Costco Wholesale Corporation (NASDAQ: COST) is a leading membership-based warehouse club retailer headquartered in Issaquah, Washington. Founded in 1983, Costco has grown to become the third-largest global retailer, operating over 879 warehouses worldwide and serving nearly 134 million cardholders. The company offers a wide range of products, including groceries, electronics, apparel, and home goods, often in bulk quantities, at competitive prices. Costco’s private-label brand, Kirkland Signature, is known for its quality and value, contributing significantly to the company’s sales. The company’s business model focuses on high-volume sales and low operating costs, allowing it to offer low prices to its members.

Recent Earnings Performance

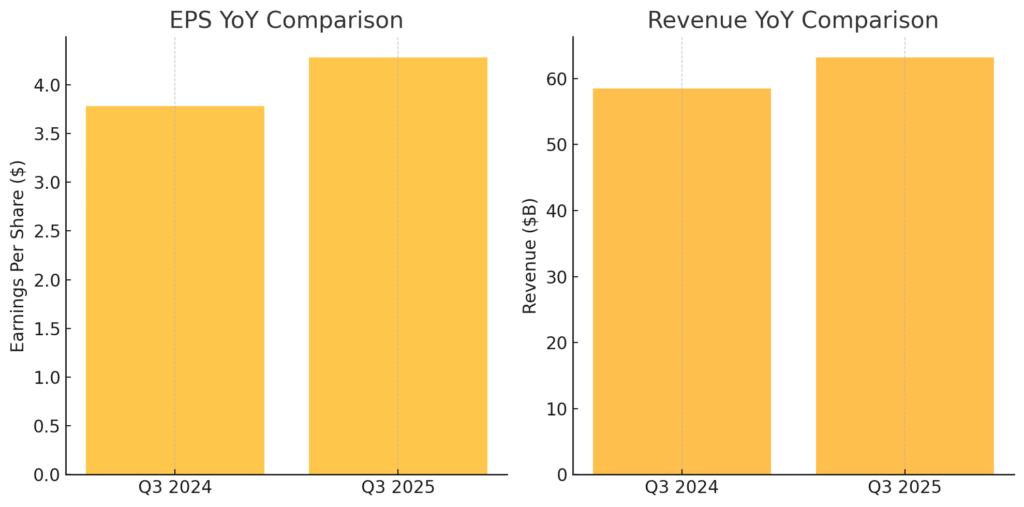

On May 29, 2025, Costco reported its fiscal Q3 2025 earnings, posting an earnings per share (EPS) of $4.28, surpassing the consensus estimate of $4.24. Revenue for the quarter reached $63.21 billion, exceeding analyst expectations of $62.93 billion. Comparable store sales grew by 5.7%, indicating strong performance in a competitive retail environment. The company also noted growth in membership fees and continued strength in its private-label offerings. Looking ahead, Costco anticipates continued growth, with earnings expected to increase by approximately 9.21% in the next fiscal year.

Company Origins and Evolution

Costco’s roots trace back to 1976 with the opening of Price Club by Sol Price in San Diego, California. In 1983, James Sinegal and Jeffrey Brotman founded Costco in Seattle, Washington, introducing a new concept in retail by offering a wide range of products at low prices through a membership model. The company merged with Price Club in 1993, forming PriceCostco, which later became Costco Wholesale Corporation. Over the years, Costco has expanded its product offerings and global presence, maintaining a focus on efficiency and member satisfaction. Its headquarters remain in Issaquah, Washington, reflecting its Pacific Northwest origins.

Market Landscape and Growth Projections

Costco operates within the warehouse club and supercenter industry, which has experienced steady growth over the years.As of 2025, the industry has reached an estimated $771.1 billion in revenue, with a compound annual growth rate (CAGR) of 3.2% over the past five years. Looking ahead, the industry is expected to continue growing, driven by consumer demand for value and convenience. Costco’s focus on bulk sales, competitive pricing, and a diverse product range positions it well to capitalize on these trends. Additionally, the company’s expansion into online grocery and other digital services aligns with evolving consumer preferences, further supporting its growth prospects.

Competitive Landscape

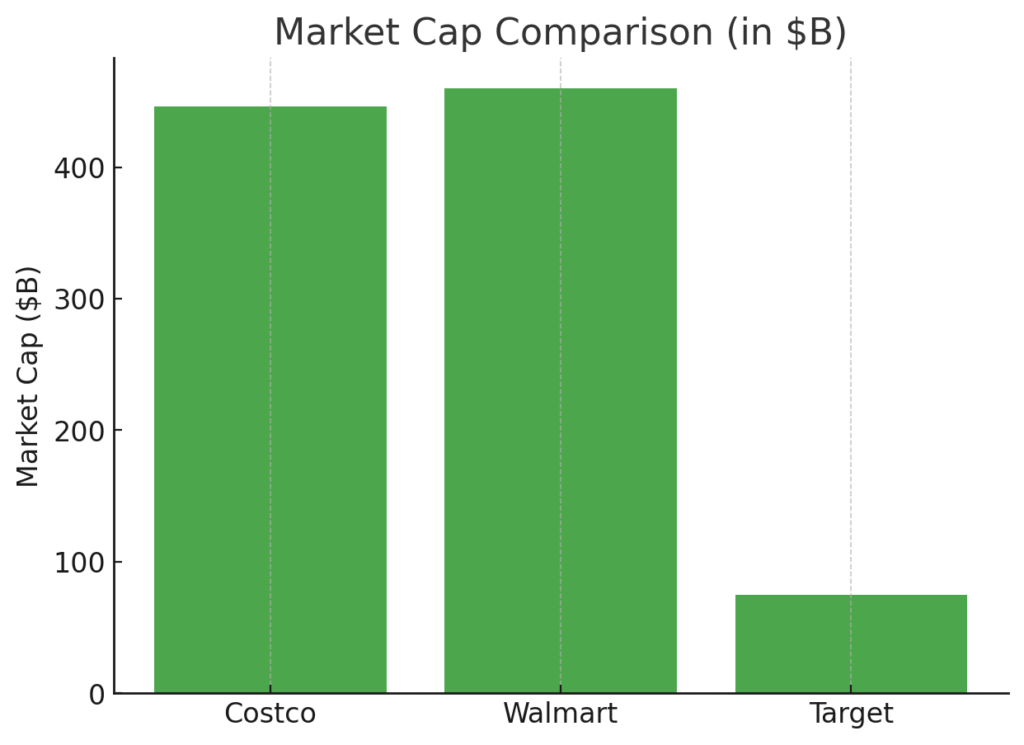

Costco faces competition from several major retailers, including Walmart, Target, and Amazon. Walmart, with its extensive network of stores and broad product offerings, remains a significant competitor, particularly in the grocery segment. Target competes with Costco in categories such as apparel, home goods, and electronics, often appealing to a similar customer base. Amazon’s dominance in e-commerce presents a challenge, especially as consumers increasingly turn to online shopping for convenience. Despite these competitors, Costco’s unique membership model, focus on value, and strong private-label brand help differentiate it in the marketplace

Differentiation and Competitive Advantage

Costco’s primary differentiation lies in its membership-based business model, which fosters customer loyalty and provides a steady revenue stream through annual fees. The company’s commitment to offering high-quality products at low prices, particularly through its Kirkland Signature brand, enhances its value proposition. Costco’s efficient supply chain and limited product selection strategy reduce operating costs and streamline inventory management. Additionally, the company’s focus on employee satisfaction and retention contributes to a positive shopping experience, further distinguishing it from competitors

Leadership and Management

Ron Vachris serves as the President and Chief Executive Officer of Costco Wholesale Corporation. He has been with the company for several years, holding various leadership positions before assuming the CEO role. Gary Millerchip is the Executive Vice President and Chief Financial Officer, bringing extensive experience in financial management to the company. Their combined expertise and leadership play a crucial role in guiding Costco’s strategic direction and operational efficiency.

Financial Performance Overview

Over the past five years, Costco has demonstrated consistent financial growth. The company’s revenue increased from $226.95 billion in 2022 to $264.09 billion in the twelve months ending February 2025, reflecting a CAGR of approximately 10.8%. Net income has also shown steady growth, supported by strong sales and efficient cost management. Costco’s balance sheet remains robust, with healthy cash flows and prudent capital allocation strategies. The company’s financial stability positions it well to navigate economic fluctuations and invest in future growth opportunities.

Bull Case for Costco

- Strong membership model ensures recurring revenue and customer loyalty.

- Consistent financial performance with steady revenue and income growth.

- Expansion into digital services and online grocery aligns with consumer trends.

Bear Case for Costco

- Intense competition from major retailers and e-commerce platforms.

- Economic downturns could impact consumer spending and membership renewals.

- Rising operational costs and supply chain challenges may pressure margins.

The stock is on a stage 2 markup (Bullish) on the monthly and weekly chart. The daily chart shows a move higher to $1078 (all time high) range as well. Any near term move lower to the $1000 would be a good entry for this stock in the long term.