Executive Summary:

DigitalOcean Holdings Inc. is a cloud service provider specializing in infrastructure for developers, startups, and small businesses. Their cloud platform offers tools and resources to simplify tasks like building, deploying, and scaling applications. The company, founded in 2011, is headquartered in New York City and operates data centers around the world. They also actively participate in the developer community through initiatives like Hacktoberfest, an annual celebration of open-source software.

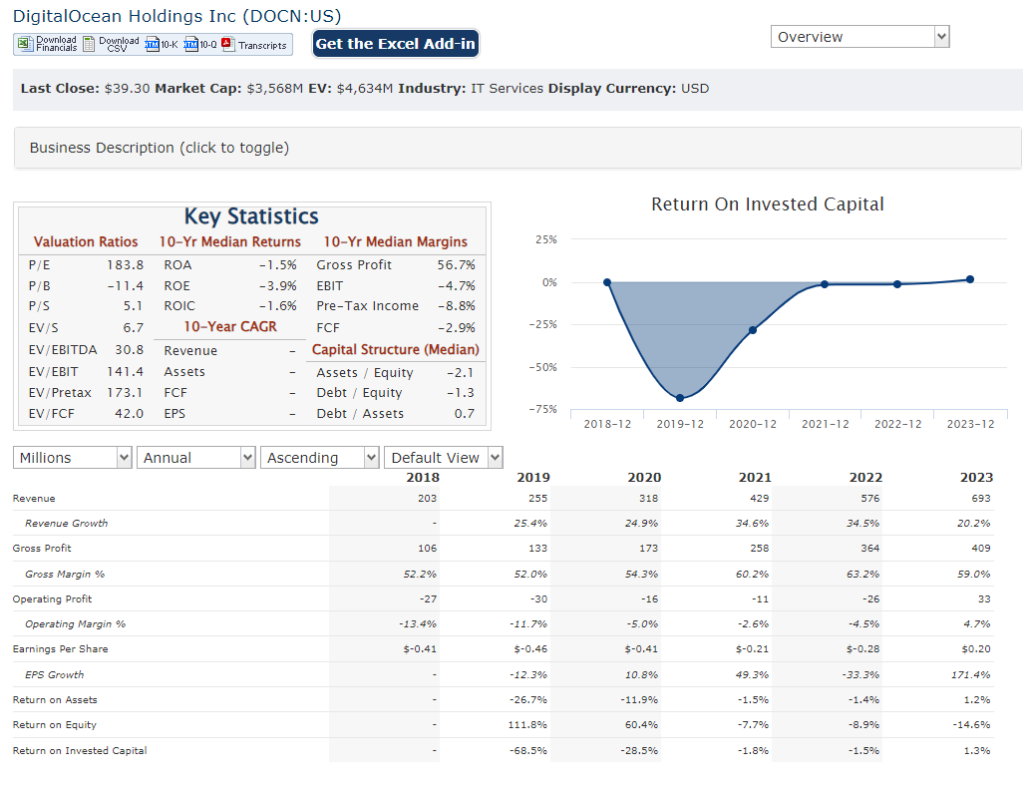

Revenue for the quarter reached $181 million, reflecting an 11% increase year-over-year. Earnings per share (EPS) were $0.17 for the reported quarter.

Stock Overview:

| Ticker | $DOCN | Price | $39.30 | Market Cap | $3.57B |

| 52 Week High | $51.69 | 52 Week Low | $19.39 | Shares outstanding | 90.79M |

Company background:

DigitalOcean was founded by Moisey Uretsky, Jeff Carr, Alec Hartman, Ben Uretsky, and Mitch Wainer. They build infrastructure-as-a-service (IaaS) solutions with compute, storage, and networking features, along with platform-as-a-service (PaaS) offerings like DigitalOcean Functions, a serverless platform for building and running applications.

DigitalOcean positions itself as a more affordable and user-centric alternative to the major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform. They focus on providing a streamlined user experience and predictable pricing, making them attractive to developers and businesses getting started with cloud computing. The company has also made strategic acquisitions in recent years, like Cloudways, a managed cloud hosting provider, to broaden its cloud offerings and cater to a wider range of users.

Recent Earnings:

- Revenue:

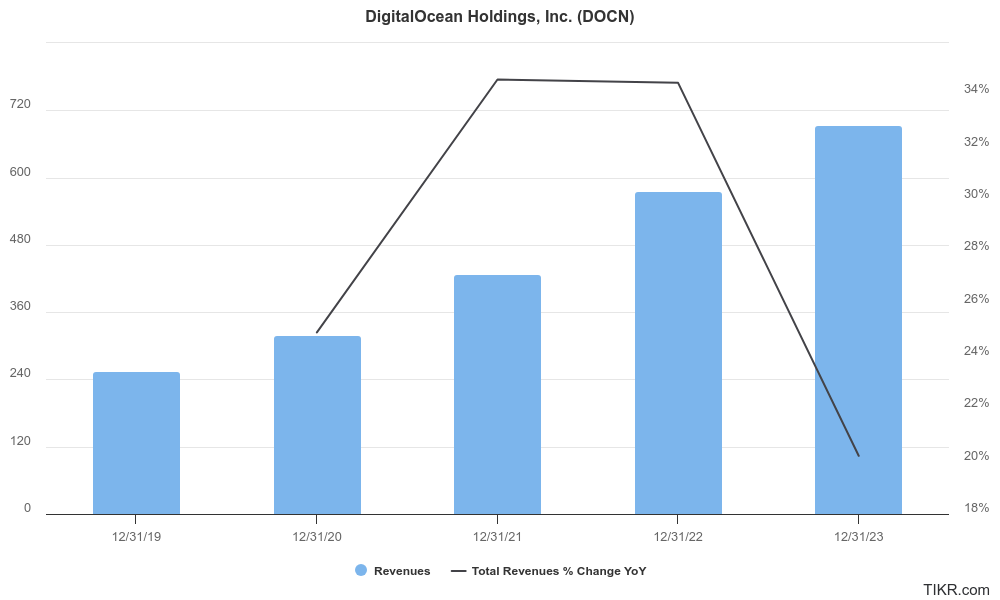

- $693 million for 2023, reflecting a 20% growth compared to the previous year.

- EPS

- $19M for 2023, vs loss of $27M the previous year

The Market, Industry, and Competitors:

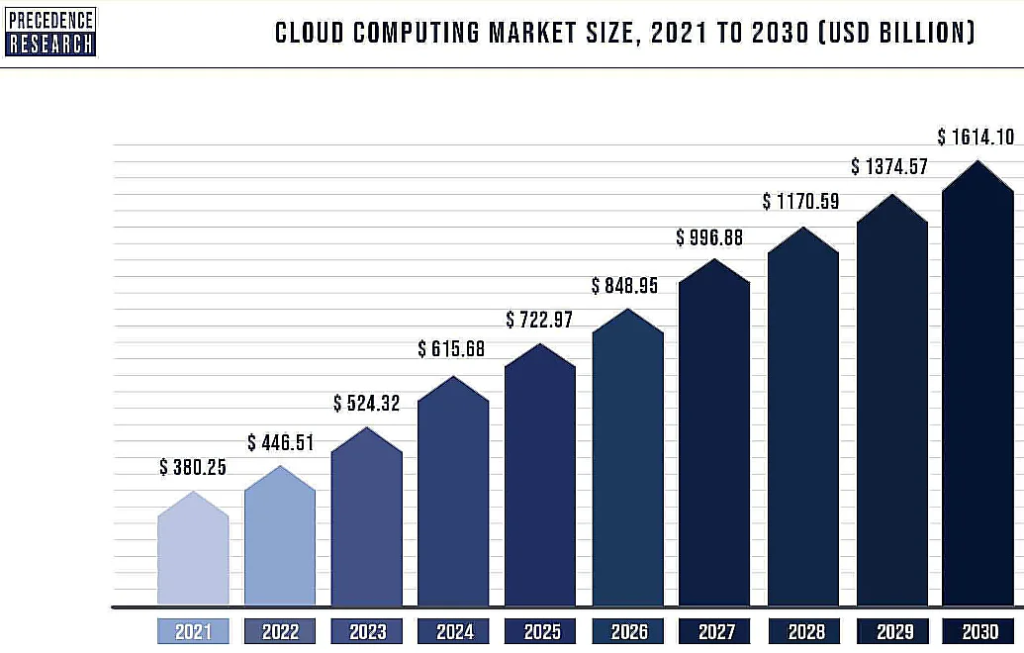

DigitalOcean Holdings Inc. operates in the cloud computing market, specifically targeting the niche of small and medium-sized businesses (SMBs) and developers. This market is expected to experience significant growth in the coming years, driven by factors like increasing adoption of remote work, big data analytics, and the Internet of Things (IoT). Analysts predict a Compound Annual Growth Rate (CAGR) of around 15% for the cloud computing market until 2030.

DigitalOcean is well-positioned to benefit from this growth due to its focus on providing user-friendly and affordable cloud solutions for SMBs. Their recent acquisition of Cloudways further strengthens their offerings in the managed cloud hosting space. By catering to the specific needs of developers and startups, DigitalOcean can carve out a significant share of the growing cloud computing market.

Unique differentiation:

DigitalOcean Holdings Inc faces competition on two fronts: established cloud giants and niche players.

The major cloud providers – Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) – dominate the cloud computing market. These giants offer a wider range of services and have deeper financial resources for innovation and marketing. While DigitalOcean can’t compete on sheer scale, it positions itself as a more affordable and user-friendly alternative for developers and SMBs who might find the major players overwhelming or expensive.

In the SMB and developer-focused space, DigitalOcean faces competition from niche players like Linode and Vultr. These companies offer similar cloud infrastructure services with a focus on simplicity and competitive pricing. The managed cloud hosting providers like Rackspace and DreamHost compete for a portion of the SMB market, offering pre-configured cloud solutions with added support services.

- Simplicity and User-Friendliness: DigitalOcean prides itself on offering a streamlined and user-friendly platform. Their interface and tools are designed to be easy to navigate, especially for developers who might be new to cloud computing.

- Predictable and Affordable Pricing: DigitalOcean positions itself as a more cost-effective alternative to the major cloud providers. Their pricing structure is transparent and predictable, making it easier for budget-conscious SMBs and developers to plan their cloud spending.

- Developer Community: DigitalOcean actively engages with the developer community through initiatives like Hacktoberfest. This fosters brand loyalty and attracts developers who value a supportive ecosystem.

Management & Employees:

- Padmanabhan Srinivasan (CEO): Srinivasan steers the strategic direction of the company. He brings over 25 years of experience in technology leadership, with a proven track record of delivering customer-centric solutions. Prior to DigitalOcean, he served as CEO of GoTo, a leading SaaS company.

- Matthew Steinfort (CFO): Steinfort is responsible for leading and scaling DigitalOcean’s global finance organization. His expertise spans over 30 years in financial operations, general management, and corporate strategy. He previously held the CFO position at Zayo Group.

- Jeffrey Guy (COO): As Chief Operating Officer, Guy oversees the day-to-day operations of DigitalOcean.

Financials:

DigitalOcean has demonstrated consistent revenue growth, solidifying its position in the cloud computing market:

- Revenue Growth: DigitalOcean’s the Compound Annual Growth Rate (CAGR) for this period reveals an impressive growth trajectory of approximately 25%.

- Earnings Growth: While revenue has consistently increased, DigitalOcean hasn’t yet achieved consistent profitability. The company transitioned from net losses in 2019 and 2020 to net income in 2023.

- Balance Sheet: DigitalOcean- their assets, liabilities, and shareholder equity within their annual reports or filings with the Securities and Exchange Commission (SEC).

Technical Analysis:

The stock has formed a head and shoulders pattern on the weekly chart, and is range bound on the monthly chart. The RSI and MACD are both negative, which indicates shares should move lower to. The daily chart shows the price action is still positive and on the uptrend, which is different from the monthly and weekly charts. Given no compelling catalyst in the near term (next earnings are on May 2nd) we expect the stock to move lower to the $35 – $37 range.

Bull Case:

- Market Opportunity: The cloud computing market is expected to experience significant growth in the coming years, driven by factors like remote work, big data, and the Internet of Things (IoT).

- Niche Focus: Unlike giants like AWS and Azure, DigitalOcean targets the underserved SMB and developer segment. This focus allows them to tailor their offerings and user experience to this specific audience, building brand loyalty and attracting new customers.

- Potential Acquisition Target: Some analysts believe DigitalOcean’s niche expertise and growth potential could make them an attractive acquisition target for a larger tech player, potentially boosting shareholder value.

Bear Case:

- Price Sensitivity: SMBs and developers are often highly price-sensitive. If competitors lower prices or offer more bundled services, DigitalOcean could face customer churn.

- Valuation: Some analysts believe DOCN’s stock price might be inflated based on future growth expectations. If the company fails to meet these expectations, the stock price could experience a correction.

- Economic Downturn: A recession could disproportionately impact SMB spending, significantly hitting DigitalOcean’s customer base and revenue.