Executive Summary:

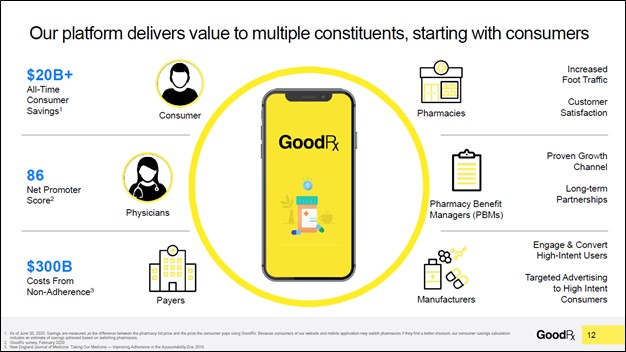

GoodRx Holdings Inc. is a digital healthcare platform focused on making healthcare in the US more affordable. They run a website and app that allows users to compare prescription drug prices and access discounts at over 70,000 pharmacies. GoodRx also offers telemedicine consultations and comprehensive healthcare information. The company was founded in 2011 and is publicly traded under the symbol GDRX. They have several subsidiaries including RxSaver and HealthiNation.

Stock Overview:

| Ticker | $GDRX | Price | $6.57 | Market Cap | $2.59B |

| 52 Week High | $9.37 | 52 Week Low | $4.14 | Shares outstanding | 93.26M |

Company background:

GoodRx Holdings Inc. was founded by Trevor Bezanson, GoodRx empowers users with information and tools to navigate the often complex US healthcare system.

GoodRx has expanded beyond prescription medications to offer additional healthcare services. They connect users with telehealth consultations, providing convenient access to medical professionals. They also provide comprehensive healthcare information and resources to help users make informed decisions about their healthcare.

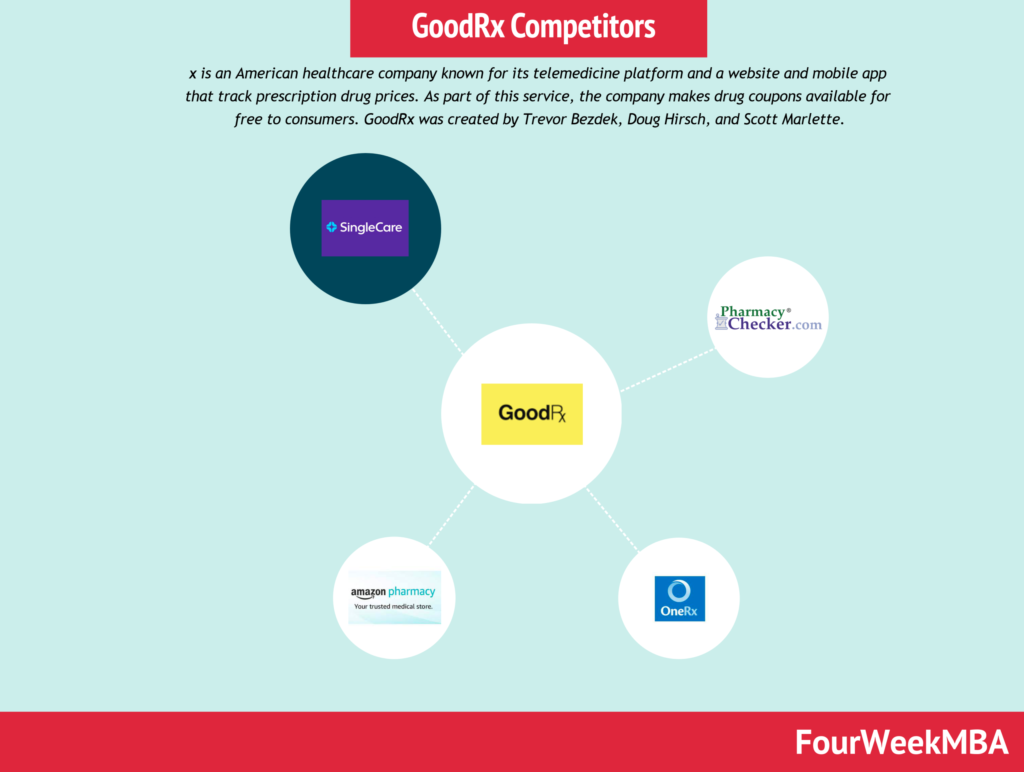

GoodRx Holdings Inc. faces competition from other companies offering similar services, including WellRx, SingleCare, and OptumRx. The company is headquartered in Santa Monica, California, and has grown significantly since its founding, going public in 2020 under the symbol GDRX.

Recent Earnings:

Analysts currently estimate EPS (earnings per share) of 0.04 for the fiscal quarter ending March 2024. This estimation has increased slightly over the past month, indicating a potential for positive earnings compared to the previous quarter.

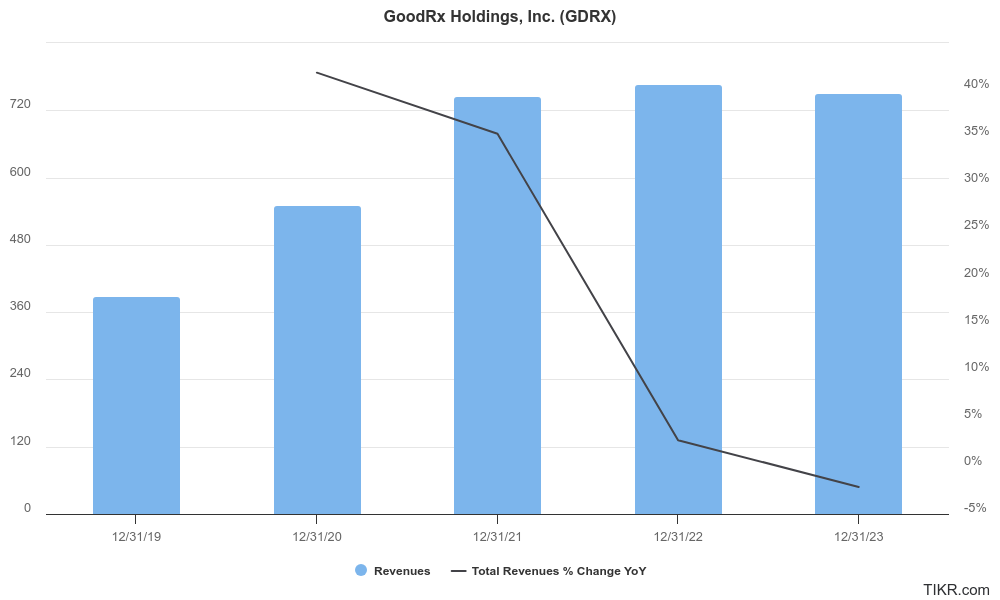

Revenues rose for the first time by 6.8% YoY to $196M after 6 quarters of negative revenue growth. On the annual basis revenue is still at negative growth of 2-3%. GoodRX is still unprofitable. The balance sheet shows over $870M in current assets (cash and equivalents) but over $711M in debt. This is still a stock in transition.

The Market, Industry, and Competitors:

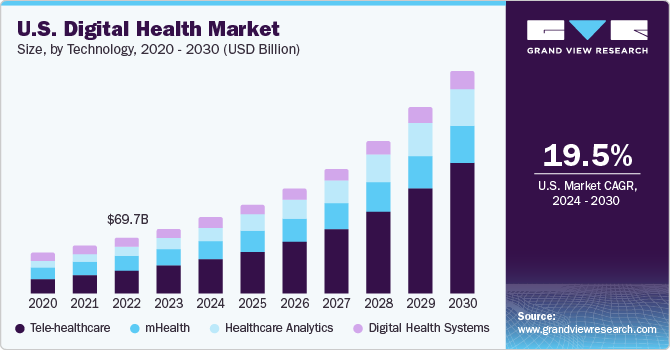

GoodRx Holdings Inc. operates in the digital healthcare market, a sector anticipated for significant growth in the coming years.

- Increased adoption of smartphones and mobile health applications: As people rely more on smartphones, mobile health apps become a convenient and accessible way to manage healthcare needs.

- Rising healthcare costs: With the rising cost of healthcare, digital healthcare platforms that offer transparency and cost-saving solutions become increasingly attractive.

- Growing demand for convenient and affordable healthcare services: Busy lifestyles and cost concerns are fueling a demand for digital healthcare solutions that offer affordability and on-demand access.

- An aging population with a greater need for chronic disease management: As the population ages, the demand for tools to manage chronic conditions is rising. Digital healthcare platforms can provide resources and support for these individuals.

The overall digital health market is projected to experience a Compound Annual Growth Rate (CAGR) in the range of 15-20% over the next five years.

Unique differentiation:

GoodRx Holdings Inc. faces competition from several companies striving to make healthcare more affordable and accessible in the US.

- Direct competitors: WellRx, SingleCare, and OptumRx all offer similar services to GoodRx. They provide prescription drug price comparisons, discounts, and may connect users with telehealth consultations. These competitors can leverage existing relationships with pharmacies and insurance companies to offer competitive pricing.

- Indirect competitors: Large pharmacy chains like CVS and Walgreens have also begun offering their own prescription discount programs and telehealth services. Additionally, some health insurance companies are developing in-house platforms with functionalities similar to GoodRx.

- Tech giants: Companies like Amazon have expressed interest in the healthcare market. Amazon Pharmacy offers prescription medications and could potentially expand its services to compete more directly with GoodRx in the future.

- Focus on affordability: GoodRx positions itself primarily as a cost-saving tool for consumers. Their core product revolves around finding the best discounts on prescription medications, potentially making them more attractive to users struggling with medication affordability.

- Wide pharmacy network: With access to discounts at over 70,000 pharmacies nationwide, GoodRx offers users a wider range of options compared to some competitors who might have partnerships with specific pharmacy chains. This flexibility can be a plus for users seeking the most convenient location.

- Telehealth integration: While some competitors offer similar features, GoodRx integrates telehealth consultations within its platform. This can be a valuable differentiator for users seeking a one-stop shop for managing their healthcare needs, potentially saving them time and effort.

- Focus on transparency: GoodRx emphasizes transparency in prescription drug pricing. This can empower users to make informed decisions about their healthcare and potentially advocate for better pricing.

Management & Employees:

- Scott Wagner (Interim Chief Executive Officer): Appointed in April 2023, Scott brings extensive experience from his previous role as CEO and President/CFO/COO at GoDaddy. He is currently serving on an interim basis.

- Doug Hirsch (Chief Mission Officer and Board Member): A co-founder of GoodRx, Doug has transitioned from CEO to Chief Mission Officer in April 2023. He focuses on GoodRx’s core mission of making healthcare affordable and brings historical knowledge and leadership experience to the table.

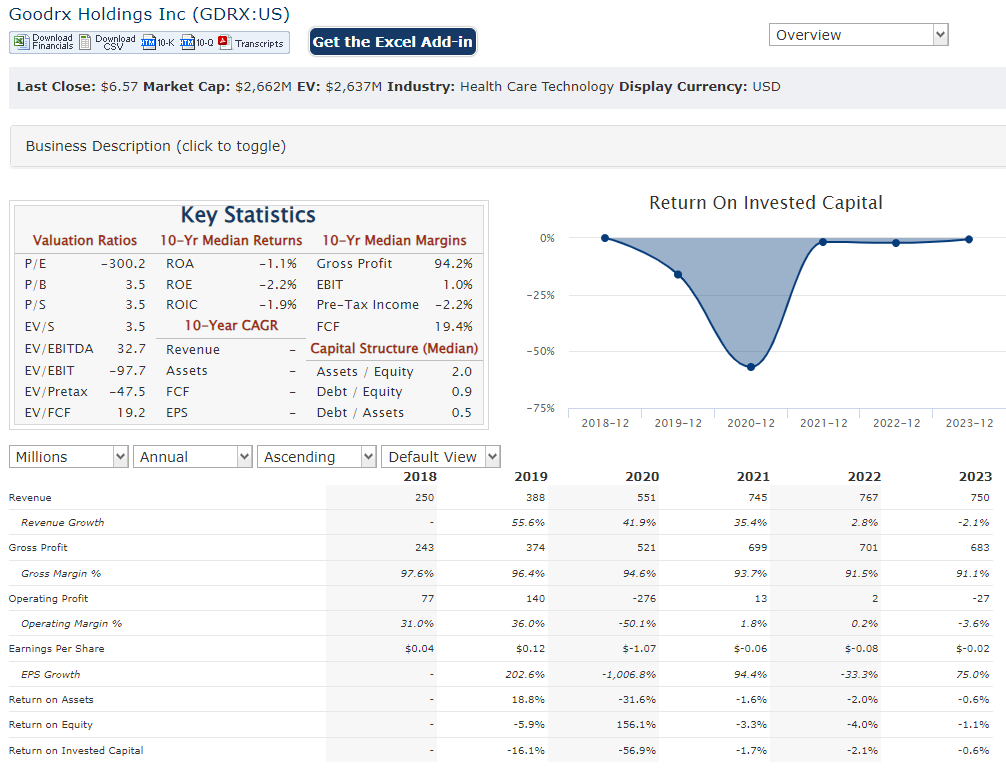

Financials:

Revenue Growth: GoodRx’s revenue has grown consistently year-over-year for the past five years.

Earnings Growth: GoodRx remains unprofitable, but their net losses have narrowed over the past five years. This indicates progress towards achieving profitability in the future.

Balance Sheet: GoodRx’s balance sheet shows a positive trend. They have more cash and short-term investments than total debt, indicating a healthy financial position. Their total shareholder equity has also improved significantly over the past five years, transitioning from negative to positive territory.

Technical Analysis: GoodRX is still forming a base (Stage 1) on the monthly and weekly chart. The daily chart has a head and shoulders (shown below) and the stock is still in a stage 4 decline on the short term. There is support at $6.27 range. The RSI is very weak and pointing down, and the MACD is negative as well. This is an easy stock to avoid.

Bull Case:

- Large and Growing Market: The digital healthcare market is anticipated for significant growth in the coming years, fueled by factors like rising healthcare costs, increased smartphone adoption, and a growing demand for convenient and affordable healthcare solutions

- Expanding Services: GoodRx is moving beyond prescription discounts by offering telehealth consultations and comprehensive healthcare information. This could position them as a one-stop shop for managing healthcare needs, increasing their value proposition to users.

- Strong Leadership: While the current leadership structure is relatively new, Scott Wagner’s experience and Doug Hirsch’s historical knowledge with GoodRx could be a strong combination for navigating the competitive landscape.

Bear Case:

- Profitability Concerns: Despite revenue growth, GoodRx remains unprofitable. This raises concerns about their long-term financial sustainability. If they can’t achieve profitability soon, investors might lose confidence in the stock.

- Reliance on Pharmacy Partnerships: GoodRx relies heavily on partnerships with pharmacies to offer discounts. These partnerships could be renegotiated or terminated, impacting GoodRx’s ability to provide competitive pricing.

- Focus on Discounts May Limit Growth: While cost savings are a major selling point, GoodRx’s focus primarily on discounts might limit their ability to capture a wider healthcare market share. Competitors offering more comprehensive healthcare services could outpace them in the long run.