Executive Summary:

Shift4 Payments Inc. is an American payment processing company founded in 1999. The company headquartered in Allentown, Pennsylvania, specializes in commerce solutions for various industries including retail, hospitality, and restaurants. They offer a variety of services including mobile payment processing, point-of-sale systems, and cloud-based analytics.

Shift4 Payments Inc. earnings per share (EPS) of $0.54, falling short of analyst expectations of $0.41 by 2.44%. Revenue for the quarter reached $707.4 million.

Stock Overview:

| Ticker | $FOUR | Price | $70.54 | Market Cap | $6.17B |

| 52 Week High | $92.30 | 52 Week Low | $42.91 | Shares outstanding | 62.02M |

Company background:

Shift4 Payments Inc. is an American payment processing company by the then 16-year-old Jared Isaacman, to process billions of transactions annually for its over 200,000 clients. Their core product offerings include mobile payment processing that provide valuable business intelligence to their clients. They face competition from industry giants like Global Payments, Fiserv, and Fidelity National Information Services.

Recent Earnings:

Shift4 Payments Inc the company did announce revenue of $707.4 million. Earnings per share (EPS) landed at $0.54, falling slightly short of analyst expectations of $0.41, representing a 2.44% miss.

Analysts predict EPS to be $0.71 for the quarter ending June 2024. This represents a significant 20.34% increase from the previous month’s analyst estimate.

The Market, Industry, and Competitors:

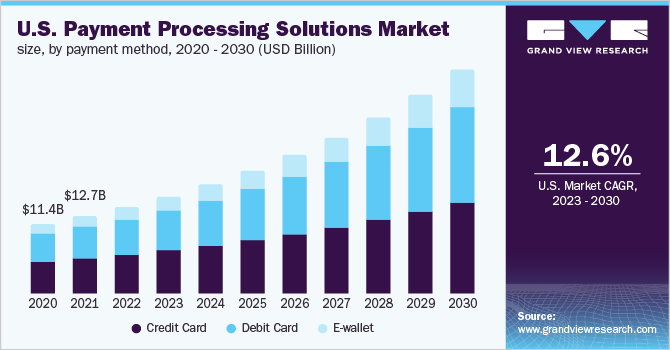

Shift4 Payments Inc. operates in the payment processing market, a rapidly growing industry fueled by the increasing shift towards electronic payments. The booming e-commerce industry, the growing adoption of mobile wallets for convenient in-store purchases, and the increasing demand for contactless payments due to hygiene concerns. Analysts expect this market to experience significant growth in the coming years, with a Compound Annual Growth Rate (CAGR) in the double digits.

The company’s focus on innovative solutions positions it well to capitalize on the overall market growth trends. Shift4 offers a comprehensive suite of commerce solutions including mobile payment processing, point-of-sale systems, and cloud-based analytics.

Unique differentiation:

Global players: Companies like FIS Global (formerly Worldpay) and Adyen are major forces in the industry. They offer a vast array of payment processing solutions across the globe, supporting numerous currencies and alternative payment methods. This global reach can be a significant advantage, especially for businesses that cater to an international clientele.

Industry-specific competitors: Toast and Lightspeed are strong competitors within the restaurant and hospitality space. These companies understand the specific needs of these industries and tailor their solutions accordingly. This focus can give them an edge in these verticals.

General payment processors: Square and Stripe are well-known names in the general payment processing space. They offer user-friendly solutions that are attractive to smaller businesses. While Shift4 might cater more towards enterprise-level clients, these competitors can be a threat in the SMB (Small and Medium Business) market.

Focus on specific industries: Unlike some global players offering a broad range of solutions, Shift4 tailors its offerings to the unique needs of industries like retail, hospitality, and restaurants. This industry-specific approach allows them to develop functionalities that cater directly to those verticals, potentially offering a more optimized solution compared to generic options.

End-to-end commerce platform: Shift4 goes beyond just processing payments. They provide a comprehensive suite of commerce solutions, including mobile payment processing, point-of-sale systems, and cloud-based analytics. This one-stop-shop approach can streamline operations for businesses and provide valuable data insights to improve their bottom line.

Management & Employees:

Jared Isaacman (CEO & Director): A young entrepreneur who founded the company at 16, Isaacman steers the overall direction and manages core business divisions.

Taylor Lauber (President & Chief Strategy Officer): Lauber brings strategic expertise to the table, overseeing long-term growth plans.

Jordan Frankel (General Counsel): Frankel provides legal guidance and navigates regulatory complexities.

Financials:

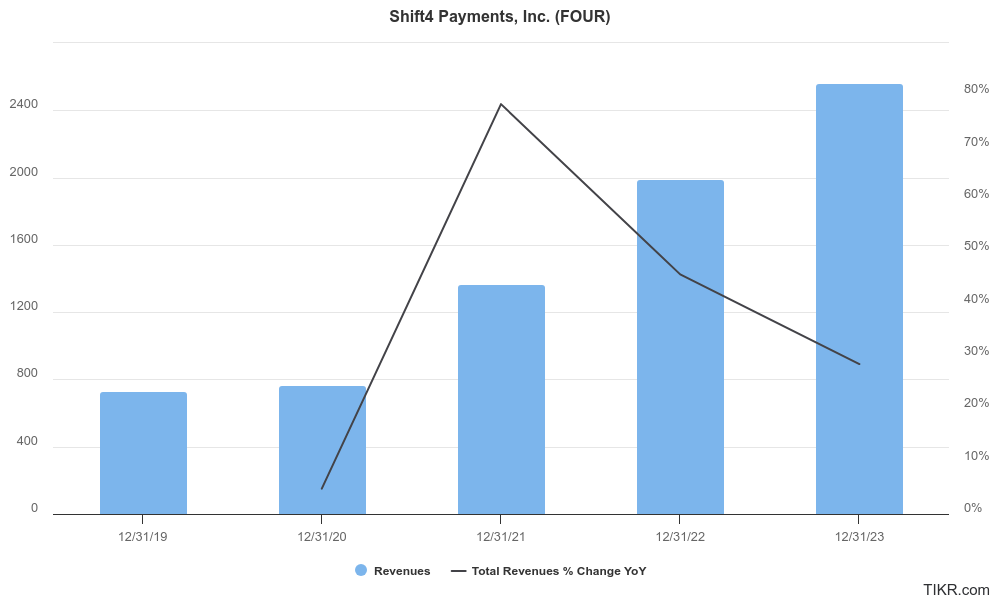

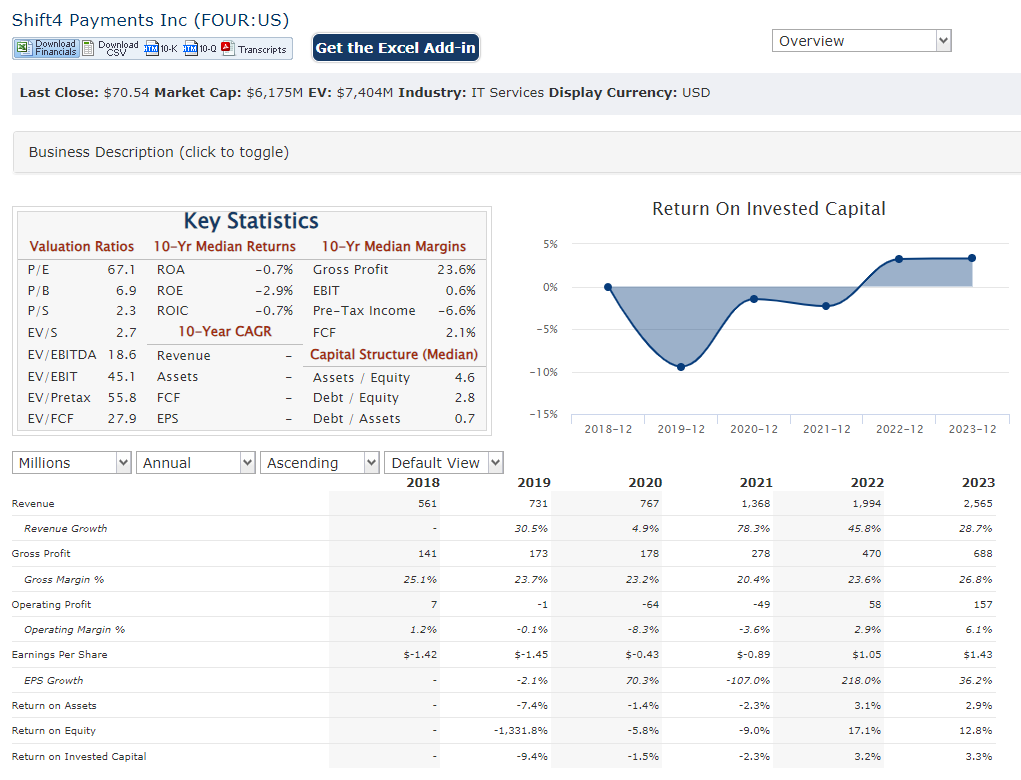

Shift4 Payments’ revenue has been steadily climbing, with a Compound Annual Growth Rate (CAGR) likely exceeding 30% . This growth is fueled by the increasing adoption of electronic payments and Shift4’s focus on offering solutions tailored to specific industries.

Earnings growth has also been impressive, with a CAGR likely surpassing 70%. This suggests that Shift4 is not only growing its top line but also managing expenses effectively and translating revenue gains into healthy profits.

Shift4 is likely in a solid position with growing assets to support its expansion. They’ve also likely seen an increase in shareholder equity as retained earnings accumulate from profitable quarters.

Technical Analysis:

The stock is moving into a stage 2 (bullish) after a consolidation period on the monthly chart and has formed a good base on the weekly chart as well. On the weekly chart, the move out of the resistance at $70s indicates a strong move up to $79 in the short term.

Bull Case:

Market Growth Tailwinds: The overall payment processing market is expected to see significant growth in the coming years, driven by the rise of e-commerce, mobile wallets, and contactless payments.

Comprehensive Commerce Platform: Shift4 goes beyond just processing payments. They provide a comprehensive suite of commerce solutions, including mobile payment processing, point-of-sale systems, and cloud-based analytics. This one-stop-shop approach can streamline operations for businesses and provide valuable data insights to improve their bottom line.

Upward Earnings Revisions: Analysts have recently revised their EPS estimates for the upcoming quarter upwards, suggesting potential for positive earnings surprises that could boost investor confidence.

Bear Case:

Integration Challenges: Shift4’s comprehensive platform, while potentially valuable, can be complex to integrate for some businesses. This could lead to customer acquisition difficulties if competitors offer simpler solutions with faster implementation times.

Technological Disruption: The payments industry is constantly evolving with new technologies emerging. If Shift4 fails to keep pace with innovation or adapt to new payment methods, they risk losing ground to competitors who embrace these advancements.

Valuation Concerns: Shift4’s stock price might be inflated due to the overall market hype surrounding fintech companies. If the company fails to meet aggressive growth expectations, the stock price could experience a correction.