Executive Summary:

Aurora Innovation Inc., is a self-driving vehicle technology company based in Pittsburgh, Pennsylvania. Their core product is the Aurora Driver, a system that can be integrated into various vehicles, converting them into autonomous cars. The Aurora Driver is a combination of sensors, software, and hardware that allows the vehicle to perceive its surroundings and navigate safely. The company was founded by veterans of the self-driving car industry, including former leaders of Google’s and Uber’s self-driving programs.

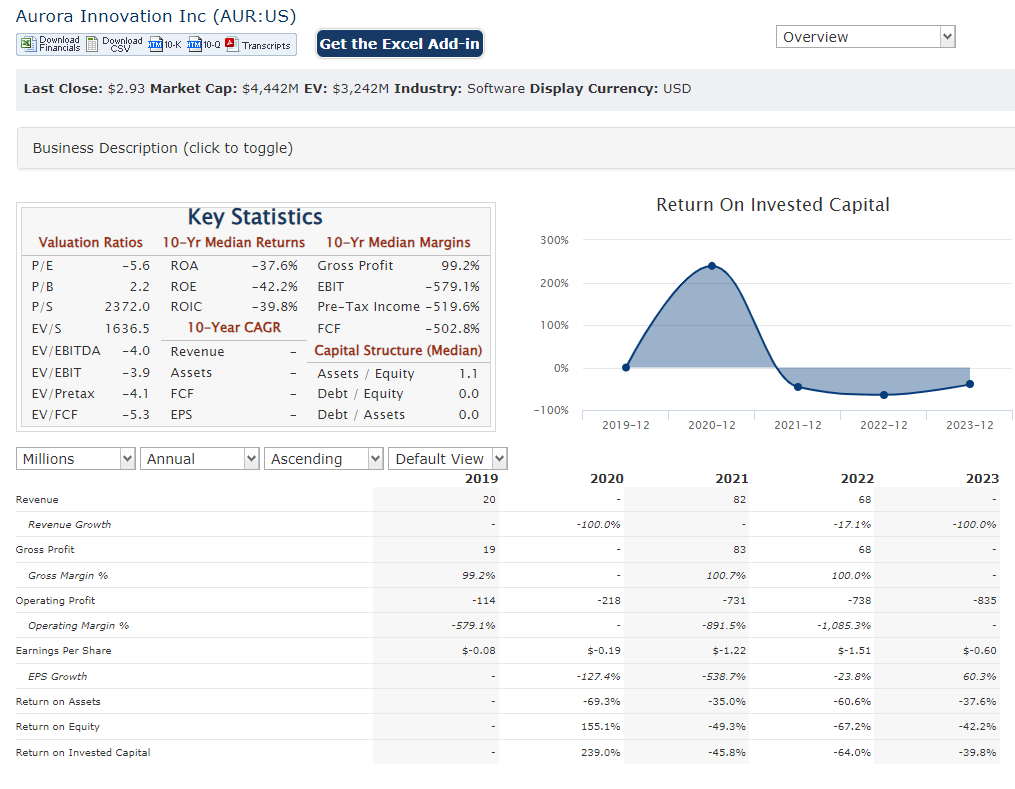

Aurora has reported a loss per share (EPS) of $0.13, which was actually better than analyst expectations of a -$0.15 loss.

Stock Overview:

| Ticker | $AUR | Price | $2.93 | Market Cap | $4.54B |

| 52 Week High | $4.81 | 52 Week Low | $1.30 | Shares outstanding | 1.18B |

Company background:

Aurora Innovation Inc., also doing business as Aurora, is a self-driving vehicle technology company. The company boasts a prestigious founding team consisting of Chris Urmson, the former chief technology officer of Google’s self-driving car project (now Waymo), Sterling Anderson, previously leading Uber’s self-driving efforts, and Drew Bagnell, a robotics professor at Carnegie Mellon University.

Aurora faces stiff competition in the self-driving car industry. Key competitors include Waymo, a subsidiary of Google, Cruise, owned by General Motors, and Baidu Apollo, a Chinese self-driving technology company. Aurora has secured over $2 billion in funding from investors such as Amazon, Sequoia Capital, and Chambers Street.

Recent Earnings:

On the earnings per share (EPS) front, Aurora reported a loss of $0.13, which was actually better than analyst expectations of a -$0.15 loss. This indicates that they managed to control their expenses better than anticipated. Analysts are expecting a slightly wider loss of $0.14 per share for the upcoming quarter.

Aurora is in the development stage, operational metrics traditionally used to evaluate established companies are not applicable here. Investors are more focused on Aurora’s progress in developing and testing their self-driving technology, securing partnerships with automakers, and achieving key milestones on their path to commercialization.

The Market, Industry, and Competitors:

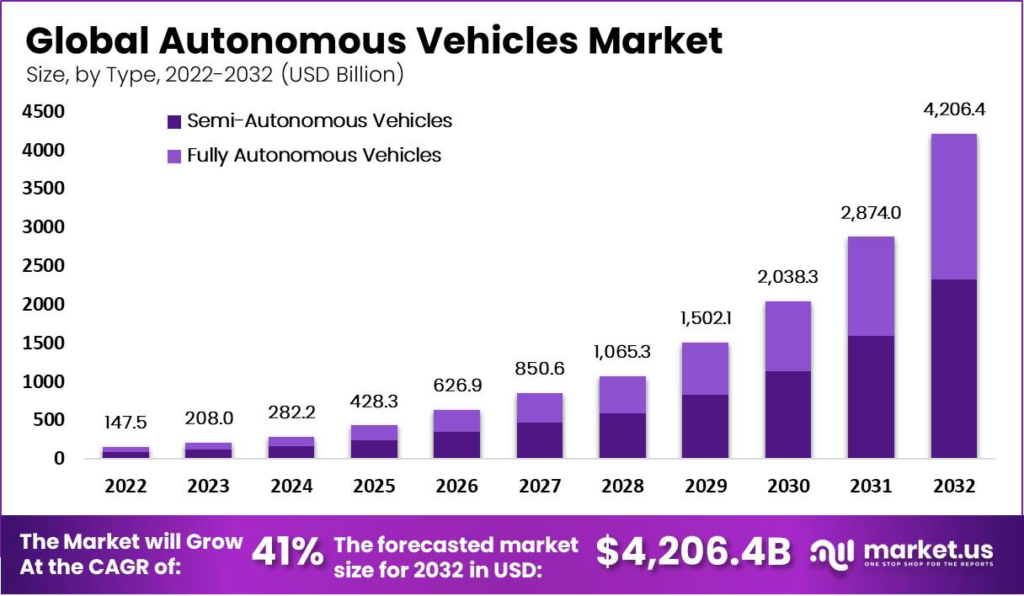

Aurora Innovation operates in the rapidly growing self-driving vehicle technology market. This market is expected to experience significant growth in the coming decades, driven by factors such as advancements in artificial intelligence, increasing demand for safer transportation, and growing urbanization. Experts predict widespread adoption of autonomous vehicles in various sectors, including personal transportation, logistics, and public transportation. Some estimates suggest the global self-driving vehicle market could reach a valuation of trillions of dollars by 2030.

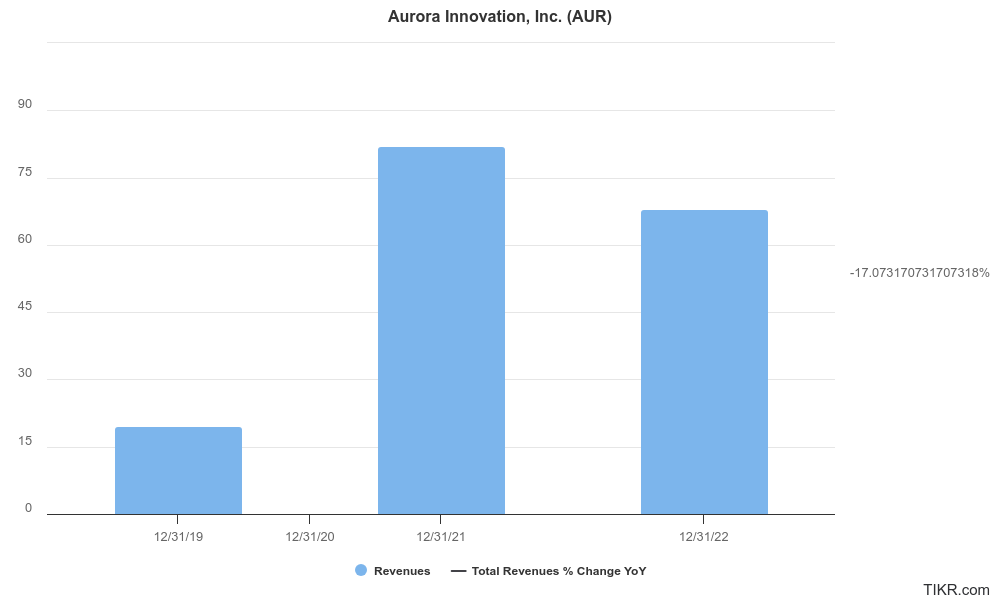

Due to Aurora’s pre-revenue stage, calculating a compound annual growth rate (CAGR) is not possible. CAGR is typically used for companies with a history of revenue generation.

Unique differentiation:

- Tech Titans: Waymo, a subsidiary of Google, is a frontrunner with extensive resources and experience. They’ve been actively testing self-driving vehicles on public roads for years. Cruise, owned by General Motors, is another major competitor with a strong focus on commercialization and partnerships with automakers.

- Legacy Automakers: Traditional car companies are not sitting idle. Ford and its partners are developing self-driving technology, while companies like Volkswagen and Toyota are making significant investments in this arena. These established players have the advantage of vast manufacturing capabilities and brand recognition.

Founding Team Pedigree: Aurora boasts a founding team with exceptional experience. Chris Urmson, Sterling Anderson, and Drew Bagnell are all veterans of leading self-driving car projects at Google and Uber, bringing a wealth of knowledge and expertise to the table. This strong leadership team can attract top talent and potentially inspire greater investor confidence.

Focus on Software & Partnerships: Unlike some competitors who are building entire self-driving vehicles, Aurora focuses on developing the software (Aurora Driver) that can be integrated into various existing vehicles. This strategy allows for greater flexibility and scalability, potentially enabling them to partner with a wider range of automakers.

Management & Employees:

Chris Urmson (Chairman & CEO): Formerly the Chief Technology Officer of Google’s self-driving car project (now Waymo), Urmson brings extensive experience in developing and leading autonomous vehicle programs.

James Andrew Bagnell (Chief Scientist): A robotics expert and co-founder of Aurora, Bagnell previously served as Chief Technical Officer and has deep knowledge of the software engineering crucial for self-driving cars. He also holds a consulting professorship at Carnegie Mellon University.

Financials:

Aurora Innovation Inc. (Aurora), being a relatively young company founded in 2016, Their financial performance is currently focused on managing expenses and losses while striving towards key development milestones.

- Technological advancements: This includes improvements to the Aurora Driver software, successful testing and integration with various vehicles.

- Partnerships: Securing partnerships with major automakers is crucial for future commercialization.

- Reduction of losses: Investors are looking for Aurora to demonstrate efficient expense management as they scale their operations.

On the earnings side, Aurora reports net losses each quarter. Their most recent earnings release showed a smaller loss per share than what analysts anticipated, indicating potential improvement in expense control.

Technical Analysis:

The stock is still building a base on the monthly and weekly chart, so any analysis is going to have to be based on its future potential which is unknown with confidence at this point.

On the daily chart, another cup after a base has been formed, and momentum looks strong before earnings on May 8th. This is a very speculative and long term stock, so any investment in it would have to be appropriately position sized.

Bull Case:

Market Opportunity: The self-driving car market is anticipated to experience exponential growth in the coming decades. Factors like advancements in AI, growing demand for safety, and increasing urbanization are expected to drive widespread adoption of autonomous vehicles across various sectors like personal transportation, logistics, and public transit.

Potential for Acquisition: The self-driving car industry is attracting significant attention from established players. There’s a possibility that a larger tech company or automaker could acquire Aurora in the future, offering a lucrative return for investors.

Bear Case:

Technological Hurdles: Developing reliable and safe self-driving technology is a complex task. Unforeseen technical challenges could arise, delaying progress and requiring significant additional investment. Regulatory hurdles regarding safety standards and liability also pose uncertainties.

Burning Cash: As a company in the development stage, Aurora is burning cash to fund its operations. This can be unsustainable in the long run, especially if they don’t secure additional funding or achieve profitability within a reasonable timeframe.