Executive Summary:

The AZEK Company Inc. is a leading manufacturer of outdoor living products in the United States and Canada, known for their innovation, quality, and sustainability. Their products, including TimberTech decking and AZEK trim, are made with a high percentage of recycled materials and are designed to be low maintenance and aesthetically pleasing.

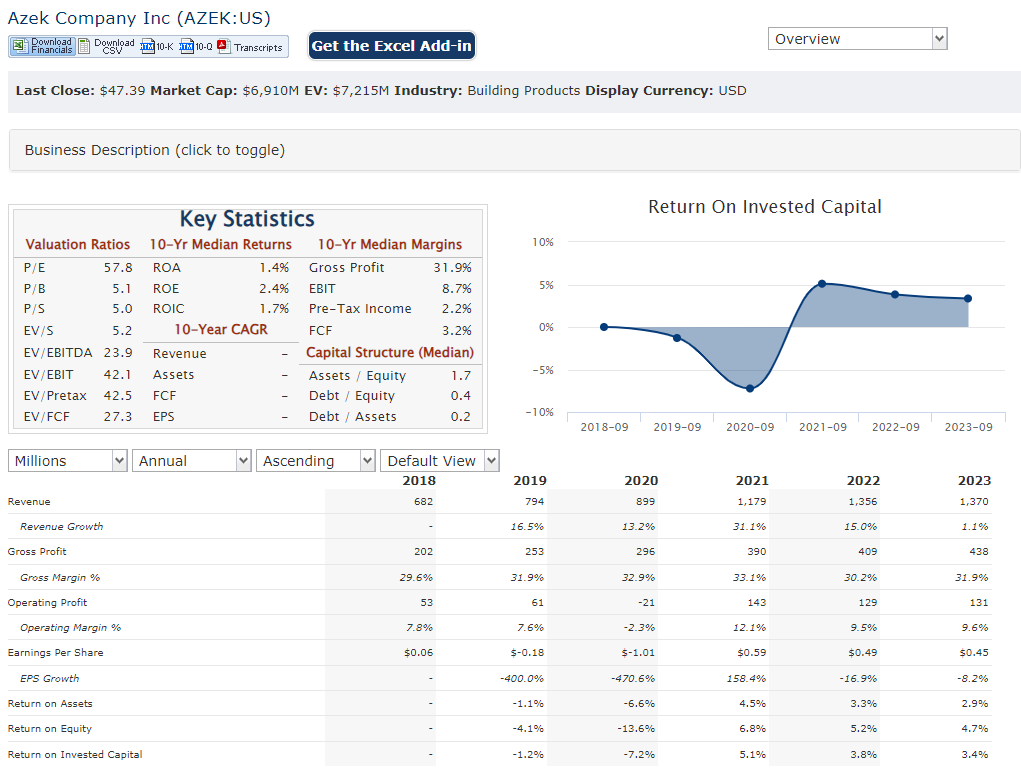

The AZEK Company Inc. adjusted earnings per share (EPS) were $0.36 for the quarter, an increase from $0.16 in the same period the prior year. Revenue for the year grew slightly to $1.37 billion, a 1.1% increase year-over-year.

Stock Overview:

| Ticker | $AZEK | Price | $47.39 | Market Cap | $6.91B |

| 52 Week High | $50.78 | 52 Week Low | $23.08 | Shares outstanding | 145.83M |

Company background:

The AZEK Company Inc. was founded in 1995 by Mitchell A. Jacoby and Joseph M. Katcha. Their product portfolio includes TimberTech decking, AZEK trim, Versatex trimboards, and vinyl railing, among others. The company faces competition from Trex Company, Versaille Deck, Wolf Composite, and CertainTeed Corporation. AZEK’s headquarters are located in Harrington, Delaware.

Recent Earnings:

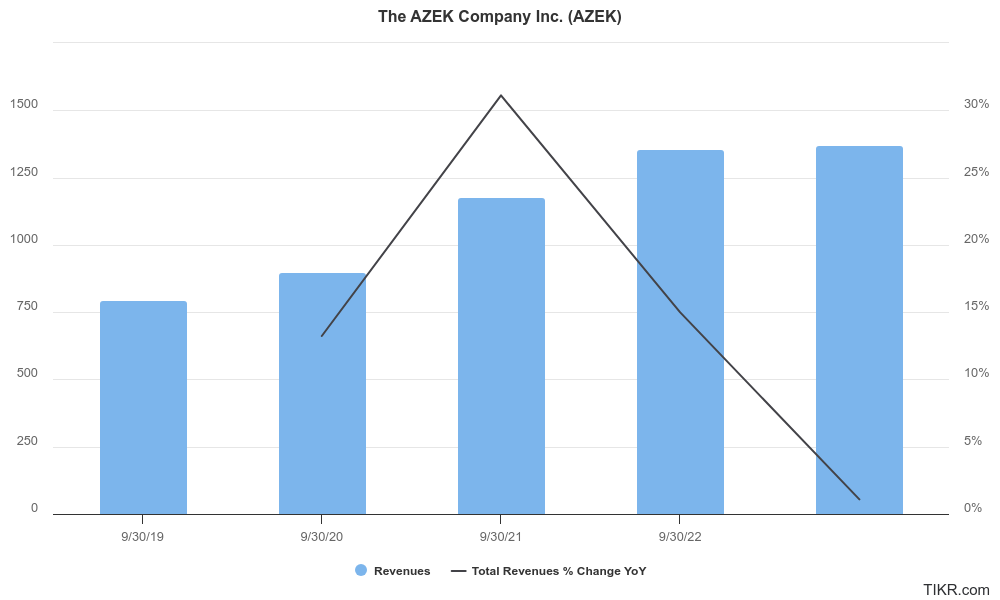

Revenue and Growth: Net sales for the year grew slightly to $1.37 billion, representing a modest 1.1% increase year-over-year. This indicates somewhat stagnant top-line growth.

EPS and Growth: Adjusted earnings per share (EPS) fared better, reaching $0.74 for the year, a significant increase compared to $0.97 in the previous fiscal year. However, this translates to a 23.7% decline.

Operational Metrics: EBITDA for the year reached $291.2 million, representing a slight decrease of $9.8 million compared to fiscal year 2022.

The Market, Industry, and Competitors:

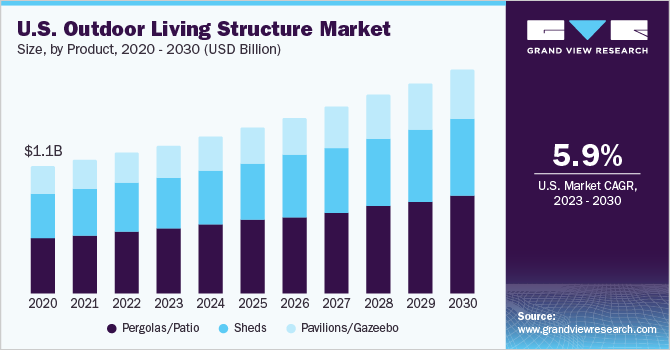

- Rising Popularity of Outdoor Living: Homeowners are increasingly investing in creating comfortable and attractive outdoor spaces, driving demand for AZEK’s products like TimberTech decking and AZEK trim.

- Increased Disposable Income: As disposable income rises, people are more likely to spend on home improvement projects, including outdoor renovations.

- Focus on Sustainability: AZEK’s commitment to using recycled materials aligns perfectly with the growing trend of sustainable building practices, making their products an attractive option for eco-conscious consumers.

Unique differentiation:

Trex Company: A leading competitor known for its Trex brand of composite decking and railing systems. Trex is a major force in the market, often compared to AZEK in terms of quality, innovation, and brand recognition.

CertainTeed Corporation: A large and diversified building materials company that offers a wide range of products, including competing vinyl and composite decking options. CertainTeed’s broad product portfolio and brand reputation make them a significant competitor for AZEK.

Other Players: Beyond these main rivals, there are additional companies vying for market share in the outdoor building products space. These include companies like Versatex, Wolf Composite, and even larger building materials companies that offer decking options alongside other products.

Focus on Sustainability: AZEK prioritizes using recycled materials in their products, boasting a higher percentage of recycled content than some competitors. This aligns with the growing trend of sustainable building practices and attracts eco-conscious consumers.

Quality and Aesthetics: AZEK products are known for their high quality and attractive aesthetics. They offer a variety of colors, styles, and textures to suit different design preferences, allowing homeowners to create a customized outdoor space.

Management & Employees:

Jesse Singh (CEO): As Chief Executive Officer, President, and Director, Jesse Singh leads the company’s overall strategy and growth initiatives.

Jonathan Skelly (President, Residential and Commercial): With experience in strategy, mergers and acquisitions, and customer experience, Jonathan Skelly oversees both the residential and commercial segments of AZEK’s business.

Chris Latkovic (Senior Vice President of Operations): Chris Latkovic manages AZEK’s production and manufacturing processes, ensuring efficient operations and product quality.

Financials:

Revenue Growth: AZEK has seen steady top-line growth, with annual revenue increasing from around $800 million in 2019 to $1.37 billion in 2023.

Earnings Growth: There’s been an overall trend of increasing earnings, with AZEK transitioning from a net loss in some earlier years to positive net income in recent years.

Technical Analysis:

A beautiful cup and handle on the monthly and weekly chart indicates a strong base built for a move higher. The stock has reversed already on the $42 zone and wants to head higher to $50s again. The RSI and MACD are primed well for a move to the $50s and a breakout after.

Bull Case:

Profitability Potential: While earnings haven’t always shown a linear increase, the company has transitioned to positive net income. Continued focus on operational efficiency and cost management can lead to improved profitability margins in the future.

Limited Downside Risk: The strong underlying trends in the outdoor building products market suggest a limited downside risk for AZEK’s stock. Even if the company experiences some short-term fluctuations, the long-term outlook remains positive.

Bear Case:

Rising Material Costs: The cost of raw materials used in AZEK’s products can fluctuate. If these costs rise significantly, it could squeeze their profit margins and make it difficult to maintain current prices.

Limited Dividend: Unlike some competitors, AZEK doesn’t currently offer a dividend on its stock. This can be a drawback for income-oriented investors seeking regular payouts.

Weather Dependence: Sales of outdoor building products can be impacted by weather conditions. A season with particularly harsh weather could lead to lower sales for AZEK.