Overview

Duolingo, Inc. is a U.S.-based ed tech company that offers a freemium, game-like platform for language learning (and increasingly other subjects). It was founded to make high-quality education universally accessible and now claims tens of millions of users globally. Its flagship app supports dozens of languages and premium subscriptions, and it has been expanding into testing and certification services. The company has transitioned into a public company, competing in the growing online / mobile learning space. While early growth was purely user acquisition, more recent focus has been on monetisation, international expansion, and leveraging AI to enhance content and scalability.

Most Recent Quarter (Q3 2025, ended September 30, 2025)

- Revenue: US$271.7 million, up ~41% year-over-year, beating analysts’ expectation of ~US$260.3 million.

- Paid subscribers grew ~34% to 11.5 million.

- Gross margin (AI content cost effects): 72.5%, slightly above expectations (~71.4%).

- Full-year 2025 revenue guidance raised to US$1.028 billion – US$1.032 billion, up from prior guidance of US$1.01-1.02 billion.

- However: Q4 bookings (a forward metric) projected at US$329.5 million – US$335.5 million, below analysts’ estimated ~US$343.6 million, which created investor concern.

In short: solid beat on actuals, raised full-year guide, but weaker than expected near-term bookings guidance triggered negative sentiment.

Company Background, Founding, Products & Competitors

Founding & Headquarters: Duolingo was founded in 2011 by Luis von Ahn and Severin Hacker (then a graduate student) at Carnegie Mellon University, and is headquartered in Pittsburgh, Pennsylvania, USA.

Products: Its core product is the Duolingo app (mobile + web) offering language courses in dozens of languages with a freemium model (free tier + paid subscription). It also offers the Duolingo English Test (a certification product) and has expanded into subjects like math, music, and chess.

Business Model & Funding: Initially a private company funded via venture capital and grants, Duolingo went public and now monetises via subscriptions, advertising, and testing fees. The company emphasises its large user base (free users) as the funnel into paid subscribers.

Key Competitors: Major competitors in the language‐learning / edtech space include Babbel GmbH, Rosetta Stone Inc. (now part of another group), Memrise Ltd., and other language-learning apps/platforms. Given its broader edtech ambitions, it could also compete with generalist e-learning companies.

Headquarters & Employees: As of recent filings, Duolingo has its HQ in Pittsburgh and operates globally.

Market & Growth Opportunity

Market Size: The global online language learning market was estimated at about US$22.12 billion in 2024 and is projected to reach roughly US$54.83 billion by 2030, implying a CAGR of about 16.6 % from 2025 to 2030. Some other sources estimate similar ranges (for example: ~$21 b in 2025 to ~$44.4 b by 2030 at ~16 % CAGR) in the self-paced apps segment.

Growth Drivers: The growth is driven by globalisation, increasing demand for multilingual workforce skills, smartphone/mobile learning adoption, and technological advances (AI-powered personalised learning). Self-learning apps form the largest segment.

Addressable Opportunity: Duolingo operates in the “self-learning app” slice which is growing fastest; given its global reach, expanding markets (e.g., Asia Pacific), and ability to scale content, the company appears well positioned to capture a meaningful portion of the market. That said, monetisation of free users remains a challenge in many geographies.

Competitor Overview

Babbel GmbH is a strong competitor focused on paid subscriptions for adult language learners (especially in Europe) with fewer free-tier distractions. Rosetta Stone has a long legacy but less “app-native” feel and more institutional sales historically. Memrise emphasises user-generated content and “spaced-repetition” techniques. Each of these competes for user attention, retention, and willingness to pay.

Moreover, broader edtech platforms expanding into language learning (or adjacent skills) may become indirect competitors, especially if they bundle language learning with other learning offerings or enterprise/government contracts.

Differentiation

Duolingo’s differentiation lies in:

- Scale: Massive global user base and strong brand recognition (often used as first step in language learning).

- Freemium model: Low barrier to entry, converting free users to paid subscriptions creates upside.

- Engagement & gamification: Highly game-like interface, strong retention hooks (streaks, gamified lessons) which drive daily / active user behaviour.

- AI & content scalability: The company has announced an “AI-first” strategy to automate content creation (e.g., launching 148 new courses in ~1 year using AI) which could reduce cost of content expansion and speed monetisation.

- Multi-product ecosystem: English Test certification, expansion into other subjects (math, music, chess) increases addressable user base and potential cross-sell.All of this gives Duolingo a potential “flywheel”: more users → more data → better product → more conversion → higher revenue.

Management Team (3 key members)

- Luis von Ahn – Co-founder, CEO & Chairman of the Board. He was formerly a professor at Carnegie Mellon and founder of reCAPTCHA; strong tech/vision background.

- Severin Hacker, PhD – Co-founder and Chief Technology Officer (CTO). Responsible for product/engineering/AI initiatives.

- Matthew Skaruppa – Chief Financial Officer. Has been with Duolingo for about 5-6 years and handles financial strategy, investor relations. The strength of this team lies in continuation of founder leadership (vision + engineering) with experienced financial leadership.

Financial Performance (Last 5 Years)

Over the last 5 years, Duolingo has demonstrated strong revenue growth. For example, in Q1 2025 revenue grew ~38 % YoY (from previous year) as the company added record daily active users and surpassed 10 million paid subscribers. In Q2 2025, revenue grew ~41.5 % YoY to US$252.3 million. The company’s guidance for full-year 2025 is revenue in the US$1.01–1.02 billion range, implying mid-30s % growth for the year.

On the earnings side, Duolingo has moved from earlier losses to positive net income in recent quarters (e.g., Q2 2025 net income of ~$44.78 million) and expanding margins. The balance sheet: The company reports healthy cash flow, improving profitability, and raised guidance which suggests strong cash-conversion potential. According to one analysis, free cash flow now exceeds US$270 million and long-term annual revenue growth is projected at ~25-30 %.

In sum: strong top-line growth, improving profitability, and expanding margin profile. Investors will want to watch how monetisation scales globally and how retention holds up, as these will determine the quality of growth over time.

Bull Case

- Huge addressable market with ~16 % + CAGR, and Duolingo is a leading global brand in this space.

- Strong user growth + monetisation ramp + AI leverage (content creation, cost structure) could drive outsized margin expansion.

- Multi-product mix (language learning + certification + other subjects) allows diversified growth beyond pure language.

Bear Case

- Freemium model: converting free users to paying users globally remains a challenge, and failure to improve this may cap revenue potential.

- Intense competition: many other players (localised apps, low-cost offerings) could erode margins or force spending increases.

- Execution risk: scaling globally (localisation, retention, regulatory issues) and effectively leveraging AI without quality degradation are non-trivial.

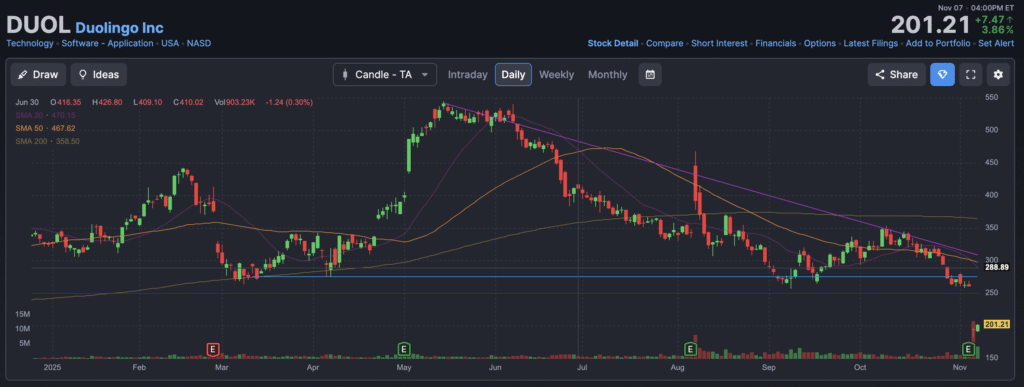

The stock is in a stage 4 markdown (bearish) on the monthly, weekly and daily charts with the near term pivots (where it might reverse) at $167 – $185 zone. We will wait for a reversal to determine if we want to invest.