General Motors is one of the world’s largest automotive manufacturers, producing vehicles under brands including Chevrolet, GMC, Cadillac, and Buick. Founded in 1908 and headquartered in Detroit, GM generated approximately $171 billion in revenue in FY2024, making it the largest U.S. automaker by revenue. The company operates across North America, China (via joint ventures), and select international markets, with a portfolio spanning internal combustion vehicles, EVs, autonomous technology, and financing via GM Financial. GM has repositioned itself as a capital-return-focused industrial company rather than a pure growth EV story. Its top competitors include Ford, Toyota, and Stellantis.

Most Recent Earnings Performance

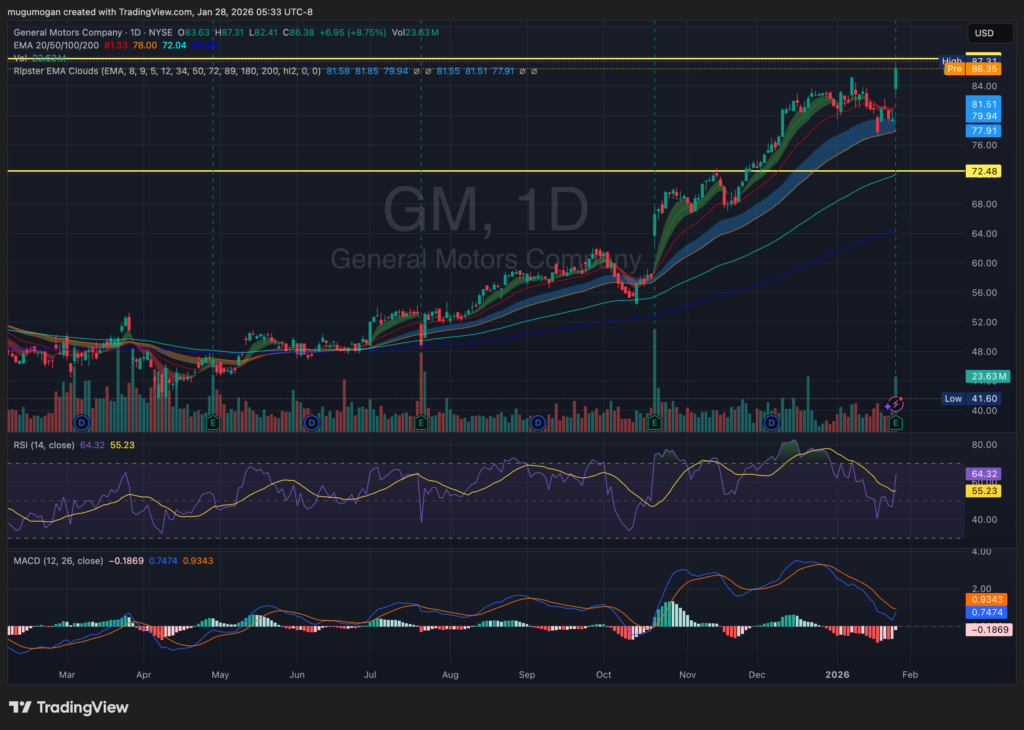

GM reported earnings on January 28, 2026 (Q4 FY2025), delivering EPS of ~$2.12, ahead of consensus expectations by roughly 10–12%, while revenue of ~$43 billion came in modestly above estimates. Year-over-year revenue was down slightly due to lower China volumes and EV pricing pressure, but operating margins in North America remained strong at ~9–10%, driven by trucks and SUVs. Management guided conservatively for FY2026, projecting flat to low-single-digit revenue growth and adjusted EPS in the $8.50–$9.50 range. The market reaction was positive, driven less by growth optimism and more by confidence in GM’s cost discipline and capital allocation.

Founding, History, and Evolution

General Motors was founded in 1908 by William C. Durant, originally as a holding company for Buick, before expanding through aggressive acquisitions including Chevrolet and Cadillac. Over the 20th century, GM became a symbol of American industrial dominance, peaking at nearly 50% U.S. auto market share in the 1950s. The company’s trajectory reversed in the 2000s due to legacy pension costs, quality issues, and a bloated brand portfolio, culminating in a government-backed bankruptcy in 2009. Post-restructuring, GM emerged leaner, with fewer brands and a sharper focus on profitability.

In the 2010s, GM invested heavily in electrification and autonomy, positioning itself as a tech-forward automaker under CEO Mary Barra. The launch of the Ultium EV platform was meant to provide modular scale across vehicle segments, from mass-market Chevy EVs to premium Cadillacs. However, execution challenges—battery manufacturing delays, software issues, and uneven consumer demand—have slowed the EV transition. As a result, GM has shifted toward a balanced strategy: defend ICE cash flows while selectively scaling EVs where returns justify the capital.

Products, Technology, and Key Competitors

GM’s core profit engine remains full-size pickup trucks and SUVs, particularly the Chevrolet Silverado, GMC Sierra, Tahoe, and Yukon. These vehicles generate outsized margins and fund investments elsewhere in the business. On the EV side, key products include the Chevrolet Bolt (legacy), Cadillac Lyriq, Chevy Blazer EV, and Silverado EV, though volumes remain below early targets. GM Financial plays a critical role, contributing stable earnings and supporting dealer and consumer financing.

Competitively, GM faces pressure from Ford in trucks and EV branding, Toyota in hybrid leadership and manufacturing efficiency, and Stellantis on cost structure and global diversification. In China, local OEMs such as BYD continue to erode share, making GM’s joint ventures structurally less profitable than a decade ago.

Market Overview and Growth Outlook

The global automotive market is expected to grow at a ~3–4% CAGR through 2030, driven primarily by emerging markets and replacement demand rather than unit expansion in developed economies. EV penetration is forecast to reach 35–45% of global auto sales by 2030, but adoption curves vary sharply by region, infrastructure, and subsidy regimes. North America is proving slower and more price-sensitive than early EV forecasts assumed.

For GM, this environment favors cash-generating incumbents over capital-hungry disruptors. While EV growth remains a long-term opportunity, near-term industry economics reward scale, manufacturing efficiency, and flexible platforms. GM’s ability to throttle EV investment without destroying margins is a competitive advantage in a market recalibrating expectations.

Competitive Landscape

Compared with Ford, GM has executed better on cost control and margin stability, though Ford has stronger EV brand visibility with the Mustang Mach-E and F-150 Lightning. Toyota remains the gold standard in capital efficiency and hybrid execution, an area GM underplayed for years. Stellantis, while more volatile, benefits from aggressive cost discipline and higher exposure to Europe.

GM’s differentiation lies not in being the most innovative automaker, but in being one of the few that can self-fund transformation while returning capital to shareholders. This makes GM less exciting—but more investable—than many peers.

Unique Differentiation

GM’s key differentiator is capital allocation discipline at scale. Unlike pure-play EV manufacturers or overly promotional incumbents, GM has explicitly prioritized free cash flow, buybacks, and dividends over chasing unprofitable volume. Its flexible manufacturing footprint allows it to shift production between ICE and EVs as demand evolves. In short, GM is optimizing for shareholder yield, not headlines.

Management Team Overview

Mary Barra (Chair & CEO) has led GM since 2014 and is widely credited with stabilizing the company post-bankruptcy while modernizing its culture and capital strategy. Paul Jacobson (CFO) has been instrumental in emphasizing free cash flow, balance-sheet strength, and disciplined EV spending. Mark Reuss (President) oversees global product development and operations, balancing legacy platforms with next-generation vehicle programs.

Financial Performance (Last Five Years)

Over the past five years, GM’s revenue has grown from approximately $122 billion in 2020 to ~$171 billion in 2024, implying a ~8% CAGR, driven by post-pandemic pricing power and mix improvement. Adjusted EBIT has expanded faster than revenue, reflecting structurally higher margins in North America. Earnings growth has been uneven year-to-year but materially higher than pre-COVID levels.

GM’s balance sheet remains solid, with automotive liquidity exceeding $35 billion and manageable net automotive debt. The company consistently generates $8–10 billion in annual automotive free cash flow in normalized conditions. This cash generation underpins aggressive buybacks and a growing dividend, reinforcing GM’s repositioning as a cash-return story rather than a speculative EV bet.

Bull Case for GM

GM is undervalued relative to its cash-flow generation and capital return profile, trading at a low-single-digit forward earnings multiple. North American truck and SUV margins remain structurally strong, providing downside protection. Management’s willingness to slow EV spending reduces execution risk materially.

Bear Case for GM

China exposure continues to structurally weaken returns and could worsen. EV profitability remains uncertain, with software and battery execution still inconsistent. The stock may remain range-bound if investors continue to view autos as ex-growth cyclicals.

Analyst Reactions to Earnings

Post-earnings, several analysts reaffirmed Buy or Overweight ratings, citing upside to free cash flow and disciplined guidance. Price targets generally moved modestly higher into the mid-$40s to low-$50s range, while bearish analysts maintained Hold ratings due to long-term EV uncertainty. Notably, there were few downgrades, reflecting confidence in GM’s near-term earnings floor rather than enthusiasm for growth acceleration.

The stock is in a stage 2 markup bullish on all 3 time frames and should continue its move higher to $90s and then $100s for the year.