Executive Summary:

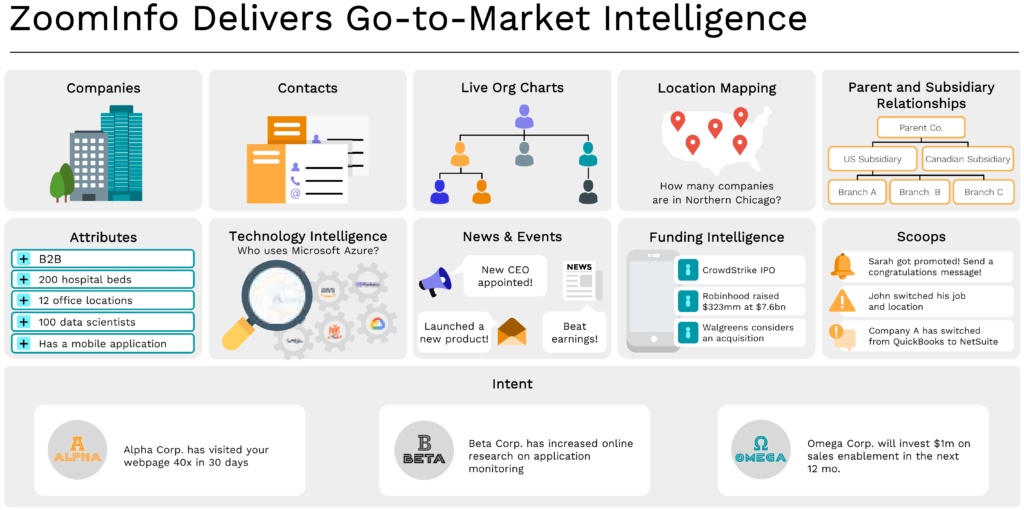

ZoomInfo Technologies Inc. is a software and data company that provides a go-to-market intelligence platform for sales and marketing teams. Their cloud-based platform offers a comprehensive database of business contacts and company information. This data helps salespeople and marketers identify target customers, personalize outreach, and close deals faster. The company was founded in 2007 and is headquartered in Vancouver, Washington.

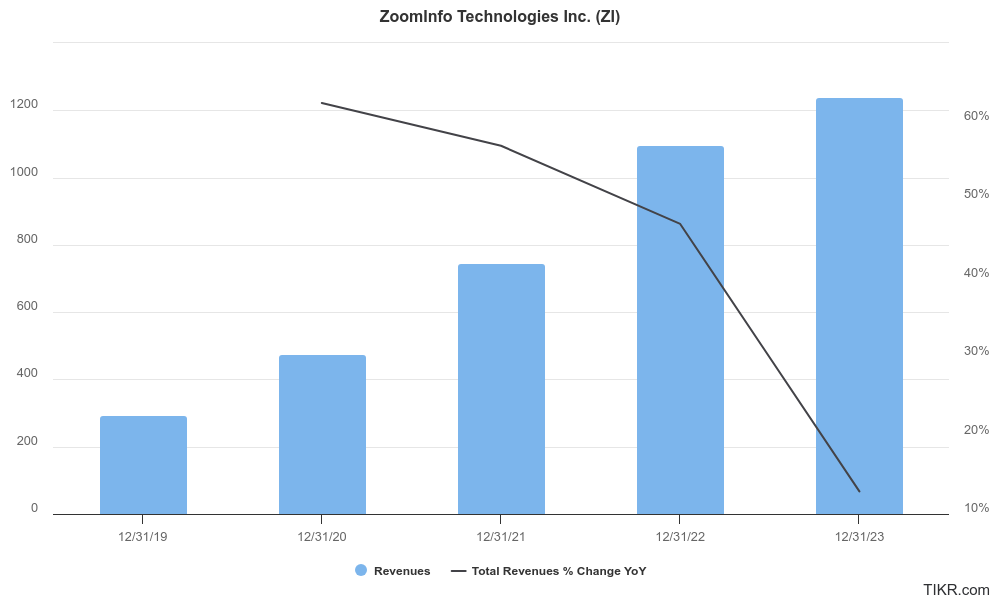

ZoomInfo Technologies Inc. beat analyst expectations for revenue, bringing in $310.1 million, which is a 3.13% increase year-over-year. Earnings per share (EPS) did outperform expectations, coming in at $0.26, reflecting an 8.33% increase year-over-year.

Stock Overview:

| Ticker | $ZI | Price | $12.28 | Market Cap | $4.59B |

| 52 Week High | $30.16 | 52 Week Low | $11.67 | Shares outstanding | 373.92M |

Company background:

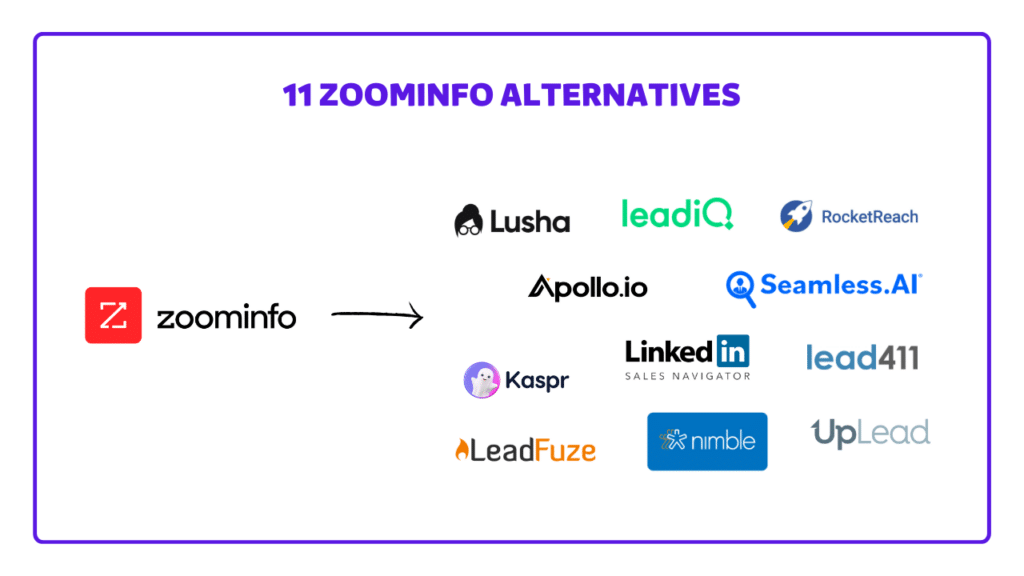

ZoomInfo Technologies Inc. is a software and data company. This platform incorporates a comprehensive database that includes business contact and company information. By leveraging ZoomInfo’s data, salespeople and marketers can identify target customers, personalize their outreach strategies, and ultimately close deals more efficiently. ZoomInfo faces competition from several established players in the market, including Salesforce, Dun & Bradstreet, and LeadGenius.

Recent Earnings:

- Revenue and Growth: ZoomInfo delivered revenue of $310.1 million, exceeding analyst expectations by a slight margin. This represents a modest year-over-year growth of 3.13%.

- EPS and Growth: Earnings per share (EPS) came in at $0.26, outperforming analyst expectations. This translates to an 8.33% increase compared to the same period last year.

The Market, Industry, and Competitors:

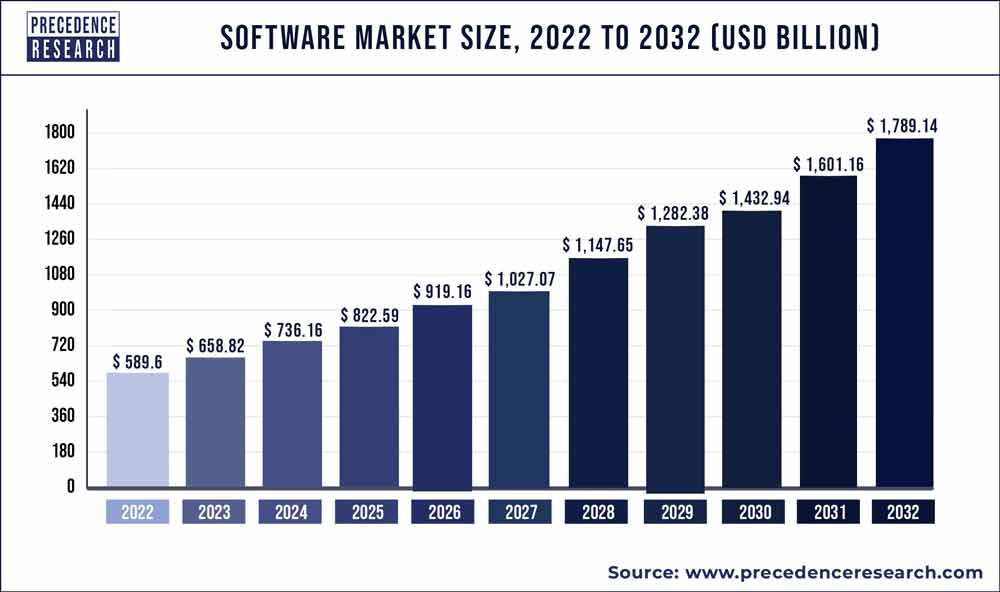

ZoomInfo Technologies Inc. market provides tools and data that empower sales and marketing teams to identify and target potential customers. Market research indicates this is a rapidly growing field due to the increasing importance of data-driven sales and marketing strategies.

CAGR (Compound Annual Growth Rate) is also to be determined based on analyst reports, but it’s expected to be in the double digits.

Unique differentiation:

Direct Competitors:

- Apollo.io: A strong competitor offering a comprehensive B2B data platform with features like lead generation, email enrichment, and omnichannel engagement tools.

- LeadGenius: Another ZoomInfo rival that provides sales intelligence solutions with a focus on real-time data and conversation insights.

- Salesforce Sales Cloud: A giant in the CRM space, Salesforce offers its own Sales Cloud which includes lead generation and contact management functionalities that compete with ZoomInfo’s offerings.

Indirect Competitors:

- LinkedIn Sales Navigator: LinkedIn Sales Navigator offers advanced search functionalities and lead generation tools that can be alternatives for specific use cases.

- Clearbit: This company focuses on data enrichment and verification, providing a complementary service that some ZoomInfo users might integrate alongside their main platform.

Comprehensiveness and Depth of Data: ZoomInfo prides itself on having one of the most extensive and verified databases of business contacts and company information. This allows for deeper insights and more targeted outreach compared to competitors with potentially less comprehensive data.

Focus on Go-to-Market Strategy: ZoomInfo’s platform is specifically designed to cater to the entire go-to-market process for sales and marketing teams. This includes features for lead generation, contact enrichment, data analysis, and campaign management, making it an all-in-one solution for many users.

Integration Capabilities: ZoomInfo offers seamless integration capabilities with several popular CRM and marketing automation platforms. This streamlines workflows and allows users to leverage their data within existing systems for maximum impact.

Verified Data and Accuracy: ZoomInfo emphasizes the accuracy and verification of its data, which is crucial for sales and marketing teams to avoid wasted efforts and ensure successful outreach.

Management & Employees:

Henry Schuck (CEO): As the Founder and CEO, Henry Schuck plays a pivotal role in shaping ZoomInfo’s vision and strategy.

Cameron Hyzer (CFO): Cameron Hyzer leads ZoomInfo’s financial operations, ensuring financial health and driving strategic growth initiatives.

Chris Hays (COO): Chris Hays oversees daily operations and streamlines internal processes to maximize efficiency across the organization.

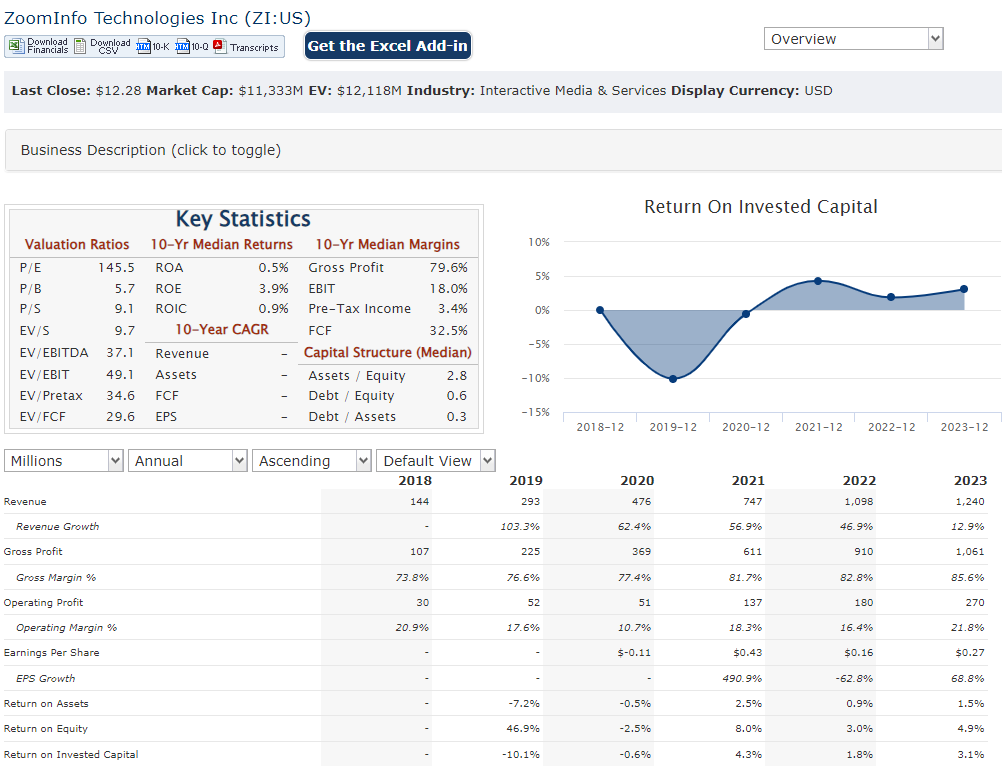

Financials:

ZoomInfo Technologies Inc.’s has managed to consistently increase its top line year-over-year, though the exact percentage growth can vary depending on the specific reporting period. This would provide a single number representing the average annual growth rate.

While ZoomInfo has demonstrated profitability, their earnings haven’t always kept pace with revenue growth. This could be due to factors like increased investments in research and development, marketing expenditures, or potential fluctuations in operating costs. Calculating the CAGR for earnings over the past five years would be beneficial to understand the overall trend in profitability. They might also have taken on debt to finance these activities.

Technical Analysis:

The stock is in a stage 4 markdown and decline (bearish) on both the monthly and weekly charts. While reversal in the $12 range looks likely with some support available, given the overall direction of the stock and its poor guidance for 2024, we would avoid buying the stock for now. It is more likely they company will get acquired by private equity in the near future.

Bull Case:

Strong Product Offering: ZoomInfo boasts a comprehensive and verified data platform that caters to the entire go-to-market process for sales and marketing teams. Features like lead generation, data analysis, and campaign management position them as a strong all-in-one solution for many users.

Focus on Data Accuracy: Accurate and verified data is crucial for successful sales and marketing campaigns. ZoomInfo’s emphasis on data quality can give them a competitive edge and improve customer trust.

Upselling and Cross-Selling Opportunities: The existing customer base presents opportunities for upselling and cross-selling additional ZoomInfo products and services. This can be a significant driver of future revenue growth.

Bear Case:

Market Saturation: The Sales and Marketing intelligence market is becoming increasingly competitive. New entrants and established players could chip away at ZoomInfo’s market share, hindering future growth.

Data Accuracy Concerns: Despite ZoomInfo’s emphasis on data quality, there’s always a risk of inaccuracies or outdated information within their database. This could lead to customer dissatisfaction and hinder sales and marketing efforts for ZoomInfo’s clients.

Integration Challenges: Integrating ZoomInfo with various CRM and marketing automation platforms can be complex. If these integrations become cumbersome or malfunction, it could lead to customer frustration and churn.