Executive Summary:

ChargePoint Holdings, a major player in the electric vehicle (EV) charging game, boasts the world’s largest network in North America and Europe. Founded in 2007, they’ve been fueling the EV revolution with comprehensive solutions for homes, businesses, fleets, and everything in between. Their hardware, software, and services cater to a wide range of customers, while their cloud-based platform keeps everything humming. Though their recent revenue dipped slightly, their subscription business is booming, hinting at exciting times ahead as EV adoption surges.

ChargePoint’s most recent earnings report was for the third quarter of fiscal year 2024, ending October 31, 2023. The company reported revenue of $110.3 million, a 12% decrease compared to the same quarter last year. This fell short of analyst expectations, who had predicted revenue of $112.5 million. However, there were some bright spots: subscription revenue jumped 41% year-over-year, reaching $30.6 million. Unfortunately, EPS wasn’t so rosy, landing at a negative $0.20 per share, while analysts had anticipated a loss of $0.19. These mixed results paint a complex picture of ChargePoint’s current state, with ongoing challenges in hardware sales but promising growth in subscription services.

Stock Overview:

| Ticker | $CHPT | Price | $1.90 | Market Cap | $794.25M |

| 52 Week High | $13.65 | 52 Week Low | $1.56 | Shares outstanding | 418.03M |

Company background:

ChargePoint Holdings, a leading name in the electric vehicle (EV) charging infrastructure, stands at the forefront of the clean transportation revolution. Founded in 2007 by Pat McCarthy and Paulo Carbone, the company has since secured over $1.6 billion in funding, allowing it to build the world’s largest network of EV charging stations in North America and Europe.

Product Prowess: ChargePoint doesn’t just offer chargers; they provide comprehensive EV charging solutions. Their portfolio includes:

- Hardware: A diverse range of charging stations for homes, businesses, fleets, and even public spaces, catering to various power levels and needs.

- Software: A cloud-based platform that manages the network, facilitates payments, and provides real-time data insights.

- Services: Installation, maintenance, and technical support, ensuring a seamless charging experience for customers.

Competition in the Fast Lane: While ChargePoint holds a dominant position, the EV charging landscape is becoming increasingly competitive. Key rivals include:

- Tesla: $TSLA With its Supercharger network catering primarily to Tesla vehicles, it’s a formidable competitor in long-distance travel.

- Electrify America: Backed by Volkswagen, this network is rapidly expanding across the US, focusing on high-power DC fast charging.

- EVgo: $EVGO Another major US player, EVgo boasts a diverse network of stations and strategic partnerships with municipalities and businesses.

ChargePoint’s global headquarters are located in Campbell, California, strategically situated in the heart of Silicon Valley’s tech hub.

With the EV market expected to soar in the coming years, ChargePoint is well-positioned to capitalize on this growth. Their comprehensive solutions, strategic partnerships, and focus on innovation are key factors driving their success. As the race to electrify transportation intensifies, ChargePoint remains a frontrunner, powering the journey towards a cleaner and more sustainable future.

Recent Earnings:

ChargePoint’s Q3 2024 Earnings: Mixed Signals amid EV Boom

ChargePoint Holdings’ latest earnings report for the third quarter of fiscal year 2024, ending October 31, 2023, painted a mixed picture of the company’s state. While some metrics hinted at promising future growth, others highlighted ongoing challenges.

Revenue: On the revenue front, ChargePoint reported $110.3 million, a 12% decrease year-over-year. This fell short of analyst expectations of $112.5 million, raising concerns about slowing growth. However, a closer look reveals a shift in revenue composition. Networked charging systems revenue, comprising hardware sales, dipped 24% to $73.9 million, reflecting broader industry headwinds. On the other hand, subscription revenue jumped 41% to $30.6 million, showcasing strong growth in their software and service offerings.

EPS: Earnings per share (EPS) remained negative at -$0.20, missing analyst predictions of a -$0.19 loss. This wider-than-expected loss suggests ongoing profitability challenges.

Operational Metrics: While headline numbers were mixed, operational metrics offered some promising insights. Station activations saw a healthy 22% year-over-year increase, indicating strong adoption of their charging network. Additionally, average revenue per station grew 8%, demonstrating ChargePoint’s ability to monetize existing infrastructure effectively.

Forward Guidance: Despite the mixed Q3 results, ChargePoint reiterated its guidance for achieving positive non-GAAP Adjusted EBITDA in the fourth quarter of calendar year 2024. This optimism, coupled with the strong growth in subscription revenue, suggests future profitability potential.

The Market, Industry, and Competitors:

ChargePoint Holdings navigates the dynamic and rapidly evolving global electric vehicle (EV) charging market. This market stands at an inflection point, fueled by:

- Soaring EV sales: Global EV sales are expected to grow at a compound annual growth rate (CAGR) of 21.4% from 2023 to 2030, reaching over 60 million units sold by 2030. This explosion in EVs directly translates to increased demand for reliable charging infrastructure.

- Governmental push: Policy initiatives and investments from governments worldwide, aiming to achieve climate goals and reduce reliance on fossil fuels, are further accelerating EV adoption and charging infrastructure development. The US Infrastructure Investment and Jobs Act alone allocates $7.5 billion for EV charging infrastructure.

- Diversifying charging needs: As the EV landscape expands, demand for diverse charging solutions emerges. This includes fast-charging stations for highways, Level 2 chargers for workplaces and homes, and even depot charging for commercial fleets.

For ChargePoint, these trends spell out immense growth potential:

- Market Size Expansion: The global EV charging market is estimated to reach $192 billion by 2040, with a CAGR of 25.6%. This presents a vast opportunity for ChargePoint to further solidify its market share and expand its offerings.

- Subscription Focus: As hardware competition heats up, ChargePoint’s shift towards recurring revenue streams through software and service subscriptions becomes increasingly crucial. This segment is forecasted to grow at a faster CAGR than hardware sales, providing a more stable income source.

- Global Domination: With its existing strong presence in North America and growing footprint in Europe, ChargePoint is well-positioned to leverage its network advantage and expand into new regions like Asia-Pacific, capturing a bigger slice of the global market.

Unique differentiation:

ChargePoint Holdings occupies a dominant position in the EV charging landscape, but it’s not alone on the racetrack. Several key competitors are vying for a piece of the pie, each with their own strengths and strategies.

Tesla Supercharger Network:

- The undisputed king of long-distance charging, Tesla’s proprietary network boasts high-powered stations strategically located along major highways, catering primarily to Tesla vehicles. While not a direct competitor for ChargePoint’s broader network, Tesla sets the bar for fast-charging technology and user experience.

Electrify America:

- Backed by Volkswagen’s massive resources, Electrify America is rapidly expanding its network of high-power DC fast charging stations across the US, focusing on urban areas and major corridors. Their focus on cutting-edge technology and partnerships with key players like General Motors makes them a formidable competitor in the fast-charging segment.

EVgo:

- Another major player in the US market, EVgo boasts a diverse network of stations in strategic locations like parking garages and retail centers. They excel in partnerships with municipalities and businesses, making them a familiar sight in many urban areas. Their focus on accessibility and affordability gives them a competitive edge.

Other notable competitors:

- Blink Charging: $BLNK A US-based company with a strong presence in urban areas and a focus on Level 2 charging solutions.

- ABB: A global technology leader offering EV charging infrastructure across various power levels and applications.

- Greenlots: A European player known for its advanced software platform and network management solutions.

The competitive landscape in the EV charging market is constantly evolving, with new players and technologies emerging all the time. ChargePoint’s success will depend on its ability to maintain its network advantage, innovate faster than its rivals, and cater to the diverse needs of a rapidly growing EV market.

ChargePoint faces stiff competition in the EV charging market, it possesses several unique differentiators that give it an edge:

1. Network Advantage: Boasting the world’s largest network of EV charging stations in North America and Europe, ChargePoint offers unparalleled breadth and accessibility. This extensive network gives drivers confidence, knowing they can easily find a charger wherever they go.

2. Comprehensive Solutions: ChargePoint goes beyond mere chargers, offering a complete end-to-end solution. Their portfolio includes hardware, software, and services, catering to the diverse needs of homes, businesses, fleets, and public spaces. This one-stop-shop approach simplifies the process for customers and provides a seamless charging experience.

3. Technological Innovation: ChargePoint invests heavily in R&D, focusing on innovative charging technologies and smart features. Their cloud-based platform offers advanced data analytics and network management capabilities, ensuring efficient operation and improved user experience.

4. Sustainability Focus: ChargePoint champions green practices throughout its operations, sourcing renewable energy for its network and offering carbon offset programs. This commitment to sustainability resonates with environmentally conscious consumers and businesses.

5. Strategic Partnerships: ChargePoint actively collaborates with leading automakers, energy providers, and other key players in the EV ecosystem. These partnerships expand their reach, leverage diverse expertise, and solidify their position in the market.

While competitors may excel in specific areas like fast-charging technology or regional presence, ChargePoint’s combination of network dominance, comprehensive solutions, innovative approach, and strategic partnerships sets it apart in the EV charging landscape. It’s this well-rounded and forward-looking strategy that positions ChargePoint for continued success in the electric mobility revolution.

Management & Employees:

President and CEO: Rick Wilmer brings a wealth of experience across various technology and design companies, having led organizations like Pliant Technology, Leyden Energy, Mojo Networks, and Chowbotics. He joined ChargePoint in 2022 as Chief Operating Officer before assuming the CEO role in November 2023. His focus lies on operational excellence, global expansion, and driving product innovation.

General Counsel and Corporate Secretary: Rebecca Chavez serves as the company’s legal counsel, overseeing governance, compliance, and regulatory matters. She boasts extensive experience in mergers and acquisitions, intellectual property, and corporate law, playing a critical role in guiding ChargePoint’s legal and ethical framework.

Interim Chief Financial Officer: Mansi Khetani steps in to manage the company’s financial operations and reporting. She brings expertise in corporate finance, accounting, and strategic planning, ensuring financial stability and responsible resource allocation.

Financials:

ChargePoint’s Financial Performance: A 5-Year Journey

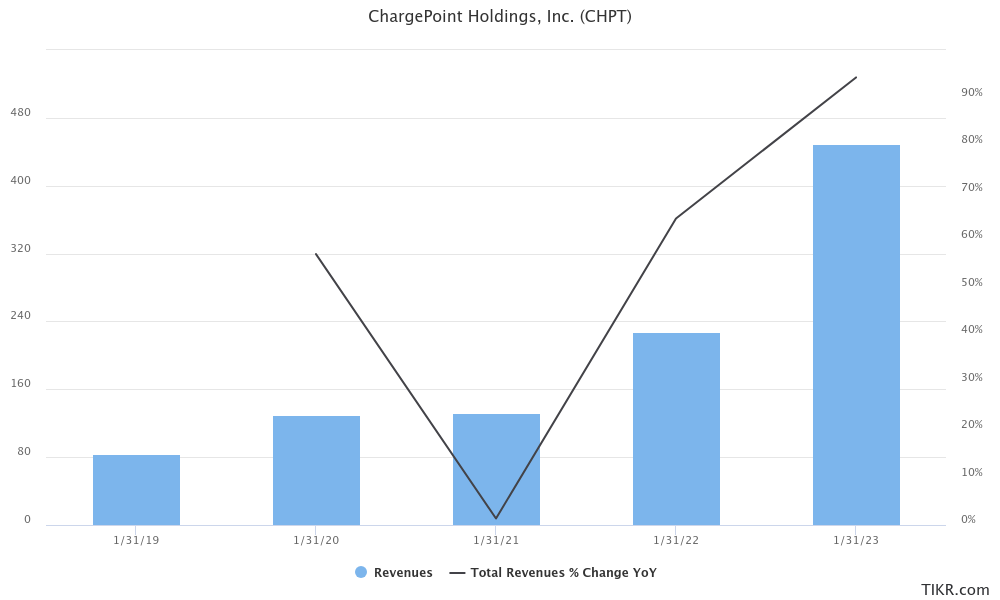

ChargePoint’s revenue journey over the past five years has been one of consistent growth, albeit with some bumps along the way. Annual revenue soared from $80.6 million in 2019 to $390.6 million in 2023, translating to a compound annual growth rate (CAGR) of 82.7%. This explosive growth reflects the rapidly expanding EV market and ChargePoint’s successful capture of market share.

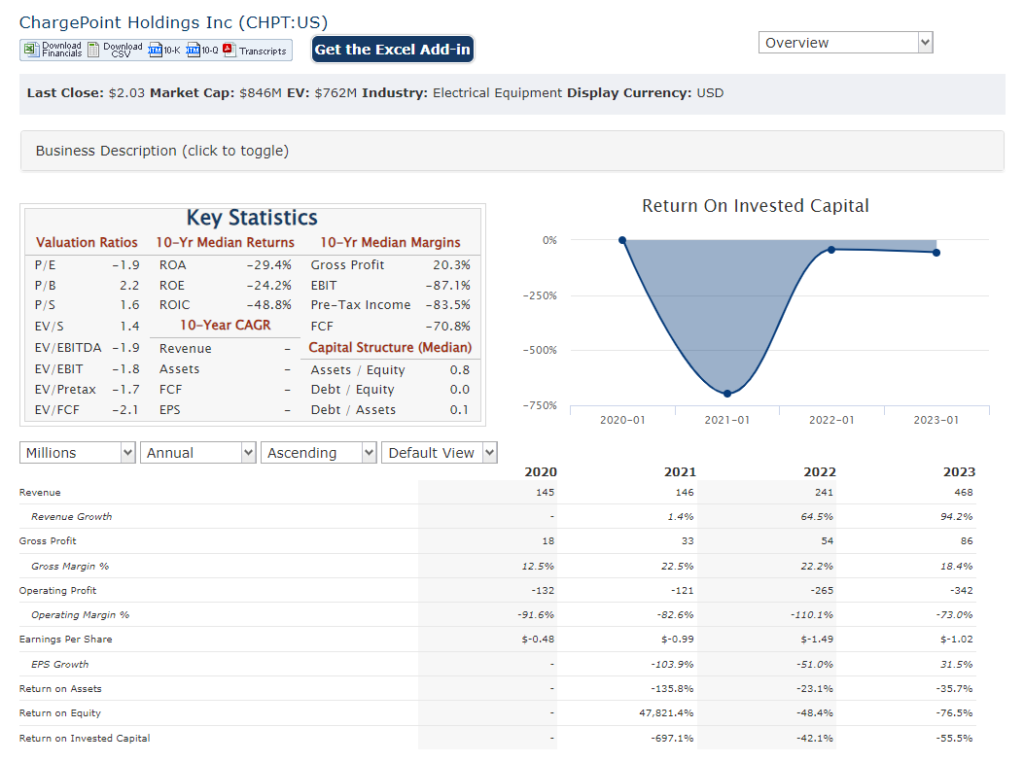

However, earnings haven’t quite kept pace. While revenue was on a continuous upward trajectory, net income remained negative throughout the five years, with a CAGR of -79.5%. This profitability gap stems from aggressive investments in network expansion, research and development, and talent acquisition, all crucial for long-term growth.

Despite the negative net income, ChargePoint boasts a healthy balance sheet characterized by consistent cash flow from operations and low debt levels. The company ended 2023 with approximately $518 million in cash and equivalents, providing them with substantial resources to navigate potential market fluctuations and pursue strategic initiatives.

Overall, ChargePoint’s financial performance paints a picture of a company prioritizing long-term growth over short-term profitability. The impressive revenue growth coupled with a strong balance sheet suggests that ChargePoint is well-positioned to capitalize on the booming EV market, with future profitability a likely outcome as the company matures and optimizes its operations.

Technical Analysis:

ChargePoint stock is still in stage 4 decline. The “bottom” for the shares is still not clear as the “base” has not been formed yet. If you are holding shares from purchases at higher prices, we dont see the shares moving up in 2024, but if you are a long term holder (3+ years) they might recover to a higher point. The near term support is at $1.54 and resistance at $2.4

Bull Case:

ChargePoint Holdings, a leader in the EV charging infrastructure space, has its fair share of bulls singing its praises.

Growth Engines:

- Unmatched Network Advantage: ChargePoint boasts the world’s largest network of EV charging stations in North America and Europe, a significant barrier to entry for competitors. This extensive reach translates to convenience and confidence for drivers, solidifying their market position.

- Subscription Boom: While hardware sales face headwinds, ChargePoint’s subscription revenue for software and services is skyrocketing, growing at a much faster CAGR than hardware. This recurring revenue stream ensures long-term stability and profitability.

- Diversification & Innovation: ChargePoint isn’t just about chargers; they offer complete solutions for homes, businesses, fleets, and public spaces. They also invest heavily in R&D, aiming to stay ahead of the curve with faster charging technologies and smart features.

Market Momentum:

- EV Boom: The global EV market is expected to explode in the coming years, reaching over 60 million units sold by 2030. This translates to tremendous demand for reliable charging infrastructure, squarely benefiting ChargePoint.

- Policy Tailwinds: Governments worldwide are pouring billions into EV adoption and charging infrastructure development. This policy thrust creates a perfect storm for ChargePoint’s continued expansion.

- Strategic Partnerships: ChargePoint actively collaborates with key players like automakers, energy providers, and tech giants. These partnerships open new doors, expand their reach, and bolster their credibility.

Financial Future:

- Path to Profitability: Despite current losses, analysts predict ChargePoint to turn a positive EBITDA in the near future. The company’s aggressive investments in growth are laying the groundwork for long-term financial success.

- Strong Balance Sheet: ChargePoint possesses a healthy cash flow and low debt levels, providing them with financial flexibility to weather market fluctuations and pursue opportunistic acquisitions.

- Experienced Leadership: The company boasts a seasoned management team with proven track records in scaling technology companies and navigating dynamic markets.

Bear case:

While bulls see bright skies for ChargePoint Holdings, bears have their own set of concerns casting shadows on the EV charging leader.

Competitive Landscape:

- Giant Threats: Tesla’s Supercharger network, Electrify America’s rapid expansion, and EVgo’s strategic partnerships pose significant challenges to ChargePoint’s dominant position. These competitors wield resources, technology, and unique target markets that could eat into ChargePoint’s market share.

- Hardware Headwinds: The hardware sales segment, which remains a major revenue source, faces potential saturation and price pressures. Competition and evolving technologies could further squeeze margins, impacting ChargePoint’s bottom line.

- Profitability Dilemma: Despite impressive revenue growth, turning a profit remains elusive for ChargePoint. Continued investments in network expansion and R&D may further delay profitability, testing investor patience and impacting stock price.

Market Uncertainties:

- EV Adoption Pace: While optimistic forecasts predict booming EV sales, unforeseen economic slowdowns or policy changes could dampen EV adoption, directly impacting the demand for charging infrastructure.

- Technological Disruption: New charging technologies like wireless charging or solid-state batteries could disrupt the current market landscape, rendering existing infrastructure obsolete and forcing ChargePoint to adapt quickly.

- Regulation Risks: Policy changes or regulatory hurdles in key markets could hinder ChargePoint’s expansion plans and profitability prospects.

Financial Concerns:

- Valuation Bubble?: Despite recent declines, ChargePoint’s stock valuation may still be inflated compared to its actual profitability. A market correction could lead to significant price drops, hurting investor returns.

- Cash Burn: Maintaining and expanding the vast network consumes substantial resources. If revenue growth stumbles, maintaining this pace could deplete cash reserves and force the company to seek additional funding, diluting existing shareholder value.

- Management Execution: While the leadership team boasts experience, successfully navigating the dynamic EV market and executing their growth strategy without missteps will be crucial to assuage bear concerns.