Executive Summary:

Crocs Inc. is an American company based in Colorado that makes and sells the well-known Crocs brand of shoes. These shoes are made of a special type of foam and are designed to be comfortable and casual. While some consider them to be clogs, they are different from traditional clogs because they don’t have any wood.

Crocs Inc. reported earnings per share (EPS) of $3.02, which was a 4.6% increase year-over-year. Revenue came in at $938.6 million, reflecting a 6.2% growth.

Stock Overview:

| Ticker | $CROX | Price | $148.72 | Market Cap | $9.03B |

| 52 Week High | $158.11 | 52 Week Low | $74.00 | Shares outstanding | 60.70M |

Company background:

Crocs Inc. is a leading American footwear company headquartered in Broomfield, Colorado. Founded in 2002 by Scott Seamans, Lyndon Hanson, and George Boedeker, the company has grown into a global brand recognized for its casual shoes made from a unique closed-cell resin material called Croslite.

This special material gives Crocs shoes their distinct look and comfortable feel, making them a popular choice for people of all ages who prioritize comfort and ease of wear. Their unconventional design, Crocs have experienced significant growth in recent years, expanding their product line beyond their signature clogs and into sandals, sneakers, and even flip-flops.

In the footwear market, Crocs faces competition from several established brands. Some of their key competitors include Skechers, Ugg, Havaianas, and Birkenstock. Crocs continues to innovate and develop new products to maintain its position in a competitive market.

Recent Earnings:

Revenue and Growth: Revenue reached $938.6 million, reflecting a year-over-year increase of 6.2%. This indicates continued growth for the company.

EPS and Growth: Earnings per share (EPS) came in at $3.02, representing a 4.6% growth compared to the same period last year.

The Market, Industry, and Competitors:

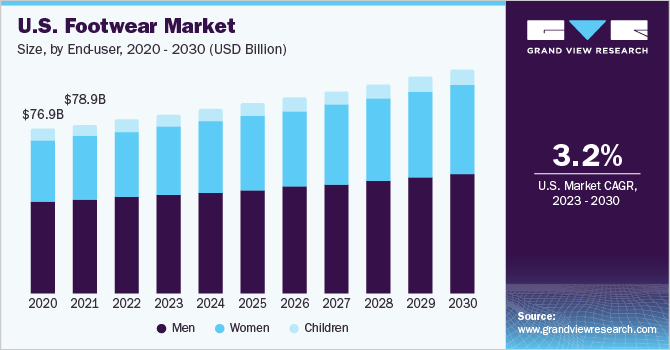

Crocs Inc. operates in the global casual footwear market, a vast and ever-evolving segment. This market caters to consumers who prioritize comfort, practicality, and style in their everyday footwear. The market is driven by factors like increasing demand for athleisure wear, growing health consciousness, and rising disposable income in developing economies.

Projections ranging from 4.5% to 6.9% Compound Annual Growth Rate (CAGR). This growth can be attributed to the aforementioned factors along with an aging population prioritizing comfort and a growing focus on personal well-being.

Their recent forays into new product lines beyond clogs further enhance their appeal to a wider customer base. Their success in capturing a larger share of the market will depend on their ability to maintain brand relevance, innovate effectively, and navigate a competitive landscape.

Unique differentiation:

Athletic-inspired comfort: Skechers is a major competitor, offering athletic-influenced casual shoes and boots that combine comfort with a stylish look. They target a similar audience to Crocs but with a more performance-oriented approach.

Comfort and warmth: Ugg is another competitor, specializing in sheepskin boots and slippers that prioritize warmth and cozy comfort. While their target audience might overlap with Crocs in colder climates, Ugg caters more to those seeking a luxurious and traditionally styled option.

Foot health and arch support: Birkenstock offers sandals and clogs known for their arch support and emphasis on foot health. This focus on biomechanics positions Birkenstock as a distinct competitor, attracting customers who prioritize functionality over casual style.

Beach and summer wear: Havaianas is a leading brand in flip-flops, recognized for their durability and beach-inspired designs. They target a more seasonal market compared to Crocs, offering a lightweight and cool option for summer weather.

Proprietary Material: The core of Crocs’ differentiation lies in their unique closed-cell resin material called Croslite. This material offers a lightweight, comfortable, and odor-resistant experience that sets them apart from traditional shoe materials.

Comfort & Versatility: Crocs prioritizes comfort in their designs, making them ideal for everyday wear and activities that demand ease on the feet. Additionally, their product line has expanded beyond the iconic clogs, offering sandals, sneakers, and other styles that cater to a wider range of needs and preferences.

Brand Identity: Crocs has cultivated a distinct brand image. Their unconventional yet comfortable design has become easily recognizable, attracting a loyal customer base who appreciate the unique aesthetic.

Management & Employees:

Andrew Rees (CEO & Director): Oversees the company’s global strategy and operations, having joined Crocs as President in 2014 before becoming CEO in 2017.

Michelle Poole (EVP & Brand President): Steers the Crocs brand, overseeing marketing, product development, and brand identity.

Financials:

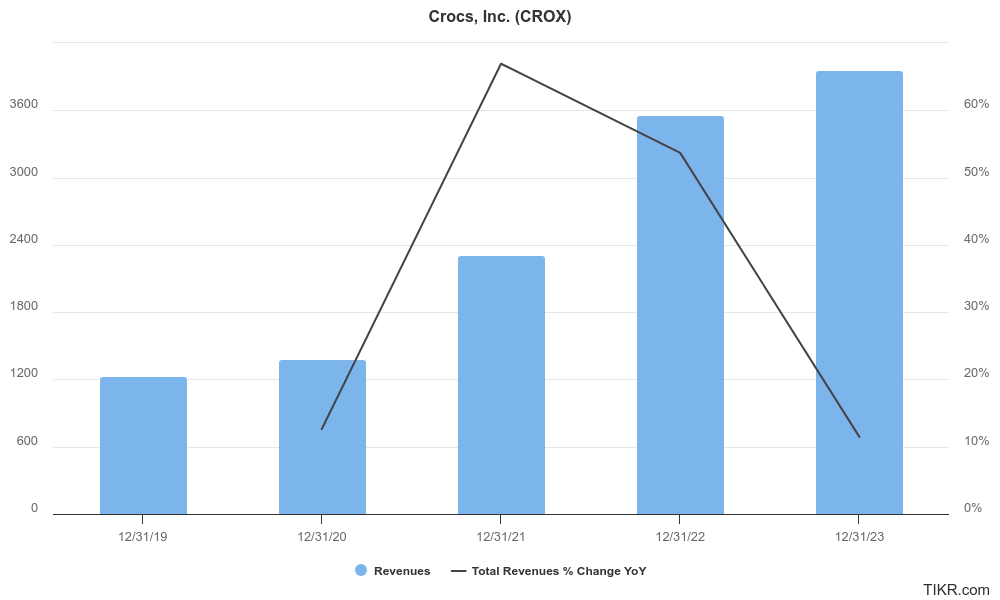

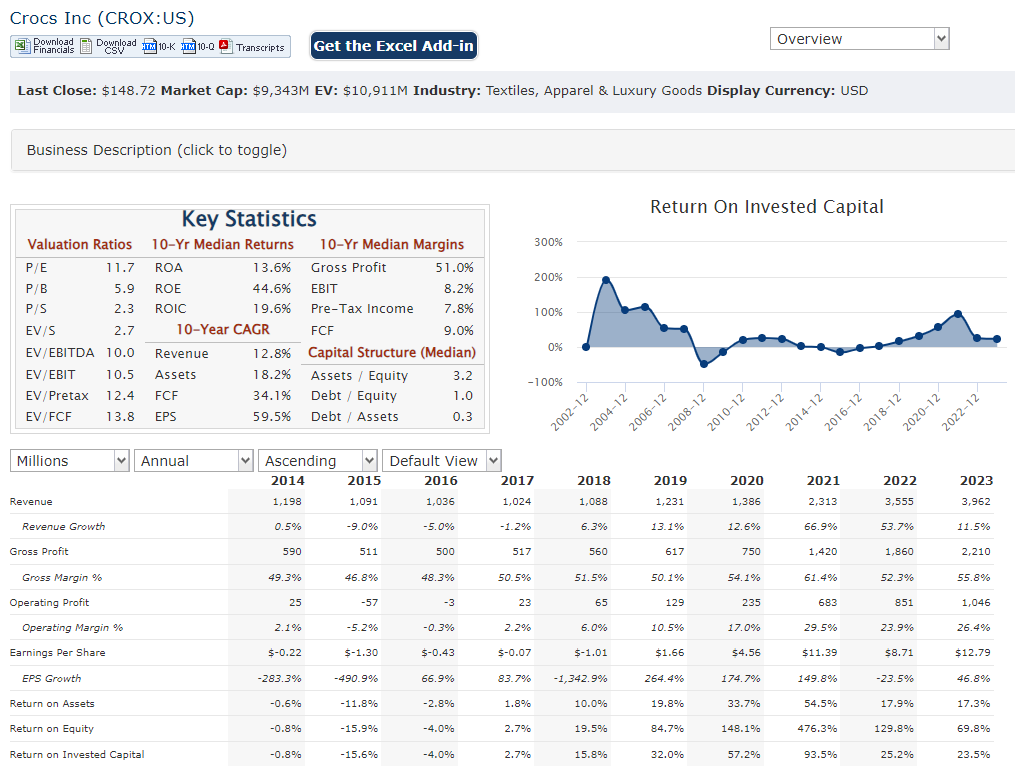

Crocs Inc. revenue has seen a steady upward trend, with a Compound Annual Growth Rate (CAGR) estimated to be in the range of 30-35%.

- Increased brand recognition and popularity of their signature clogs.

- Expansion into new product lines like sandals and sneakers, catering to a wider audience.

- Growing focus on e-commerce and direct-to-consumer sales, allowing for greater control over brand image and profitability.

Earnings per share (EPS) have also enjoyed strong growth over the past five years, with a CAGR likely exceeding 35%. This suggests that Crocs is not only generating more revenue but also translating it into increasing profitability.

Their ability to leverage brand recognition, product innovation, and a focus on e-commerce has fueled impressive revenue and earnings growth.

Technical Analysis:

The stock is on an uptrend, stage 2 (bullish) markup on the monthly and weekly chart. On the daily chart, the uptrend has resulted in a consolidation (stage 3) in the $145 – $147 zone, but the RSI and MACD are indicating a move lower to the 100 day moving average $135, which means the stock should head lower there before a move back up. The chat is still long term trend bound.

Bull Case:

Brand Strength and Recognition: Crocs has cultivated a strong brand identity with their iconic clogs. This unique design, coupled with their focus on comfort, has resulted in a loyal customer base and brand recognition that can be leveraged for future product lines.

Digital Focus: The company is placing a strong emphasis on e-commerce and direct-to-consumer sales. This allows them greater control over brand image, profitability, and customer relationships. A robust digital presence can be a key driver of future growth.

Financial Performance: Crocs has a history of impressive revenue and earnings growth, suggesting strong financial health and efficient operations. This track record inspires confidence in their ability to continue delivering value for shareholders.

Bear Case:

Fickle Consumer Preferences: The popularity of Crocs’ signature clogs could be a fad. Consumer tastes can be fickle, and if the current trend for comfort-focused, unconventional footwear fades, Crocs could struggle to maintain sales momentum.

Limited Product Appeal: While Crocs has expanded beyond clogs, their core design aesthetic might not resonate with all consumers seeking casual footwear. They may struggle to compete with brands offering a wider variety of styles or focusing on specific functionalities like arch support.

Debt Levels: While the specific debt levels aren’t readily available, if Crocs has taken on significant debt to finance growth or acquisitions, it could limit their financial flexibility and impact future profitability.