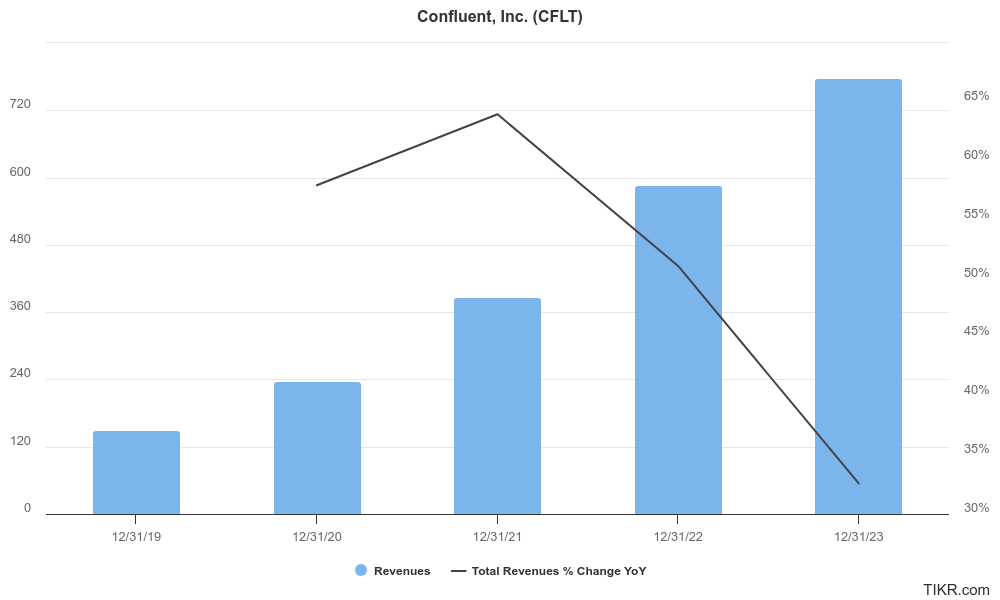

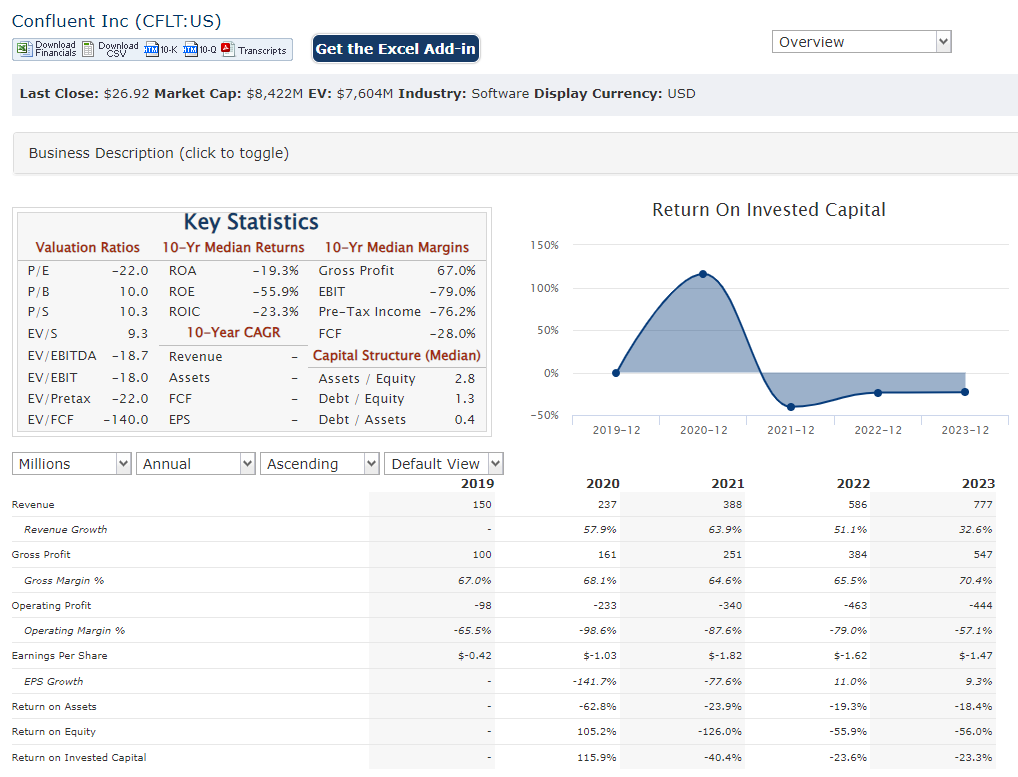

Confluent Inc reported revenue of $217.24 million, a 1.9% increase from the previous quarter and a 24.63% jump year-over-year. Earnings per share (EPS) came in at -$0.30, reflecting a 42.31% decline year-over-year.

Stock Overview:

| Ticker | $CFLT | Price | $26.92 | Market Cap | $8.56B |

| 52 Week High | $41.22 | 52 Week Low | $14.69 | Shares outstanding | 244.66M |

Company background:

Confluent was founded in 2014 by Jay Kreps, Jun Rao, and Neha Narkhede, all key contributors to the open-source Apache Kafka project. They saw the potential of Kafka for businesses beyond just the tech world and launched Confluent to provide a commercial, enterprise-ready version. The company has grown significantly, securing funding rounds totaling over $567 million.

This platform acts as a central nervous system for an organization’s data infrastructure, enabling them to capture and react to real-time data streams. Data in motion is becoming increasingly important for businesses, and Confluent’s platform facilitates data-driven decision making by allowing companies to ingest, store, and process data streams efficiently.

Confluent faces competition from several established players in the cloud computing space. Some of their key competitors include Amazon Kinesis, Microsoft Azure Stream Analytics, and Google Cloud Pub/Sub. These companies all offer similar data streaming functionalities, and the choice for a business often comes down to factors like existing cloud infrastructure and specific feature sets. Confluent is headquartered in Mountain View, California, and continues to be a leader in the data streaming space as cloud adoption grows.

Recent Earnings:

Confluent reported total revenue reached $217.24 million, reflecting a 24.63% increase year-over-year. This positive trend aligns with the increasing adoption of cloud-based solutions.

EPS (earnings per share) came in at -$0.30, reflecting a 42.31% decline compared to the same quarter last year. While Confluent isn’t yet profitable, this decrease is likely due to ongoing investments in growth initiatives.

Confluent having 1,260 customers with an annual recurring revenue (ARR) of over $100,000, up 17% year-over-year. This indicates growth in their high-value customer segment.

Confluent expect total revenue to reach approximately $957 million, representing a significant increase year-over-year. Subscription revenue is expected to be around $910 million, and the company is targeting a non-GAAP operating margin of around 0%. They also provided a range for non-GAAP net income per diluted share of $0.19 to $0.20.

The Market, Industry, and Competitors:

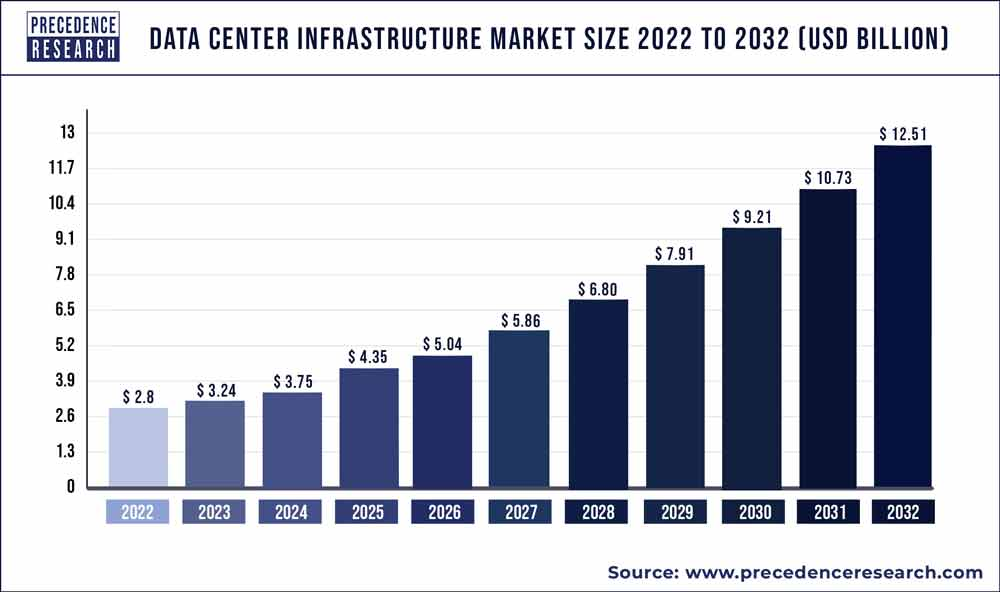

Confluent Inc. operates in the data streaming market, a rapidly growing segment of the big data landscape. The exact market size is difficult to quantify, but estimates suggest it’s in the billions and is projected to reach 2030 at a Compound Annual Growth Rate (CAGR) exceeding 20%. Companies are realizing the value of reacting to events and making data-driven decisions instantly, rather than relying on historical data analysis.

Confluent is well-positioned to benefit from this market expansion. Their cloud-native platform built upon Apache Kafka is designed to be the central nervous system of an organization’s data infrastructure, and its features like scalability and reliability cater to the demanding data workloads businesses are facing today.

Unique differentiation:

Cloud providers like Amazon (with Amazon Kinesis), Microsoft (with Azure Stream Analytics), and Google (with Google Cloud Pub/Sub) offer managed data streaming services within their broader cloud platforms. This integration can be a major advantage for businesses already heavily invested in a particular cloud provider’s ecosystem. These cloud giants have vast resources and are constantly innovating, making them formidable competitors.

Confluent also competes with open-source alternatives, primarily Apache Kafka itself. While Confluent offers a commercial, enterprise-ready version of Kafka with additional features and support, some businesses prefer the flexibility and lower costs of managing their own open-source Kafka deployments. Other open-source competitors include Striim and Strimzi, which offer variations on the Kafka architecture. The choice between Confluent and open-source alternatives often depends on a company’s specific needs, budget, and technical expertise.

Completeness: While competitors offer data streaming services, Confluent goes beyond. They provide a comprehensive “data in motion” stack. This includes over 100 pre-built connectors for various data sources and applications, simplifying data ingestion and integration. Additionally, ksqlDB, a SQL interface for stream processing, lets developers use familiar SQL queries to analyze real-time data streams, lowering the barrier to entry.

Focus on Apache Kafka: Unlike cloud providers offering generic streaming services, Confluent is deeply invested in Apache Kafka, the underlying technology for their platform. This translates to a more feature-rich and performant Kafka experience. They actively contribute to the open-source project, ensuring their platform stays current with the latest advancements in Kafka.

Multi-Cloud and On-Premise Flexibility: Many companies have hybrid cloud environments with on-premise infrastructure alongside cloud deployments. Confluent’s platform caters to this by offering deployment options for both on-premise and various cloud platforms. This flexibility allows businesses to choose the deployment model that best suits their needs without vendor lock-in.

Management & Employees:

- Jay Kreps (Co-founder & CEO): Kreps co-founded Confluent and brings extensive experience in distributed systems and real-time data processing.

- Neha Narkhede (Co-founder): Another co-founder who contributes to the company’s strategic direction from the board.

Financials:

Confluent’s prioritizing market share and user acquisition over immediate profitability. Revenue has seen impressive growth, with estimates suggesting a Compound Annual Growth Rate (CAGR) exceeding 35%. This aligns with the booming demand for data streaming solutions. Earnings per Share (EPS) remain negative, though the rate of decline appears to be slowing down in recent quarters. This suggests ongoing investments in product development, sales & marketing, and employee recruitment to fuel future growth.

Confluent has a growing cash pile, likely due to their successful funding rounds. This provides a financial cushion to support their aggressive growth strategy.

Technical Analysis:

On the monthly chart, the stage 4 decline is now consolidating and looking at signs of a reversal. The weekly chart is an early reversal as well. The daily chart is still consolidating with momentum and relative strength flat. We dont expect the stock to move higher in the short term, but a move to $29 (currently $27s) is likely.

Bull Case:

Strong Product Differentiation: Confluent offers a comprehensive data-in-motion stack with features like pre-built connectors and ksqlDB, making data ingestion and analysis easier. Their deep focus on Apache Kafka translates to a feature-rich and performant experience.

Path to Profitability: While not yet profitable, Confluent’s recent earnings reports show a potentially slowing decline in EPS. This suggests their investments in growth initiatives might be nearing a point where they can achieve profitability in the near future.

Bear Case:

Valuation: As a high-growth company, Confluent’s stock price might be inflated based on future potential rather than current earnings. If the company struggles to achieve profitability within a reasonable timeframe, the stock price could experience a correction.

Macroeconomic Factors: A broader economic downturn could impact Confluent’s growth prospects. Businesses might tighten their budgets and delay investments in new technologies like data streaming platforms.

Technological Disruption: The data streaming space is still evolving, and there’s always the risk of disruptive new technologies emerging that could render Confluent’s platform obsolete.