Executive Summary:

Lyft is a transportation company in the United States and Canada offering ride-hailing, scooters, bikes, car rentals, and even food delivery in some areas. They operate a network of drivers connected to riders through their app, and also provide businesses with transportation solutions. Founded in 2007, Lyft is the second-largest ridesharing company in the US after Uber.

Lyft reported their revenue hit $1.3 billion, up 28% year-over-year, while they reported a loss of -$0.07 per share.

Stock Overview:

| Ticker | $LYFT | Price | $17.08 | Market Cap | $6.88B |

| 52 Week High | $20.82 | 52 Week Low | $7.85 | Shares outstanding | 394.6M |

Company background:

Lyft was founded by Logan Green and John Zimmer, Lyft is a transportation company headquartered in San Francisco, California. They started as a peer-to-peer ridesharing service, connecting drivers and passengers through their mobile app. They’ve expanded their offerings to include bikes, scooters, car rentals, and even food delivery in some regions.

Their goal is to be a one-stop shop for all your travel needs, offering a variety of transportation options within a single platform.

Recent Earnings:

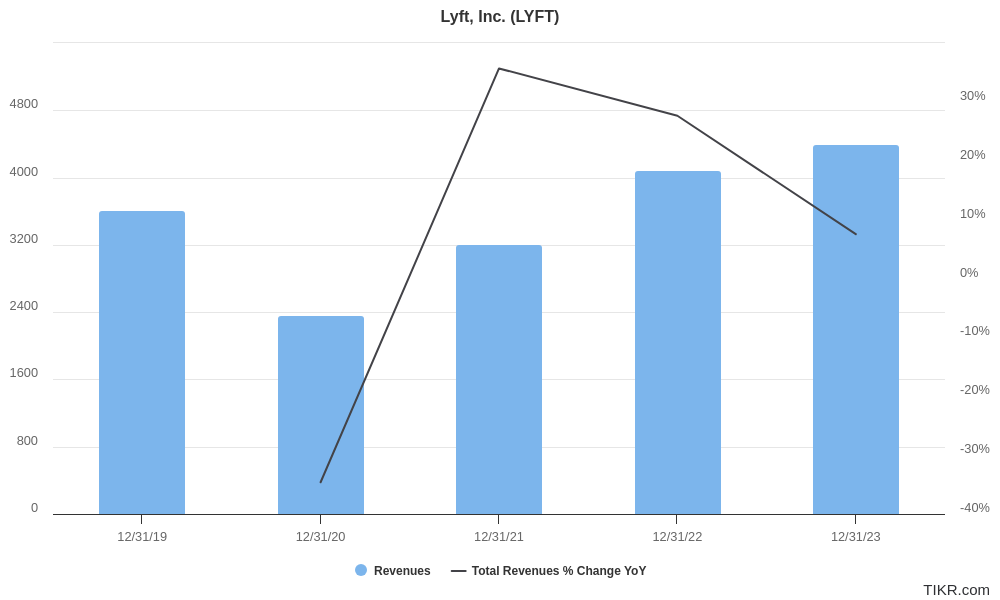

Lyft’s revenue reached $1.3 billion, reflecting a strong year-over-year growth of 28%. This growth seems to be fueled by a 21% increase in gross bookings, the total value of transactions on the platform.

On the earnings per share (EPS) front, Lyft also outperformed analyst expectations. The company reported a loss of -$0.07 per share, which was narrower than the -$0.16 loss analysts had predicted. The company is likely benefiting from increased ridership and potentially improved efficiency.

Lyft provided an optimistic outlook for the second quarter of 2024. They project gross bookings to land between $4.0 billion and $4.1 billion, representing continued growth. They expect Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) to reach $95 million to $100 million, reflecting a healthy profit margin.

The Market, Industry, and Competitors:

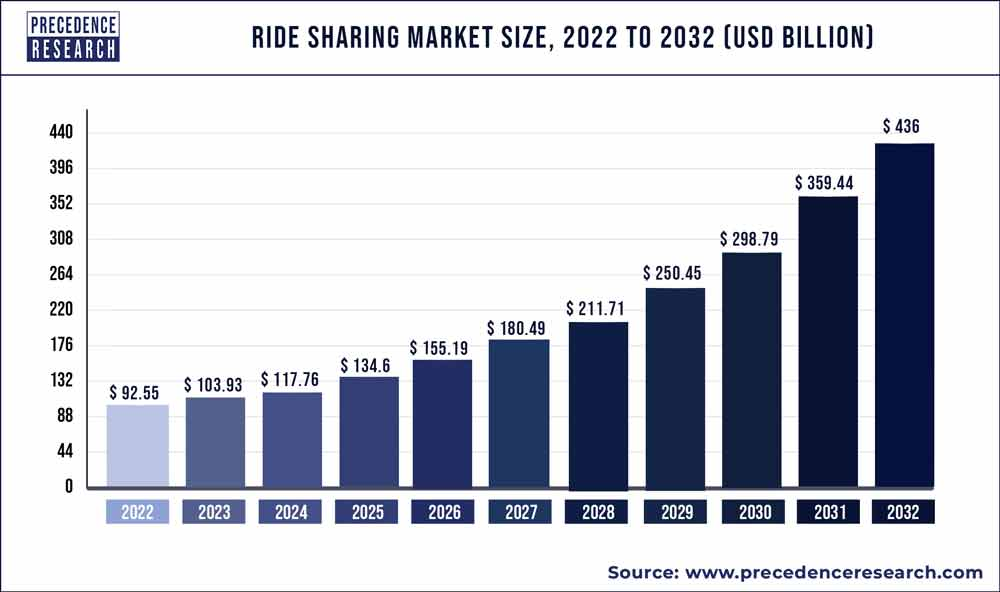

Lyft operates in the rapidly growing ride-hailing market, which is expected to reach a global market size of around $6 trillion by 2 According to a study by McKinsey, the ride-hailing industry is anticipated to experience a compound annual growth rate (CAGR) of around 14% between 2020 and 2030. This growth is fueled by factors like increasing urbanization, rising disposable incomes, and growing smartphone penetration in developing economies.

Lyft faces competition from other ride-hailing companies and also from alternative transportation options like public microtransit and electric scooters. Lyft’s future success will depend on its ability to innovate, expand its service offerings, and navigate this competitive landscape.

Unique differentiation:

Lyft faces competition on multiple fronts within the transportation industry. The most prominent competitor is undoubtedly Uber, the global ride-hailing giant. Uber holds the top spot in the market, with a larger user base and wider geographic reach. Both companies battle for market share by offering similar services, competitive pricing, and occasional promotions.

Beyond Uber, several regional players pose challenges in specific markets. For instance, Grab dominates Southeast Asia, while Didi holds a strong presence in China. These companies often cater to local preferences and regulations, making them formidable competitors within their respective regions.

Public microtransit services, bike-sharing programs, and electric scooter rentals are all vying for a piece of the urban transportation pie. These options often cater to shorter trips and can be more cost-effective, especially for younger demographics.

Brand Image: Compared to Uber’s focus on efficiency and speed, Lyft cultivates a more friendly and community-oriented image. Their pink mustaches and focus on charitable initiatives resonate with customers who value a positive and socially responsible experience.

Platform Diversification: While Uber remains primarily a ride-hailing service, Lyft has expanded its platform to include bikes, scooters, car rentals, and even food delivery . This multi-modal approach positions Lyft as a one-stop shop for urban transportation needs, offering riders a wider range of options for various situations.

Management & Employees:

David Risher (Chief Executive Officer and Director): Risher joined Lyft in 2021 as a board member and became CEO in April 2023. He brings leadership experience from the non-profit sector (Worldreader) and e-commerce (Amazon).

Kristin Sverchek (President): Sverchek has been with Lyft since 2012, holding various legal positions before becoming President in July 2023. Her deep understanding of the company’s history and legal landscape is a valuable asset.

Financials:

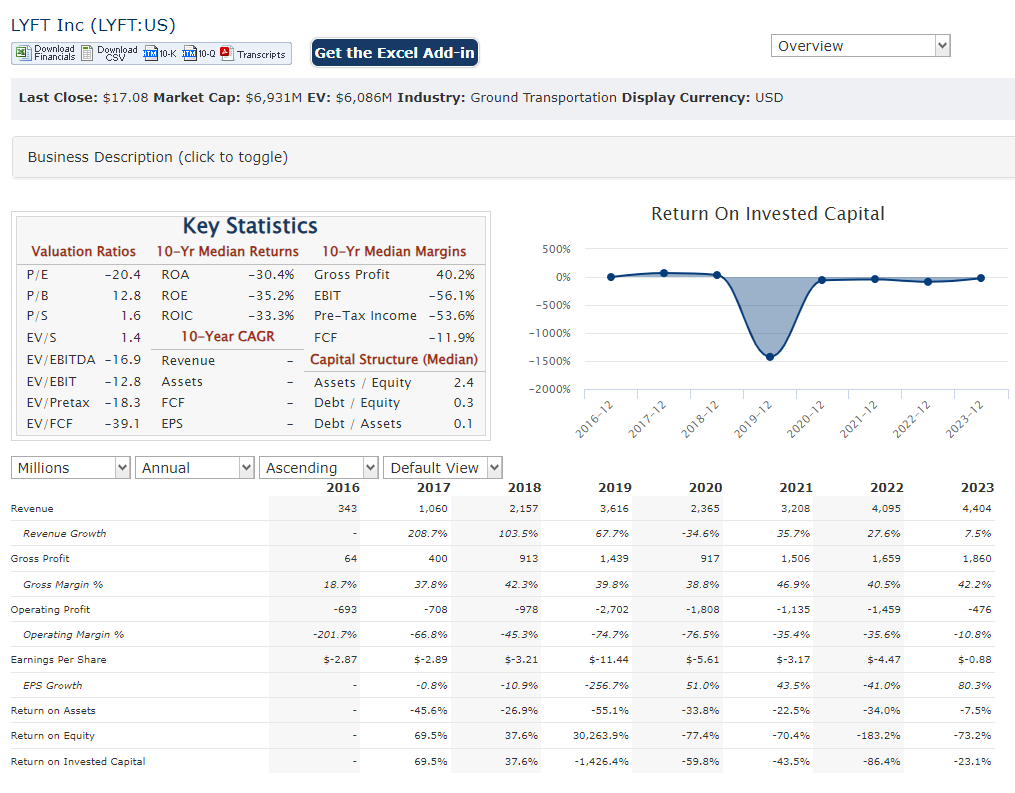

Lyft’s has steady revenue growth but continued losses. Revenue has increased year-over-year, with a Compound Annual Growth Rate (CAGR) likely in the double digits. This growth reflects an expanding user base and potentially an increase in the total value of transactions . Despite rising revenue, Lyft hasn’t achieved profitability yet.

Lyft likely has significant cash reserves accumulated from funding rounds. These funds have fueled their growth initiatives and helped them stay competitive in the ride-hailing market.

Technical Analysis:

Still forming a base on the monthly chart and a cup and handle (Bullish) on the weekly chart. On the daily chart the RSI and MACD indicate heading lower to $15s range, which might be a good long term entry for a move back to the $20s. In this space of ride sharing and delivery however, $UBER and $DASH seem like better options.

Bull Case:

Market Growth: The ride-hailing industry is anticipated to experience significant growth in the coming years, driven by urbanization, rising disposable incomes, and smartphone penetration in developing economies. This rising tide could lift all boats, including Lyft.

Improved Profitability: Lyft’s recent earnings reports show promising signs. They’re narrowing losses and exceeding analyst expectations, indicating progress towards profitability. If they can continue on this track, it would improve investor confidence and potentially lead to a higher stock price.

Bear Case:

Regulatory Landscape: The regulatory environment for ride-hailing companies remains fluid. Potential changes in regulations, especially regarding driver classification as employees, could significantly impact Lyft’s operating costs and business model.

Dependence on Drivers: Lyft relies heavily on a network of independent drivers. Disruptions in driver availability or recruitment due to factors like wages or working conditions could negatively impact their service availability and customer experience.

Macroeconomic Factors: Economic downturns or rising fuel costs could dampen consumer demand for ride-hailing services, impacting Lyft’s revenue and growth.