Executive Summary:

StoneCo Ltd. is a Brazilian financial technology company that offers software solutions to businesses for conducting electronic transactions. Their services cater to in-store, online and mobile commerce channels. They primarily focus on small and medium businesses but also serve marketplaces and larger enterprises. StoneCo Ltd. prides itself on its client-centric approach and aims to empower businesses to grow through its technological solutions. The company was founded in 2000 and is headquartered in the Cayman Islands.

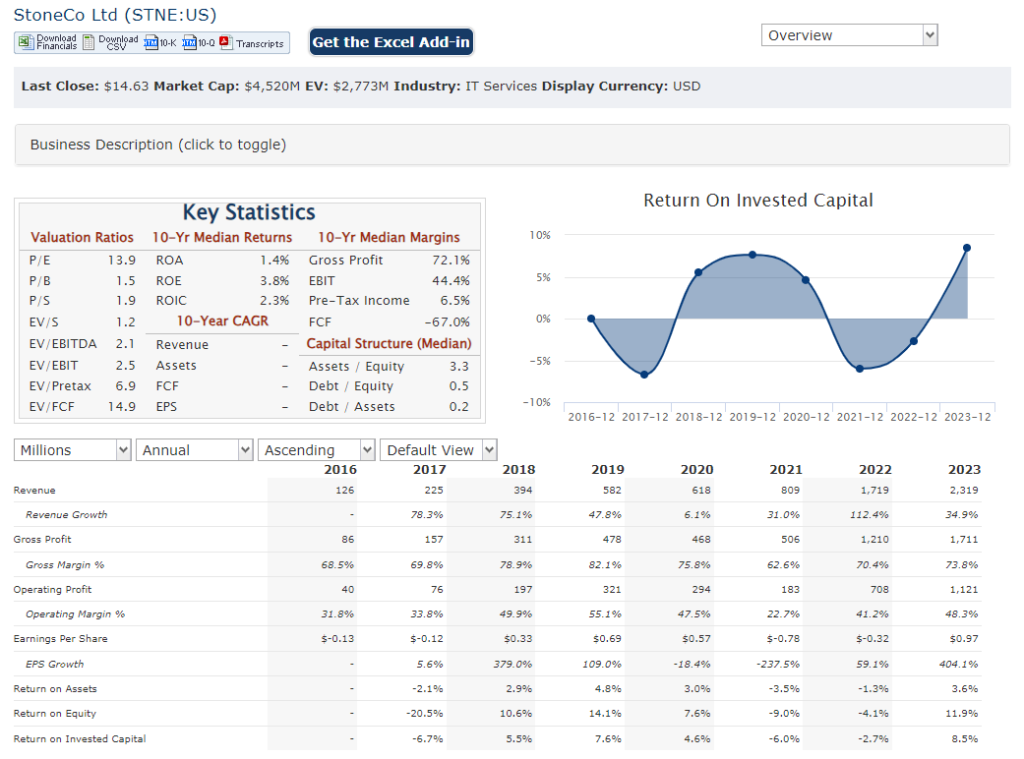

StoneCo Ltd. reported Earnings per share (EPS) came in at 1.42, while total revenue reached R$3.08 billion. This represents a 20.1% year-over-year increase in revenue.

Stock Overview:

| Ticker | $STNE | Price | $14.63 | Market Cap | $4.52B |

| 52 Week High | $19.46 | 52 Week Low | $9.34 | Shares outstanding | 290.2M |

Company background:

StoneCo Ltd., founded by Thiago Macêdo and André Street. StoneCo’s include point-of-sale systems, enterprise resource planning software, and digital banking tools.

The company is securing funding through private investments and an initial public offering (IPO) in 2020. StoneCo Ltd. is headquartered in the Cayman Islands but maintains a strong presence in Brazil, where they compete with other financial technology players like Cielo and PagSeguro.

Recent Earnings:

StoneCo Ltd. revenue hit R$3.08 billion, reflecting a year-over-year increase of 20.1%. This growth was primarily driven by a 24.4% rise in their financial services platform revenue, likely due to a larger active client base and increased monetization from existing clients, particularly in the micro, small, and medium-sized business (MSMB) segment. StoneCo Ltd. reported earnings per share (EPS) of $1.42.

They boasted having 3.7 million active payment clients and a total payment volume of R$390.7 billion for MSMBs over the last twelve months (LTM), which includes PIX P2M.

The Market, Industry, and Competitors:

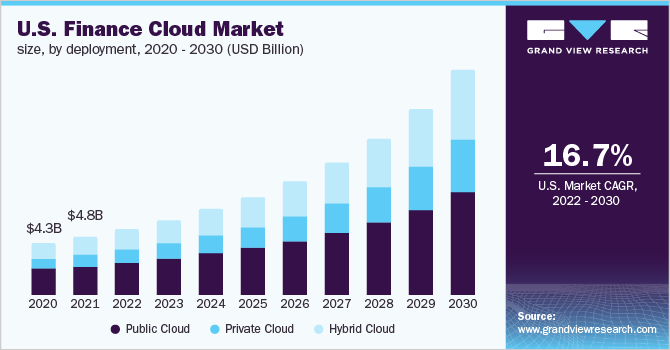

StoneCo Ltd. operates in the Brazilian FinTech (Financial Technology) market. Fueled by a large and increasingly tech-savvy population, Brazil presents a fertile ground for financial technology solutions. Analysts project a Compound Annual Growth Rate (CAGR) in the high-teens for the Brazilian FinTech market by 2030. This growth is driven by factors like rising smartphone penetration, increasing internet access, and a growing demand for convenient and secure financial services.

This surge in FinTech adoption is particularly beneficial for companies like StoneCo Ltd. StoneCo’s cloud-based solutions cater specifically to the needs of Brazilian businesses, offering them the tools to conduct electronic transactions across various channels.

Unique differentiation:

- PagSeguro: A major competitor offering similar financial technology solutions, including point-of-sale systems, digital payments processing, and online banking tools. PagSeguro boasts a large client base and strong brand recognition in Brazil. They particularly focus on the micro and small business segments, similar to StoneCo Ltd.

- Cielo: Another well-established competitor, Cielo is a dominant player in merchant acquiring and payment processing services in Brazil. They have a vast network of physical points-of-sale and offer comprehensive payment solutions for businesses of all sizes.

StoneCo differentiates itself through its focus on client service, user-friendly technology, and building a robust financial services ecosystem for its clients. By continually innovating and expanding its offerings.

Client-Centric Approach: StoneCo prioritizes exceptional customer service and building strong relationships with its clients. This focus ensures businesses receive personalized support and solutions tailored to their specific needs.

Building a Financial Services Ecosystem: StoneCo goes beyond simply providing point-of-sale systems or payment processing. They aim to create a comprehensive financial services ecosystem for their clients. This might include offering additional services like digital banking tools, working capital solutions, and other tools that empower businesses to manage their finances effectively.

Management & Employee:

- Thiago Piau: Chief Executive Officer (CEO)

- Board of Directors

- Mauricio Luis Luchetti (Chairman)

- Gilberto Caldart (Vice-Chairman)

Financials:

StoneCo Ltd. revenue has risen steadily, with a Compound Annual Growth Rate (CAGR) likely exceeding 30% based on available information. This impressive growth is fueled by the increasing adoption of FinTech solutions in Brazil and StoneCo’s success in capturing a share of this expanding market.

StoneCo has reported some profitable quarters, there have also been periods of net losses. StoneCo Ltd. likely has a growing asset base due to factors like user base expansion and potential acquisitions. The company might also have increasing liabilities to support its ongoing operations and potentially manage debt financing.

Technical Analysis:

On the monthly and weekly chart the based (cup) that was formed also had a handle, but momentum has moved lower in the daily chart. The stock is in a stage 4 decline and on the daily chart, with a break on the 200 day moving average. There is some support at $14.26, but most likely will break that given the lack of momentum or relative strength. We are not bullish long term, and find other opportunities in #fintech such as $NU or $MELI a better fit.

Bull Case:

Strong Client Focus: StoneCo prioritizes exceptional customer service and building strong relationships with its clients. This could lead to higher client retention, increased adoption of their service offerings, and potentially a larger market share within the Brazilian FinTech landscape.

Expanding Ecosystem: StoneCo goes beyond just point-of-sale systems, aiming to create a comprehensive financial services ecosystem for businesses. This might include digital banking tools, working capital solutions, and other tools that make them a one-stop shop for businesses’ financial needs.

Bear Case:

Economic Dependence: StoneCo’s performance is heavily tied to the Brazilian economy. An economic downturn in Brazil could significantly impact consumer spending and business investment, leading to a decline in demand for StoneCo’s FinTech solutions.

Currency Fluctuations: Since StoneCo reports earnings in Brazilian Reais (BRL) but has American investors, fluctuations in the exchange rate can impact the attractiveness of their stock. A strengthening US dollar relative to the BRL could decrease the value of StoneCo’s earnings for US investors.

Have you heard of Zenvia? (ZENV on nasdaq)

No Matt. I will check