Executive Summary:

Founded in 2015, IonQ is a company developing quantum computers with the goal of solving complex problems and making a positive impact on various fields. They utilize trapped-ion quantum computers, which they believe outperform existing models in terms of accuracy and capability. The company is known for making their quantum computers accessible through cloud platforms and collaborating with various institutions. In October 2021, IonQ became the first publicly traded company solely focused on quantum computing.

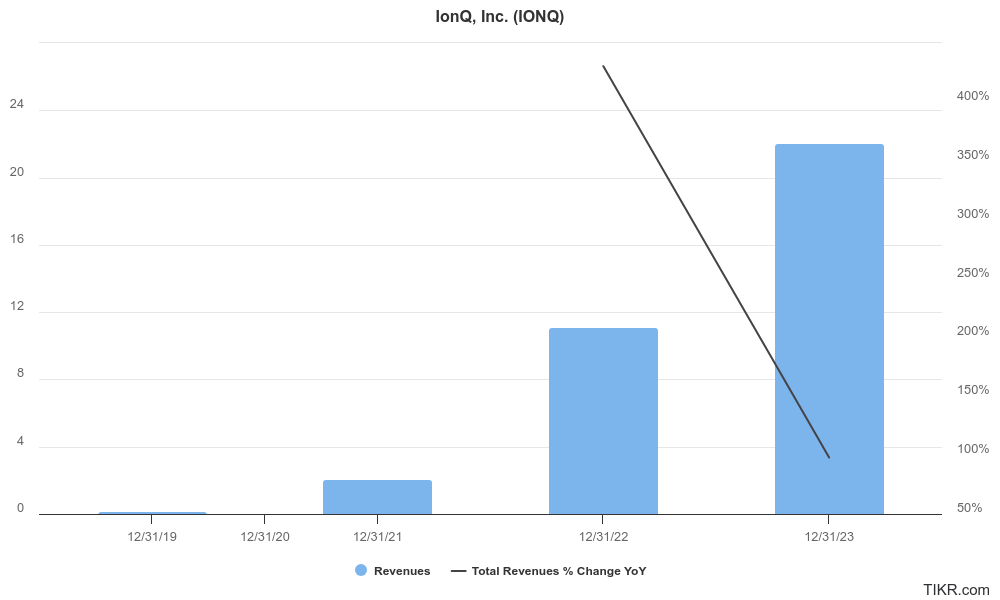

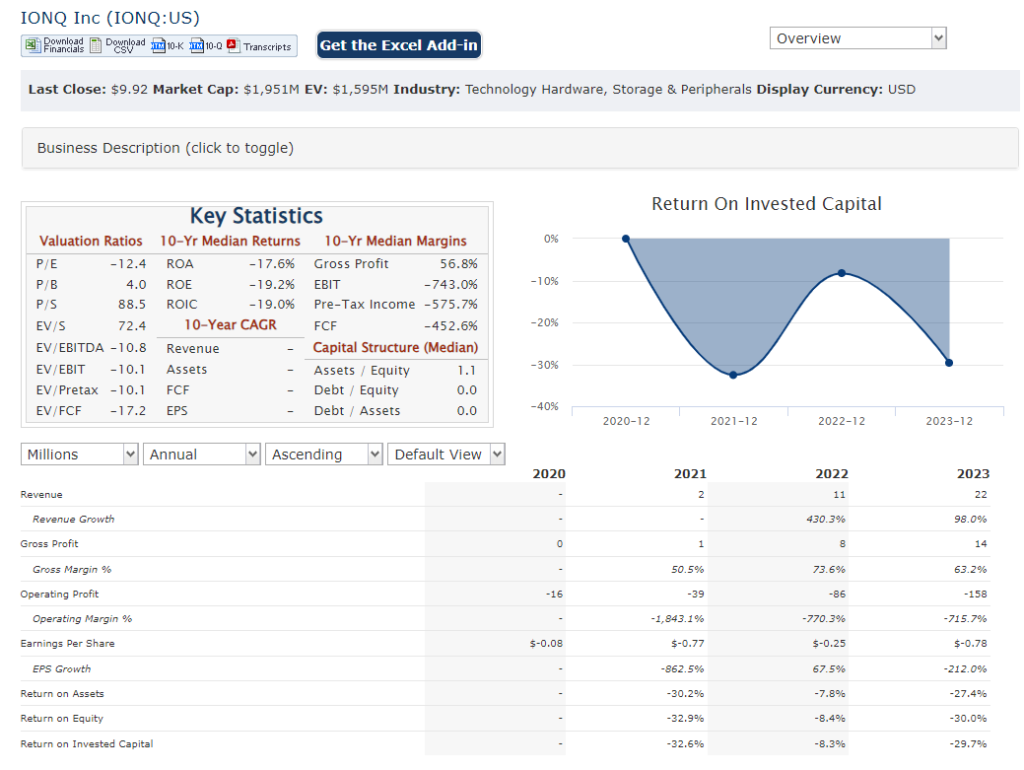

Revenue of $6.1 million for the fourth quarter, bringing the full year total to $22.0 million. This represents a significant 98% growth compared to the previous year. While they haven’t reported a profit yet, their net loss for the full year was $157.8 million.

Stock Overview:

| Ticker | $IONQ | Price | $9.92 | Market Cap | $2.06B |

| 52 Week High | $21.60 | 52 Week Low | $4.38 | Shares outstanding | 208.2M |

Company background:

IonQ was started by Christopher Monroe and Jungsang Kim, is a company developing and commercializing quantum computing infrastructure. Their goal is to solve problems that are intractable for classical computers, aiming to make a positive impact across various fields like chemistry, materials science, and finance.

IonQ believes their trapped-ion technology offers advantages in performance and scalability compared to other quantum computing approaches. They also focus on making their quantum computers accessible through integrations with major cloud platforms and partnerships with various institutions and companies. This focus on accessibility has been a key differentiator for IonQ.

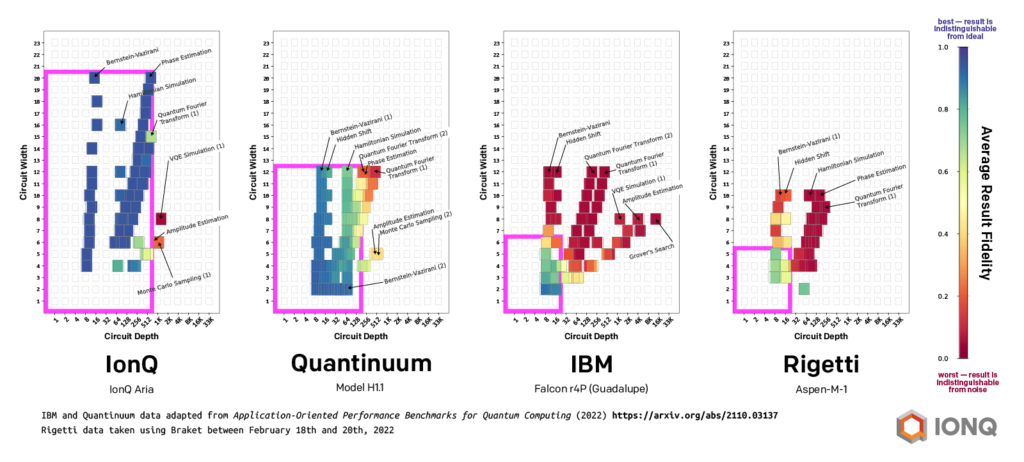

IonQ is a leader in the race to build practical and impactful quantum computers. They face competition from several other companies like Rigetti Computing, IBM Quantum, Google Quantum AI, and Honeywell Quantum, all vying to be at the forefront of this revolutionary technology.

The Market, Industry, and Competitors:

IonQ operates in the field of quantum computing, a rapidly developing technology with the potential to revolutionize various industries. Quantum computers leverage the principles of quantum mechanics to solve problems intractable for traditional computers. This opens doors for breakthroughs in fields like materials science, drug discovery, and financial modeling.

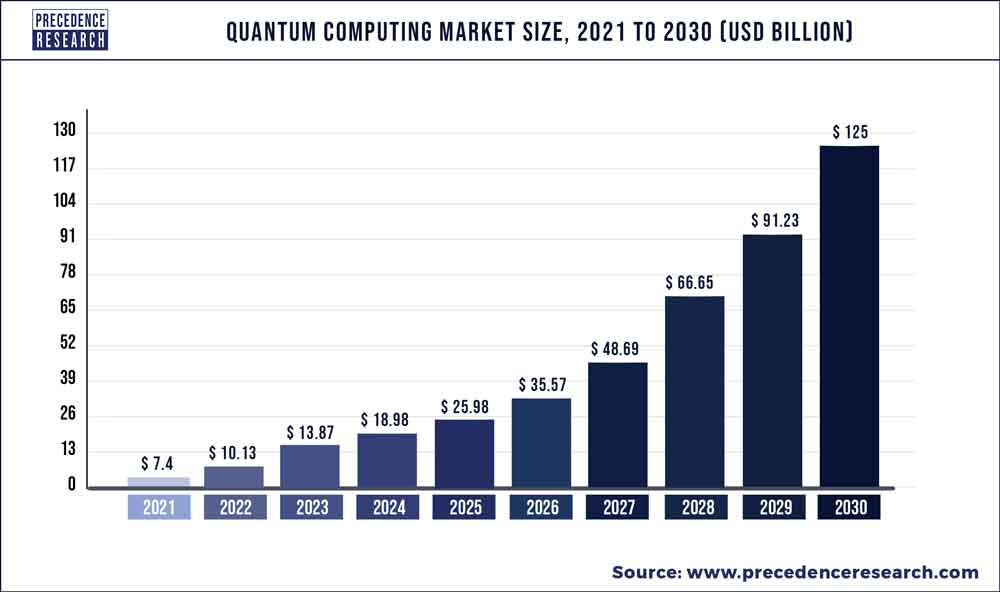

The global quantum computing market is expected to experience significant growth in the coming years. Estimates suggest a CAGR (Compound Annual Growth Rate) of 50-100% between 2023 and 2030. This translates to a potential market size exceeding $1.7 billion by 2026, compared to around $470 million in 2021.

Unique differentiation:

- Rigetti Computing: Founded in 2014, Rigetti Computing utilizes a similar trapped-ion approach to IonQ. They focus on building commercially viable quantum computers and offer cloud access to their systems.

- IBM Quantum: Backed by the vast resources of IBM, IBM Quantum is a leader in the field with a diverse range of quantum computing technologies, including superconducting qubits and trapped-ion systems. They offer access to their quantum computers through the IBM Cloud platform.

- Google Quantum AI: Google, a major player in the tech industry, has a dedicated research division, Google Quantum AI, focused on developing quantum computers. They utilize various approaches, including superconducting qubits, and offer access to their systems through Google Cloud.

- Honeywell Quantum: Honeywell is another major corporation with a significant investment in quantum computing. They primarily focus on superconducting qubit technology and collaborate with various institutions and companies to advance the field.

1. Trapped-Ion Technology: IonQ emphasizes their reliance on trapped-ion technology, which they believe offers advantages in performance and scalability compared to other approaches like superconducting qubits. They claim their trapped-ion approach leads to lower error rates and higher fidelity in quantum operations, potentially resulting in more accurate and reliable computations.

2. Accessibility Focus: IonQ prioritizes making their quantum computers accessible to a wider audience. They achieve this through:

- Cloud Integration: Integrating their systems with major cloud platforms like Amazon Braket and Microsoft Azure allows users to access and utilize their quantum computers remotely without needing specialized hardware.

- Partnerships: IonQ collaborates with various institutions and companies, providing them with access to their technology and expertise. This fosters collaboration and broadens the potential applications of their technology.

Management & Employees:

- Peter Chapman (CEO & President): Previously led engineering teams at Amazon, bringing experience in large-scale technology projects.

- Jungsang Kim (Co-Founder & CTO): A physicist and co-founder of IonQ, contributing deep technical knowledge and expertise in trapped-ion quantum computing.

- Thomas Kramer (CFO): Responsible for overseeing IonQ’s financial operations and bringing experience from various financial leadership roles.

Financials:

- Revenue:

- In 2019, IonQ’s revenue was minimal at around $0.2 million.

Balance Sheet:

- IonQ’s balance sheet reflects its focus on growth and investment.

- They have raised significant capital through various funding rounds, resulting in a strong cash position.

- As of December 31, 2023, they reported cash, cash equivalents, and investments of $455.9 million.

- This financial cushion provides them with resources to continue research and development, expand their infrastructure, and pursue future growth opportunities.

Technical Analysis: While shares were tightening and forming a base on the monthly and weekly charts, they have since broken a key level at $10.3 after earnings a few days ago (Feb 28). We expect the next support to be at $8.99 and the stock should bounce back to the $10s.

Bull Case:

- First-mover advantage: IonQ became the first publicly traded company solely focused on quantum computing in October 2021. This early entrance could give them a head start in establishing themselves as a leader in the field.

- Market potential: The global quantum computing market is expected to experience significant growth in the coming years, with estimates suggesting a CAGR of 50-100% between 2023 and 2030. If IonQ can capture a significant share of this market, it could lead to substantial revenue growth and stock appreciation.

- Strong financial backing: IonQ has raised significant capital through various funding rounds, giving them the resources to invest in research and development, expand their infrastructure, and pursue growth opportunities.

Bear Case:

- Early stage technology: Quantum computing is still in its early stages of development. The technology faces significant technical challenges, and it’s uncertain if or when it will become mature enough for widespread commercial adoption. This uncertainty poses a significant risk for investors, as IonQ’s future success heavily relies on technological advancements.

- Unproven business model: IonQ’s business model is still evolving, and it’s unclear how they will generate sustainable profits in the long run. Their current revenue streams are limited, and they rely heavily on continued funding to support their operations.

- Overvaluation: Some argue that IonQ’s stock price might be overvalued compared to its current revenue and profitability. The high valuation reflects the potential of the market, but it also means that the stock price could face significant correction if the company fails to meet high expectations.