1. Company Summary

ACV Auctions is a digital marketplace that enables car dealers to buy and sell wholesale vehicles through online auctions. Founded in 2014, the company has disrupted the traditional wholesale automotive industry with its real-time auction platform, inspection tools, and vehicle condition reports. ACV operates across North America and provides an end-to-end solution, including logistics, titles, and floor plan financing. The company targets automotive dealers seeking efficiency, transparency, and broader access to inventory. ACV went public in March 2021 and trades under the ticker symbol “ACVA” on the NASDAQ.

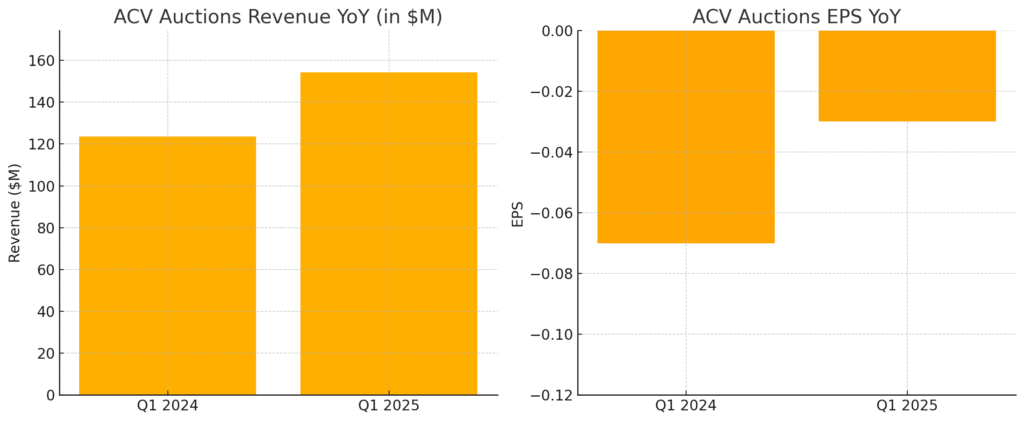

2. Q1 2025 Earnings (Reported May 1, 2025)

In its Q1 2025 earnings report, ACV Auctions posted revenue of $154.3 million, up 25% year-over-year, exceeding analyst estimates of $150 million. Adjusted EPS was -$0.03, beating consensus expectations of -$0.05. The company’s gross merchandise volume (GMV) grew 18% YoY, reflecting stronger dealer engagement and platform usage. For Q2 2025, ACV guided revenue between $158 million and $162 million, implying growth of 22–25%. For the full year 2025, it reaffirmed its outlook of 20–25% revenue growth with a path toward adjusted EBITDA profitability in H2.

3. Founding, Founders, Products, and Key Competitors

ACV Auctions was founded in 2014 by George Chamoun (CEO), Dan Magnuszewski, and Joe Neiman. The company originated in Buffalo, New York, aiming to modernize how wholesale vehicles are bought and sold. ACV’s key offerings include its flagship real-time auction platform, True360 vehicle inspections, transportation services, title management, and floor plan financing via ACV Capital. It also provides data analytics tools for pricing and inventory optimization. ACV competes with legacy physical auction houses like Manheim (a division of Cox Automotive) and KAR Global, as well as other digital auction and wholesale platforms.

4. Products and Expansion

The company has steadily expanded its product ecosystem to support dealers at every stage of the wholesale process. Recent innovations include ACV Transportation, which simplifies vehicle logistics; and ACV Max, an appraisal tool that provides retail pricing data and competitive insights. ACV is also investing in AI and computer vision technology to enhance inspection accuracy and streamline condition reporting. Its platform supports thousands of daily auctions and has a dealer network exceeding 20,000 participants across the U.S.

5. Headquarters and Funding History

ACV Auctions is headquartered in Buffalo, New York. Before its IPO, the company raised over $300 million in venture funding from investors including Bessemer Venture Partners and SoftBank. The IPO in 2021 raised around $400 million, giving it a post-IPO valuation of $4.5 billion. Since going public, ACV has focused on sustainable growth and technological innovation over aggressive expansion.

6. Market Landscape and Growth Outlook

ACV operates in the $250 billion U.S. wholesale vehicle market, which has traditionally been dominated by in-person auctions and inefficient logistics. The market is ripe for digitization, especially post-COVID, with dealer demand shifting toward faster, more transparent digital channels. The global automotive remarketing market is expected to reach over $400 billion by 2030, with a projected CAGR of 9–11% through the decade. Digital platforms like ACV, backed by data and logistics, are set to benefit disproportionately from this trend.

7. Industry Dynamics and Trends

The used vehicle market remains strong amid rising new car prices and inventory constraints. Dealers increasingly rely on wholesale platforms to replenish inventory, manage risk, and source specific vehicles. Additionally, tools that improve vehicle condition transparency and streamline post-sale processes are in high demand. ACV’s integrated suite positions it well to capitalize on these macro trends, especially as competition intensifies between digital and legacy players.

8. Competitor Landscape

ACV faces competition from traditional auction giants like Manheim, which operates a hybrid of digital and physical auctions, and KAR Global (operator of ADESA). While these players have scale and established dealer relationships, ACV’s full-stack digital approach, mobile inspections, and focus on customer experience provide a nimble edge. Other emerging digital-only competitors like BacklotCars (owned by KAR) also seek to capture share in this transforming space.

9. Differentiation and Competitive Advantage

What sets ACV apart is its mobile-first, fully digital auction experience paired with high-fidelity inspections and logistics integration. Its True360 inspections are performed by trained technicians and leverage machine learning for standardized reporting. ACV’s transparency, real-time auction model, and nationwide reach attract dealers looking for trust and speed. Unlike traditional auction houses, ACV’s data-rich approach enables smarter sourcing decisions and faster inventory turnover.

10. Key Management Team

- George Chamoun, CEO: A co-founder and longtime tech entrepreneur, Chamoun previously led Synacor. He has been instrumental in scaling ACV from startup to public company.

- Vikas Mehta, CFO: Joined in 2021 from Etsy, bringing financial discipline and public company operations experience.

- Michael Waterman, Chief Commercial Officer: Oversees growth and dealer engagement strategies; previously held leadership roles at Groupon and Vroom.

11. Financial Performance Overview

Over the past five years, ACV Auctions has grown revenue from approximately $84 million in 2019 to over $600 million in 2024, representing a 5-year CAGR of nearly 50%. This rapid growth reflects both organic platform expansion and new product rollouts. Despite strong topline growth, the company has yet to achieve GAAP profitability, with net losses narrowing from over $100 million in 2021 to around $45 million in 2024. The adjusted EBITDA margin has improved each year, moving toward breakeven. On the balance sheet, ACV maintains over $300 million in cash, with modest debt, supporting ongoing investments in technology and expansion.

12. Bull Case for ACV Auctions

- ACV becomes the dominant digital platform as legacy auction players struggle to modernize quickly.

- Strong margin expansion from high-margin software and financing services (ACV Capital).

- Growth in AI-based inspections and data monetization increases ARPU and reduces operating costs.

13. Bear Case for ACV Auctions

- Intensifying competition from well-capitalized rivals like Manheim and KAR Global limits market share growth.

- Dealers revert to hybrid or physical auctions in an economic downturn.

- Difficulty achieving sustained profitability due to heavy investments in logistics and inspection infrastructure.

14. Analyst Reactions to Q1 2025 Earnings

Analyst sentiment post-earnings was generally positive, with several firms reaffirming Buy ratings and raising price targets by 5–10%. Morgan Stanley cited improved operating leverage and higher GMV growth as key positives. JPMorgan noted better-than-expected cost discipline but remains neutral due to long-term margin uncertainty. There were no major downgrades post-report.

15. Valuation Table (as of June 2025)

| Company | Revenue (TTM) | Revenue Growth | Net Income (TTM) | Market Cap |

|---|---|---|---|---|

| ACV Auctions | $610M | 25% | -$45M | $2.8B |

| KAR Global | $1.6B | 5% | -$20M | $1.5B |

| Manheim (Cox)* | $3.5B | 4% | ~$200M est. | Private |

The stock is in a stage 4 markdown on the monthly, weekly and daily charts. The near term support is in the $14 range and then again in the $12 range, where it might reverse. We won’t be taking a position here.