Executive Summary:

Dillard’s Inc. is a major fashion retailer in the United States, founded in 1938. They operate nearly 300 stores across 30 states, along with an online store. The company offers a variety of merchandise including apparel, cosmetics, and home goods, with a focus on both national brands and exclusive lines. Dillard’s prides itself on delivering style, service, and value to its customers.

Dillard’s Inc. reported an EPS of $11.09. Revenue also dipped year-over-year to $1.57 billion, representing a decline of 2.55%.

Stock Overview:

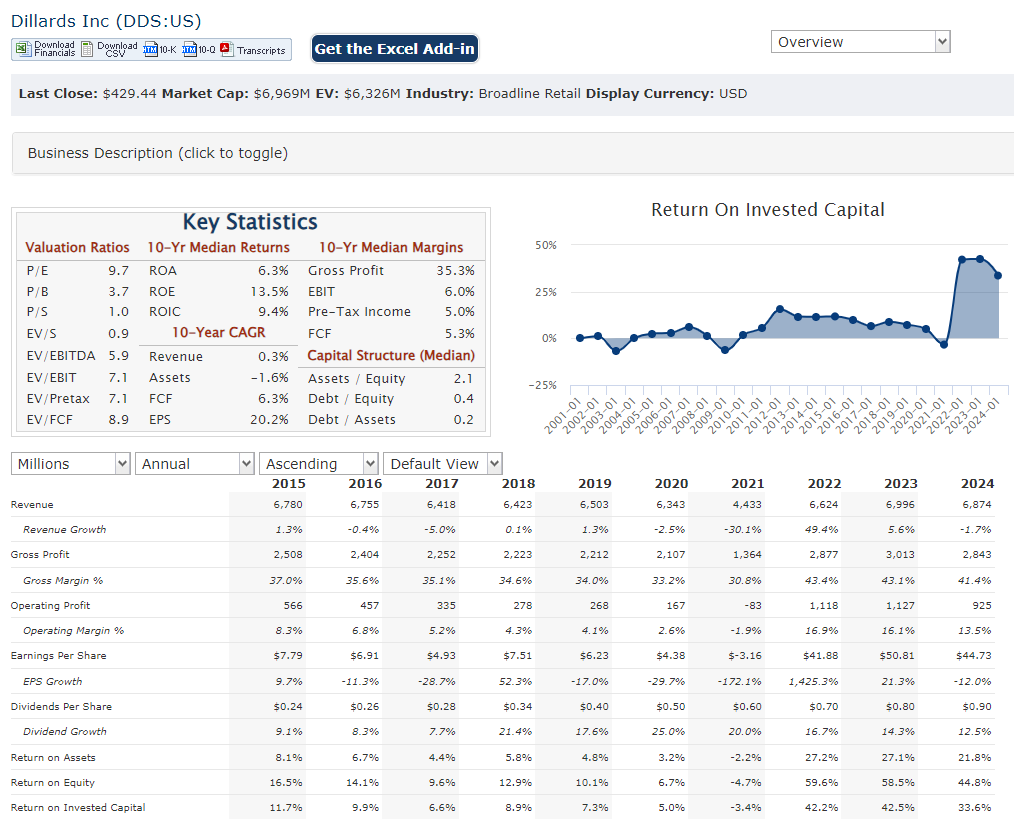

| Ticker | $DDS | Price | $424.70 | Market Cap | $6.89B |

| 52 Week High | $476.48 | 52 Week Low | $286.39 | Shares outstanding | 12.24M |

Company background:

Dillard’s Inc. was founded by William T. Dillard in Nashville, Arkansas with a single store. Dillard’s grew from that initial investment into a retail giant, avoiding traditional outside funding methods by strategically using its own profits to fuel expansion.

They offer a curated selection of merchandise including apparel, cosmetics, and home goods, featuring both national brands and exclusive lines like Gianni Bini and Antonio Melani. Dillard’s prioritizes exceptional customer service alongside its focus on style and value. Their main competitors include other established department stores like Macy’s, Kohl’s, and JCPenney.

Recent Earnings:

Revenue and Growth: Dillard’s reported revenue of $1.57 billion for Q2 2024. This represents a decrease of 2.55% compared to the same period in the previous year.

EPS and Growth: Earnings per share (EPS) came in at $11.09.

The Market, Industry, and Competitors:

Dillard’s Inc. navigates the competitive landscape of the department store industry in the United States. This market has faced challenges in recent years due to the rise of e-commerce and discount retailers. Brick-and-mortar stores like Dillard’s need to adapt to changing consumer preferences and offer a compelling omnichannel experience that seamlessly blends online and physical shopping.

Growth expectations for Dillard’s in 2030 are uncertain. Analyst forecasts are mixed, with some sources predicting a decline in revenue based on current trends. Dillard’s could defy expectations if they successfully implement strategic initiatives. This might involve strengthening their online presence, curating unique merchandise assortments, or focusing on exceptional customer service to differentiate themselves from competitors.

Unique differentiation:

Department Stores: Direct competitors include established brick-and-mortar department stores like Macy’s, Kohl’s, and JCPenney. These companies offer similar merchandise categories at comparable price points, vying for customer loyalty through promotions and rewards programs. Belk also falls into this category, though their presence is more regional, mainly concentrated in the southeastern United States.

Online Retailers: The rise of e-commerce giants like Amazon and department store chains’ own online platforms has significantly impacted traditional department stores. These online retailers offer a vast selection of products, competitive pricing, and convenient delivery options, forcing Dillard’s to enhance their own digital presence to stay relevant.

Discount Retailers: Retailers like TJ Maxx, Ross Dress for Less, and Burlington offer a treasure hunt shopping experience with significantly lower price points. While they might not directly compete on every item Dillard’s carries, they target a value-conscious segment of the market, potentially influencing customer spending decisions.

Customer Service: Dillard’s has a long-standing reputation for exceptional customer service. They invest in employee training to provide personalized attention and a positive shopping experience, setting them apart from some competitors who may prioritize efficiency over service.

Merchandise Mix: Dillard’s offers a curated selection of merchandise, featuring both national brands and exclusive lines. This focus on private label brands allows them to provide unique items you might not find elsewhere.

Focus on Value: While not a discount retailer, Dillard’s emphasizes value alongside style. They offer regular promotions and loyalty programs to incentivize purchases, making designer and name brands more accessible to their customer base.

Omnichannel Experience: Dillard’s is investing in creating a seamless omnichannel experience, allowing customers to shop online, pick up in-store, or return online purchases to physical locations. This convenience caters to modern shopping habits.

Management & Employees:

William T. Dillard II (Chairman & CEO): With over 26 years at the helm, William Dillard leads the company’s overall strategy and vision.

Alex Dillard (President & Director): Alex plays a crucial role in the day-to-day operations of Dillard’s.

Mike Dillard (Executive VP & Director): Mike holds a leadership position within the executive team.

Financials:

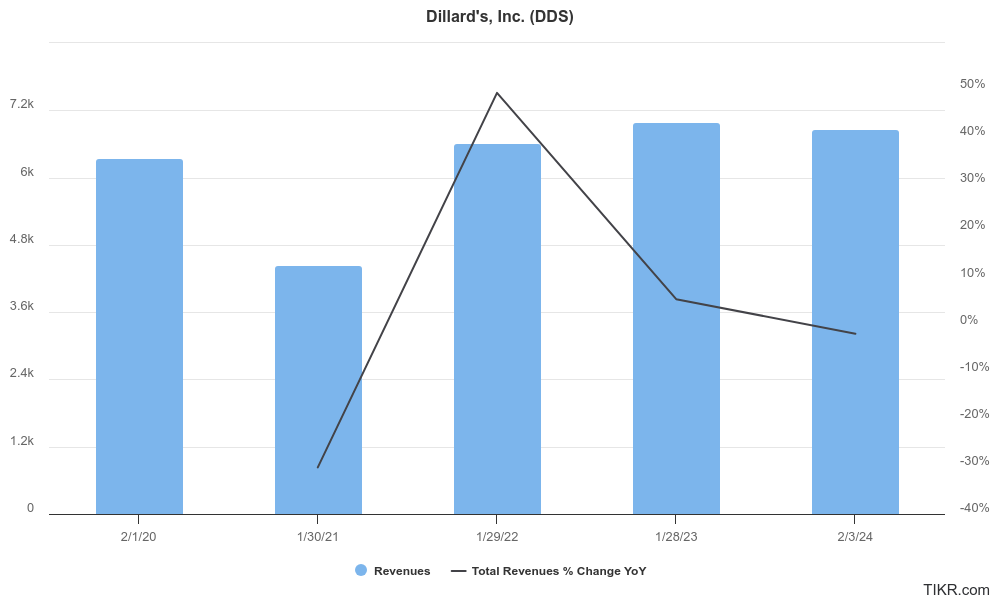

Revenue: Dillard’s growth of 49.42% in fiscal year 2021, likely due to rebounds from pandemic disruptions. Revenue has since declined slightly in the last two years, with a decrease of 1.74% in fiscal year 2024 compared to the prior year.

Earnings: Dillard’s reached a peak net income of $891.64 million in fiscal year 2023. Net income did dip slightly in fiscal year 2024 to $738.85 million.

Technical Analysis:

The stock is on a stage 2 markup (bullish) on the monthly chart, and consolidating stage 3 neutral on the weekly chart. On the daily chart a good tight triangle pattern indicates consolidation to $434 before a likely move up. The RSI and MACD however, indicate a move lower to $400 – $415 range. Long term this stock should head higher, but not after a few moves lower.

Bull Case:

Resilient Financials: Dillard’s boasts a healthy balance sheet with low debt and ample cash reserves. This financial stability positions them well to weather economic downturns and invest in growth initiatives.

Omnichannel Strategy: Dillard’s is investing in creating a seamless online and in-store shopping experience. This caters to modern shopping habits and could attract new customers who prefer a flexible shopping experience.

Insider Buying: Recent insider purchases of Dillard’s stock by company executives could be interpreted as a sign of confidence in the company’s future prospects.

Bear Case:

Declining Industry: The department store industry faces headwinds from online retailers and discount chains. This trend could lead to continued pressure on Dillard’s revenue and market share.

Vulnerability to Economic Downturns: Consumers may cut back on discretionary spending like apparel and home goods during economic recessions, impacting Dillard’s sales.

Rising Costs: Factors like inflation and increasing labor costs could put pressure on Dillard’s profitability if they can’t effectively manage expenses or raise prices without alienating customers.