1. Company overview – Nutanix at a glance

Nutanix, Inc. is a hybrid multicloud and enterprise virtualization software company that started in hyperconverged infrastructure (HCI) and now sells a full cloud platform spanning compute, storage, networking, virtualization, Kubernetes, databases, and desktop-as-a-service. Founded in 2009 and public since 2016, it generated roughly $2.54 billion in revenue in fiscal 2025 with high-80s gross margins as it completed its pivot to a subscription software model. The company’s Nutanix Cloud Platform (NCP) runs on standard x86 hardware from OEM partners and on major public clouds, giving customers a single control plane across private and public environments. Nutanix is headquartered in San Jose, California, and employs around 7,800 people globally. Its most direct competitors are VMware’s vSAN and VMware Cloud Foundation (now under Broadcom), as well as HPE GreenLake, Dell VxRail and PowerFlex, Cisco HyperFlex, and a long tail of smaller HCI and edge players.

2. Latest quarter – Q1 FY26 earnings snapshot

For the quarter ended October 31, 2025 (Q1 FY26, reported November 25), Nutanix delivered revenue of about $670.6 million, up roughly 13% year over year but slightly below consensus expectations of around $676 million. Non-GAAP EPS came in at $0.41, flat to modestly down versus the prior year’s $0.42, but in line with analyst estimates, while GAAP EPS was $0.21 on net income of about $62 million. Annual recurring revenue reached roughly $2.28 billion, growing 18% year over year, and free cash flow for the quarter was around $175 million, up mid-teens versus the prior year. Management guided Q2 FY26 revenue to roughly $705–715 million and full-year FY26 revenue to $2.82–2.86 billion, trimming prior guidance of $2.90–2.94 billion to reflect some revenue shifting into later periods. The headline read as a small top-line miss and guidance cut, but underlying ARR, margins, and cash generation remained strong, which is why the stock reaction was more muted than the guidance change might imply.

3. Company history – Founding and early years

Nutanix was founded in 2009 by Dheeraj Pandey, Mohit Aron, and Ajeet Singh with the core idea of collapsing traditional three-tier architecture (servers + SAN storage + separate networking) into a software-defined, scale-out platform. The company initially sold branded appliances bundling its software with commodity hardware, popularizing the term “hyperconverged infrastructure” and competing head-on with EMC, NetApp, Cisco, and others. Backed by more than $300 million of venture funding pre-IPO and achieving “unicorn” status by 2013, Nutanix went public in 2016 in what was then the largest VC-backed tech IPO of the year. Over time, it shifted from hardware to a software-only model and from perpetual licenses to subscription, which depressed reported revenue during the transition but significantly improved predictability and economics. The founding CEO, Dheeraj Pandey, stepped down in 2020 and was succeeded by VMware COO Rajiv Ramaswami, marking a strategic pivot toward hybrid multicloud and broader platform ambitions.

4. Product evolution – From HCI to cloud platform

The core Nutanix Cloud Platform combines its Acropolis stack (including the AHV hypervisor) with the Prism management layer to provide a single console for compute, storage, and virtualization. On top of this base, Nutanix has added database-as-a-service (NDB), file and object storage services, desktop-as-a-service (Frame), Kubernetes management (Nutanix Kubernetes Platform, NKP), and security and networking capabilities, all consumed as subscriptions. The key value proposition is a consistent operating model: enterprises can run workloads on-premises, in colocation facilities, at the edge, or in public clouds like AWS and Azure with the same tooling and policies. In the last two years, Nutanix has leaned heavily into partnerships, enabling its software on Dell servers and storage, HPE, Lenovo, and Pure Storage arrays, as well as adding integrations for Azure Virtual Desktop and cloud marketplaces. This effectively turns Nutanix into an abstraction layer above both hardware vendors and cloud providers.

5. Funding, IPO, and current competitive posture

Before its IPO, Nutanix raised multiple rounds from investors such as Lightspeed, Khosla, and Blumberg Capital, reaching valuations above $2 billion as enterprises adopted HCI to simplify data center operations. Its 2016 IPO raised roughly $230 million at $16 per share; the stock traded poorly for several years as Nutanix burned cash and wrestled with its subscription transition. Over the last three to four fiscal years, the company has moved from steep losses to sustained profitability and positive free cash flow, while growing revenue mid-teens and ARR high-teens. Today Nutanix’s competitive posture is as a neutral, software-centric control plane competing against vertically integrated stacks like VMware/Broadcom, Dell, and HPE. Its ability to ride partner hardware and cloud infrastructure, plus recent share gains from VMware dislocation, have repositioned Nutanix as a strategic “exit ramp” for customers unhappy with lock-in or pricing changes in incumbent platforms.

6. Market landscape – HCI and hybrid multicloud

Nutanix operates primarily in the global hyperconverged infrastructure and hybrid cloud infrastructure software markets, which sit at the intersection of on-prem data centers, private cloud, and public cloud services. Research firms estimate the HCI market alone in the mid-to-high tens of billions of dollars by 2030, with CAGRs in the high-teens to low-20s range as enterprises refresh legacy SAN-based systems and consolidate workloads into software-defined solutions. Broader hybrid multicloud management – including platforms that abstract across on-prem and hyperscalers – is expected to grow similarly, propelled by data gravity, latency-sensitive workloads, data sovereignty requirements, and cost optimization efforts. Nutanix benefits directly from this trend because its platform is designed for “run apps anywhere” use cases rather than pushing customers to a single cloud.

7. Market growth – AI, edge, and 2030 outlook

Looking out to 2030, the key incremental tailwind is AI. Data center expansion for AI training and inference drives demand for dense, energy-efficient compute and storage architectures, and many customers want local or edge deployments for data governance, latency, or cost reasons. This is expected to lift spend not just on hyperscalers but on hybrid solutions that let enterprises keep sensitive data on-prem while tapping cloud GPUs as needed. Various third-party forecasts for adjacent markets (HCI, hybrid cloud management, and data center infrastructure tied to AI) cluster around mid-teens to low-20s CAGR through 2030; even if Nutanix grows slightly below those top-line market rates, it can still compound revenue in the low- to mid-20s percentage range if it continues to take share from VMware and traditional SAN vendors. Coupled with high gross margins, this creates the potential for operating leverage as Nutanix scales toward $4–5 billion in annual revenue later in the decade.

8. Competitive set – Incumbents and adjacent rivals

Nutanix’s closest competitor historically has been VMware’s vSAN and broader VMware Cloud Foundation stack, which under Broadcom is being repositioned with a tighter product portfolio and more aggressive pricing and bundling. That has created an opening for Nutanix, particularly among mid-market and enterprise customers frustrated by contract changes and perceived lock-in. Beyond VMware, Nutanix competes with HPE GreenLake (especially in as-a-service private cloud), Dell’s VxRail and PowerFlex-based solutions, Cisco’s HyperFlex, Lenovo ThinkAgile, and a range of regional or specialized HCI/edge providers such as Scale Computing. Public cloud providers (AWS, Azure, Google Cloud) are both partners and competitors, as their native services can displace on-prem platforms for some workloads.

9. Competitive dynamics – Position vs Dell, HPE, Vertiv

In the broader infrastructure arena, Nutanix competes indirectly with Dell Technologies, Hewlett Packard Enterprise, and Vertiv. Dell and HPE sell full stacks (servers, storage, networking, and services) and increasingly push their own cloud- or consumption-based offerings (Dell APEX, HPE GreenLake), often bundling compute and storage with software subscriptions. Vertiv, while not an HCI competitor, is a major player in power, cooling, and physical data center infrastructure, meaning it captures a large share of AI-driven data center capex that Nutanix aims to ride at the software layer. Compared to these hardware-heavy peers, Nutanix is smaller in revenue and market cap but has a purer software mix, higher gross margins, and a more focused mission around hybrid multicloud control rather than end-to-end hardware.

10. Differentiation – What makes Nutanix unique

Nutanix’s key differentiation is that it is a neutral, software-first cloud operating layer that can sit on top of a broad range of hardware and integrate with multiple public clouds, while providing a single, relatively simple management plane. VMware/Broadcom, Dell, and HPE are all incentivized to drive customers deeper into their own hardware or vertically integrated stacks; Nutanix, by design, can ride on top of those (where supported) or on commodity alternatives, giving customers more flexibility in sourcing and lifecycle management. Its AHV hypervisor and Prism management suite, coupled with integrated data services (files, objects, databases, desktops, Kubernetes), create a coherent platform rather than a loose collection of point products. In the current environment, the biggest practical differentiator is that Nutanix is the most credible large-scale alternative for enterprises looking to move away from VMware without completely re-architecting their environments.

11. Management team – Who runs Nutanix now

Nutanix is led by President and CEO Rajiv Ramaswami, who joined in December 2020 after serving as COO for Products & Cloud Services at VMware and holding senior roles at Broadcom and Cisco; he brings deep experience in both networking and virtualization. The CFO is Rukmini Sivaraman, a long-time Nutanix executive who previously ran FP&A and served as Chief People Officer, and who also has an investment banking background at Goldman Sachs; she has been a central figure in the company’s shift to a subscription model, balance sheet cleanup, and focus on free cash flow. A third key leader is CRO (and key go-to-market leader) Andrew Brinded, who oversees global sales execution and partnerships with OEMs like Dell, HPE, Lenovo, and with hyperscalers, making him critical to how Nutanix capitalizes on VMware dislocation and AI-driven infrastructure demand.

12. Five-year financial performance – Growth and profitability

Over the last five fiscal years, Nutanix has grown from roughly $1.1 billion in revenue in FY21 to about $2.54 billion in FY25, implying revenue CAGR in the low-20s percent range despite the drag from its subscription transition. That growth has been accompanied by a dramatic improvement in profitability: operating income swung from persistent losses to approximately $173 million of GAAP operating income in FY25, with non-GAAP operating margin in the low-20s percentage range. Net income moved from a loss of around $125 million in FY24 to a profit of about $188 million in FY25, and EPS flipped similarly from negative to positive. The business has also scaled free cash flow to roughly $750 million annually, giving it a strong cash-generation profile relative to its size.

13. Five-year financial performance – Margins, cash, and balance sheet

Gross margins have expanded into the high-80s percent range as hardware has been de-emphasized and the software subscription mix has increased, putting Nutanix in line with high-quality infrastructure software peers rather than hardware vendors. Operating expenses grew much slower than revenue in FY24–FY25 as management focused on sales efficiency and leverage in R&D and G&A, allowing operating margin to inflect from near-zero to low double digits on a GAAP basis and above 20% on a non-GAAP basis. The balance sheet has steadily strengthened, with net debt turning increasingly negative as cash and investments outpaced debt, and with convertible notes being managed down or refinanced; Nutanix exits FY25 with a net cash position and substantial liquidity. This gives it room to invest in product, tuck-in acquisitions (like D2iQ assets for Kubernetes), and shareholder-friendly uses of capital over time without stressing the balance sheet.

14. Five-year financial performance – Stock, multiples, and valuation context

At a market cap of roughly $12–13 billion, Nutanix currently trades at around 5–5.5x trailing revenue and a high-20s forward P/E on consensus FY26 EPS, placing it at a premium to hardware-centric peers but at a discount to high-growth pure-play cloud software names. Revenue growth in the high-teens, combined with expanding margins and strong free cash flow, implies a PEG ratio near 1 on many forward estimates, which is reasonable but not obviously cheap. The stock ran very hard into mid-2025 on the back of strong earnings beats and VMware share gain narratives, then corrected as investors digested slowing ARR growth and the FY26 guidance cut. Overall, the market is now pricing Nutanix as a profitable, mid-teens grower with structural tailwinds, but with less “hypergrowth” optionality than the peak narrative suggested.

15. Analyst and market reaction – How the Street sees Nutanix now

Analyst reaction to recent results has been mixed but generally constructive: firms like Goldman Sachs initiated or reiterated Buy ratings in 2025 with price targets in the mid-90s, highlighting Nutanix as a key beneficiary of legacy infrastructure modernization and VMware dislocation, while others have flagged decelerating ARR growth and the guidance cut as reasons for caution. After the strong Q2 and Q3 FY25 beats, Nutanix shares jumped double digits on multiple occasions as revenue and EPS topped estimates and full-year guidance was raised, only to pull back following Q4 FY25 when ARR growth undershot expectations and again after Q1 FY26 when FY26 guidance was lowered. Overall, the Street seems to view Nutanix as a high-quality, execution-sensitive story where small changes in ARR growth or guidance can move the stock sharply, but where the long-term thesis around hybrid multicloud, VMware share gains, and AI-enabled workload growth remains intact.

Bull case for Nutanix stock

• Nutanix continues to take meaningful share from VMware and traditional SAN vendors as Broadcom’s pricing and packaging changes drive customer churn, supporting sustained high-teens revenue and ARR growth with expanding margins.

• AI, data gravity, and regulatory pressures accelerate hybrid and on-prem workloads, making Nutanix’s neutral cloud operating layer a core part of enterprise infrastructure with ARR compounding into the $4–5 billion range by early next decade.

• High-80s gross margins, strong free cash flow conversion, and a net cash balance sheet allow Nutanix to steadily increase shareholder returns and potentially become an attractive M&A target for a hyperscaler or large infrastructure vendor.

Bear case for Nutanix stock

• VMware churn proves more modest than expected, or is offset by VMware/Broadcom’s own aggressive moves, leaving Nutanix with mid-teens rather than high-teens growth and a valuation that compresses toward lower-multiple infrastructure peers.

• ARR growth continues to decelerate and large deals become lumpier, causing recurring guidance cuts and eroding investor confidence in Nutanix’s transition from “hypergrowth disruptor” to “steady compounder.”

• Intensifying competition from hyperscaler-native solutions (like AWS Outposts, Azure Stack HCI) and integrated OEM offerings caps Nutanix’s pricing power and margin expansion, while hardware partners choose to prioritize their own stacks.

Valuation snapshot – Nutanix vs key infrastructure peers

| Company | Revenue (latest FY, USD B) | Revenue growth YoY | Net income (USD B) | Market cap (USD B, ~Dec 2025) |

|---|---|---|---|---|

| Nutanix | 2.54 | ~18% | 0.19 | ~12.7 |

| Dell | 95.6 | 8% | 4.58 | ~88.8 |

| HPE | 30.1 | 3.4% | 2.55 | ~28.9 |

| Vertiv | 8.01 | 16.7% | 0.50 | ~68.7 |

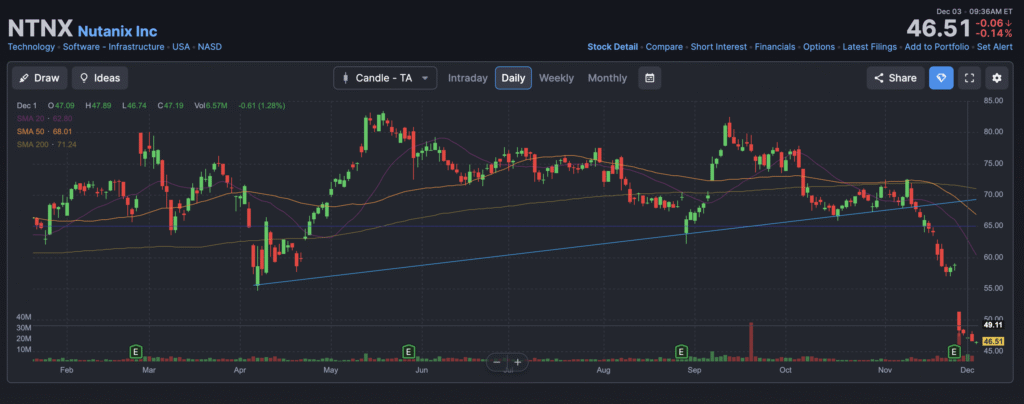

The stock is in a stage 4 bearish markdown in all 3 timeframes with support in the $40 range. We wont be investing until the reversal is confirmed.