Salesforce is a global leader in cloud-based enterprise software, best known for its CRM (Customer Relationship Management) suite that spans sales, service, marketing, commerce and analytics.

It offers a broad set of cloud applications — including Sales Cloud, Service Cloud, Marketing Cloud, Commerce Cloud — and supports heavy customization, integrations, AI-powered features and enterprise workflows.

Founded in 1999, Salesforce has grown into one of the largest enterprise-software firms worldwide.

Its core value proposition is enabling businesses to manage customer relationships, sales pipelines, marketing, support, data analytics — all within a unified, cloud-native, scalable platform.

In recent years, Salesforce has increasingly positioned itself as an “AI CRM,” embedding artificial intelligence to automate tasks, drive insights and streamline workflows.

Recent Earnings (Q3 Fiscal 2026 – ended October 31, 2025)

In its third quarter of fiscal 2026, Salesforce reported revenue of US$ 10.26–10.3 billion, up around 9% year-over-year.

Adjusted EPS came in at US$ 3.25, comfortably beating the consensus estimate of ~US$ 2.86 — a ~13.6% surprise.

Operating cash flow grew to US$ 2.3 billion (up 17% Y/Y) and free cash flow hit US$ 2.2 billion (up 22% Y/Y).

Following these results, Salesforce raised its full-year fiscal 2026 guidance: revenue now expected at US$ 41.45–41.55 billion (≈ 9–10% growth Y/Y), and adjusted EPS forecast at US$ 11.75–11.77.

The strong performance was driven by accelerating uptake of its AI/data products — notably Agentforce and Data 360 — whose combined annual recurring revenue (ARR) reached ~US$ 1.4 billion, up 114% Y/Y.

Origins, Founders, Business, Funding & Key Competitors

Salesforce was founded on March 8, 1999 by a team including Marc Benioff, Parker Harris, Dave Moellenhoff and Frank Dominguez.

Originally delivering CRM via cloud/SaaS — a relatively novel concept at the time — Salesforce grew quickly, going public in 2004.

Over time, it expanded well beyond “just CRM”: through acquisitions (e.g. Tableau, MuleSoft, Slack, Informatica), Salesforce built a broad enterprise platform covering analytics, data integration, internal collaboration, marketing, service, commerce, AI.

Its headquarters remain in San Francisco (Salesforce Tower), but it operates globally with many offices and a massive workforce of over 76,000 employees as of 2025.

Key competitors include Microsoft Dynamics 365, HubSpot CRM, SAP CRM / ERP + CRM suites, Oracle CX, and other CRM / customer-data-platform vendors — especially those targeting SMBs or mid-market firms.

Market — Dynamics, Size, Growth Expectations

The broader SaaS CRM market is expansive and growing rapidly: according to recent research, the market size in 2025 is projected around US$ 54.98 billion, climbing to roughly US$ 139.7 billion by 2030 — a CAGR of ~20.5%.

Alternative estimates put the overall customer-relationship-management (CRM) market at US$ 73.4 billion in 2024, with a projection to reach US$ 163.16 billion by 2030, implying a ~14.6% CAGR.

Growth is being driven by rising demand for cloud-delivered CRM, increasing adoption of AI and automation, greater need for marketing automation, customer service tools, data analytics, and unified customer-data platforms.

SMBs are increasingly adopting CRM, but large enterprises continue to dominate share due to complexity, compliance, and integration demands. That said, adoption among smaller companies is rising fastest thanks to lower-cost/usage-based tiers and simpler onboarding.

Regionally: while North America remains the largest market (with mature digital infrastructure), high growth is expected in Asia-Pacific as businesses globally transition from legacy to cloud-native CRM.

Competitors and Competitive Landscape

Some of Salesforce’s most significant competitors include:

- Microsoft Dynamics 365 — often considered the leading alternative for enterprises already embedded in the Microsoft ecosystem.

- HubSpot CRM — popular among small-to-medium businesses (SMBs) and often chosen where ease-of-use, affordability, and lightweight CRM suffice.

- SAP CRM / ERP-integrated suites and Oracle CX — appeal to large, global enterprises needing full ERP/CRM/service stacks, often with deep back-office integration, data governance, compliance.

Beyond those, there are dozens of other CRM vendors catering to niche verticals, small businesses, or specialized functions (customer service platforms, smaller-scale automation, industry-specific workflows).

What Differentiates Salesforce vs Competitors

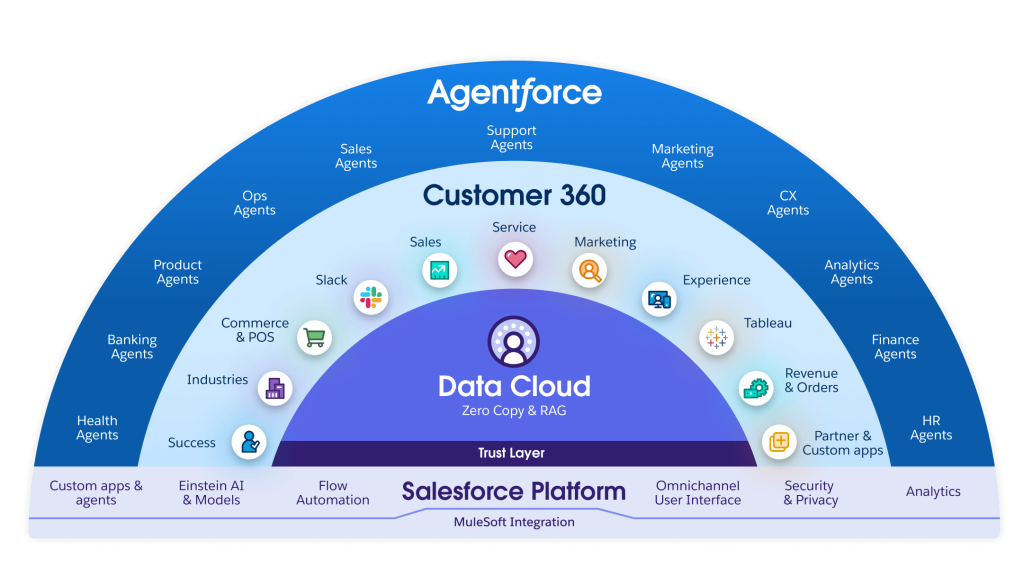

- Comprehensive, integrated platform: Salesforce isn’t just CRM; it’s a full enterprise ecosystem — sales, marketing, service, commerce, analytics, data integration, collaboration (Slack), BI (Tableau), and more. Competitors often cover only subsets.

- Scale + enterprise readiness: Salesforce supports large, complex organizations with global footprints, compliance, enterprise-grade security, deep customization and mature support — features many SMB-first CRM tools don’t deliver reliably.

- Ecosystem & extensibility: With thousands of integrations via its marketplace, APIs, and acquired tools (e.g. MuleSoft, Informatica), Salesforce allows heavy customization and integration with existing enterprise infrastructure.

- AI and data-driven innovation: Through products like Agentforce and Data 360, Salesforce is pushing toward “AI CRM” — embedding automation, analytics, generative-AI-powered agents, and data-driven workflows, which few competitors match at scale right now.

- Brand, trust, and track record: As one of the oldest and largest players in the CRM + enterprise-software space, Salesforce enjoys strong brand recognition, trust among large clients, and a deep track record of performance and scalability — a nontrivial advantage in enterprise sales cycles.

Leadership / Key Management (selected)

- Marc Benioff — Founder and CEO (Chairman & CEO). The driving visionary behind Salesforce from inception to present.

- Amy Weaver — CFO (and previously other senior executive roles), responsible for financial operations, strategy, investor relations.

- Parker Harris — Co-founder and senior technical leader (longtime CTO-type role), instrumental in product architecture and core engineering.

Financial Performance (Past ~5-Years)

Between 2014 and 2024, Salesforce’s revenue grew at a compounded annual growth rate (CAGR) of ~24%.

Earnings (net income) — since it returned to profitability — grew at a ~44% CAGR in that period.

More broadly, over a multi-year span, revenue has grown on average at ~12.9% annually.

Return on equity has been around 12%, with net margins in the ballpark of 17.9%.

The company generates strong cash flows, enabling significant shareholder returns: in recent quarters, Salesforce has returned capital via share repurchases and dividends.

Bull Case for Salesforce Stock 🟩

- Continued momentum of AI/data products (Agentforce, Data 360) — if adoption scales further, these could become major revenue engines.

- Large and growing total addressable market (CRM + cloud services + enterprise AI), with CRM market forecast to expand sharply through 2030.

- Strong cash flow and ability to reinvest or return capital via buybacks/dividends — defensive quality in volatile macro environments.

- Robust platform and ecosystem lock-in: once enterprises adopt Salesforce deeply, switching costs are high, giving recurring revenue stability.

Bear Case / Risks 🟥

- Heavy reliance on AI / “agentic” growth: if AI adoption stalls or customers balk at price, momentum could falter.

- Competition from cheaper, more flexible, or more specialized CRM alternatives — especially for SMBs or niche verticals.

- High valuation relative to growth (if growth slows, downside risk in stock price).

- Integration complexity, customer churn risks, and risk of over-extension via acquisitions (e.g. integrating big acquisitions like the $8B for Data/AI tools).

Analyst Reactions & Market Sentiment (Recent)

- Following Q3 2026 earnings beat, analysts generally responded positively, leading to upward revisions in full-year guidance.

- Optimism centers on accelerating transition to AI-driven CRM and strong demand for integrated enterprise cloud tools.

- Some caution remains — given macroeconomic headwinds, broader tech sentiment, and questions over the pace of AI monetization — but near-term reaction was favorable, stock trading higher post-earnings.

Valuation vs Top Competitors (At a High Level)

| Company | Approx Revenue (most recent) | Revenue Growth (Y/Y or CAGR) | Net Income | Market Capitalization (approx) |

|---|---|---|---|---|

| Salesforce | ~US$ 37.9 b in 2024 | ~12.9% annual average (multi-year) | Growing at ~44% CAGR over 2017–2024 | Among world’s largest: ~US$ 238 b (as of 2025) |

| Microsoft Dynamics 365 (Microsoft) | Part of a much larger orbit — Microsoft’s enterprise revenues (hard to isolate) | Microsoft overall ~US$ 2+ trn market cap — difficult to isolate exact Dynamics 365 segment | ||

| HubSpot CRM (HubSpot) | HubSpot 2024 revenue ~US$ 2 b (company wide) | High growth but smaller scale | $20M | $20B |

| SAP / Oracle (CRM + broader ERP suites) | Broad enterprise software revenue (multi-segment) | Moderate growth | $3B | $250B |

Key Takeaway

Salesforce remains the heavyweight champion in cloud-based CRM and enterprise customer-service platforms. Its strength is in scale, integration, ecosystem breadth, and increasingly, AI/data-driven innovation. Recent earnings and raised guidance show momentum is still strong — but the long-term upside (and risk) will likely hinge on how successfully Salesforce monetizes its AI offerings and sustains growth in a competitive, evolving landscape.

The stock is in a bearish stage 4 markdown with support at $202 – $220 range on the monthly chart. The weekly chart is trending down in a bearish stage 4 markdown as well, but the daily chart is showing signs of a reversal to stage 2 with resistance at $276 range. We are not buyers yet.