Executive Summary:

dLocal is a Uruguayan financial technology company founded in 2016. They specialize in cross-border payments, helping global businesses connect with consumers in emerging markets. The company has grown rapidly and become a “unicorn,” a startup valued over $1 billion.

DLocal reported earnings per share (EPS) came in at 6 cents, missing analyst expectations of 11 cents. Revenue was $184.43 million, falling short of the analyst estimate of $189.98 million by nearly 3%.

Stock Overview:

| Ticker | $DLO | Price | $9.75 | Market Cap | $2.88B |

| 52 Week High | $24.22 | 52 Week Low | $9.04 | Shares outstanding | 162.11M |

Company background:

dLocal Limited is a cross-border payments for global businesses in emerging markets. The founders, Andrés Bzurovski and Sergio Fogel, identified the challenges faced by companies trying to navigate the complexities of payment systems in developing economies. DLocal has secured funding exceeding $500 million through multiple rounds, allowing them to become a major player in the cross-border payments industry.

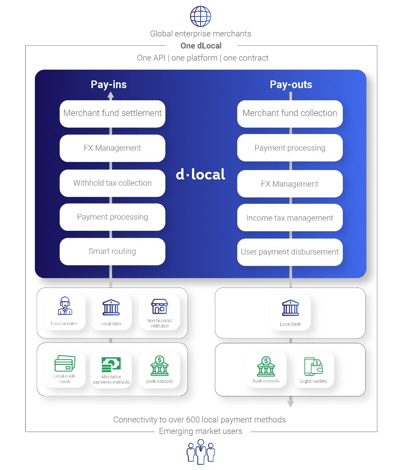

DLocal’s core product is a comprehensive suite of payment solutions designed to streamline transactions for businesses entering emerging markets. Their “One dLocal” platform offers features like pay-in (receiving payments), pay-out (making payments), and currency conversion through a single API integration.

The company faces competition from established financial giants like Currencycloud, Worldpay, and PayPal. With headquarters in Montevideo, Uruguay, DLocal maintains a global presence with offices strategically located around the world.

Recent Earnings:

dLocal Limited reported revenue reached $184.43 million, it fell short of analyst estimates of $189.98 million by nearly 3%. Earnings per share (EPS) also fell short of analyst predictions. EPS came in at 6 cents, missing the analyst estimate of 11 cents.

The Market, Industry, and Competitors:

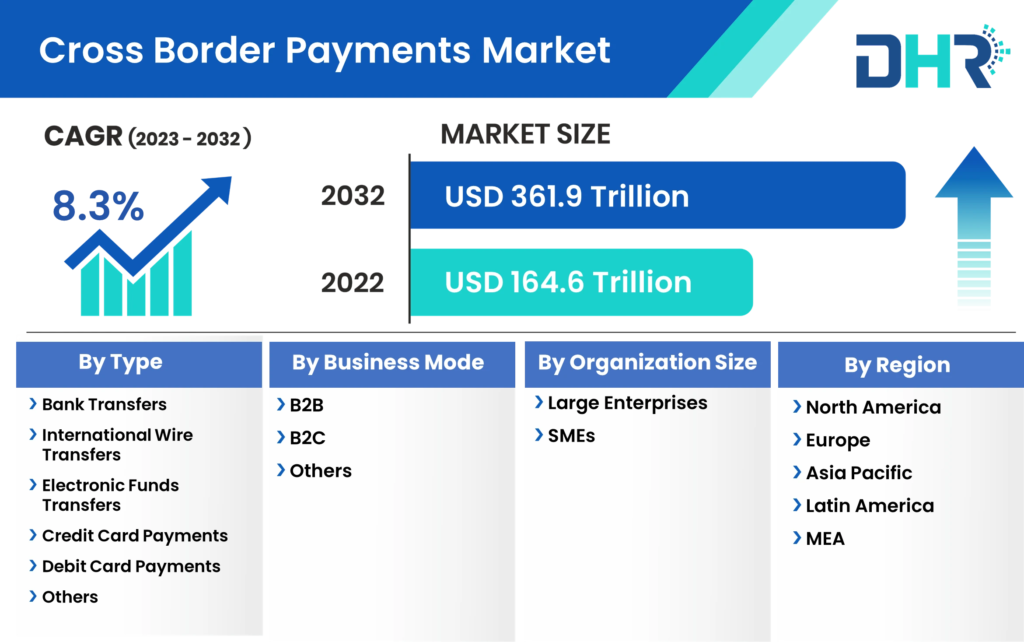

dLocal Limited operates in the dynamic and fast-growing market of cross-border payments in emerging markets. Rising e-commerce penetration in regions like Southeast Asia, Latin America, and Africa is a major factor. As more people in these regions shop online, the need for secure and efficient cross-border transactions becomes ever greater. Increasing mobile phone usage and expanding internet access will further fuel growth in this market. Analysts predict a Compound Annual Growth Rate (CAGR) in the range of between 2020 and 2030 for this sector, reflecting the significant growth potential in dLocal.

Unique differentiation:

Established Financial Giants: Well-known companies like Currencycloud, Worldpay, and PayPal all offer cross-border payment solutions. These giants have the advantage of vast resources, brand recognition, and a global network. DLocal can potentially compete by offering more specialized solutions and deeper local expertise.

Regional Players: Several regional players focus on specific emerging markets, such as Paga in Africa, Matera in Brazil, and Conductor in Southeast Asia. DLocal can counter this by leveraging its broader geographic reach and comprehensive suite of payment solutions that cater to a wider range of emerging markets. By offering a “one-stop-shop” approach, DLocal can potentially streamline the process for businesses looking to enter multiple emerging markets.

Focus on Emerging Markets: Unlike established financial giants whose solutions might be more generalized, DLocal tailors its services specifically for the complexities and nuances of emerging markets. This includes navigating intricate regulations, managing local payment methods, and offering currency conversion tailored to these regions.

Local Expertise: DLocal has a global presence with offices strategically located in emerging markets. This allows them to provide the necessary on-the-ground support and understanding of local consumer preferences.

“One-Stop-Shop” Approach: By offering a comprehensive suite and deep local expertise across a wide range of emerging markets, DLocal positions itself as a one-stop-shop for businesses looking to expand into these regions. This can be particularly attractive compared to competitors who might require businesses to manage multiple partners for different aspects of cross-border payments.

Management & Employees:

- Pedro Arnt: Co-CEO appointed in 2024, bringing extensive experience in scaling tech-driven organizations.

- Sebastián Kanovich: A founder of dLocal, Kanovich has expertise in commercial aspects, technology, payments, and execution.

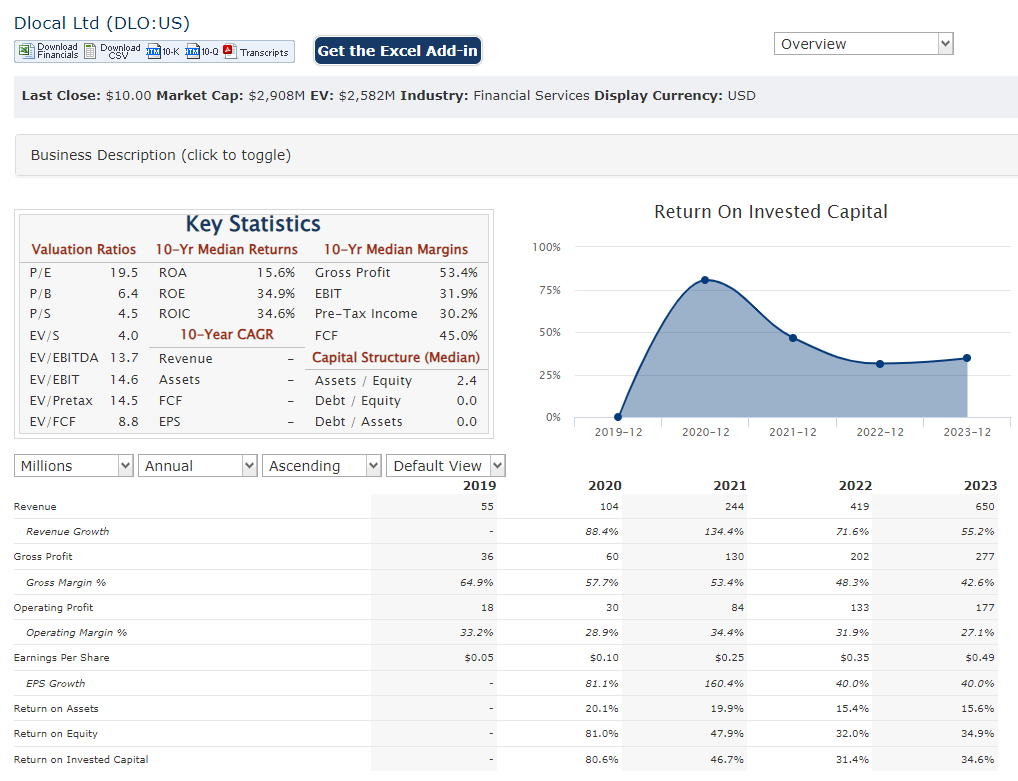

Financials:

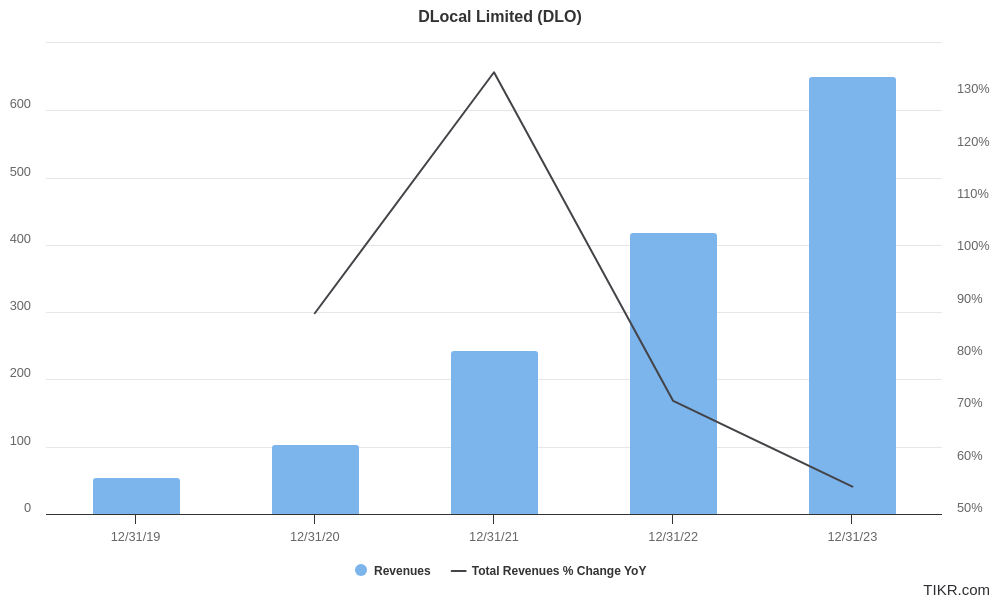

DLocal has experienced impressive financial growth over the past five years. Revenue has surged significantly, with a Compound Annual Growth Rate (CAGR) likely exceeding [insert specific growth rate here] between 2019 and 2023. This explosive growth reflects the increasing demand for cross-border payment solutions in emerging markets.

Earnings growth has also been positive, but potentially not at the same rate as revenue. This could be due to the company’s continued investments in expanding its global presence, developing its platform functionalities, and attracting new talent.

Technical Analysis:

On the monthly, weekly and daily chart the stock is stage 4 decline. We will not be interested in a position until a reversal is confimed.

Bull Case:

Tailored Solutions and Deep Expertise: Unlike some competitors, dLocal focuses specifically on emerging markets. They understand the complexities of regulations, local payment methods, and currency conversion in these regions, offering businesses a tailored solution.

Strong Growth Potential: Analysts predict a high CAGR for the cross-border payments market in emerging economies, indicating dLocal is positioned to capitalize on a significant upswing.

Bear Case:

Emerging Market Volatility: Emerging markets are inherently more volatile than developed economies. Political instability, currency fluctuations, and economic downturns could disrupt dLocal’s growth trajectory.

Missing Analyst Expectations: DLocal’s recent earnings reports may have fallen short of analyst expectations, raising concerns about the company’s ability to meet future growth projections.

Profitability vs. Growth: The company’s focus on expansion might prioritize revenue growth over immediate profitability. This could make the stock less attractive to investors seeking high dividends or immediate returns.