Hims & Hers Health is a digital-health and wellness company that operates a consumer-facing telehealth platform connecting individuals with licensed healthcare providers and, where appropriate, delivering prescription and over-the-counter medications and wellness products. The company was founded in 2017 and is headquartered in San Francisco, California. Its 2024 revenue reached approximately US$1.48 billion, representing strong growth over prior years. Key competitors include telehealth and wellness platforms such as Roman (Ro), Keeps, and other digital health services.

Most Recent Earnings (Q2 2025)

For the quarter ended August 4, 2025, Hims & Hers reported revenue of approximately US$544.8 million, up about 72.6 % year-over-year. The company reported EPS of US$0.17, which missed consensus estimates of US$0.18 by US$0.01. For full-year 2025, the company reaffirmed revenue guidance in the range of US$2.3 billion to US$2.4 billion, consistent with analysts’ expectations, and raised its adjusted EBITDA guidance to US$295 million to US$335 million. The next quarter’s expectations are for roughly US$579 million revenue and EPS of ~US$0.10.

Founding, Funding, Products, Headquarters & Key Competitors

Hims & Hers began life in 2017 launching as a men’s-wellness direct-to-consumer business addressing issues such as hair loss, erectile dysfunction, and skincare, with sleek consumer branding and online marketing. Over time the company expanded into broader wellness services for both men and women, encompassing sexual health, skincare, mental health, and weight-management offerings. It is headquartered in San Francisco, California. The company was venture-backed before going public, with early funding rounds valuing it in the hundreds of millions (e.g., in 2018 Wired reported a valuation of US$200 million for the startup). Its product set includes online medical consultations via its digital platform, prescribing of medications via partner pharmacies, over-the-counter wellness and personal care products, and subscription-based care models. Key competitors include direct-to-consumer telehealth & wellness brands such as Ro (which offers men’s wellness and broader telehealth services), Keeps (focused on hair-loss treatment), and more broadly telemedicine platforms such as Teladoc and Amwell.

Market and Growth Potential

Hims operates in the digital telehealth and wellness market, which has seen accelerated adoption driven by consumer demand for convenience, subscription models, and broader access to care. The shift toward at-home, online healthcare delivery and wellness solutions is an enduring trend. The company has emphasized expansion into women’s health, weight-loss management (including GLP-1 drugs), and global markets as future growth vectors. Industry estimates suggest that the telehealth market and the digital health/wellness market could grow at a compound annual growth rate (CAGR) in the high single- to low double-digits toward 2030, driven by rising consumer spending on wellness, aging populations, and evolving care models. For example, Hims itself noted large growth potential in its women’s health segment. By 2030 the addressable market could be tens of billions of dollars when factoring in weight-loss therapies, skincare, mental health, and other recurring wellness revenue streams.

Competitors

Among Hims & Hers’ competitors, Ro stands out as a broad telehealth platform that addresses many of the same conditions (men’s wellness, weight-loss, skincare) but also has its own direct-to-consumer pharmacy and marketing muscle. Keeps focuses primarily on hair-loss in men and offers a more narrow niche. Traditional telemedicine providers such as Teladoc and Amwell serve broader primary care and speciality telehealth but may lack the niche wellness branding and direct-to-consumer product integration that Hims emphasizes. Each competitor has strengths but also different business models, geographic footprints, and monetization strategies.

Unique Differentiation

Hims & Hers differentiates itself through its strong consumer-brand identity, targeting wellness categories that have historically been under-served or stigmatized (e.g., erectile dysfunction, hair loss, sexual health, beyond traditional primary care). Its vertically integrated model – combining online consultations, prescriptions, and direct-to-consumer delivery of products – enables recurring-revenue potential and deep customer-engagement. Additionally, its strategy of expanding into women’s health and international markets positions it to capture growth beyond its original men’s-wellness niche. Because many telehealth platforms focus on physician matching, Hims’ combination of wellness branding + product delivery gives it an edge in consumer mind-share.

Management Team

The company is led by CEO Andrew Dudum, who co-founded the company and has been instrumental in building the consumer-facing brand and expanding into new categories. The CFO is Yemi Okupe, responsible for financial strategy and corporate operations. Another key executive is Chief Operating Officer Michael Chi, who oversees platform operations, customer experience and product delivery. Together, the leadership team blends consumer-brand experience with digital health operations, though they face challenges such as regulatory risk, execution in new segments, and sustaining margins in a growth business.

Financial Performance Overview (Last 5 Years)

Over the past five years Hims & Hers has posted strong revenue growth, reflecting its rapid expansion in wellness categories. For example, in Q1 2025 revenue grew 111 % year-over-year to US$586 million. The full-year 2024 revenue was approximately US$1.48 billion, representing a ~69 % increase over the prior year. Earnings have turned positive recently: annual EPS for the trailing twelve months ending June 30, 2025 was US$0.79, up from significantly negative levels in prior years. The CAGR in revenue over this period is high (on the order of 40-60 % depending on start year) reflecting the growth trajectory. On the balance sheet the company appears well-capitalized for its scale, with no significant dividend obligations and substantial institutional ownership (over 60 %). While gross margins and profitability metrics have been improving, the company still faces margin pressure as it scales and invests in new products and geographies. Overall, the financial picture shows strong growth, improving earnings, and a business transitioning from startup-mode into scale-mode – though with the attendant risks of execution, competition, and regulatory change.

Bull Case

- The company is tapping into a large and growing addressable wellness market, including weight-loss, mental health, skincare, and women’s health, giving multi-category growth potential.

- Its consumer-brand positioning and vertically integrated model (consultation + prescription + product delivery) could enable recurring revenue and high customer lifetime value.

- International expansion (e.g., Europe via acquisition) and expansion into new categories (women’s health, menopause) could unlock further doors and significantly scale the business.

Bear Case

- Regulatory risk and oversight are material — for example, the termination of a partnership with Novo Nordisk over alleged “deceptive practices” weighed heavily.

- Market expectations are high, and missing on guidance or margins could lead to large share-price downside, particularly in a growth stock.

- Competition from established telehealth players, pharma companies, or niche disruptors may compress margins or slow growth, especially if consumer acquisition costs rise and product differentiation narrows.

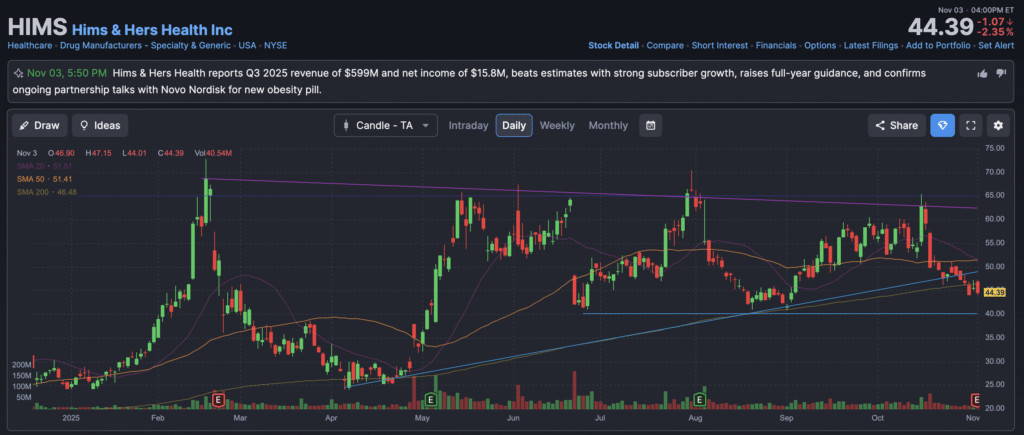

The stock is in a range bound stage 3 consolidation between $40 and $71 for the last few months in the monthly and weekly charts. The daily chart is range bound as well and should be in the reversal zone at $39. We are waiting for a trade entry