Executive Summary:

Dutch Bros Inc. is a publicly traded drive-thru coffee chain founded in Oregon in 1992. They specialize in handcrafted beverages including espresso drinks, cold brew, teas, and more. The company is headquartered in Grants Pass, Oregon and has franchised and company-owned locations primarily in the western United States, though they have expanded eastward to Florida.

Dutch Bros Inc. revenue jumped 39% year-over-year to $275 million. Earnings per share (EPS) also came in positive at $0.06.

Stock Overview:

| Ticker | $BROS | Price | $35.35 | Market Cap | $5.89B |

| 52 Week High | $36.25 | 52 Week Low | $22.67 | Shares outstanding | 78.57M |

Company background:

Dutch Bros Inc. is a high-growth drive-thru coffee chain founded by brothers Travis and Dane Boersma.

They focus on serving high-quality, handcrafted beverages with a focus on speed and friendly service. Customers can choose from hot and cold coffees, teas, frosts, their own Blue Rebel energy drink, and even nitrogen-infused cold brew.

Dutch Bros faces competition from coffee giants like Starbucks and Dunkin’ Donuts, but they differentiate themselves through their unique drive-thru experience, focus on customization, and energetic customer interaction.

Recent Earnings:

Dutch Bros Inc. revenue surged 39% year-over-year to $275 million, demonstrating continued momentum from 2023. Earnings per share (EPS) also came in positive at $0.06, beating out any analyst predictions.

The secret sauce behind Dutch Bros’ success this quarter lies in a combination of factors. Their unique menu offerings, including protein coffee and boba, fueled a 10% rise in same-store sales, a key metric indicating strong customer demand for existing stores. The company plans to accelerate spending to fuel continued expansion and capitalize on their current market momentum.

The Market, Industry, and Competitors:

Dutch Bros Inc. operates in the competitive specialty coffee shop market, facing giants like Starbucks and Dunkin’ Donuts. This market is expected to reach $81.7 billion by 2030 in the US alone, with a Compound Annual Growth Rate (CAGR) of 4.3%.

Dutch Bros’ recent strong performance and focus on innovation, they are well-positioned to capture a significant share of this growth. Their emphasis on high-quality drinks, customization, and a fast-paced drive-thru experience differentiates them from competitors.

Unique differentiation:

Dutch Bros faces competition on two fronts: coffee giants and regional coffee chains. Starbucks, in particular, holds a dominant market share and is known for its premium coffees and atmosphere. Dunkin’, on the other hand, competes more on price and convenience with its focus on grab-and-go options.

Dutch Bros combats these giants by emphasizing its unique drive-thru experience. Their focus on speed and friendly customer service creates a distinct atmosphere. Dutch Bros tailors its menu to regional preferences and offers more customization options than some competitors. This focus on strong customer connections and a constantly evolving menu helps Dutch Bros stand out.

Dutch Bros competes with regional coffee roasters and cafes. These smaller players often focus on high-quality beans and a more intimate coffee experience. Dutch Bros counters this competition by highlighting its commitment to high-quality ingredients while still offering a fast-paced and convenient option. Their expansion strategy prioritizes non-saturated markets, allowing them to avoid direct competition with established local coffee shops.

Drive-Thru Experience: Unlike Starbucks’ focus on cafes or Dunkin’s grab-and-go model, Dutch Bros prioritizes a fast and friendly drive-thru experience. This caters to customers on the go who value speed and convenience.

Highly Customized Drinks: Dutch Bros goes beyond standard espresso drinks. They offer a vast menu with customization options, including sugar levels, flavorings, and unique additions like protein powder or boba. This caters to a wider range of taste preferences and dietary needs.

Energetic Customer Interaction: Dutch Bros is known for its energetic and friendly baristas, often nicknamed “Broistas.” This creates a distinct and welcoming atmosphere that fosters customer loyalty and builds a strong brand identity.

Management & Employees:

- Travis Boersma: Co-founder and Executive Chairman. Travis, along with his late brother Dane, co-founded Dutch Bros in 1992. He remains deeply involved in day-to-day operations and is passionate about preserving the company culture they established. Travis emphasizes Dutch Bros’ role in the community and giving back through charitable initiatives.

- Christine Barone: Chief Executive Officer and President. Ms. Barone joined Dutch Bros in February 2023 and brings over a decade of experience in the food and beverage industry. She previously held leadership positions at Starbucks and True Food Kitchen.

Financials:

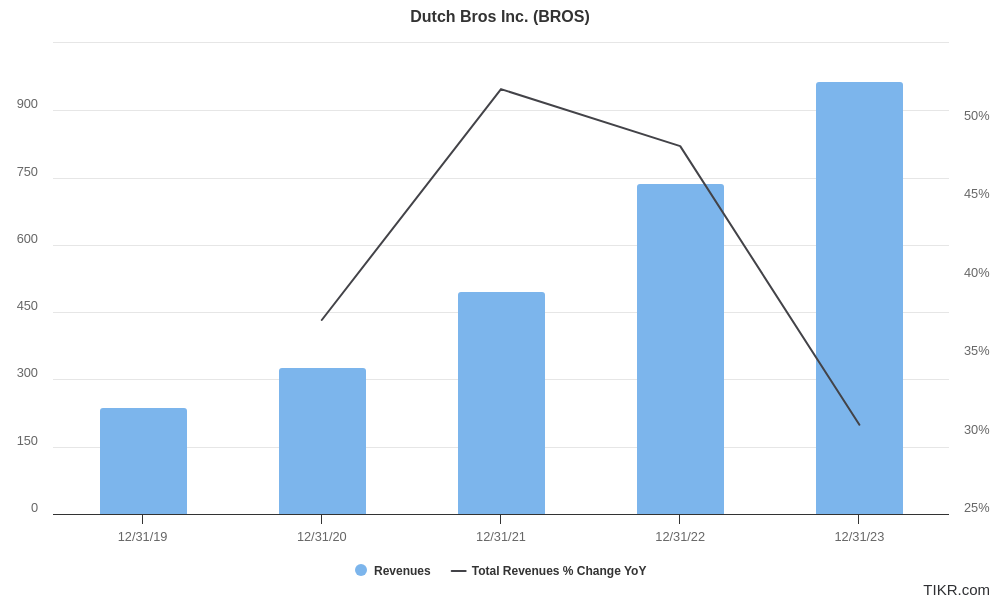

Dutch Bros revenue hovered around $238 million, and by the end of 2 023, it had skyrocketed to over $966 million. This translates to a CAGR exceeding 30% for the period.

Earnings growth has also been impressive, although not as consistent as revenue growth. Dutch Bros transitioned from negative earnings in its early years to profitability in recent quarters.

Dutch Bros has likely seen a significant increase in assets, particularly property and equipment, to accommodate the growing number of stores. On the flip side, liabilities have likely also grown to finance this expansion.

Technical Analysis:

A cup and handle with a strong reversal on the monthly chart, and a strong candle on earnings on the weekly chart should be the start of a stage 2 markup phase for $BROS. The daily chart showed a move higher from a key resistance area at $34,but still a lot of resistance at $35 – $36 along with divergence on the RSI and MACD indicates a trading approach to wait for the gap fill at $33 might be the best entry.

Bull Case:

Strong Market Tailwinds: The specialty coffee market is booming, with a projected CAGR of 4.3% until 2030. Dutch Bros is well-positioned to capture a large share of this growth due to its unique offerings.

Rapid Expansion: Dutch Bros has a robust expansion plan, aiming to reach 4,000 stores nationwide. This aggressive growth strategy will increase brand recognition and drive revenue.

Exceeding Analyst Expectations: Dutch Bros recently reported a strong first quarter of 2024, exceeding analyst expectations for both revenue and EPS.

Bear Case:

Execution Risk: Rapid expansion plans come with inherent risks. Dutch Bros needs to effectively manage logistics, staffing, and real estate decisions to avoid stumbles that could hinder growth or profitability.

Limited Menu Variety Compared to Competitors: While Dutch Bros offers customization, their core menu might not be as extensive as some competitors, potentially limiting their appeal to broader customer segments.

Dependence on Drive-Thru Model: Dutch Bros’ success hinges heavily on their drive-thru experience. If consumer preferences shift towards a more sit-down coffee shop atmosphere, Dutch Bros might need to adapt their model, which could be costly and challenging.