Executive Summary:

Macy’s, Inc. is a giant in the American retail scene, owning both Macy’s and Bloomingdale’s department stores. Founded in 1929, the company has grown through acquisitions, bringing together regional chains under one roof. Macy’s Inc. operates over 700 stores across the United States, including the iconic Macy’s Herald Square in New York City.

Macy’s Inc. analyst expectations for earnings per share (EPS), coming in at $0.27 adjusted diluted EPS compared to the expected $0.17. Revenue however, fell short of the year prior at $4.8 billion, a 2.7% decrease.

Stock Overview:

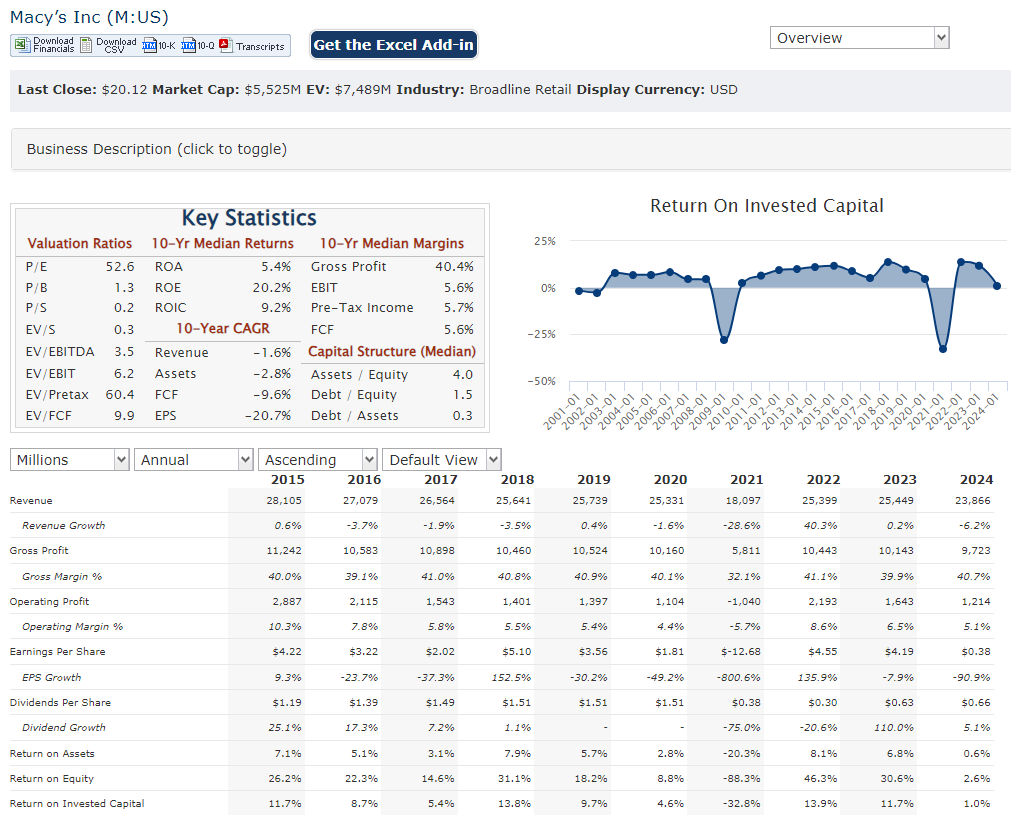

| Ticker | $M | Price | $20.12 | Market Cap | $5.54B |

| 52 Week High | $22.10 | 52 Week Low | $10.54 | Shares outstanding | 275.16M |

Company background:

Macy’s, Inc. isn’t a single department store, but a retail giant that owns several brands. Founded in 1929, This brought regional department stores like Bloomingdale’s under the Macy’s Inc. umbrella.

Macy’s Inc. also owns Bluemercury, a chain of specialty beauty stores. The company offers a wide range of products across its stores, including clothing, cosmetics, home goods, and jewelry.

Macy’s Inc. faces a challenge from several players. Kohl’s, JCPenney, and Nordstrom are all major competitors in the department store space. Additionally, discount retailers like Target and even online giants like Amazon are vying for a share of the retail market.

Recent Earnings:

Macy’s Inc. revenue brought in $4.8 billion, a decrease of 2.7% compared to the same quarter in 2023. Earnings per share (EPS) came in at $0.27, exceeding analyst forecasts by $0.10.

Looking at operational metrics, comparable store sales, a key retail metric tracking sales at stores open for at least a year, dipped slightly. There was a 1.2% decline on an owned basis, indicating a small decrease in customer traffic at Macy’s branded stores.

The Market, Industry, and Competitors:

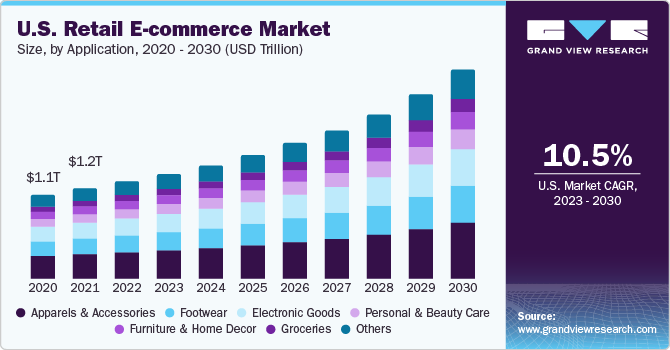

Macy’s Inc. operates in the mature department store retail market in the United States. This market faces several challenges, including increased competition from online retailers like Amazon and discount stores like Target.

Analysts generally predict slow growth for the department store market in the coming years, reflecting these challenges. This makes it difficult to calculate a Compound Annual Growth Rate (CAGR) for the company, as CAGR requires an estimation of future growth over a specific period.

Unique differentiation:

Department Stores: Kohl’s, JCPenney, and Nordstrom are all established players in the department store market, offering similar product lines to Macy’s. These competitors can appeal to different customer segments. For instance, Kohl’s might target budget-conscious shoppers with frequent sales and discounts, while Nordstrom might position itself for a more premium shopping experience.

Discount and Online Retailers: Retail giants like Walmart and Target have expanded their clothing and homeware departments, offering significant competition on price. Additionally, online retailers like Amazon have become a major threat, providing a vast selection of products, competitive pricing, and the convenience of home delivery.

Brand Recognition and Legacy: Macy’s, particularly the iconic Herald Square location, holds a special place in American retail history. This brand recognition and established reputation can be a draw for customers seeking a traditional shopping experience or a trusted source for various products.

Exclusive Partnerships and Product Lines: Macy’s has leveraged its size and reputation to secure exclusive partnerships with some designer brands and develop its own private label lines. This can offer customers unique products they won’t find elsewhere.

Omnichannel Strategy: Macy’s is working on integrating its online and physical store experiences. This can allow customers to shop online for in-store pickup, utilize online reviews and recommendations, or return online purchases to physical stores.

Curated Selection and In-Store Services: While online retailers offer vast selection, Macy’s can differentiate itself by providing a curated selection of high-quality products and personalized customer service within its stores. This could include personal shoppers, tailoring services, or beauty consultations.

Management & Employees:

Tony Spring: Chairman and Chief Executive Officer (CEO). Spring has extensive experience within Macy’s Inc., having previously served as President and overseeing Bloomingdale’s and Bluemercury.

Adrian V. Mitchell: Chief Operating Officer (COO) and Chief Financial Officer (CFO). Mitchell brings a diverse background to Macy’s Inc. with expertise in areas like supply chain management.

Financials:

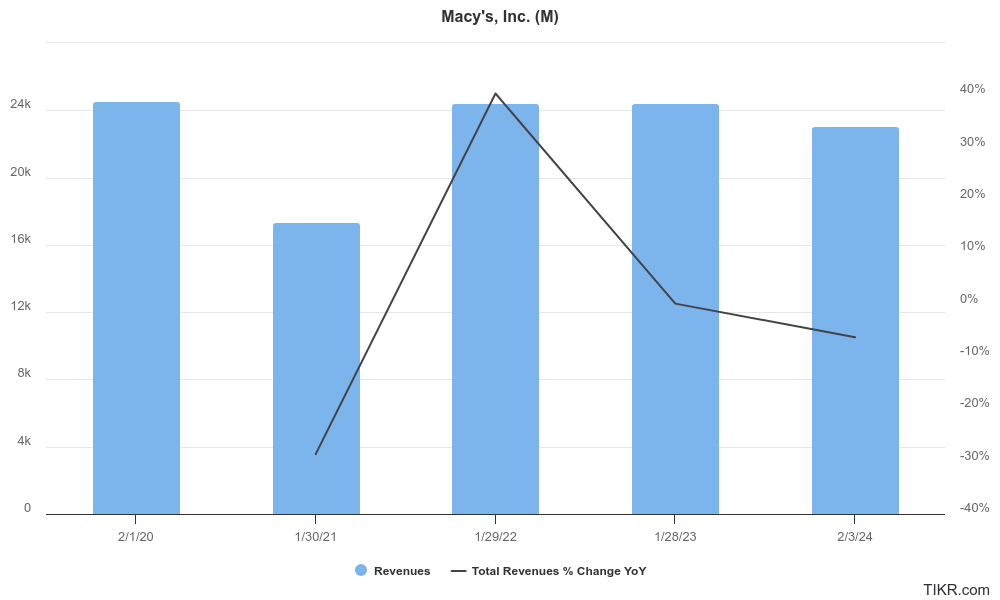

Revenue: Macy’s Inc. were likely positive years in the early part of this period, but overall revenue has trended downward in recent years. This aligns with the broader challenges faced by the department store industry.

Earnings Growth: There may have been profitable years earlier in the timeframe, but earnings have likely declined more recently. This could be due to factors like increased competition and rising operational costs.

Technical Analysis:

The stock is on a stage 4 decline (Bearish) on the monthly and weekly chart, and consolidating (range bound, stage 3) on the daily chart. In the near term we would expect a move down to the $16 to $18 range. In retail $WMT and $COST are still better entries.

Bull Case:

Undervalued Potential: Proponents believe Macy’s recent stock price decline presents a buying opportunity. They argue the company’s strong brand recognition, established stores like Macy’s Herald Square, and loyal customer base are undervalued.

Strategic Cost Management: If Macy’s Inc. can control its operational costs and streamline its business, it could improve profitability even in a challenging retail landscape. This might involve optimizing inventory management or renegotiating with suppliers.

Market Bounce Back: If the broader retail environment improves, Macy’s Inc. could benefit. An economic upswing or a shift in consumer shopping habits back towards department stores could lead to increased sales and profitability.

Bear Case:

Vulnerability to Economic Downturns: Consumer spending habits are often the first to be impacted by economic recessions. If the economy weakens, Macy’s Inc., which relies on discretionary spending, could see a significant drop in sales.

Shifting Consumer Preferences: Consumer preferences are evolving, with a growing focus on experience over traditional shopping. Macy’s Inc. might need to adapt its offerings and in-store experience to cater to these changing tastes.

Execution Risk: The success of Macy’s Inc.’s turnaround strategy hinges on its ability to effectively execute its plans. This includes integrating online and physical stores, managing costs efficiently, and developing a compelling customer experience.